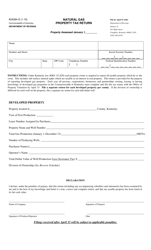

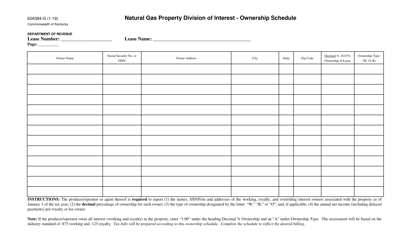

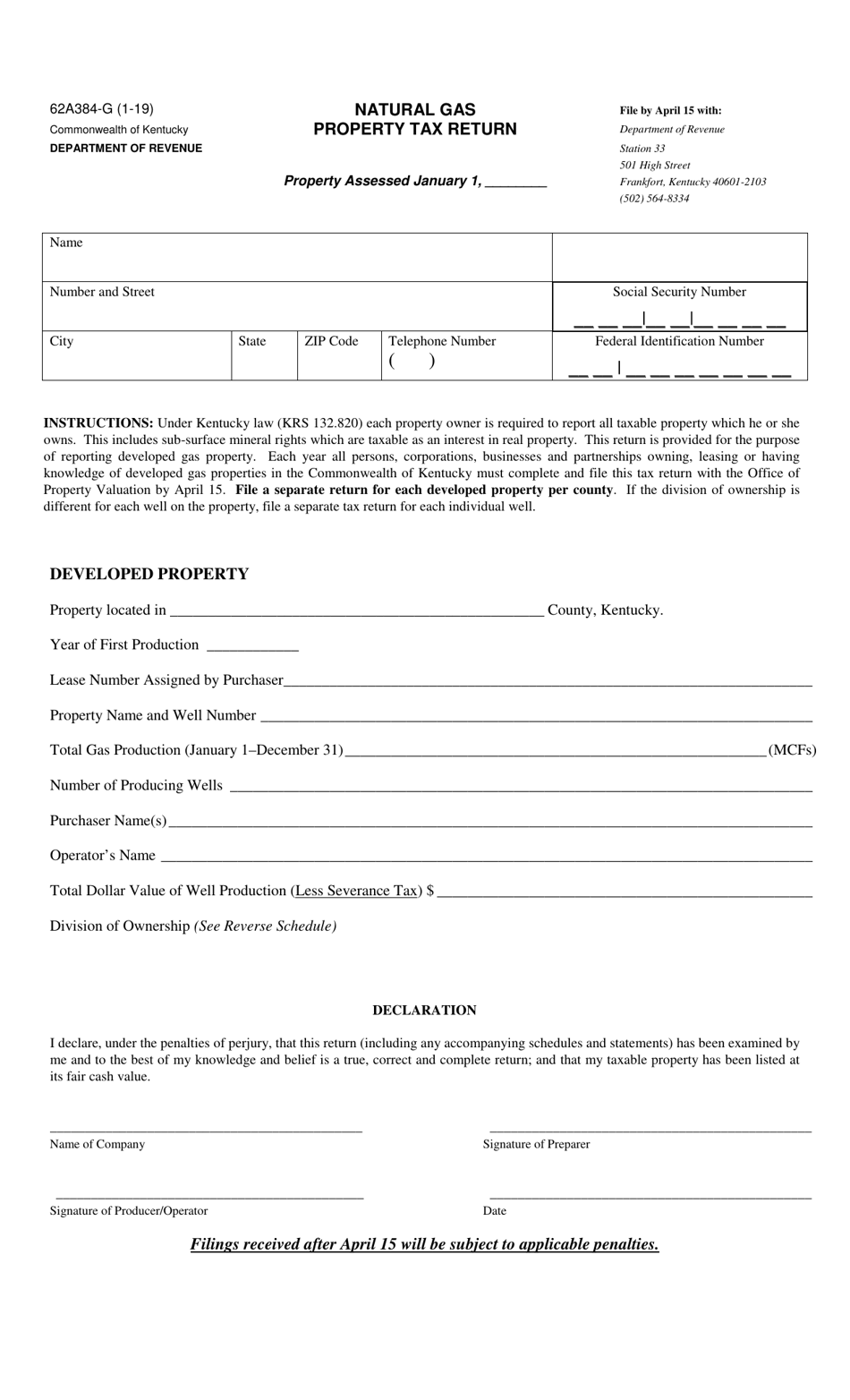

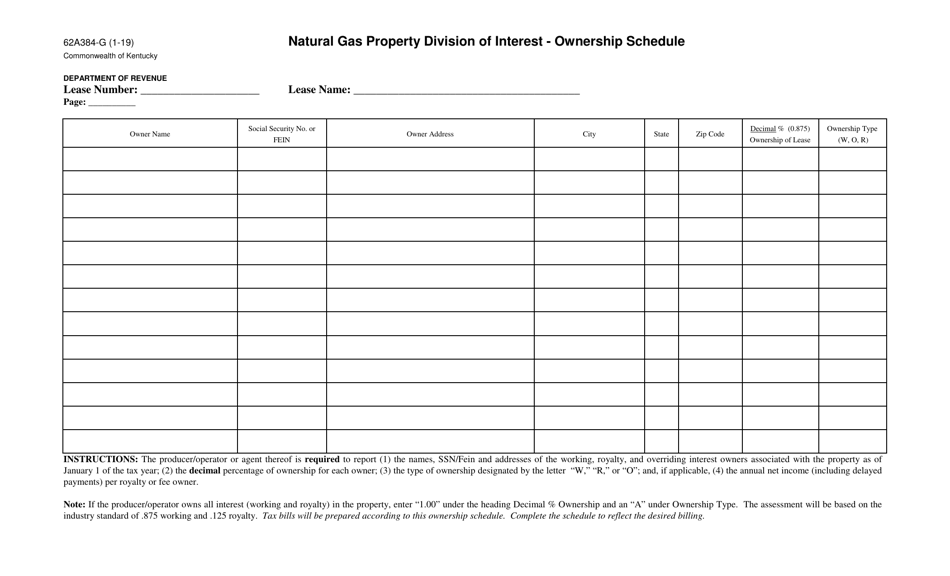

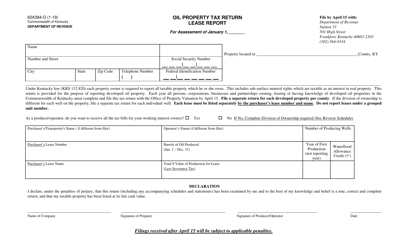

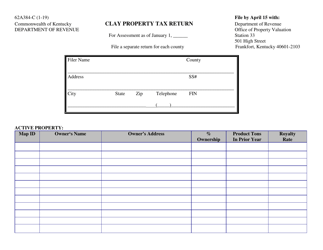

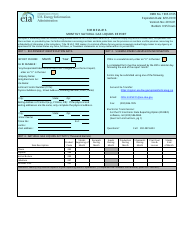

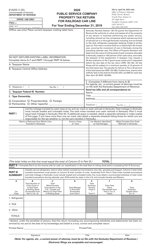

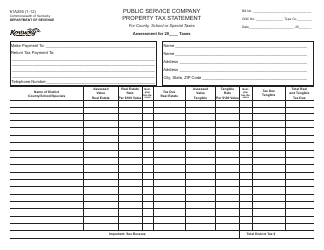

Form 62A384-G Natural Gas Property Tax Return - Kentucky

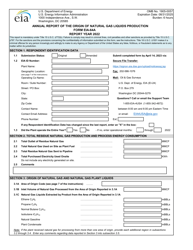

What Is Form 62A384-G?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 62A384-G?

A: Form 62A384-G is a Natural Gas Property Tax Return specifically for the state of Kentucky.

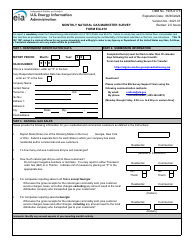

Q: Who needs to file Form 62A384-G?

A: Individuals or entities who own or operate natural gas property in Kentucky need to file Form 62A384-G.

Q: What is the purpose of filing Form 62A384-G?

A: The purpose of filing Form 62A384-G is to report and pay the property tax on natural gas property in Kentucky.

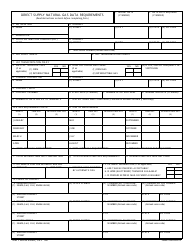

Q: When is the due date for filing Form 62A384-G?

A: The due date for filing Form 62A384-G is typically May 15th of each year.

Q: Are there any penalties for late filing of Form 62A384-G?

A: Yes, there may be penalties for late filing of Form 62A384-G. It's important to file on time to avoid any penalties or interest charges.

Q: Is there any specific documentation required to file Form 62A384-G?

A: Yes, you may need to provide supporting documentation such as production reports, well lists, or other relevant records when filing Form 62A384-G.

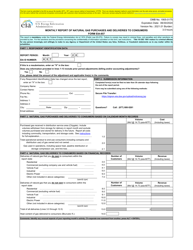

Q: Can I file Form 62A384-G electronically?

A: Yes, you can file Form 62A384-G electronically through the Kentucky Department of Revenue's electronic filing system, if available.

Q: What should I do if I have questions or need assistance with Form 62A384-G?

A: If you have questions or need assistance with Form 62A384-G, you should contact the Kentucky Department of Revenue or consult a tax professional.

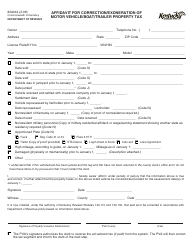

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 62A384-G by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.