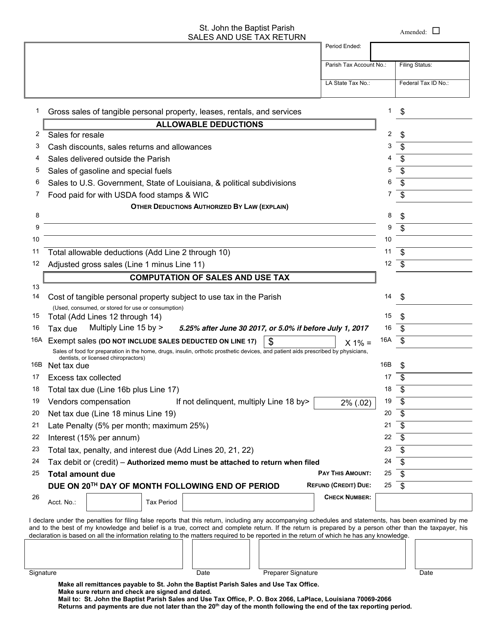

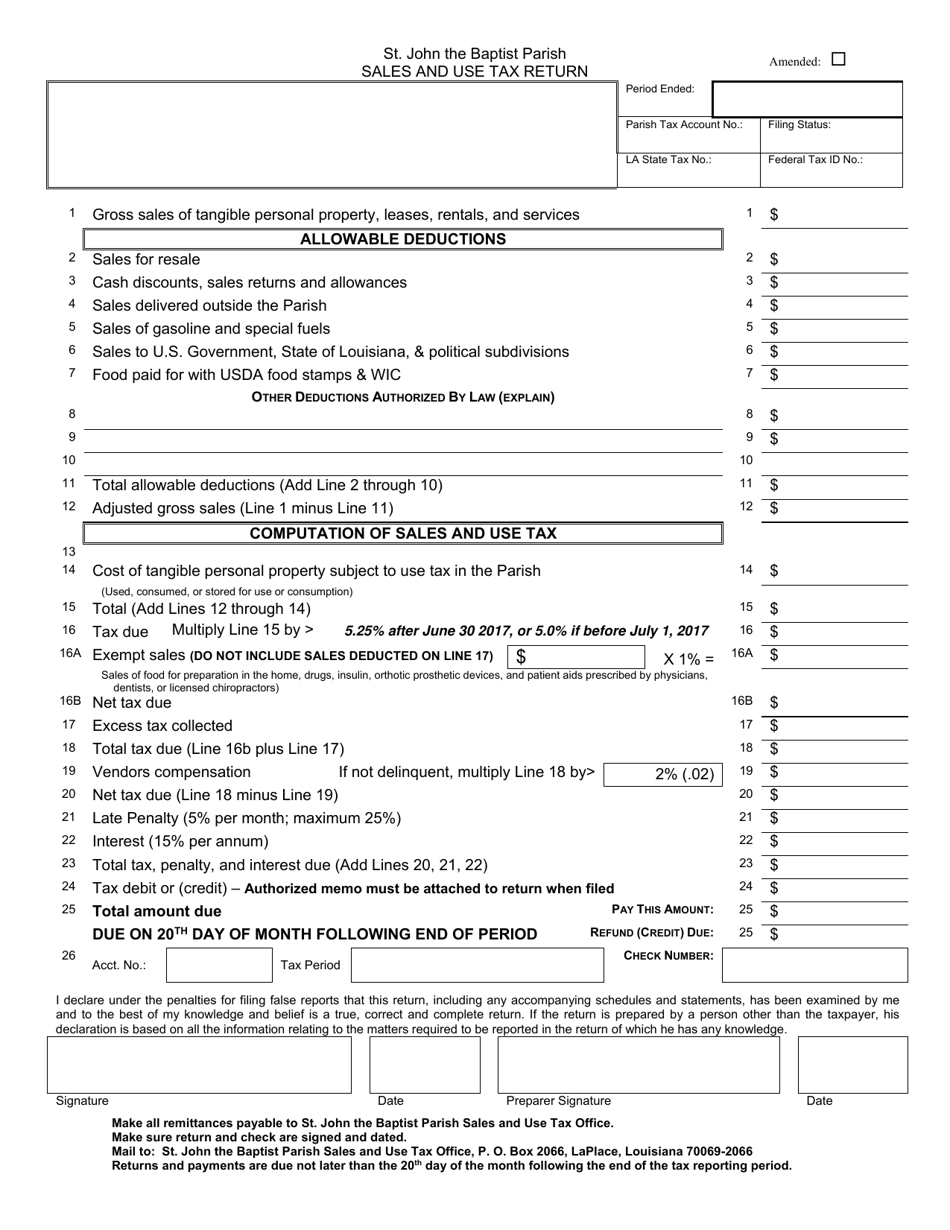

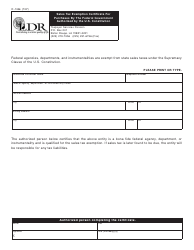

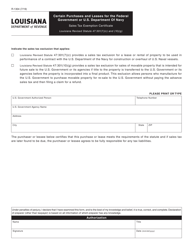

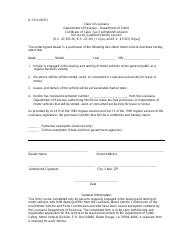

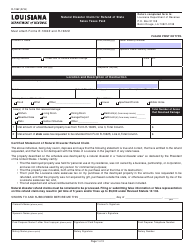

Sales and Use Tax Return - St. John the Baptist Parish, Louisiana

Sales and Use Tax Return is a legal document that was released by the Sales and Use Tax Office - St. John the Baptist Parish, Louisiana - a government authority operating within Louisiana. The form may be used strictly within St. John the Baptist Parish.

FAQ

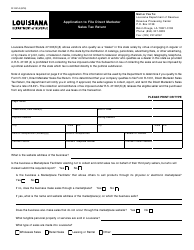

Q: What is the Sales and Use Tax Return?

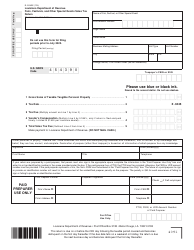

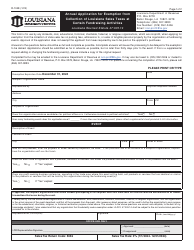

A: The Sales and Use Tax Return is a form used to report sales and use tax collected by businesses in St. John the Baptist Parish, Louisiana.

Q: Who is required to file a Sales and Use Tax Return?

A: Businesses that engage in selling or leasing tangible personal property in St. John the Baptist Parish, Louisiana are required to file a Sales and Use Tax Return.

Q: What is the purpose of the Sales and Use Tax Return?

A: The purpose of the Sales and Use Tax Return is to report and remit the sales and use tax collected from customers.

Q: When is the Sales and Use Tax Return due?

A: The due date for filing the Sales and Use Tax Return varies and is typically based on the filing frequency assigned to the business.

Q: Are there any penalties for late filing or noncompliance?

A: Yes, there can be penalties for late filing or noncompliance, including interest charges and possible legal actions.

Form Details:

- The latest edition currently provided by the Sales and Use Tax Office - St. John the Baptist Parish, Louisiana;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Sales and Use Tax Office - St. John the Baptist Parish, Louisiana.