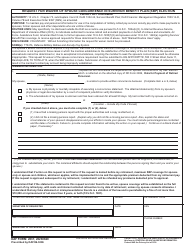

This version of the form is not currently in use and is provided for reference only. Download this version of

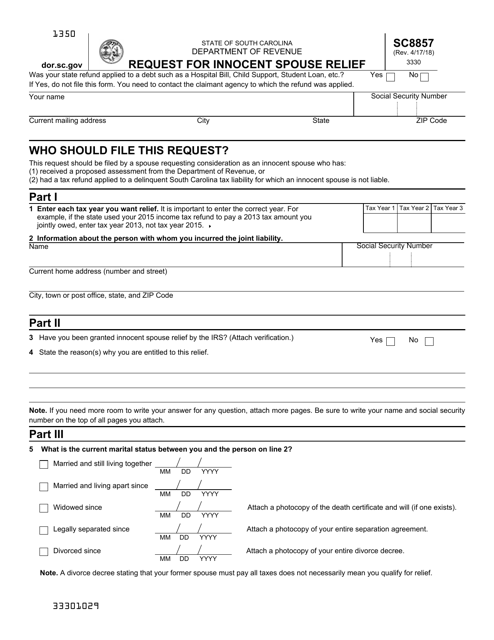

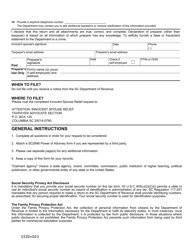

Form SC8857

for the current year.

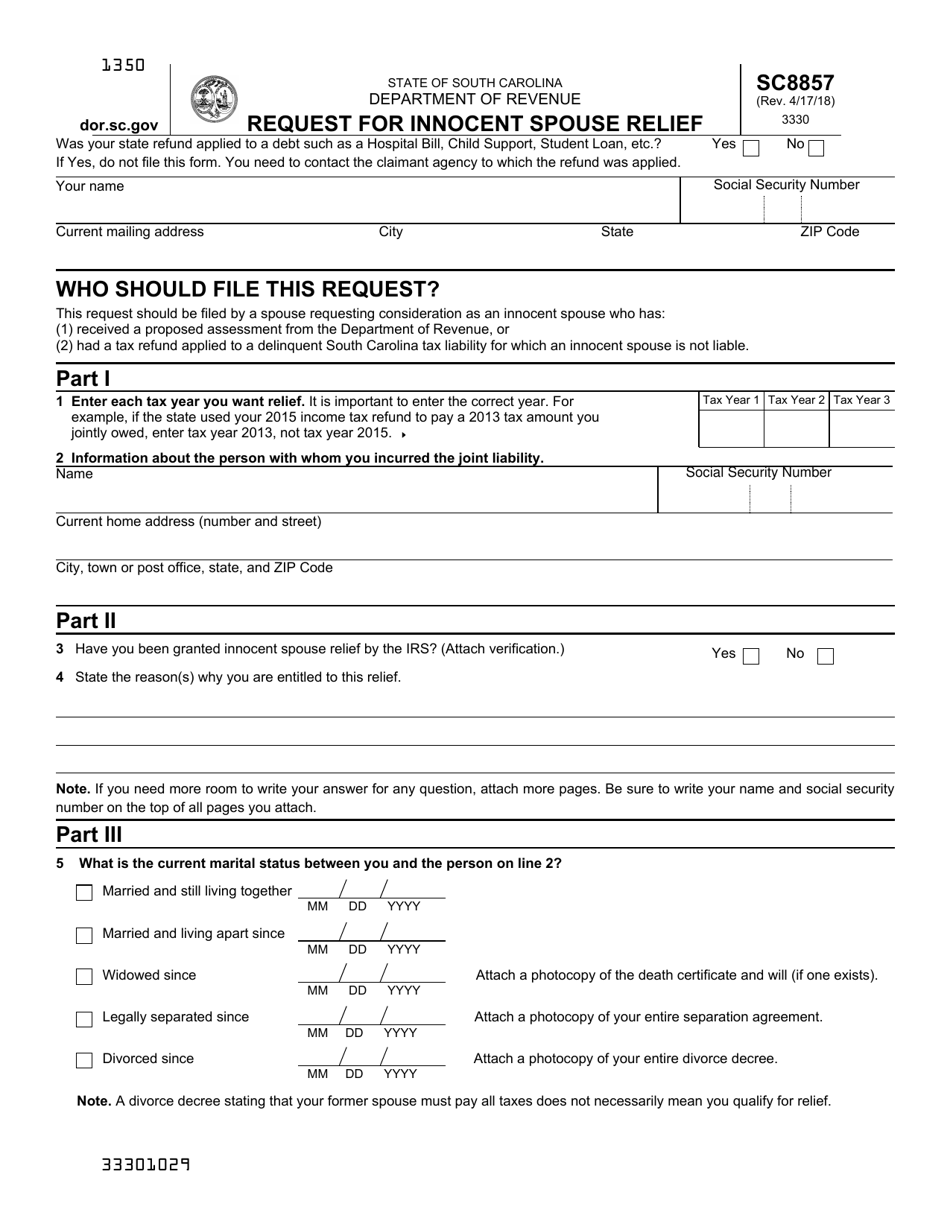

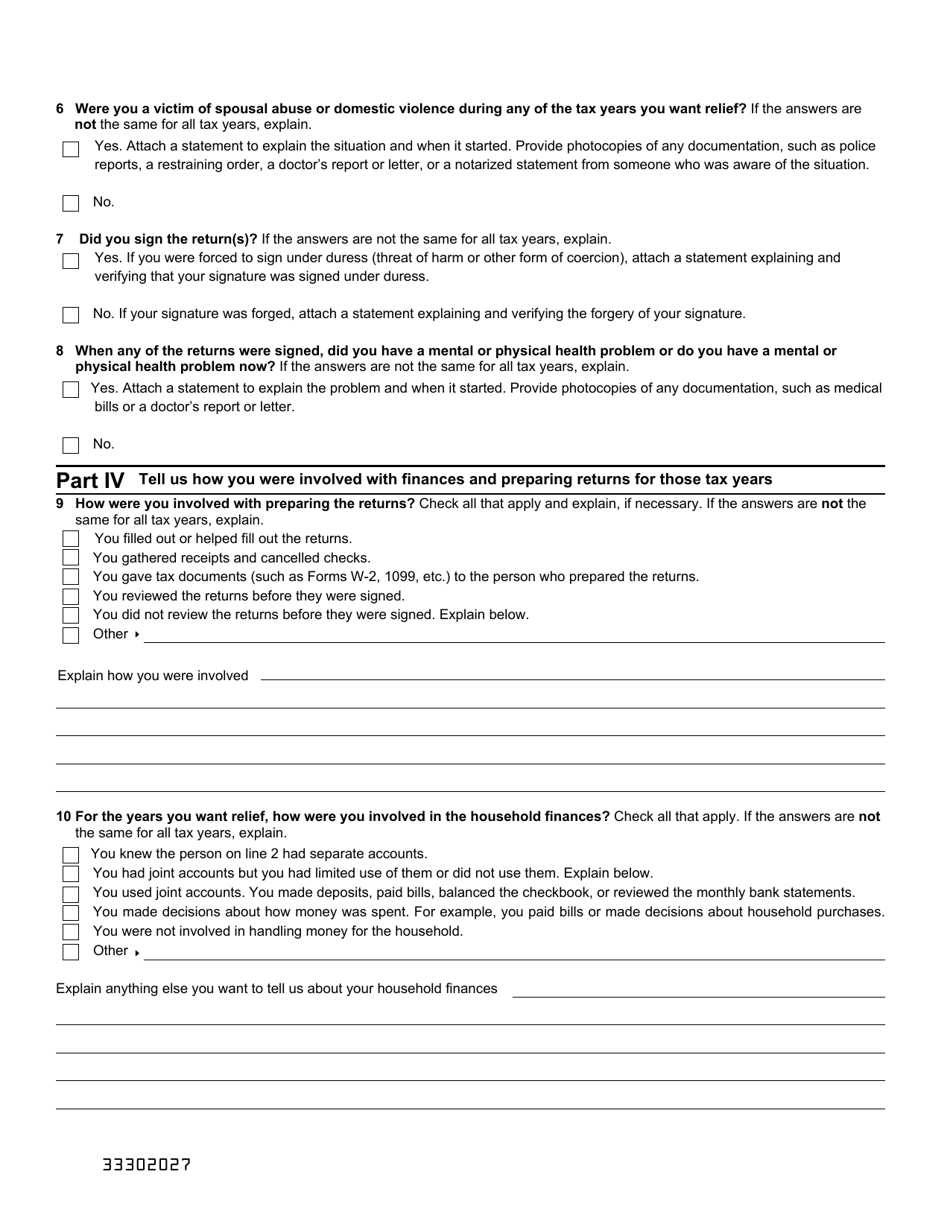

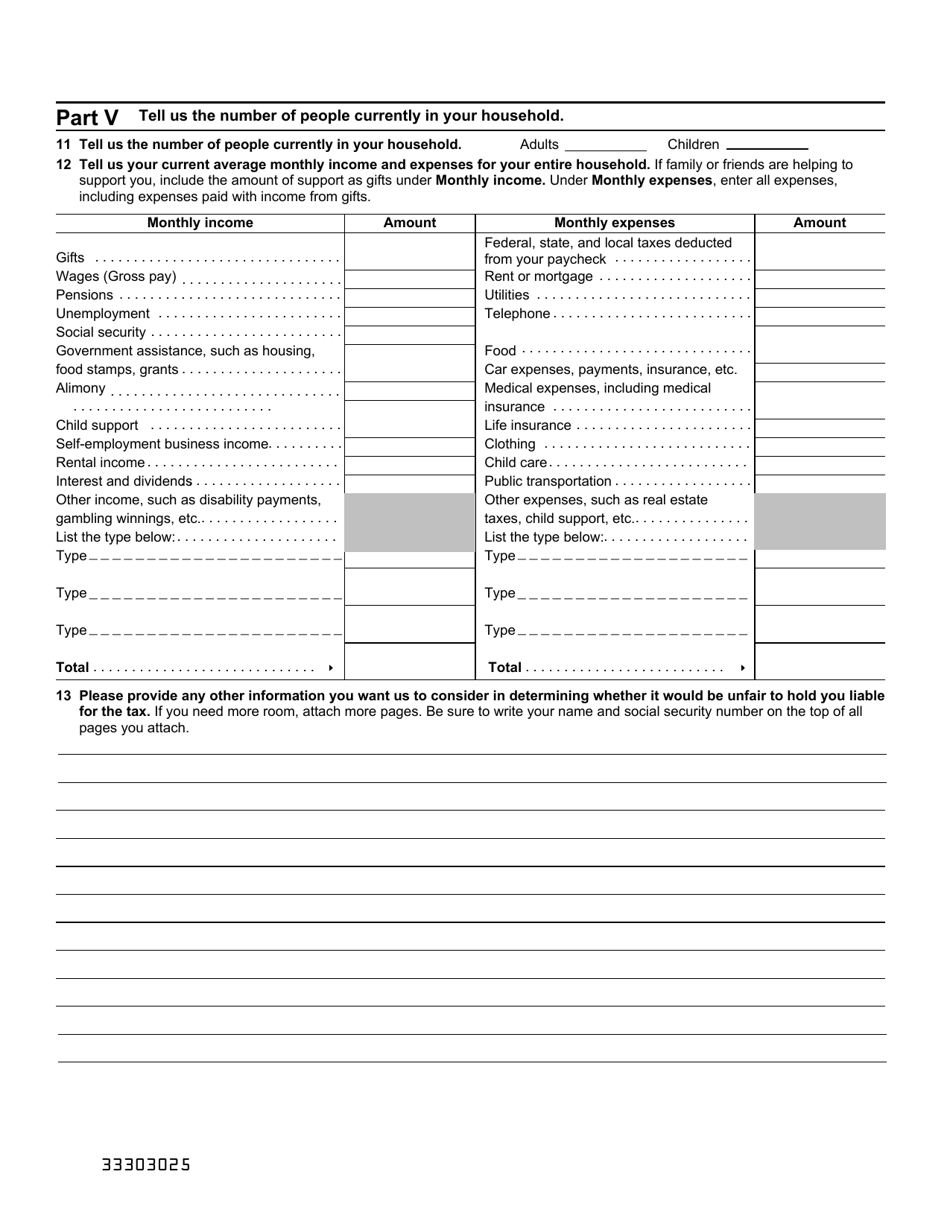

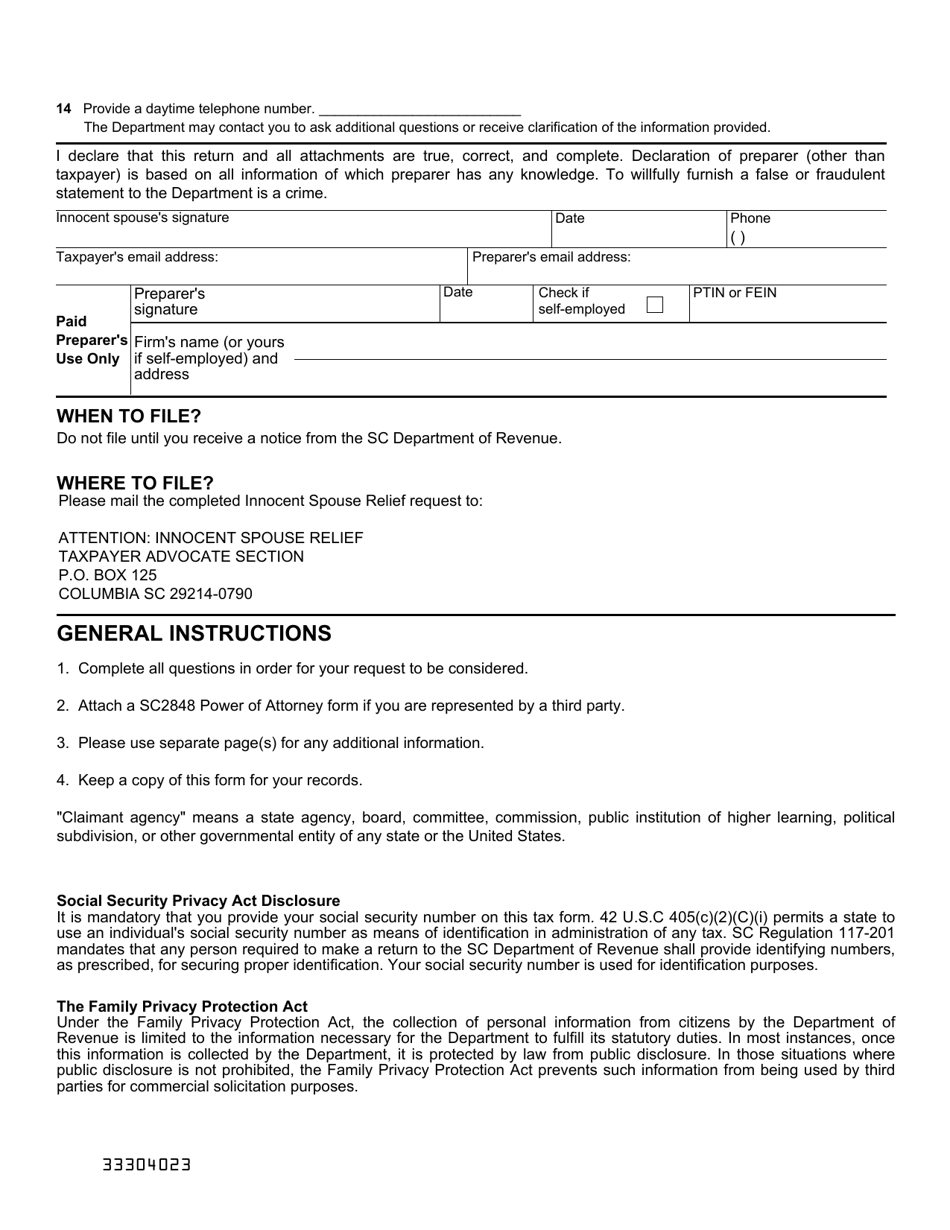

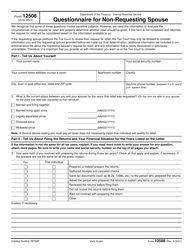

Form SC8857 Request for Innocent Spouse Relief - South Carolina

What Is Form SC8857?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

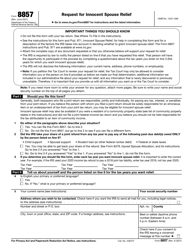

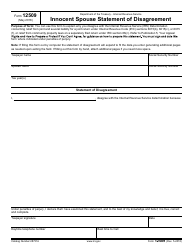

Q: What is Form SC8857?

A: Form SC8857 is a request forInnocent Spouse Relief in South Carolina.

Q: What is Innocent Spouse Relief?

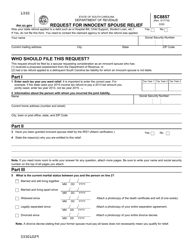

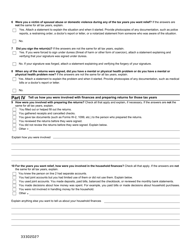

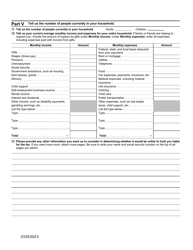

A: Innocent Spouse Relief is a way for eligible individuals to be relieved of the responsibility for paying tax, interest, and penalties on a joint tax return.

Q: Who can file Form SC8857?

A: Form SC8857 can be filed by individuals who filed a joint tax return with their spouse or former spouse, and believe they should not be held responsible for the tax liability.

Q: What is the purpose of Form SC8857?

A: The purpose of Form SC8857 is to request relief from joint and several liability for tax, interest, and penalties resulting from a joint tax return.

Q: What are the eligibility requirements for Innocent Spouse Relief?

A: To be eligible for Innocent Spouse Relief, you must meet certain requirements, including showing that you had no knowledge or reason to know that there was an understatement of tax on the joint return and that it would be unfair to hold you responsible for the tax liability.

Q: Are there any fees to file Form SC8857?

A: No, there are no fees to file Form SC8857.

Q: What should I do after I file Form SC8857?

A: After you file Form SC8857, the South Carolina Department of Revenue will review your request and make a determination on your eligibility for Innocent Spouse Relief.

Q: Can I appeal if my request for Innocent Spouse Relief is denied?

A: Yes, if your request for Innocent Spouse Relief is denied, you have the right to appeal the decision.

Form Details:

- Released on April 17, 2018;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC8857 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.