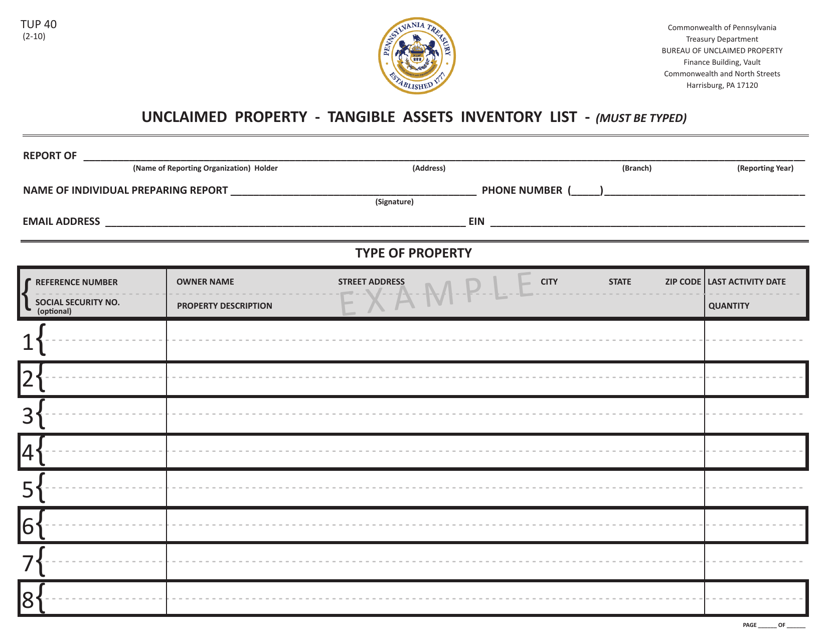

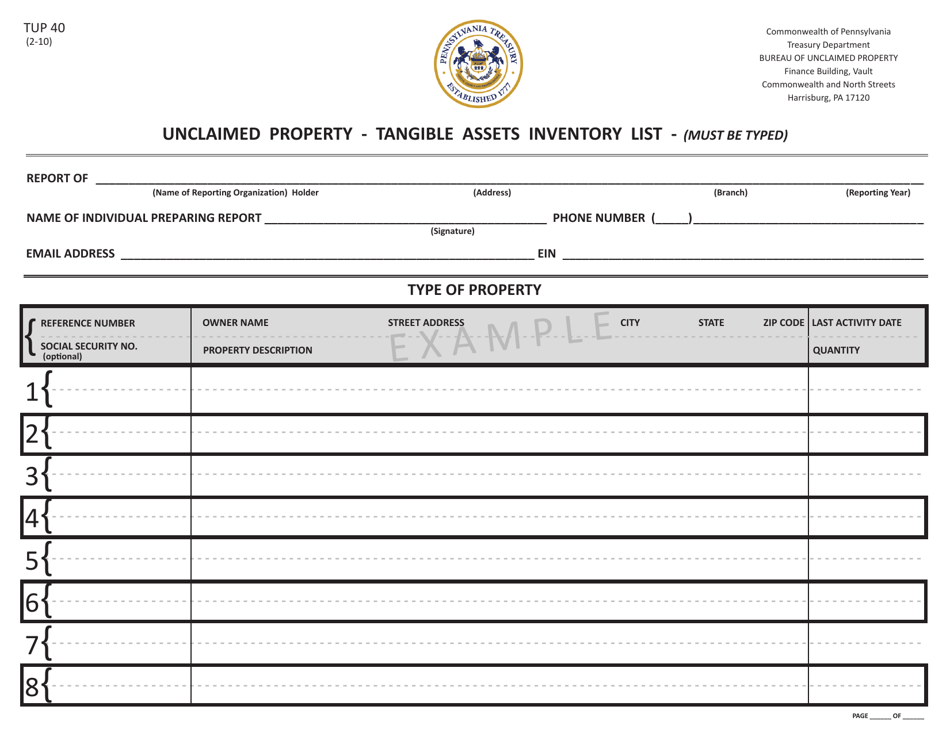

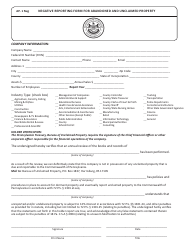

Form TUP40 Unclaimed Property - Tangible Assets Inventory List - Pennsylvania

What Is Form TUP40?

This is a legal form that was released by the Pennsylvania Treasury - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TUP40?

A: Form TUP40 is the Unclaimed Property Tangible AssetsInventory List for Pennsylvania.

Q: What does Form TUP40 report?

A: Form TUP40 reports tangible assets that are considered unclaimed property.

Q: Who needs to file Form TUP40?

A: Any business or organization holding unclaimed tangible assets in Pennsylvania needs to file Form TUP40.

Q: What are tangible assets?

A: Tangible assets include items such as uncashed checks, safety deposit box contents, and unclaimed inheritances.

Q: When is Form TUP40 due?

A: Form TUP40 is due on or before April 30th of each year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. It is important to file Form TUP40 by the deadline to avoid penalties.

Q: Is there a minimum threshold for reporting tangible assets?

A: Yes, Pennsylvania requires reporting when the aggregate value of tangible assets held is $50 or more.

Q: What happens to the reported tangible assets?

A: The Pennsylvania Treasury Department holds the reported tangible assets and tries to locate the rightful owners.

Form Details:

- Released on February 1, 2010;

- The latest edition provided by the Pennsylvania Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TUP40 by clicking the link below or browse more documents and templates provided by the Pennsylvania Treasury.