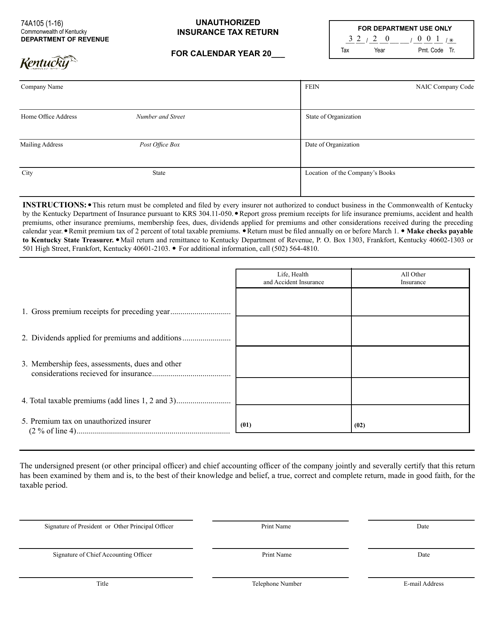

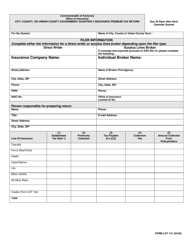

Form 74A105 Unauthorized Insurance Tax Return - Kentucky

What Is Form 74A105?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 74A105?

A: Form 74A105 is the Unauthorized Insurance Tax Return specific to the state of Kentucky.

Q: Who needs to file Form 74A105?

A: Insurance companies that engage in unauthorized insurance transactions in Kentucky need to file Form 74A105.

Q: What is unauthorized insurance?

A: Unauthorized insurance refers to insurance transactions conducted by insurance companies that are not authorized or licensed in Kentucky.

Q: When is Form 74A105 due?

A: Form 74A105 is due on or before the 15th day of the fourth month following the end of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. It is important to file Form 74A105 on time to avoid penalties and interest.

Q: Do I need to include payment with Form 74A105?

A: Yes, you need to include payment for any tax due along with Form 74A105 when you file.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 74A105 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.