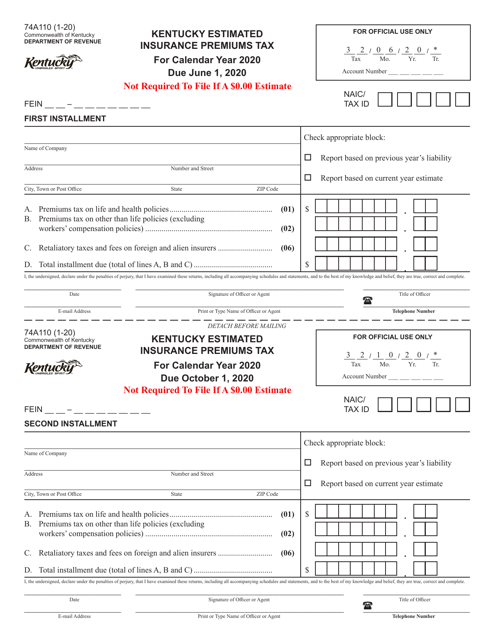

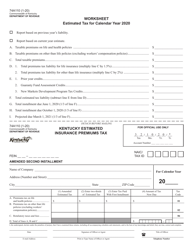

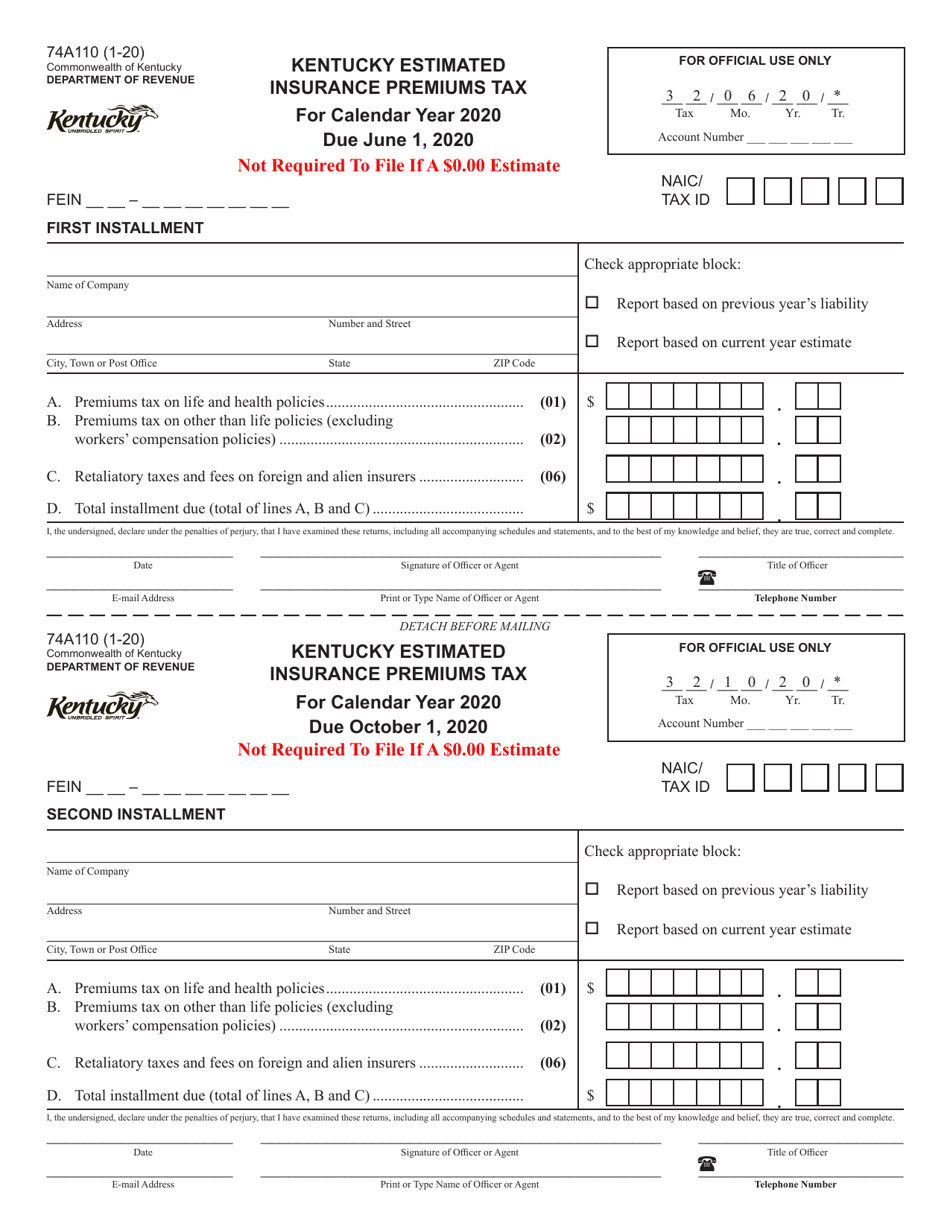

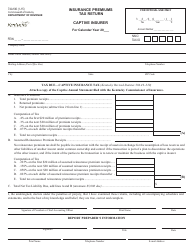

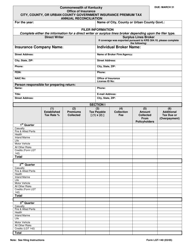

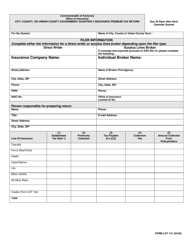

Form 74A110 Kentucky Estimated Insurance Premiums Tax - Kentucky

What Is Form 74A110?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 74A110?

A: Form 74A110 is the Kentucky Estimated Insurance Premiums Tax form.

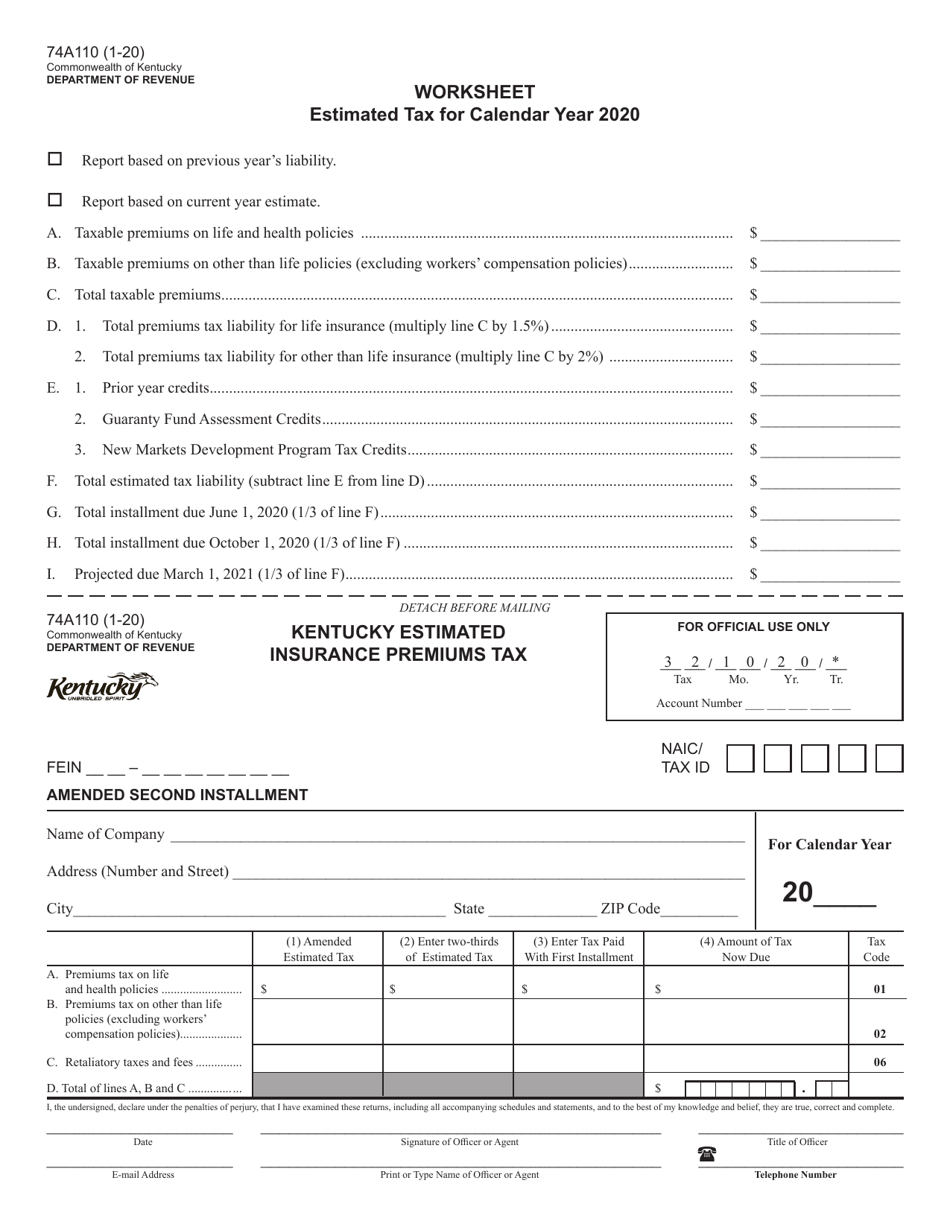

Q: What is the purpose of Form 74A110?

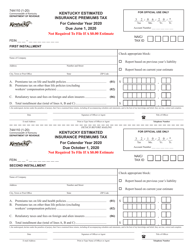

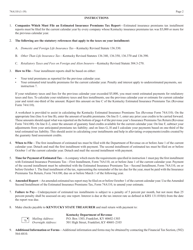

A: Form 74A110 is used to calculate and pay the estimated insurance premiums tax in Kentucky.

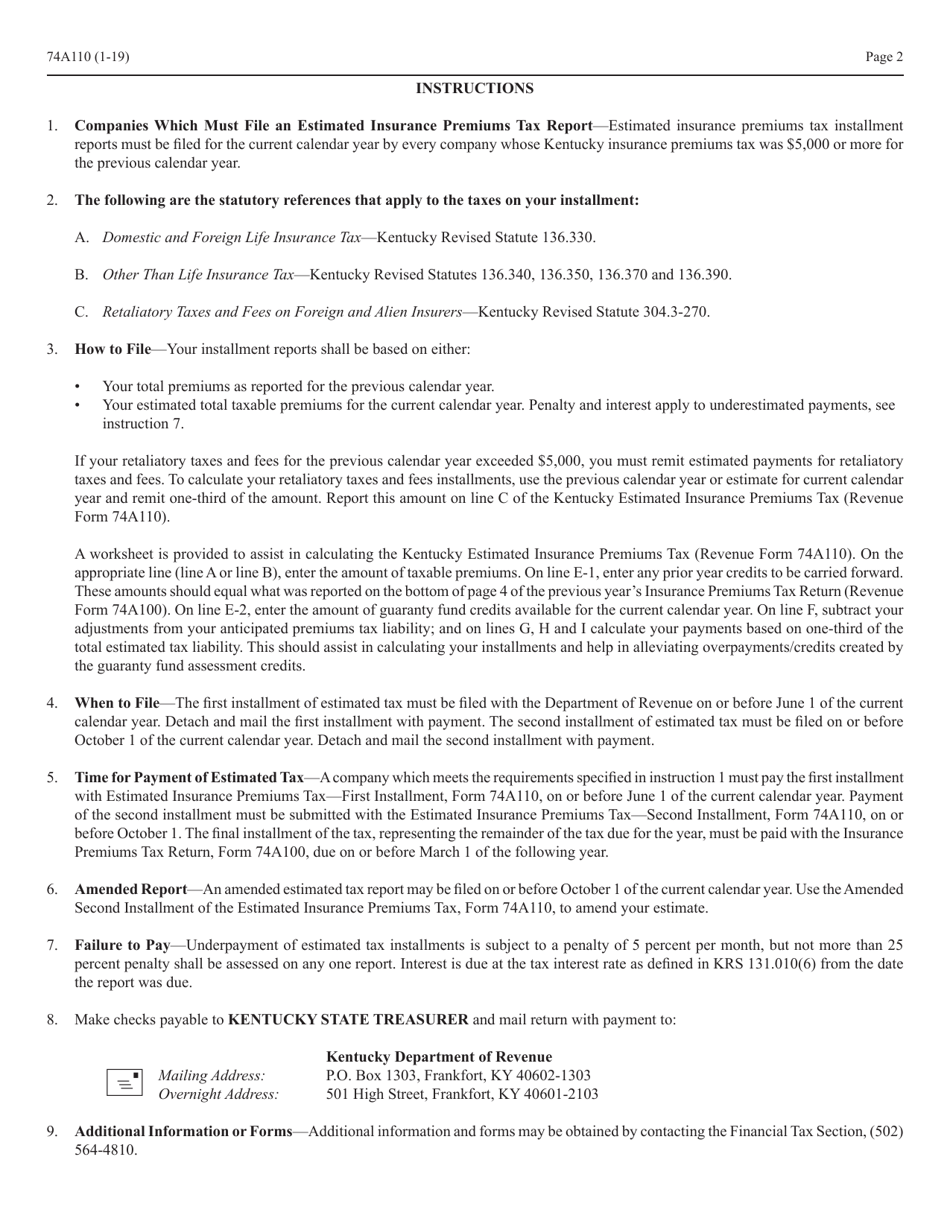

Q: Who needs to file Form 74A110?

A: Insurance companies and other entities that are subject to the insurance premiums tax in Kentucky need to file Form 74A110.

Q: When is Form 74A110 due?

A: Form 74A110 is due on or before the 15th day of the fourth month following the end of the taxable period.

Q: Do I need to include a payment with Form 74A110?

A: Yes, you need to include the estimated tax payment with the form.

Q: Are there any penalties for late filing of Form 74A110?

A: Yes, there are penalties for late filing and late payment of the insurance premiums tax in Kentucky.

Q: What if I have questions about Form 74A110?

A: If you have questions about Form 74A110, you can contact the Kentucky Department of Revenue for assistance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 74A110 by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.