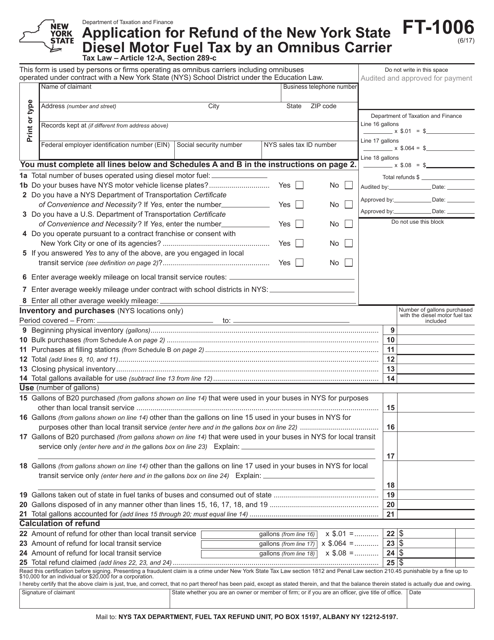

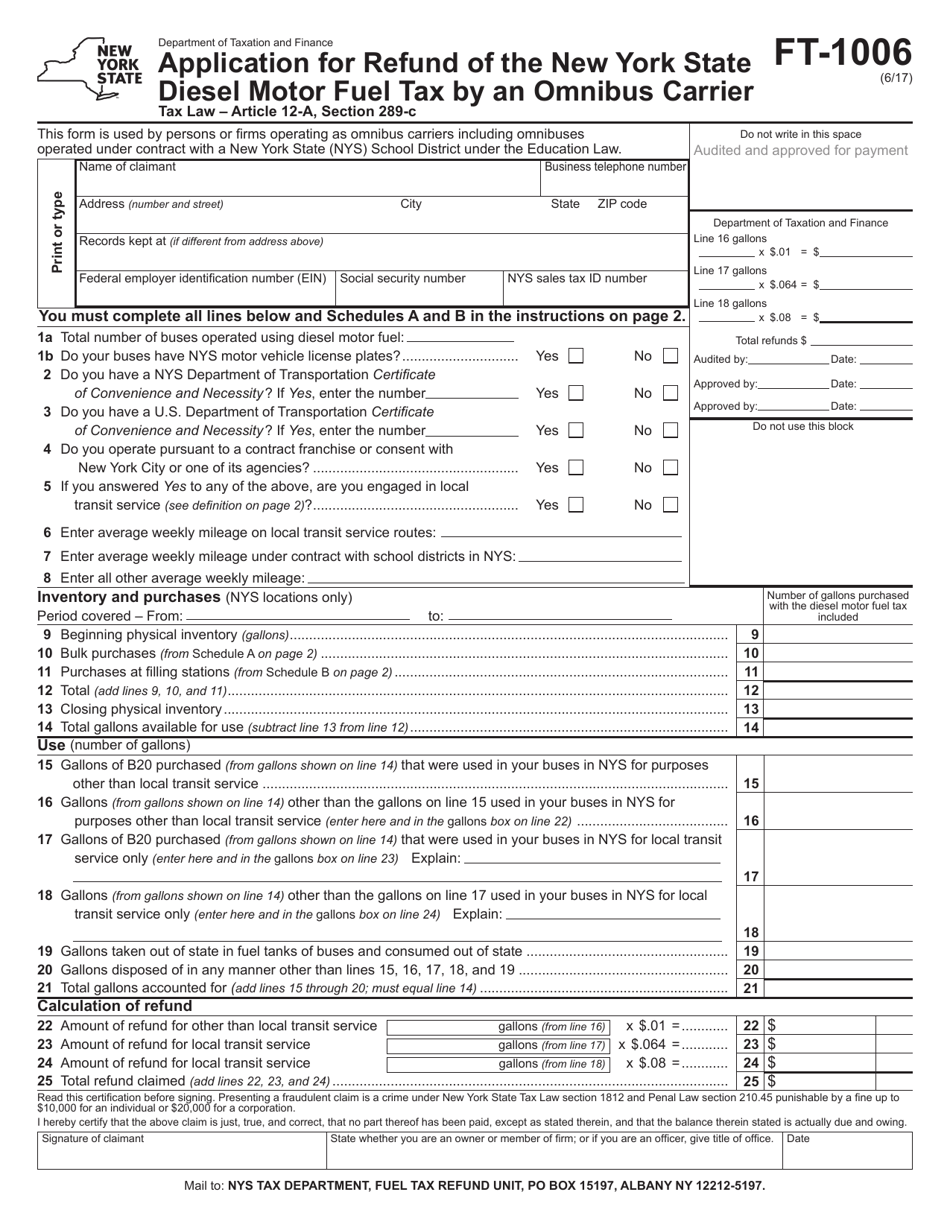

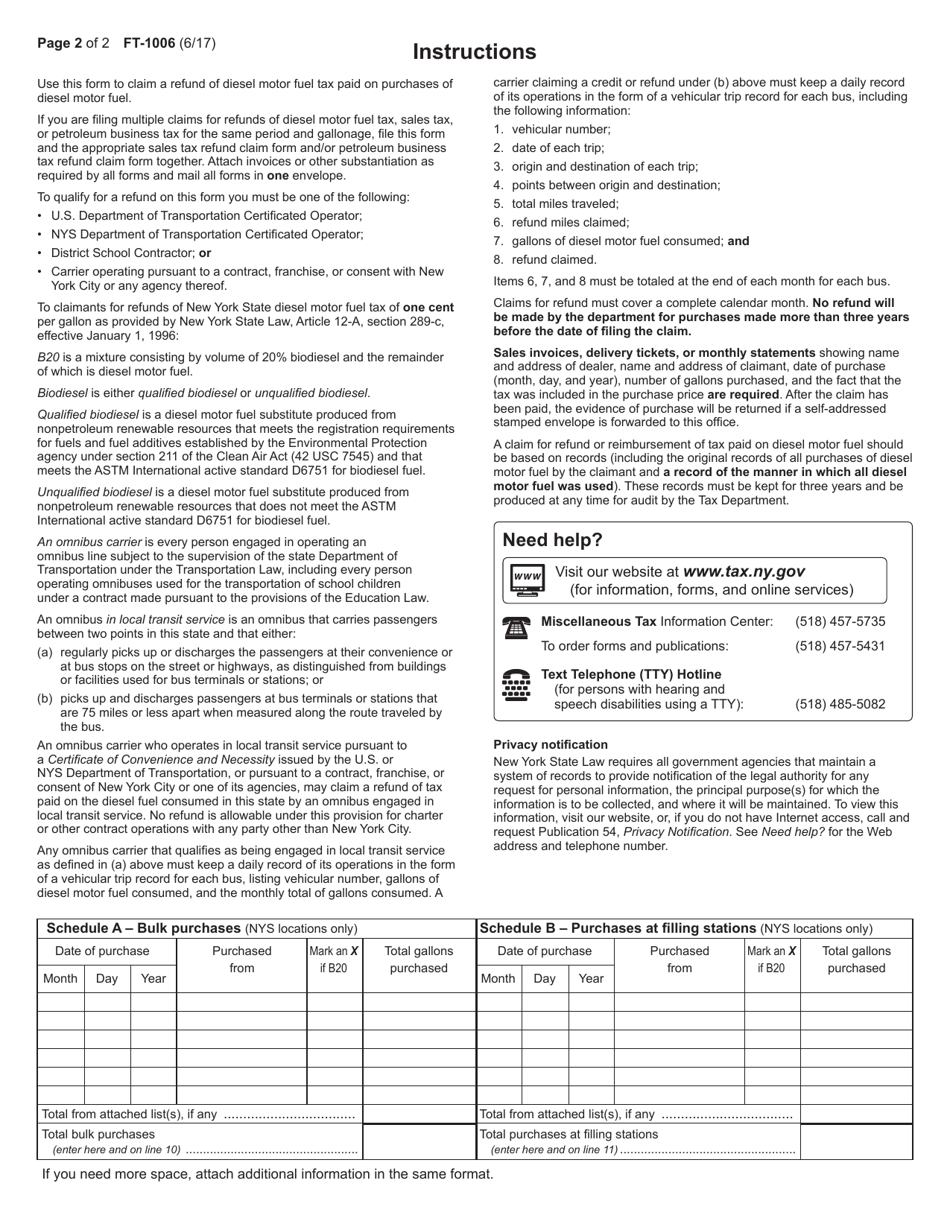

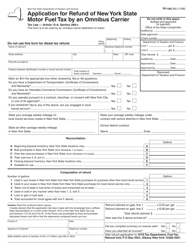

Form FT-1006 Application for Refund of the New York State Diesel Motor Fuel Tax by an Omnibus Carrier - New York

What Is Form FT-1006?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-1006?

A: Form FT-1006 is an application for refund of the New York State Diesel Motor Fuel Tax by an Omnibus Carrier in New York.

Q: Who can use Form FT-1006?

A: Omnibus carriers in New York can use Form FT-1006 to apply for a refund of the Diesel Motor Fuel Tax.

Q: What is the purpose of Form FT-1006?

A: The purpose of Form FT-1006 is to allow omnibus carriers to apply for a refund of the New York State Diesel Motor Fuel Tax.

Q: When should I submit Form FT-1006?

A: You should submit Form FT-1006 within three years from the original purchase date of the diesel motor fuel.

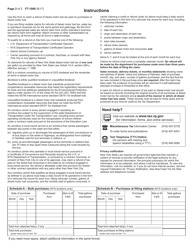

Q: What supporting documents do I need to submit with Form FT-1006?

A: You need to include copies of invoices or receipts for the diesel motor fuel purchases, along with any other supporting documentation mentioned in the form instructions.

Q: How long does it take to process Form FT-1006?

A: The processing time for Form FT-1006 can vary, but generally it takes approximately 4-6 weeks for the refund to be issued.

Q: Can I file Form FT-1006 electronically?

A: At the moment, Form FT-1006 cannot be filed electronically. You must submit a paper copy by mail.

Q: Is there a fee for filing Form FT-1006?

A: There is no fee for filing Form FT-1006.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FT-1006 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.