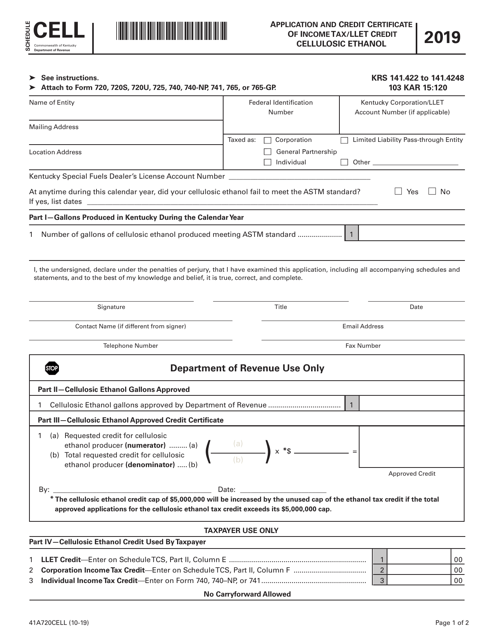

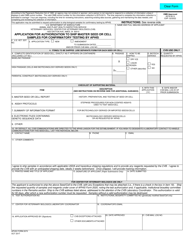

Form 41A720CELL Schedule CELL Application and Credit Certificate of Income Tax / Llet Credit Cellulosic Ethanol - Kentucky

What Is Form 41A720CELL Schedule CELL?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 41A720CELL?

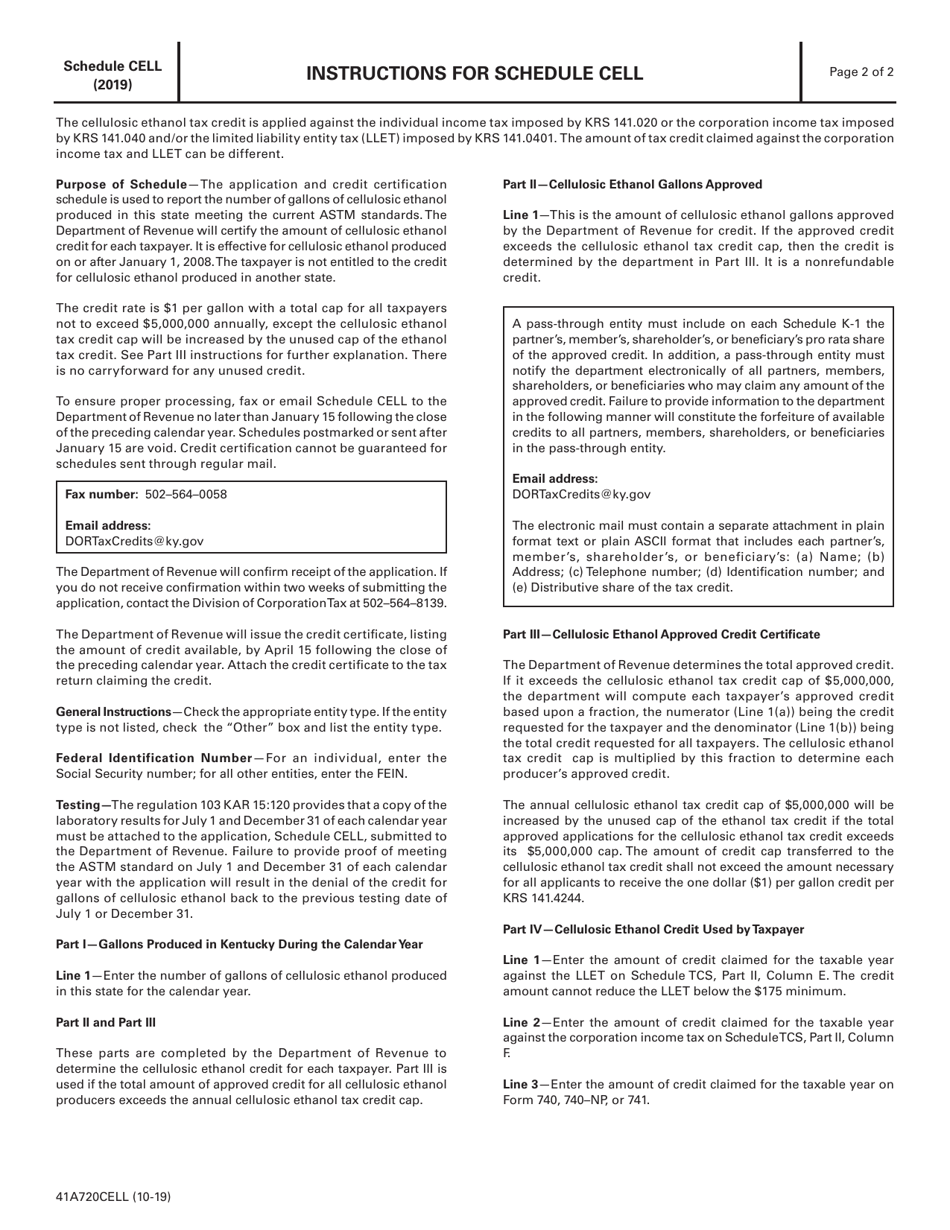

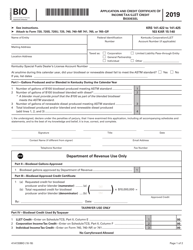

A: Form 41A720CELL is a schedule used to apply for the credit certificate of income tax/letter credit for cellulosic ethanol in Kentucky.

Q: What is the purpose of Form 41A720CELL?

A: The purpose of Form 41A720CELL is to apply for the credit certificate of income tax/letter credit for cellulosic ethanol in Kentucky.

Q: Who can use Form 41A720CELL?

A: Anyone who wants to apply for the credit certificate of income tax/letter credit for cellulosic ethanol in Kentucky can use Form 41A720CELL.

Q: What is cellulosic ethanol?

A: Cellulosic ethanol is a type of biofuel produced from non-edible plant material like agricultural residues, grasses, and wood.

Q: What is the credit certificate of income tax/letter credit for cellulosic ethanol?

A: The credit certificate of income tax/letter credit is a financial incentive provided by Kentucky to promote the production and use of cellulosic ethanol.

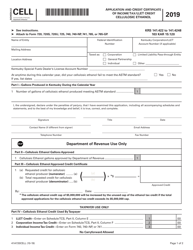

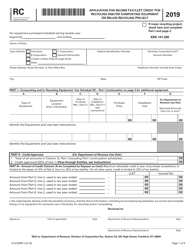

Q: What information is required on Form 41A720CELL?

A: Form 41A720CELL requires information such as the taxpayer's identification details, ethanol production details, and calculation of the credit amount.

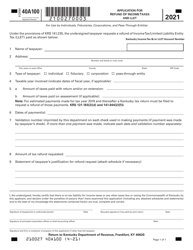

Q: Are there any deadlines for submitting Form 41A720CELL?

A: Yes, Form 41A720CELL must be filed on or before the 15th day of the fourth month following the close of the taxpayer's taxable year.

Q: Are there any supporting documents required with Form 41A720CELL?

A: Yes, supporting documents such as the production records, purchase invoices, and any other relevant documents must be submitted with Form 41A720CELL.

Q: What is the benefit of the credit certificate of income tax/letter credit for cellulosic ethanol?

A: The benefit of the credit certificate of income tax/letter credit is that it allows the taxpayer to claim a credit against their Kentucky income tax liability for the production and use of cellulosic ethanol.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 41A720CELL Schedule CELL by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.