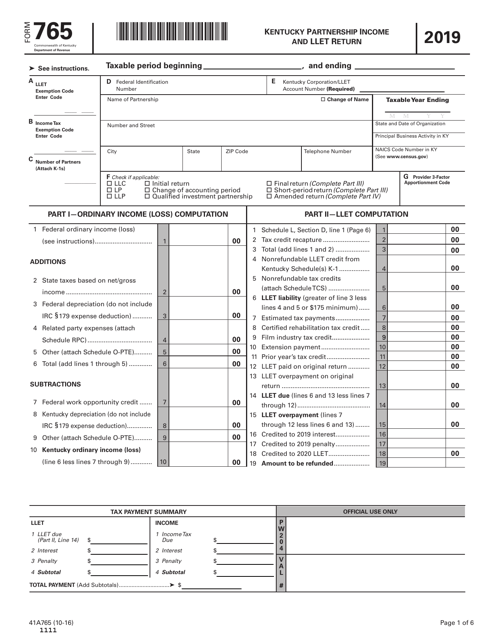

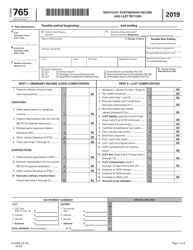

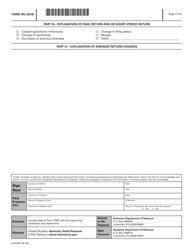

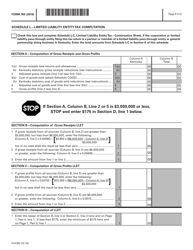

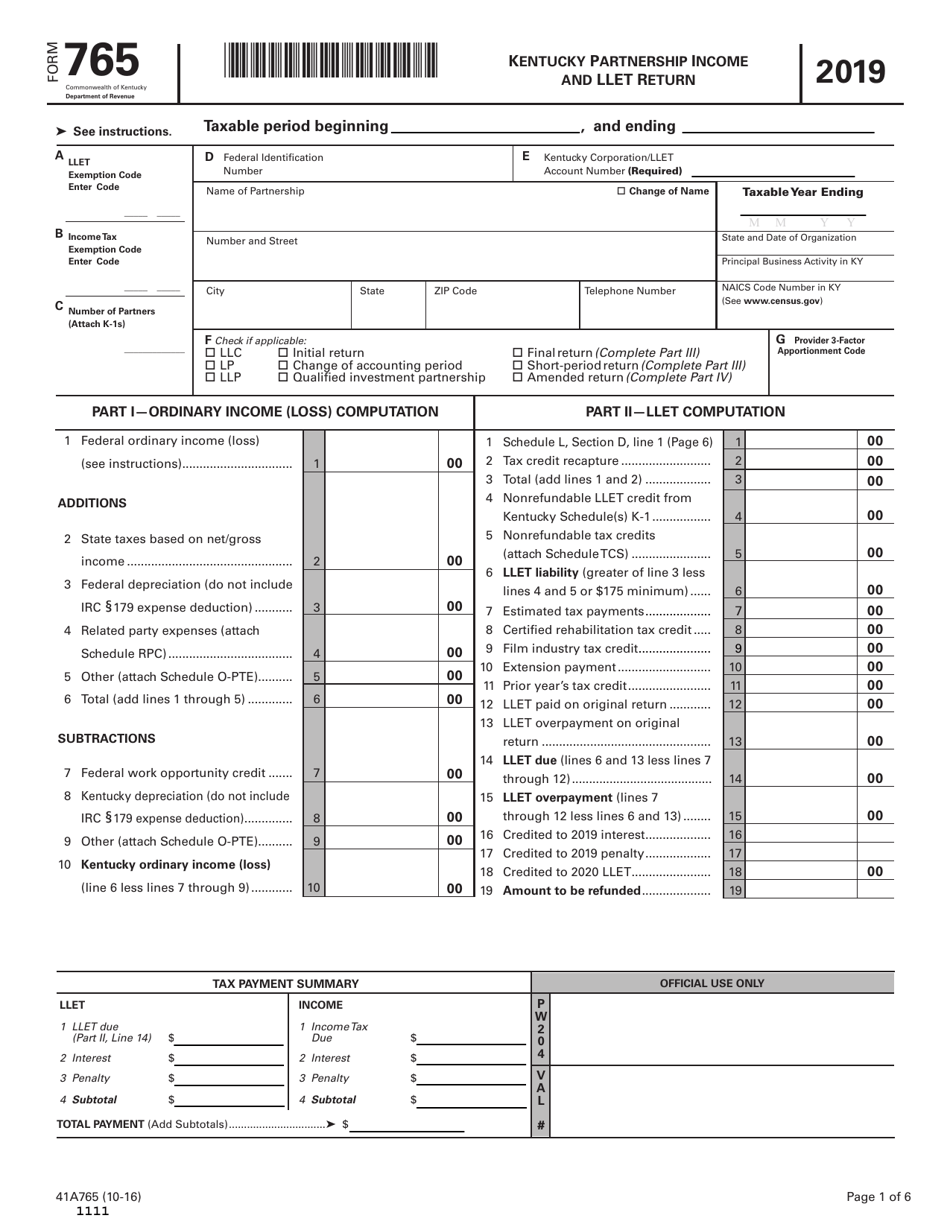

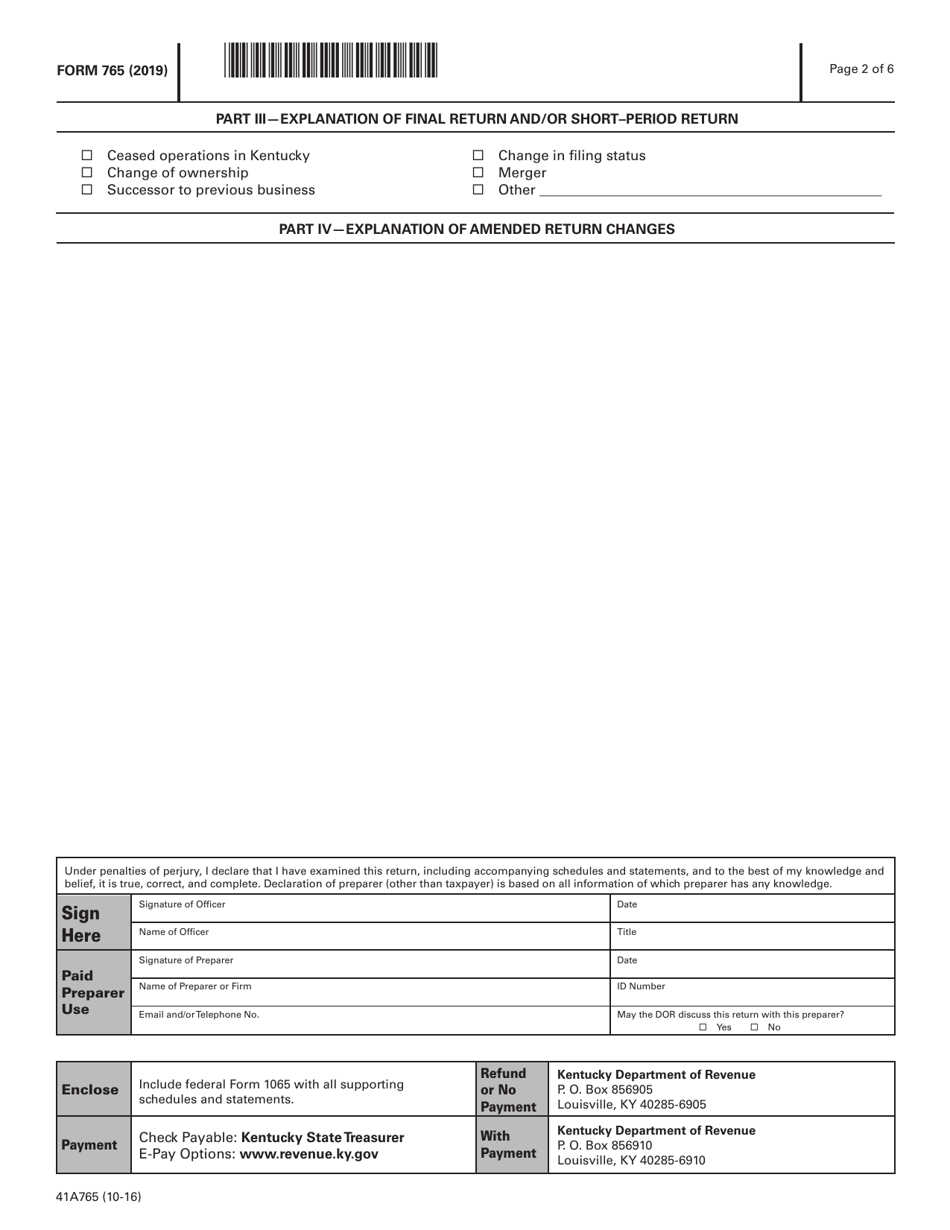

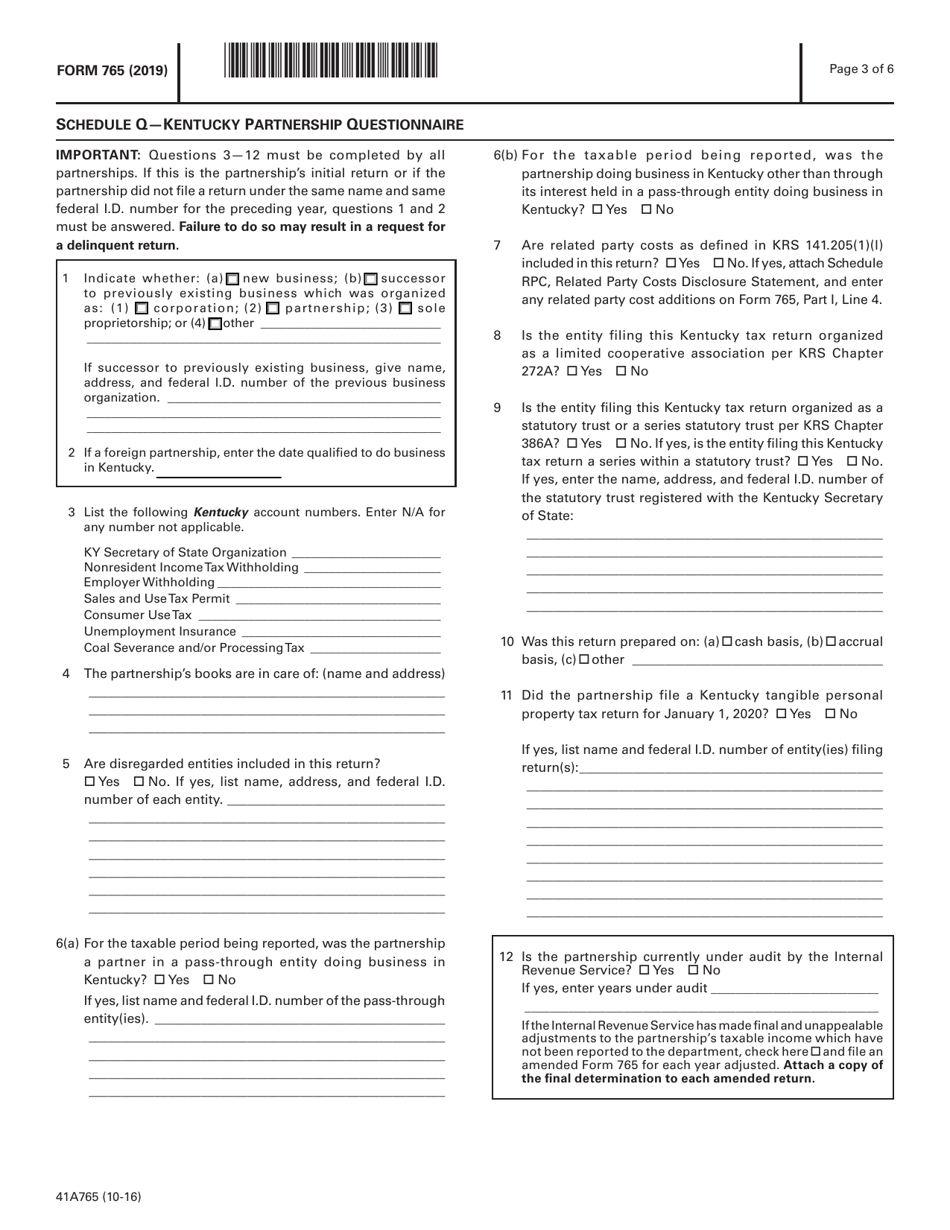

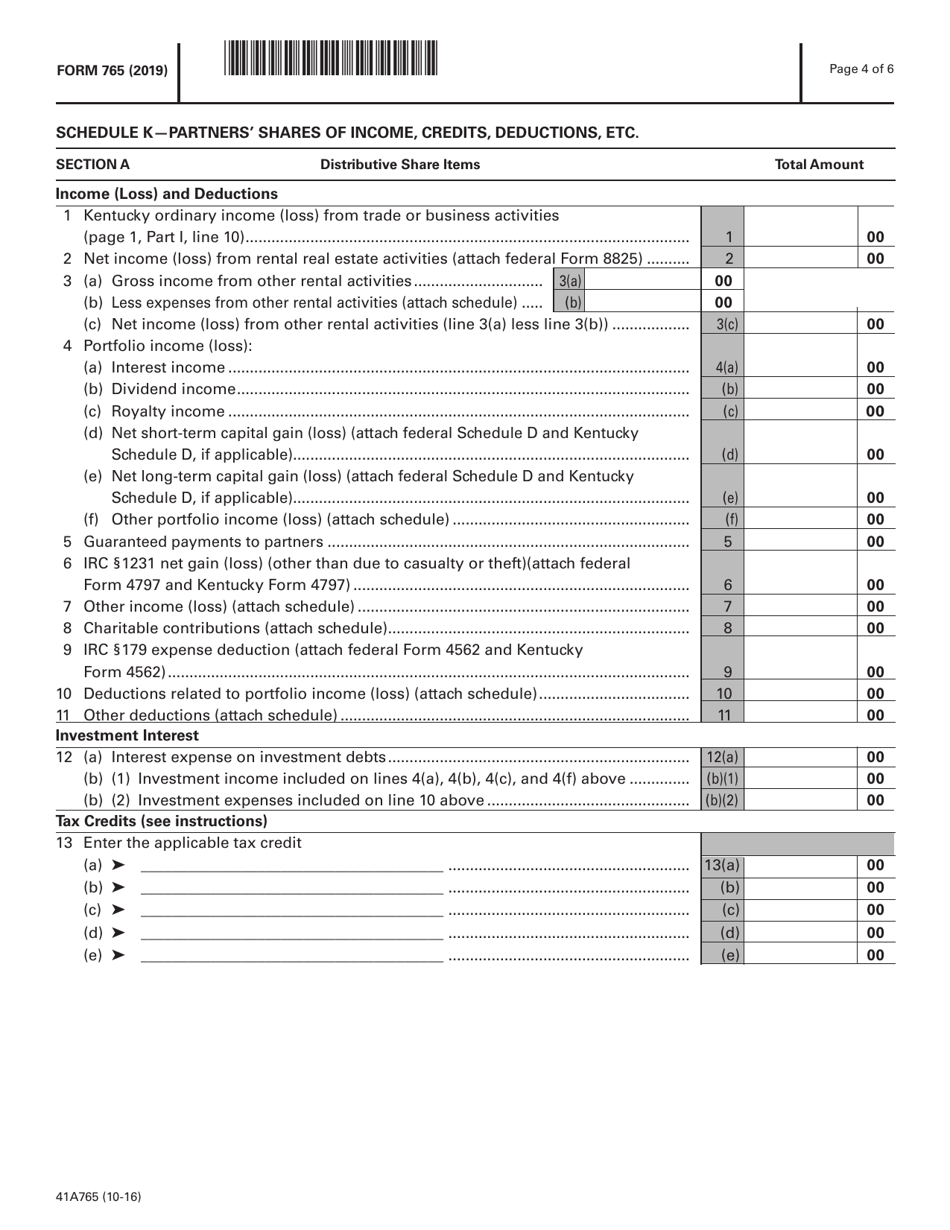

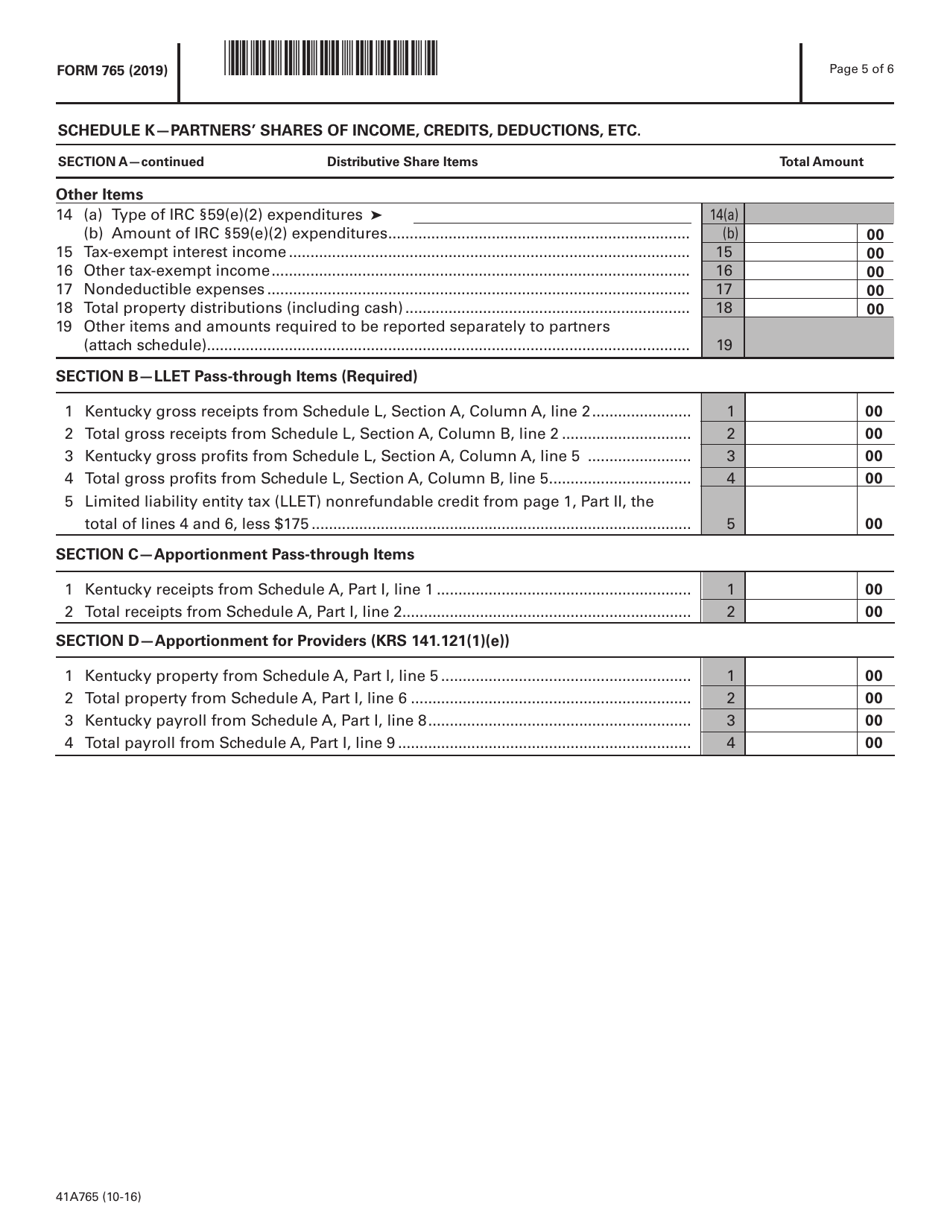

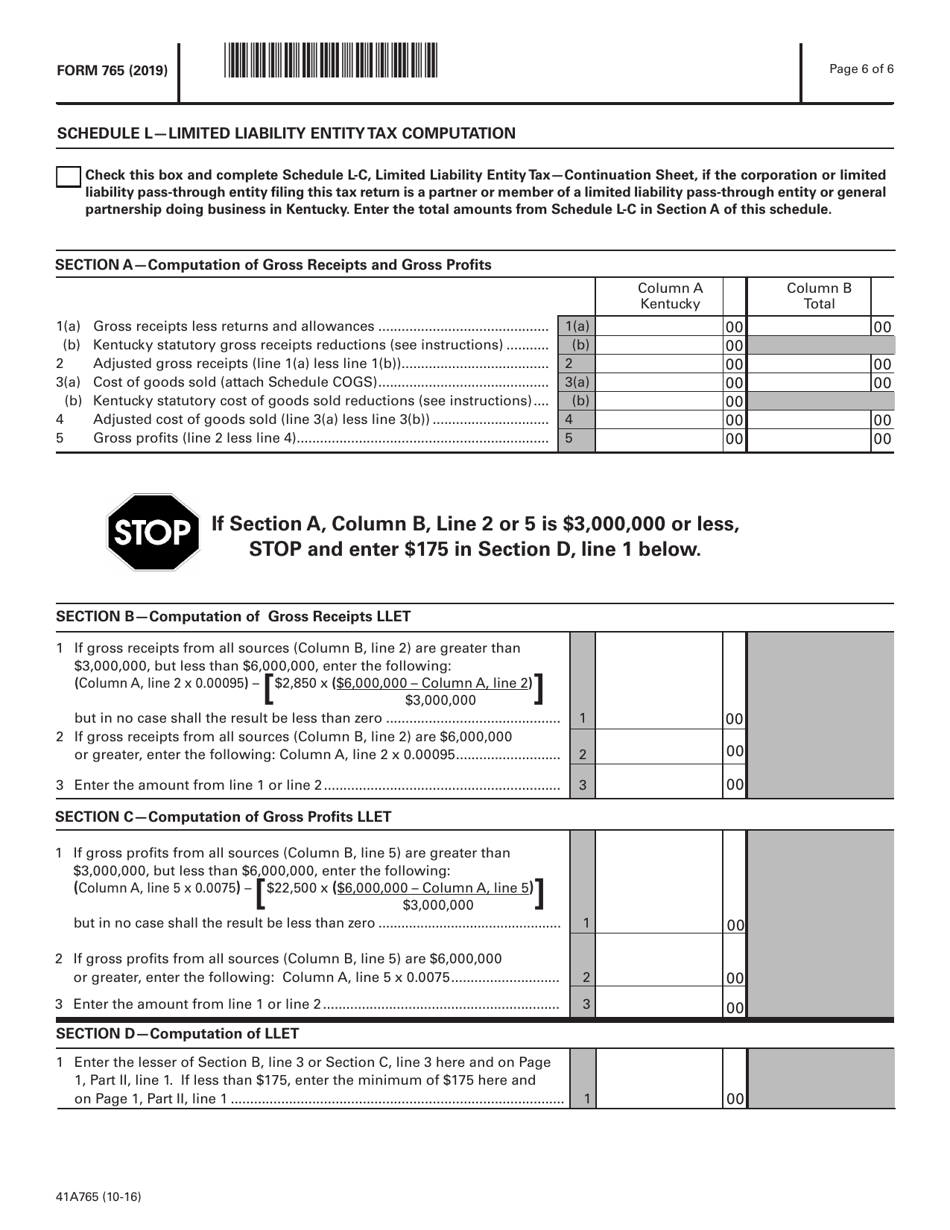

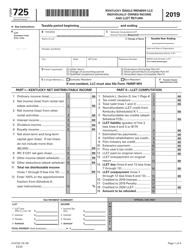

Form 765 (41A765) Kentucky Partnership Income and Llet Return - Kentucky

What Is Form 765 (41A765)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 765 (41A765)?

A: Form 765 (41A765) is the Kentucky Partnership Income and Llet Return.

Q: Who needs to file Form 765 (41A765)?

A: Kentucky partnerships need to file Form 765 (41A765) to report their income and calculate their tax liability.

Q: What information is required to complete Form 765 (41A765)?

A: You will need information about your partnership's income, deductions, credits, and partners.

Q: When is the due date for filing Form 765 (41A765)?

A: Form 765 (41A765) is due on the 15th day of the 4th month following the close of the partnership's taxable year.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 765 (41A765) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.