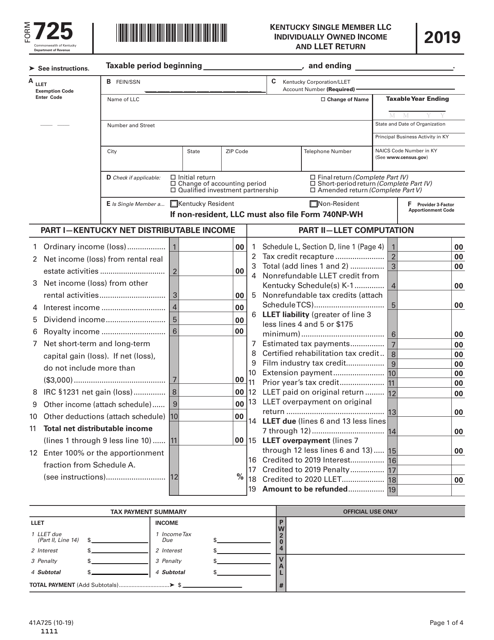

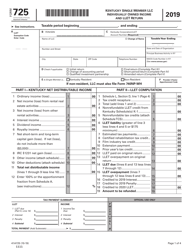

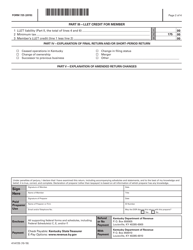

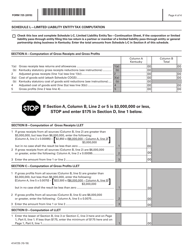

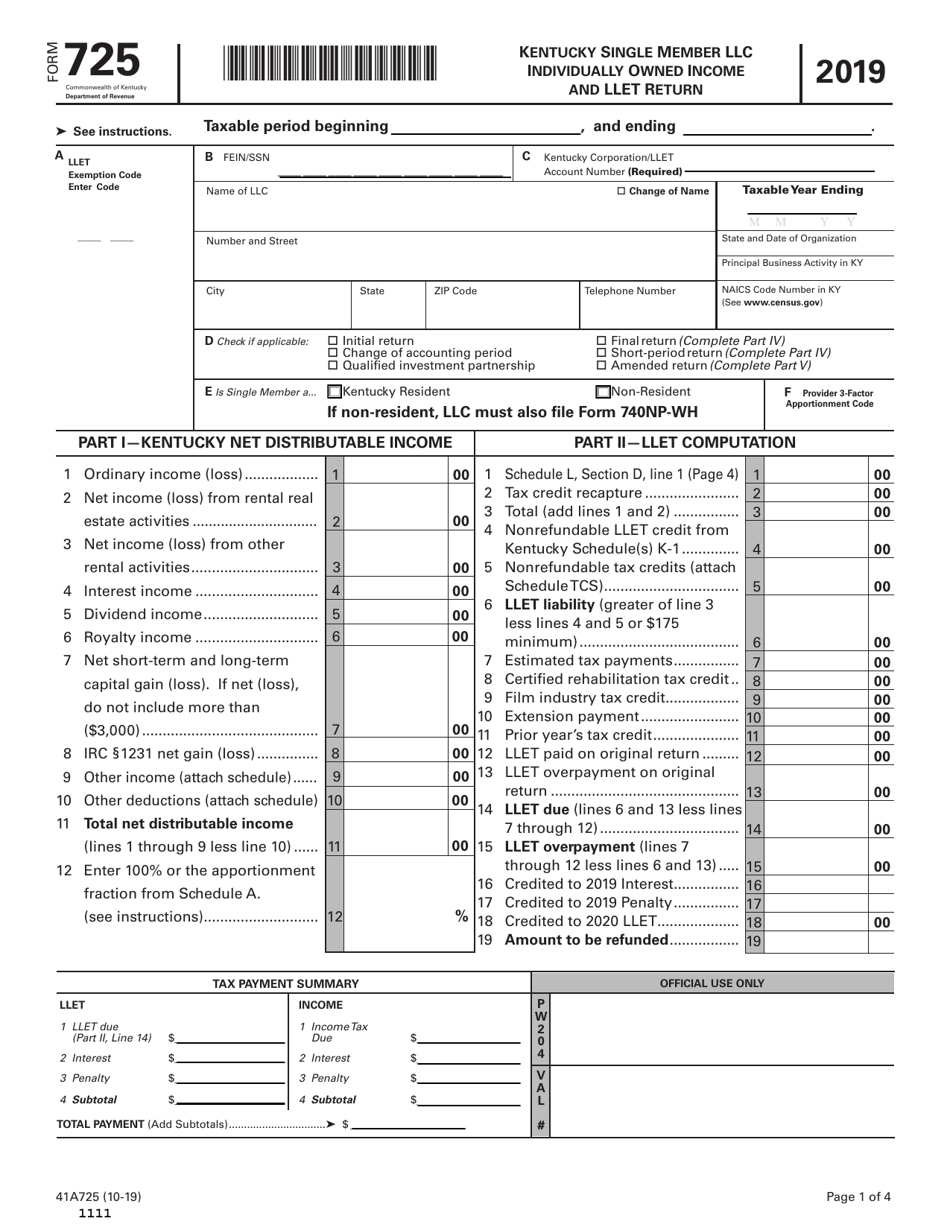

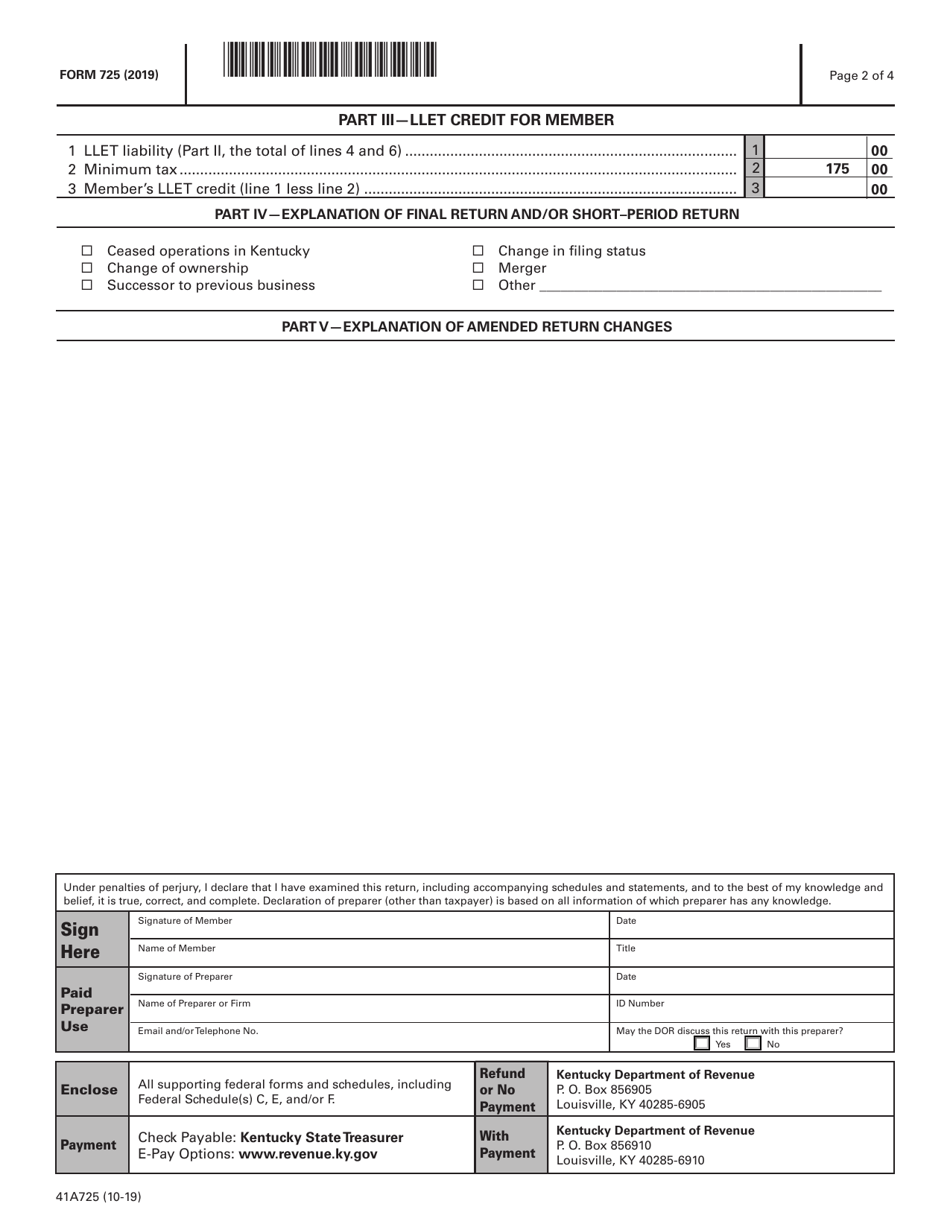

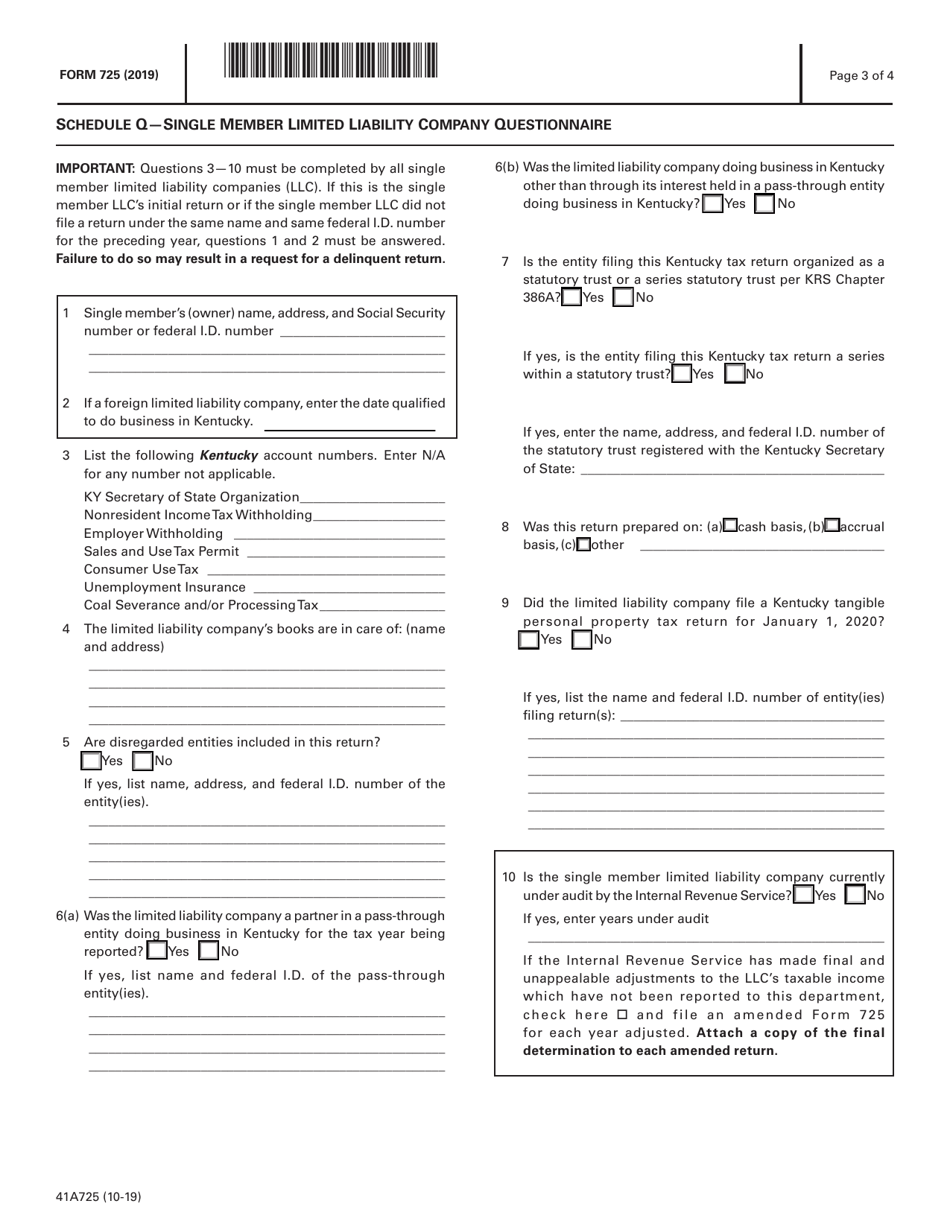

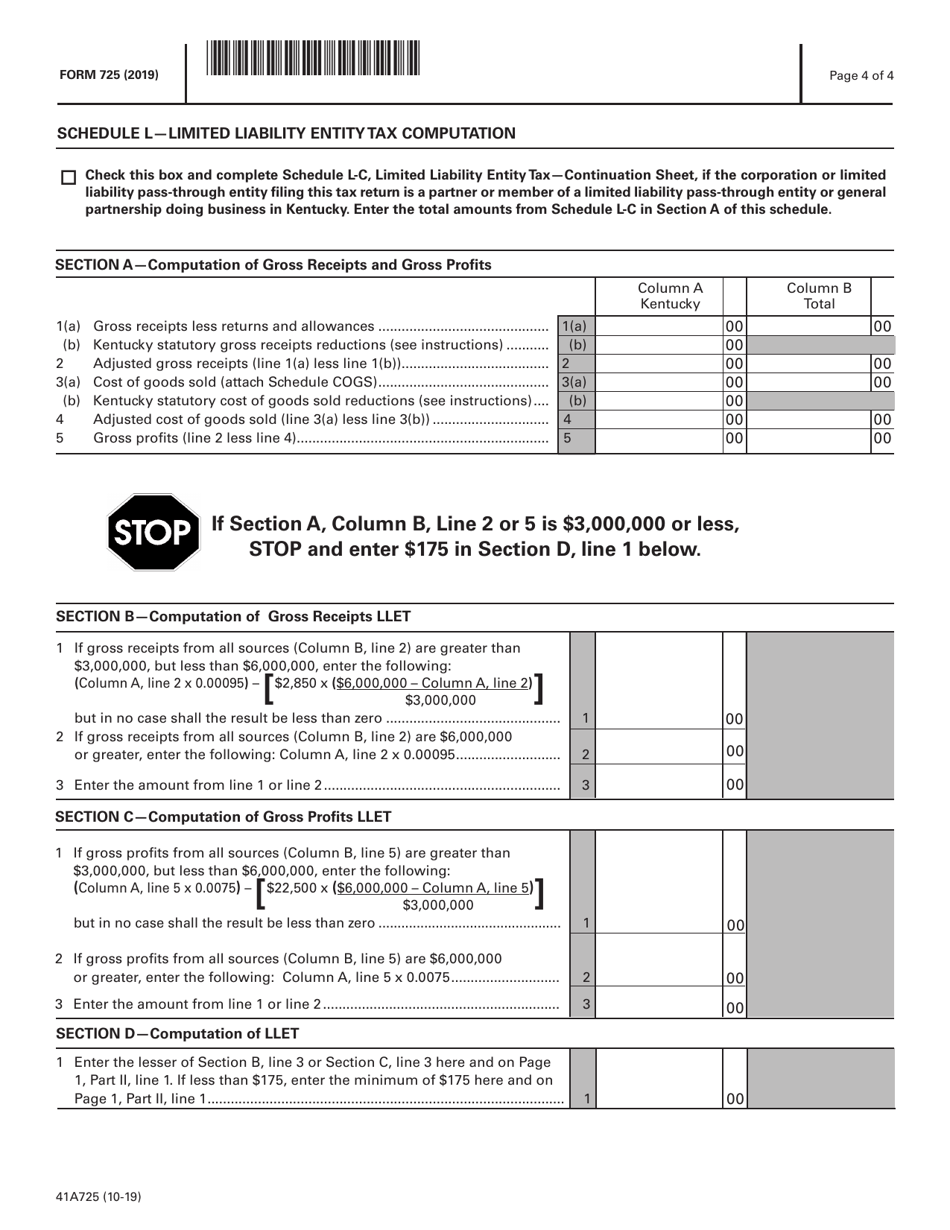

Form 725 (41A725) Kentucky Single Member LLC Individually Owned Income and Llet Return - Kentucky

What Is Form 725 (41A725)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 725?

A: Form 725 is an income and LLET (limited liability entity tax) return form for single member LLCs in Kentucky.

Q: Who needs to file Form 725?

A: Single member LLCs in Kentucky that are individually owned need to file Form 725.

Q: What is the purpose of Form 725?

A: The purpose of Form 725 is to report the income and pay the LLET tax for single member LLCs in Kentucky.

Q: What is LLET?

A: LLET stands for limited liability entity tax, which is a tax imposed on certain business entities in Kentucky.

Q: Is Form 725 only for Kentucky residents?

A: No, Form 725 is for single member LLCs in Kentucky, regardless of whether the owner is a resident or not.

Q: When is Form 725 due?

A: Form 725 is due on the 15th day of the 4th month after the close of the taxable year.

Q: Are there any penalties for not filing Form 725?

A: Yes, there are penalties for not filing Form 725, including late filing penalties and interest on unpaid taxes.

Q: What should I do if I need more information or assistance with Form 725?

A: If you need more information or assistance with Form 725, you can contact the Kentucky Department of Revenue or consult a tax professional.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 725 (41A725) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.