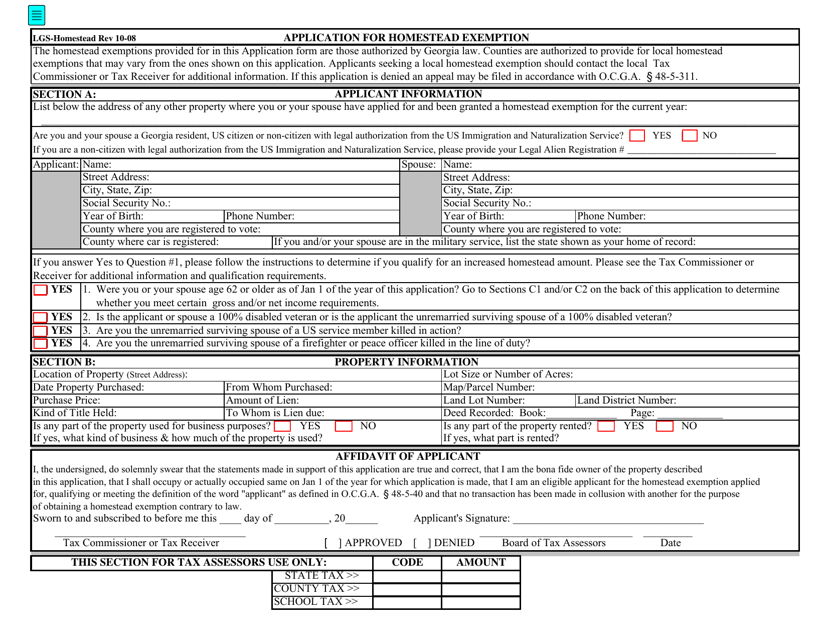

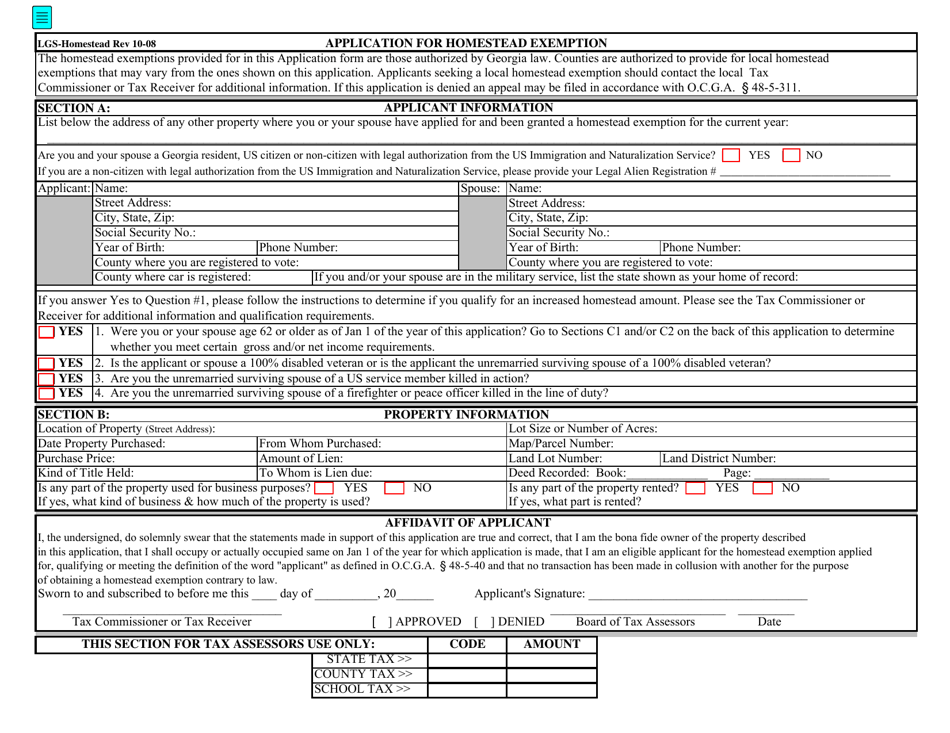

Lgs-Homestead - Application for Homestead Exemption - Georgia (United States)

Lgs-Homestead - Application for Homestead Exemption is a legal document that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States).

FAQ

Q: What is the Homestead Exemption?

A: The Homestead Exemption is a property tax relief program.

Q: Who is eligible for the Homestead Exemption in Georgia?

A: Georgia residents who own and occupy their home as their primary residence.

Q: What is the purpose of the Homestead Exemption?

A: The purpose is to provide property tax relief to homeowners.

Q: How much is the Homestead Exemption in Georgia?

A: The exemption can vary by county, but it is typically a reduction of up to $2,000 off the assessed value of the property.

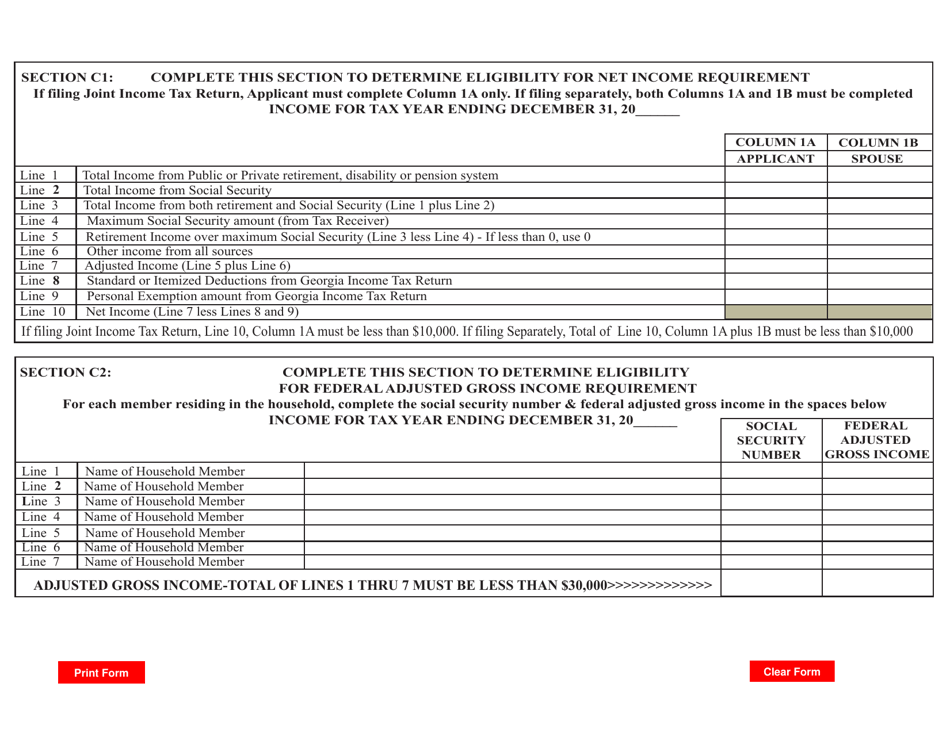

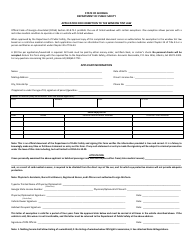

Q: How do I apply for the Homestead Exemption in Georgia?

A: You can apply by filling out the LGS-Homestead application form.

Q: When is the deadline to apply for the Homestead Exemption in Georgia?

A: The deadline is typically April 1st of the year you wish to claim the exemption.

Q: What documents do I need to include with my application?

A: You will need to provide proof of ownership and occupancy of your home, such as a deed or lease agreement.

Q: Can I apply for the Homestead Exemption if I rent my home?

A: No, only homeowners who occupy their home as their primary residence are eligible.

Q: Is the Homestead Exemption the same in all states?

A: No, the rules and benefits of the Homestead Exemption can vary by state.

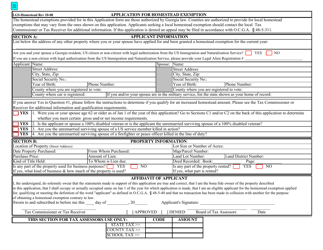

Q: Are there any income restrictions to qualify for the Homestead Exemption?

A: No, there are no income restrictions to qualify for the Homestead Exemption in Georgia.

Form Details:

- Released on October 1, 2008;

- The latest edition currently provided by the Georgia Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.