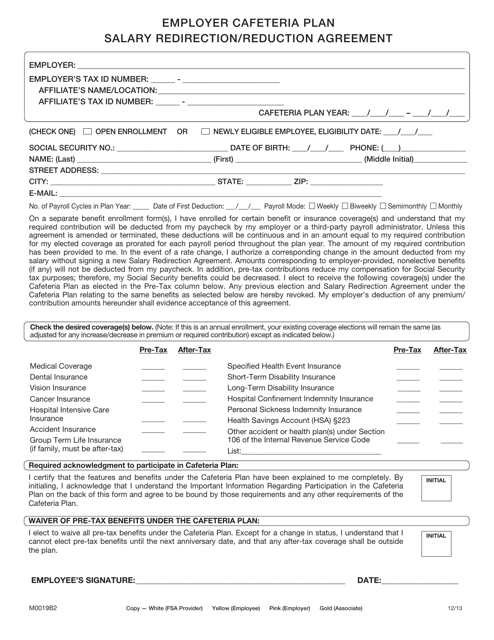

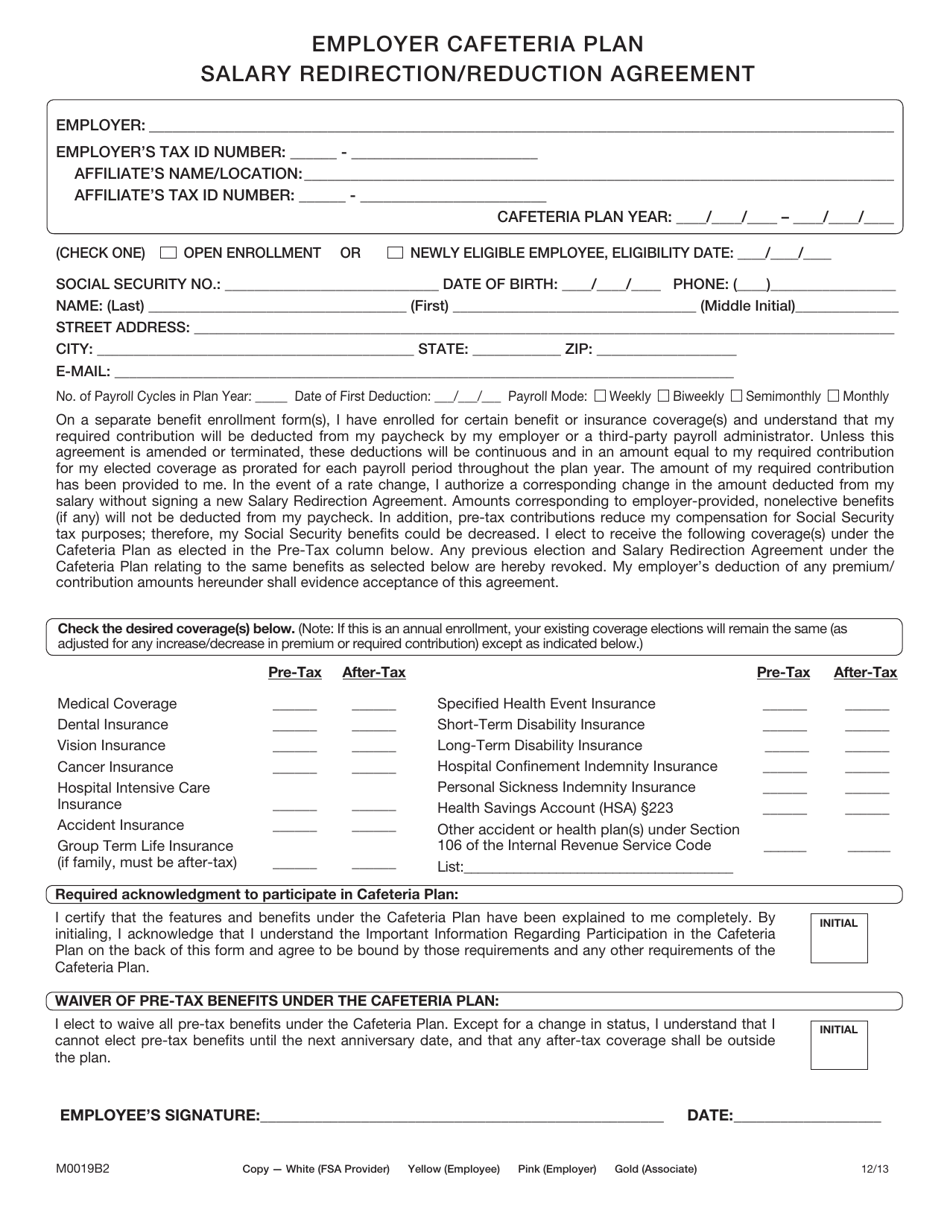

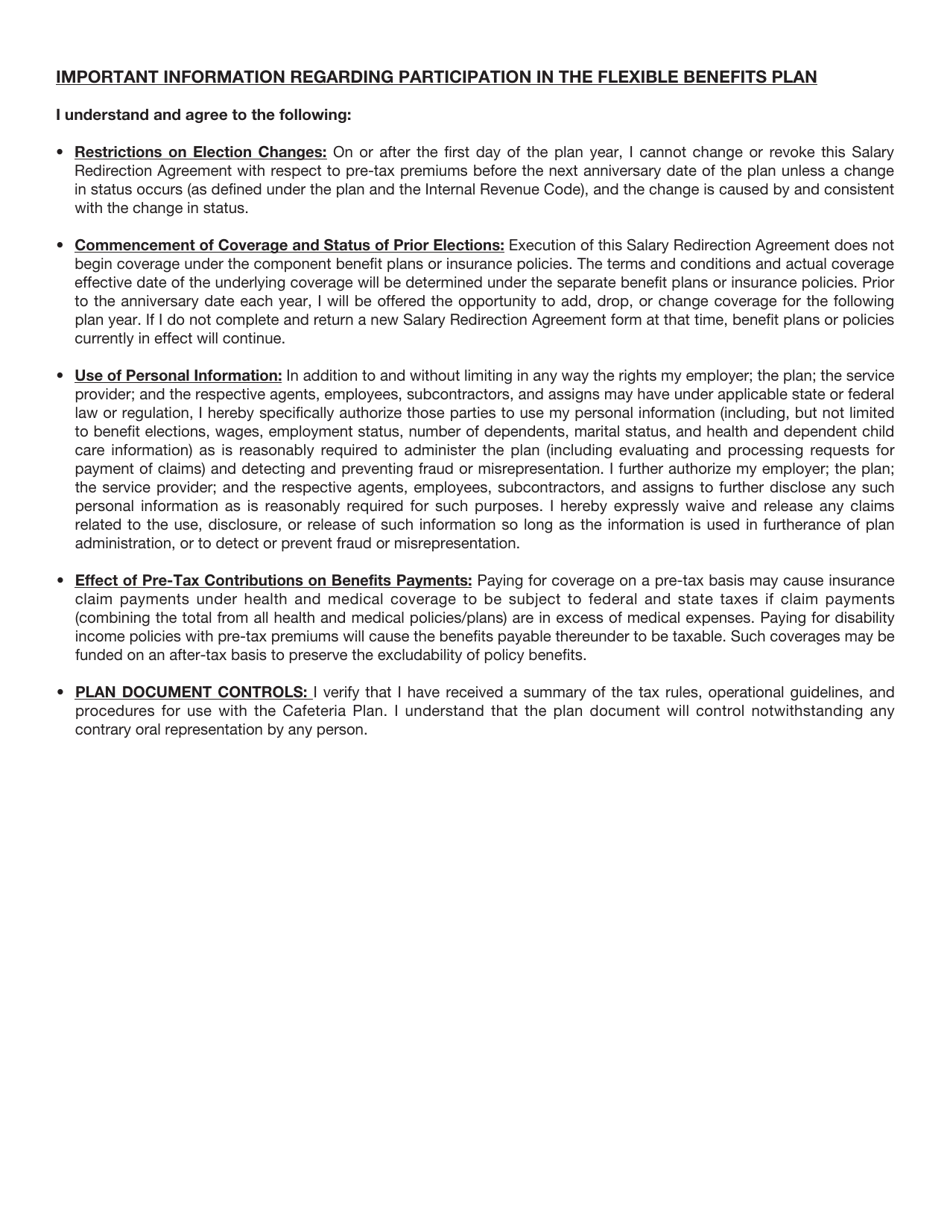

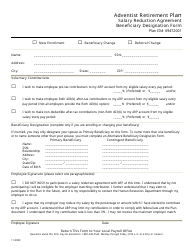

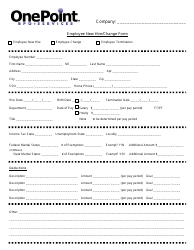

Employer Cafeteria Plan Salary Redirection / Reduction Agreement - Aflac

The Employer Cafeteria Plan Salary Redirection/Reduction Agreement - Aflac is a plan that allows employees to redirect or reduce a portion of their salary towards Aflac insurance premiums. This gives employees the option to use pre-tax dollars to pay for their insurance coverage provided by Aflac.

The Employer files the Employer Cafeteria Plan Salary Redirection/Reduction Agreement - Aflac.

FAQ

Q: What is an employer cafeteria plan?

A: An employer cafeteria plan is a benefits program that allows employees to choose from a menu of pre-tax benefits.

Q: What is salary redirection?

A: Salary redirection refers to the process of redirecting a portion of an employee's salary towards their selected benefits in a cafeteria plan.

Q: What is salary reduction?

A: Salary reduction refers to the reduction of an employee's taxable income by redirecting a portion of it towards their chosen benefits in a cafeteria plan.

Q: What is Aflac?

A: Aflac is a supplemental insurance company that offers a range of voluntary insurance products to individuals and employers.

Q: How does Aflac work?

A: Aflac policies pay cash benefits directly to the policyholders in the event of covered accidents or illnesses, providing them with financial support during their time of need.

Q: What are the benefits of participating in an employer cafeteria plan?

A: Participating in an employer cafeteria plan allows employees to save on taxes by using pre-tax income to pay for their selected benefits, such as health insurance or flexible spending accounts.