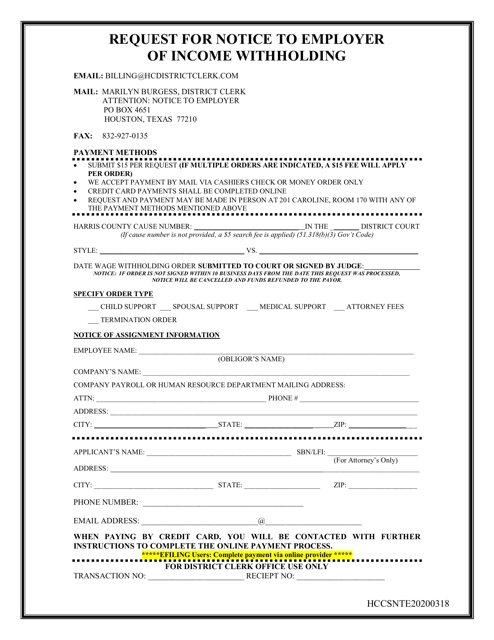

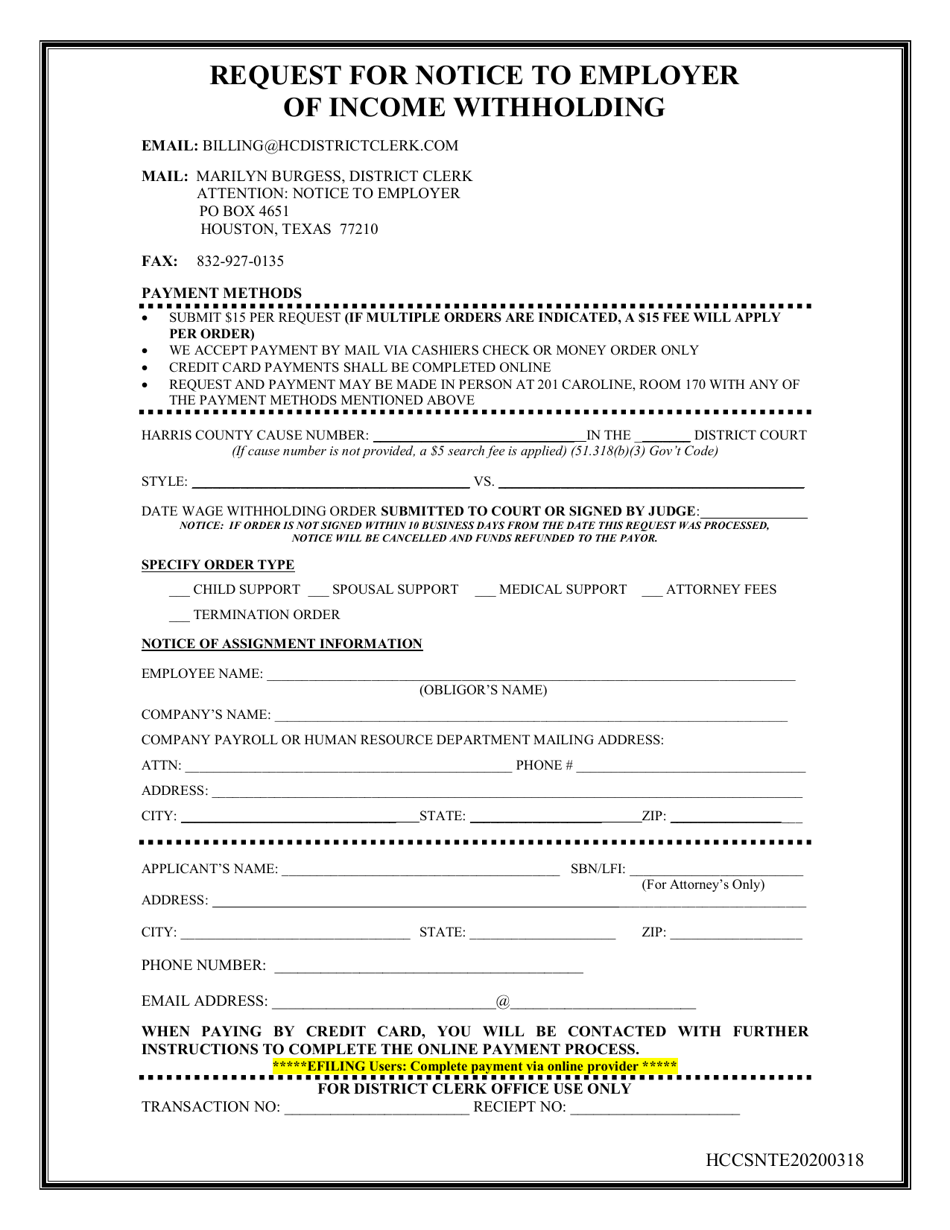

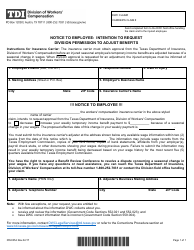

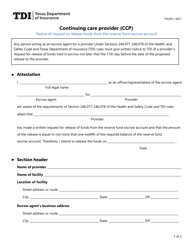

Request for Notice to Employer of Income Withholding - Harris County, Texas

Request for Notice to Employer of Income Withholding is a legal document that was released by the Clerk's Office - Harris County, Texas - a government authority operating within Texas. The form may be used strictly within Harris County.

FAQ

Q: What is a Notice to Employer of Income Withholding?

A: A Notice to Employer of Income Withholding is a document issued by the court to instruct an employer to withhold a portion of an employee's income for child support or other court-ordered payments.

Q: Who issues the Notice to Employer of Income Withholding in Harris County, Texas?

A: In Harris County, Texas, the Notice to Employer of Income Withholding is typically issued by the Harris County Domestic Relations Office or the court handling the case.

Q: When is a Notice to Employer of Income Withholding used?

A: A Notice to Employer of Income Withholding is used when a person is ordered by the court to make child support or other court-ordered payments, and their income needs to be withheld to ensure compliance with the court order.

Q: How does a Notice to Employer of Income Withholding work?

A: The Notice to Employer of Income Withholding instructs the employer to deduct a specified amount from an employee's paycheck and send it directly to the appropriate agency or individual to satisfy the court-ordered payments.

Q: What information is included in a Notice to Employer of Income Withholding?

A: A Notice to Employer of Income Withholding typically includes the employee's name, social security number, employer's name and address, the amount to be withheld, and the recipient of the withheld funds.

Q: Can an employee contest a Notice to Employer of Income Withholding?

A: Yes, an employee who believes there is an error or they are not subject to income withholding can contest the Notice with the court handling the case.

Q: What happens if an employer fails to comply with a Notice to Employer of Income Withholding?

A: If an employer fails to comply with a Notice to Employer of Income Withholding, they may be subject to penalties, fines, and other legal consequences.

Q: How long does a Notice to Employer of Income Withholding remain in effect?

A: A Notice to Employer of Income Withholding remains in effect until further notice from the court, typically until the court-ordered payments are satisfied or modified by a subsequent court order.

Q: Can an employer fire an employee for having a Notice to Employer of Income Withholding?

A: No, an employer cannot legally terminate an employee or take adverse action solely based on the existence of a Notice to Employer of Income Withholding.

Q: What should an employee do if they have questions or issues regarding a Notice to Employer of Income Withholding?

A: An employee should contact the Harris County Domestic Relations Office or the court handling their case for questions or issues regarding a Notice to Employer of Income Withholding.

Form Details:

- Released on March 18, 2020;

- The latest edition currently provided by the Clerk's Office - Harris County, Texas;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Clerk's Office - Harris County, Texas.