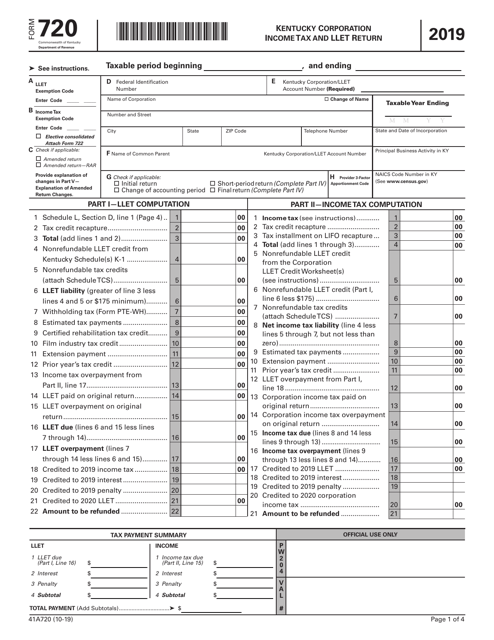

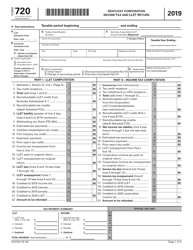

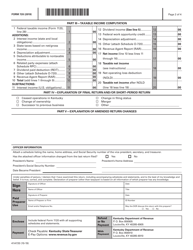

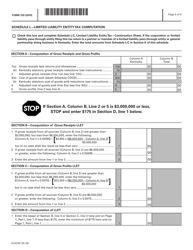

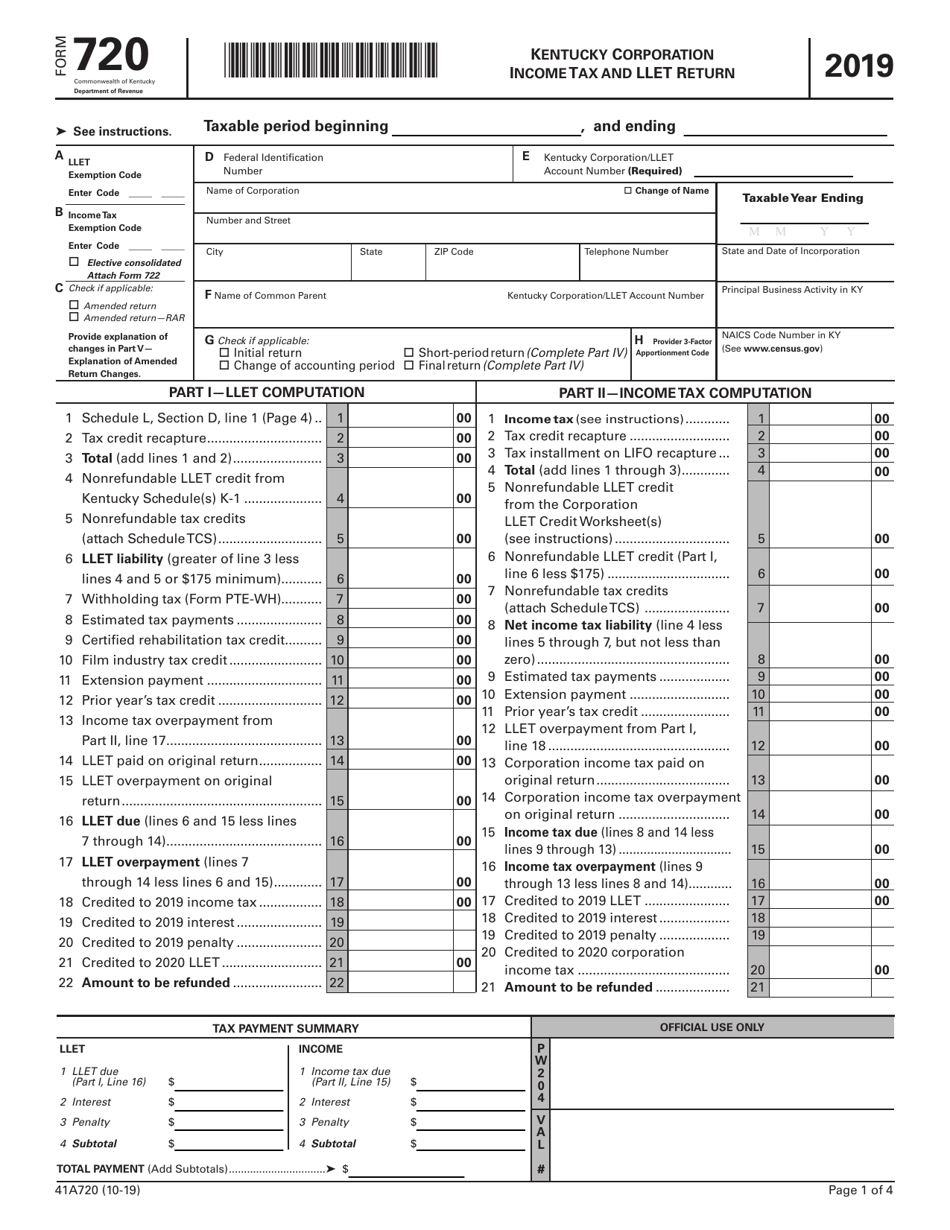

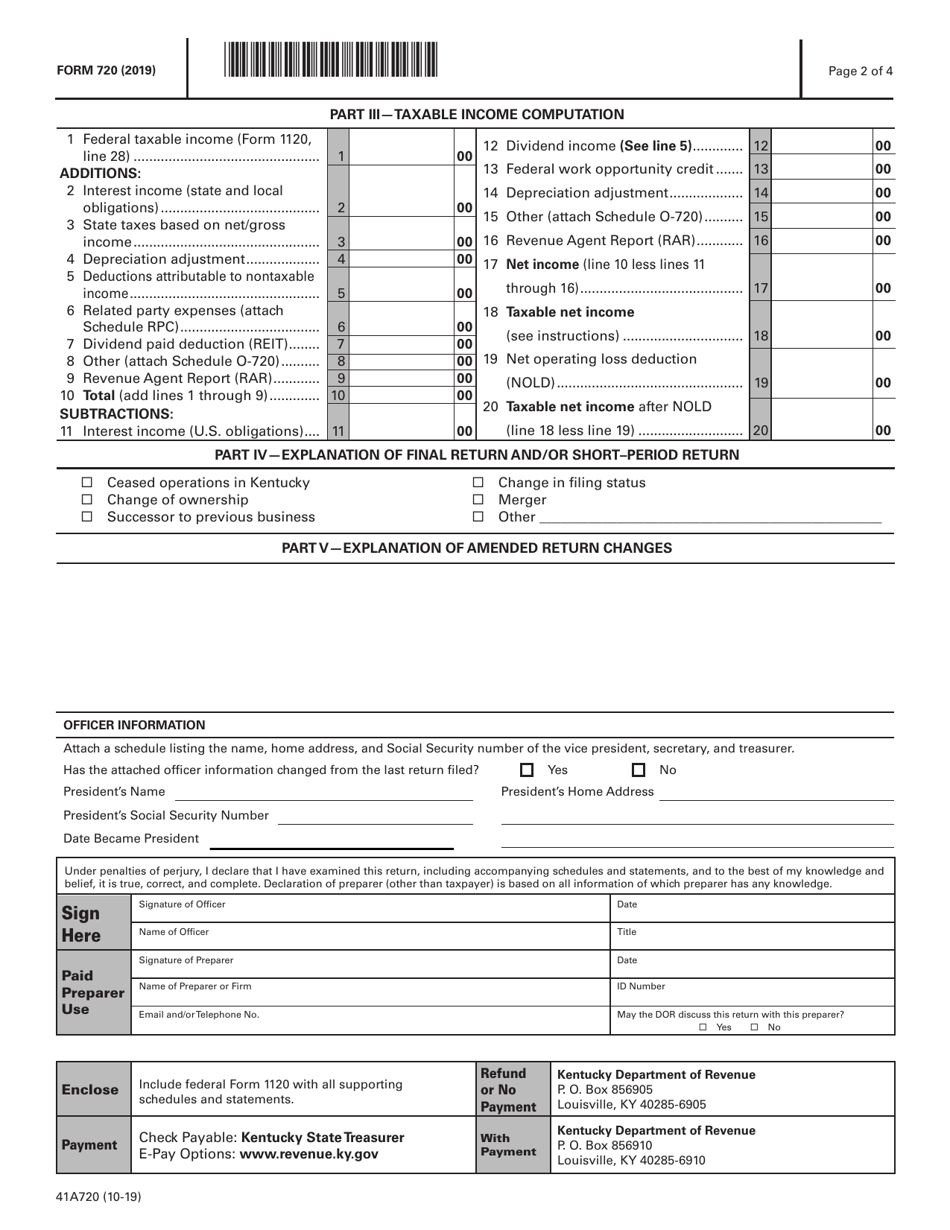

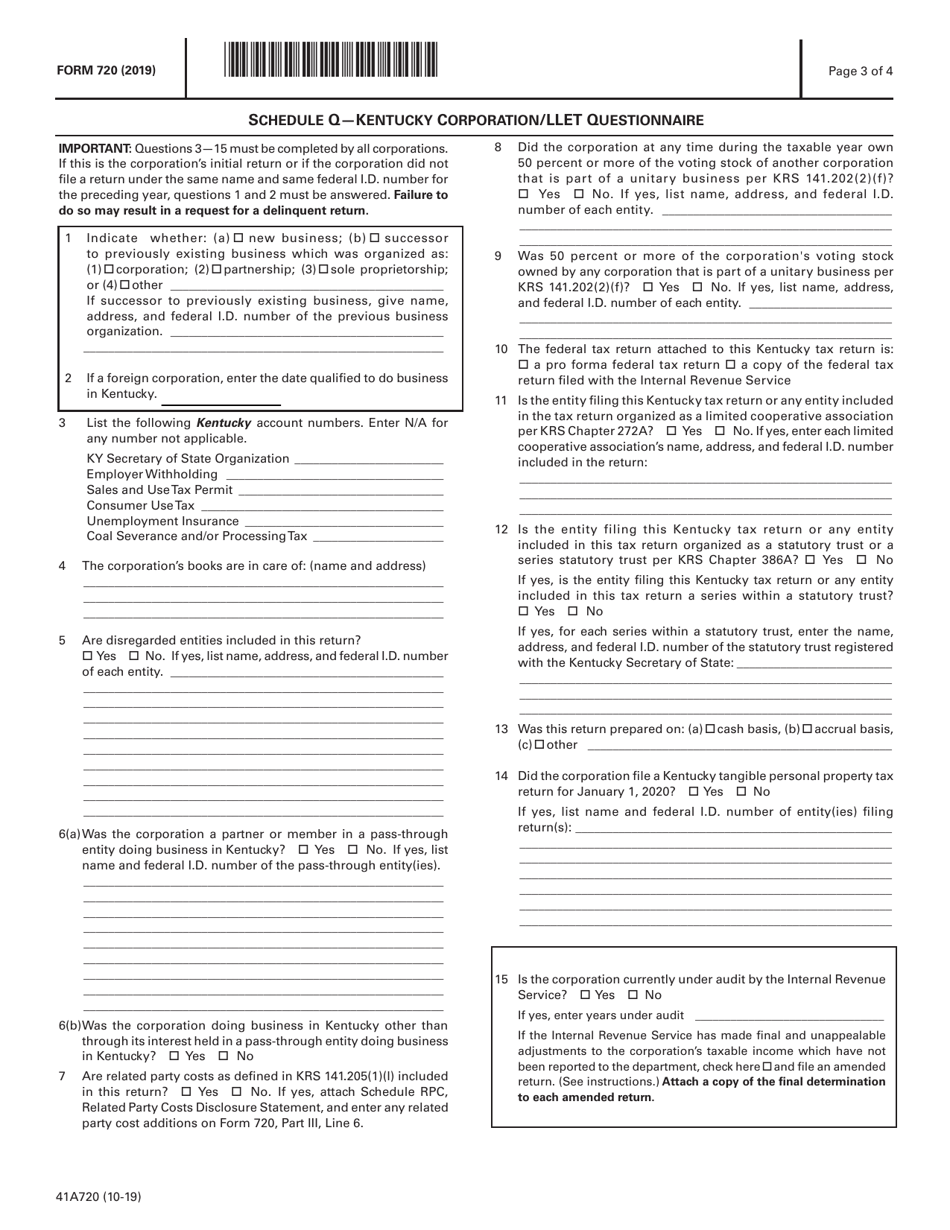

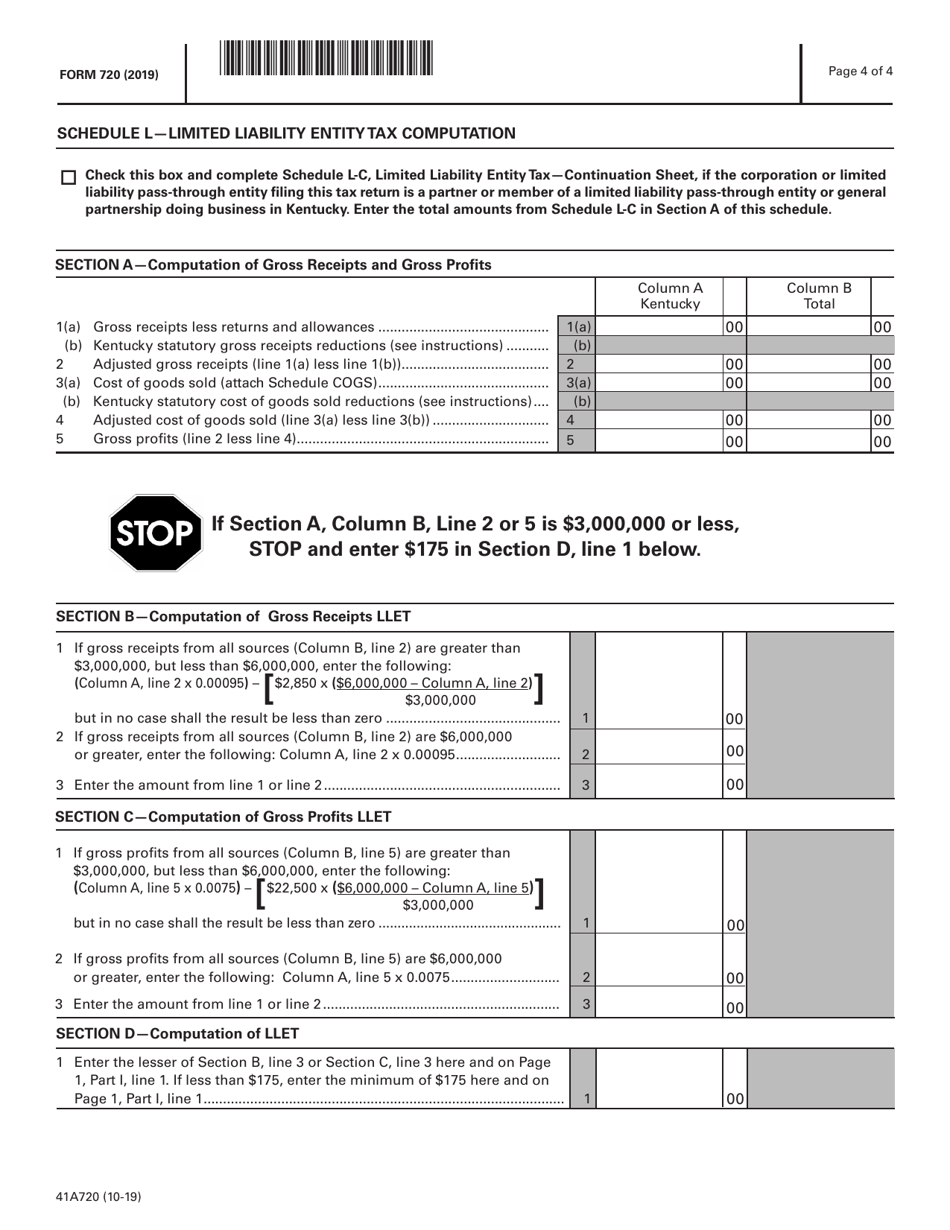

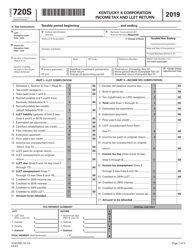

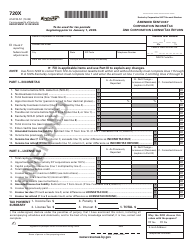

Form 720 (41A720) Kentucky Corporation Income Tax and Llet Return - Kentucky

What Is Form 720 (41A720)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 720 (41A720)?

A: Form 720 (41A720) is the Kentucky Corporation Income Tax and Llet Return form.

Q: Who needs to file Form 720 (41A720)?

A: Kentucky corporations need to file Form 720 (41A720).

Q: What is the purpose of Form 720 (41A720)?

A: Form 720 (41A720) is used to report and pay the Kentucky corporation income tax.

Q: What information do I need to complete Form 720 (41A720)?

A: You will need information about your corporation's income, deductions, credits, and other relevant financial details.

Q: When is the deadline to file Form 720 (41A720)?

A: The deadline to file Form 720 (41A720) is generally the 15th day of the 4th month following the end of the corporation's tax year.

Q: Are there any penalties for late filing or payment?

A: Yes, there may be penalties for late filing or payment of the Kentucky corporation income tax.

Q: Do I need to include any supporting documents with Form 720 (41A720)?

A: You generally do not need to include supporting documents with Form 720 (41A720), but you should keep them for your records in case of an audit.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 720 (41A720) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.