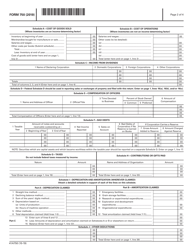

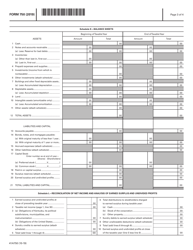

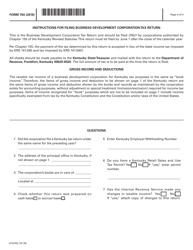

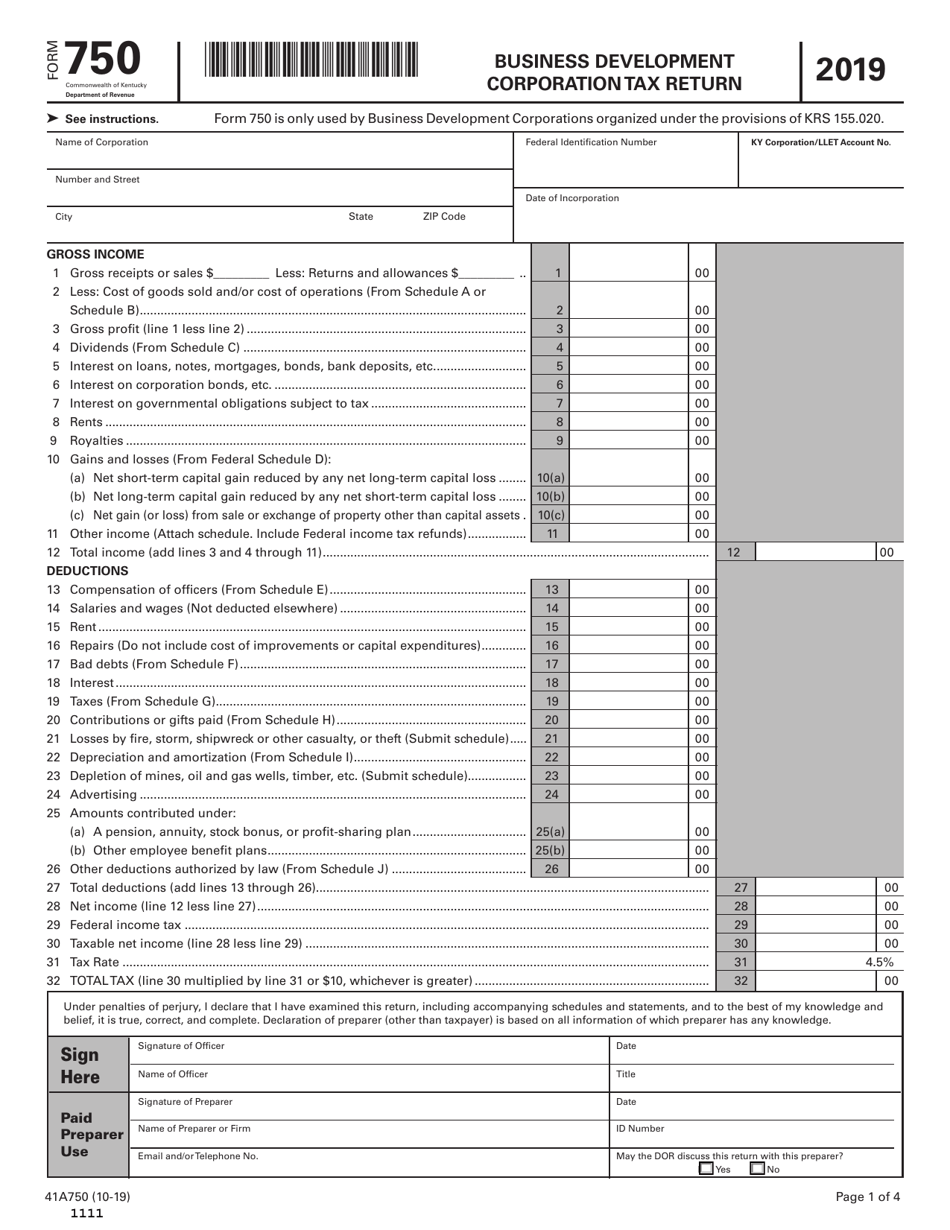

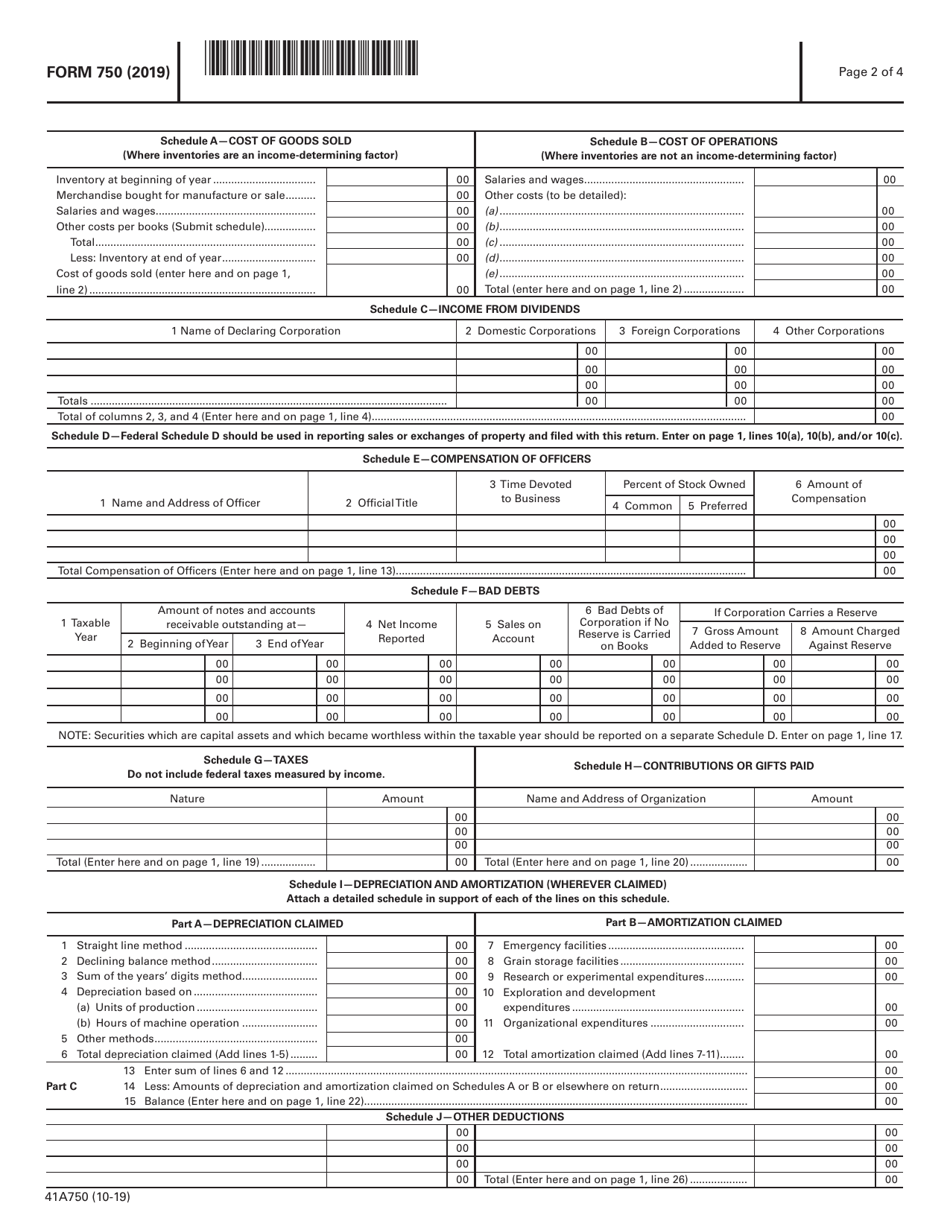

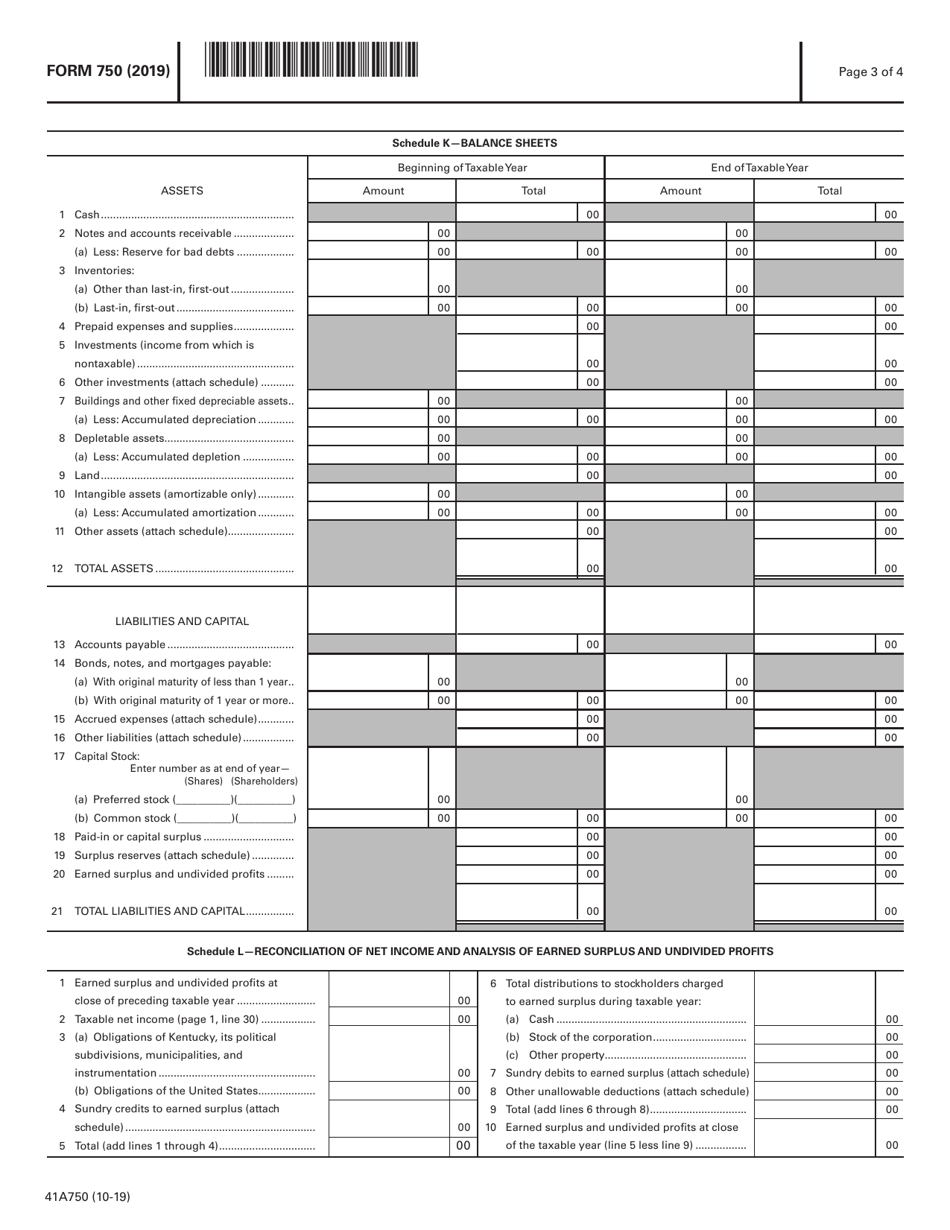

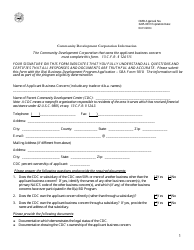

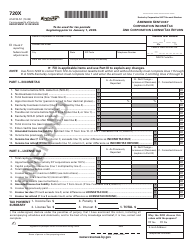

Form 750 (41A750) Business Development Corporation Tax Return - Kentucky

What Is Form 750 (41A750)?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 750?

A: Form 750 is the Business DevelopmentCorporation Tax Return for Kentucky.

Q: Who needs to file Form 750?

A: Business Development Corporations in Kentucky need to file Form 750.

Q: What is the purpose of Form 750?

A: The purpose of Form 750 is to report and pay taxes for Business Development Corporations in Kentucky.

Q: When is the deadline to file Form 750?

A: The deadline to file Form 750 is the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for late filing of Form 750?

A: Yes, there are penalties for late filing of Form 750. It is best to file the form on time to avoid any penalties.

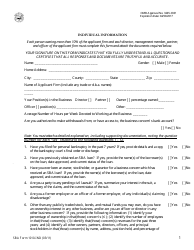

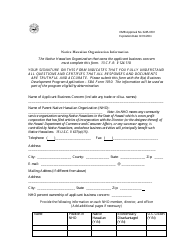

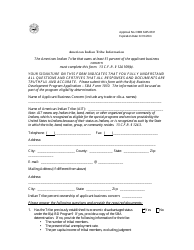

Q: Are there any specific instructions for completing Form 750?

A: Yes, there are specific instructions provided on the form itself. Make sure to read and follow the instructions carefully when completing Form 750.

Q: Is Form 750 only for businesses in Kentucky?

A: Yes, Form 750 is specifically for Business Development Corporations in Kentucky. It is not applicable to businesses in other states.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 750 (41A750) by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.