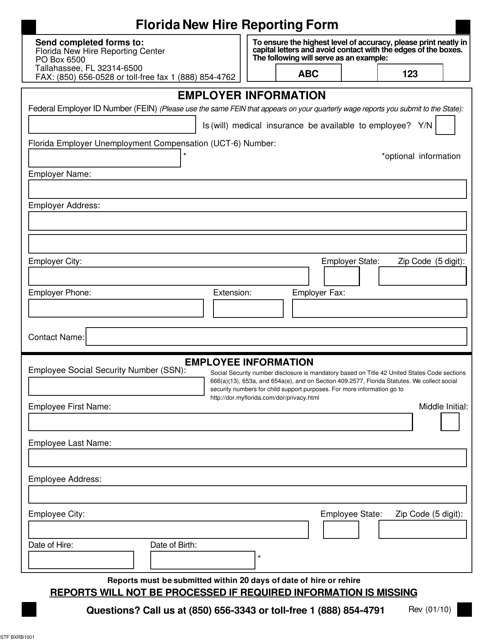

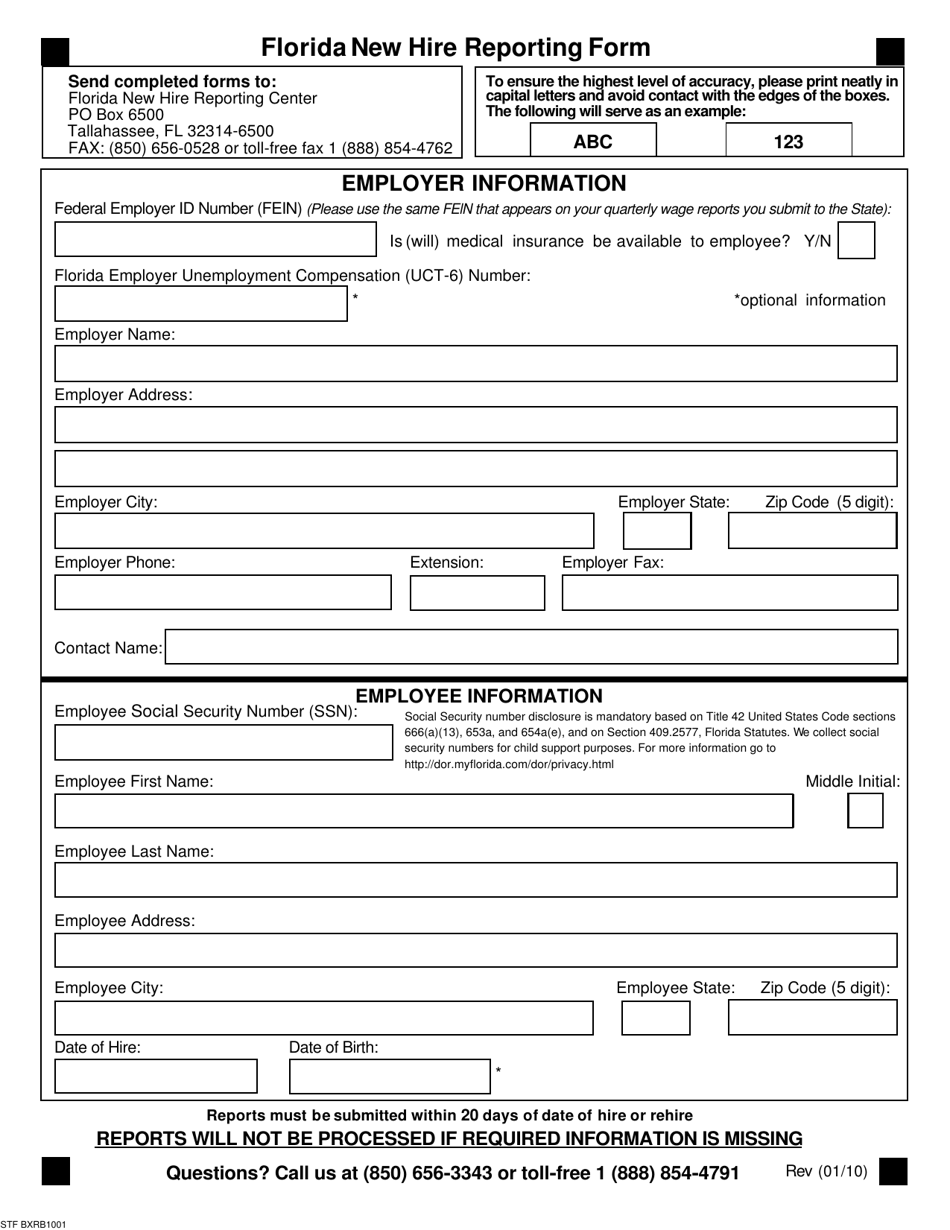

Florida New Hire Reporting Form - Florida

Florida New Hire Reporting Form is a legal document that was released by the Florida Department of Revenue - a government authority operating within Florida.

FAQ

Q: What is the Florida New Hire Reporting Form?

A: The Florida New Hire Reporting Form is a document used to report newly hired employees to the state of Florida.

Q: Why is the Florida New Hire Reporting Form important?

A: The Florida New Hire Reporting Form is important because it helps the state track child support payments and enforce court orders.

Q: Who is required to submit the Florida New Hire Reporting Form?

A: All employers in Florida are required to submit the Florida New Hire Reporting Form within 20 days of hiring a new employee.

Q: What information is needed to complete the Florida New Hire Reporting Form?

A: The Florida New Hire Reporting Form requires information such as the employee's name, address, Social Security number, and the employer's information.

Q: What happens if I fail to submit the Florida New Hire Reporting Form?

A: Failure to submit the Florida New Hire Reporting Form may result in penalties or fines imposed by the state of Florida.

Q: Are there any exemptions to the requirement of submitting the Florida New Hire Reporting Form?

A: There are specific exemptions to the requirement of submitting the Florida New Hire Reporting Form, such as hiring an employee for domestic services in a private home.

Q: Can I submit the Florida New Hire Reporting Form for independent contractors?

A: No, the Florida New Hire Reporting Form is only for reporting newly hired employees, not independent contractors.

Q: How long do I need to keep a copy of the Florida New Hire Reporting Form?

A: Employers are required to keep a copy of the Florida New Hire Reporting Form for a period of at least 5 years.

Form Details:

- Released on January 1, 2010;

- The latest edition currently provided by the Florida Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.