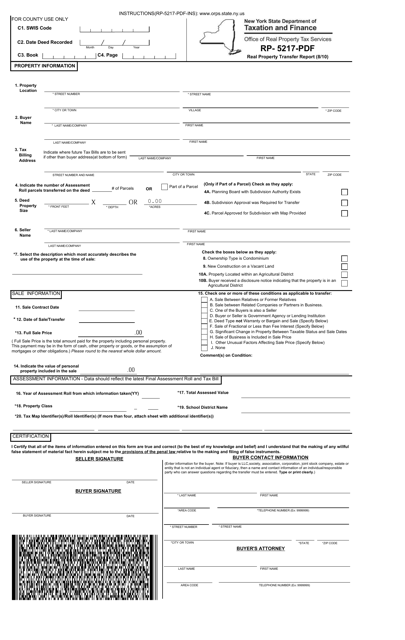

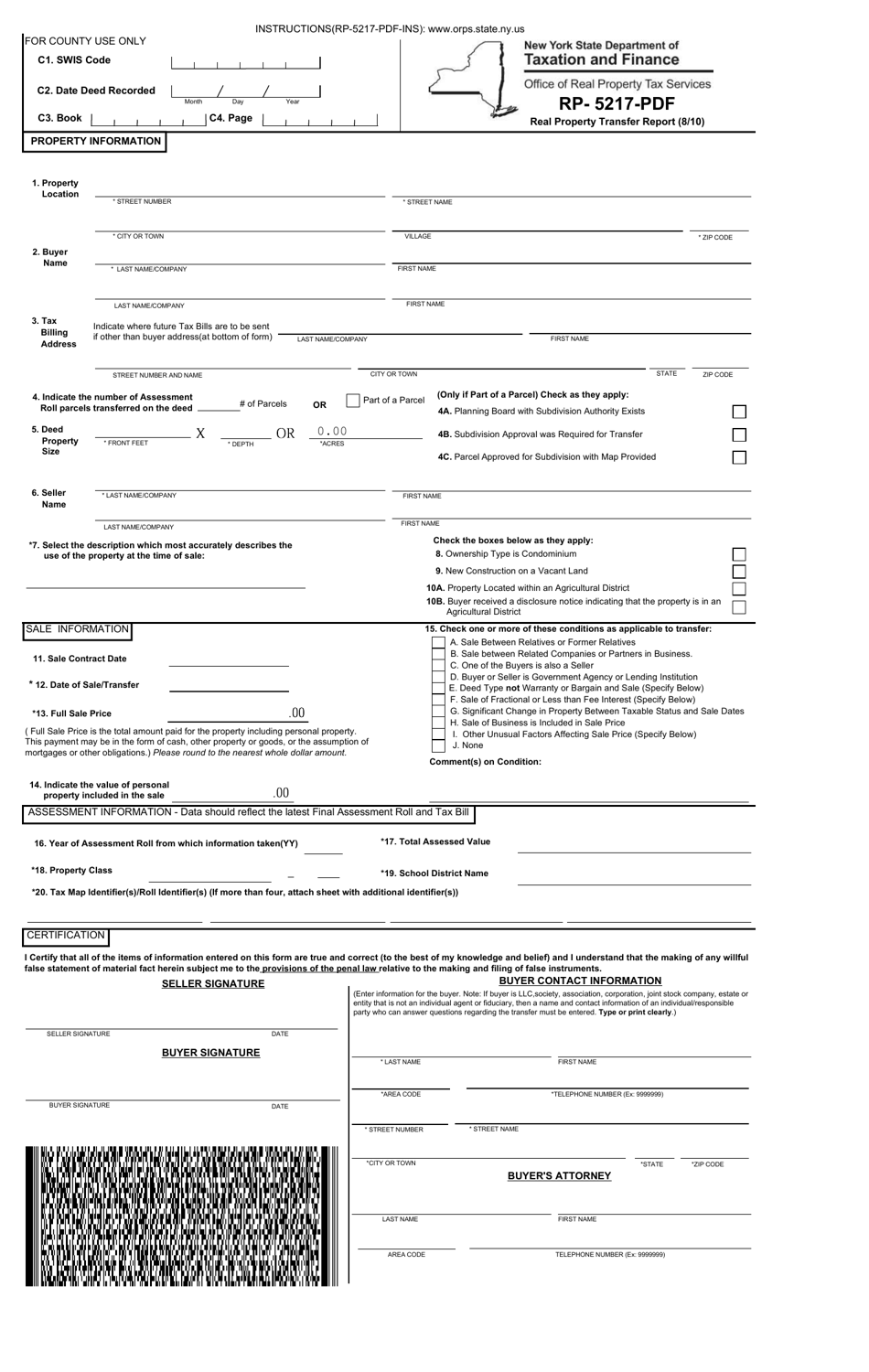

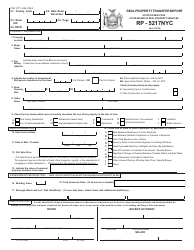

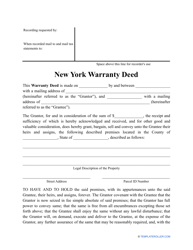

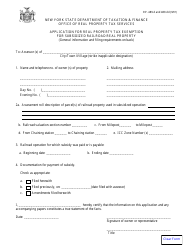

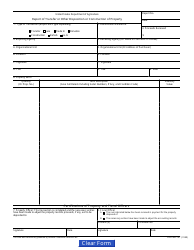

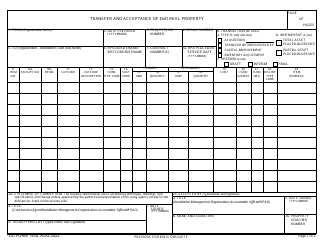

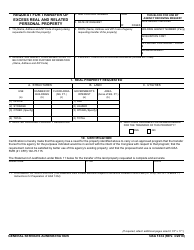

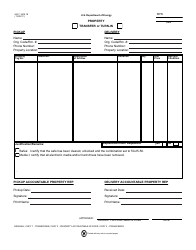

Form RP-5217-PDF Real Property Transfer Report - New York

What Is Form RP-5217-PDF?

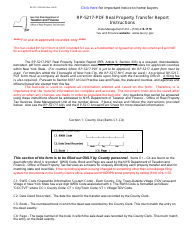

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RP-5217-PDF?

A: Form RP-5217-PDF is a Real PropertyTransfer Report in New York.

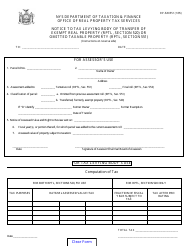

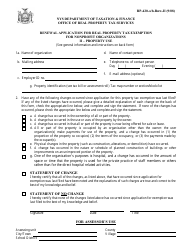

Q: What is the purpose of Form RP-5217-PDF?

A: The purpose of Form RP-5217-PDF is to report details of real property transfers in New York.

Q: Who needs to file Form RP-5217-PDF?

A: Buyers or their representatives (such as attorneys) typically file Form RP-5217-PDF.

Q: When should Form RP-5217-PDF be filed?

A: Form RP-5217-PDF should be filed within 30 days after the delivery of the deed.

Q: Are there any fees associated with filing Form RP-5217-PDF?

A: Yes, there are filing fees associated with Form RP-5217-PDF. The fees vary depending on the value of the property being transferred.

Q: What information is required on Form RP-5217-PDF?

A: Form RP-5217-PDF requires information about the property being transferred, the parties involved, and the terms of the transfer.

Q: Are there any penalties for not filing Form RP-5217-PDF?

A: Yes, there are penalties for not filing Form RP-5217-PDF, including monetary penalties and potential legal consequences.

Q: Is Form RP-5217-PDF specific to New York?

A: Yes, Form RP-5217-PDF is specific to real property transfers in New York.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-5217-PDF by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.