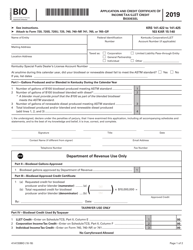

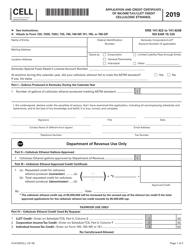

This version of the form is not currently in use and is provided for reference only. Download this version of

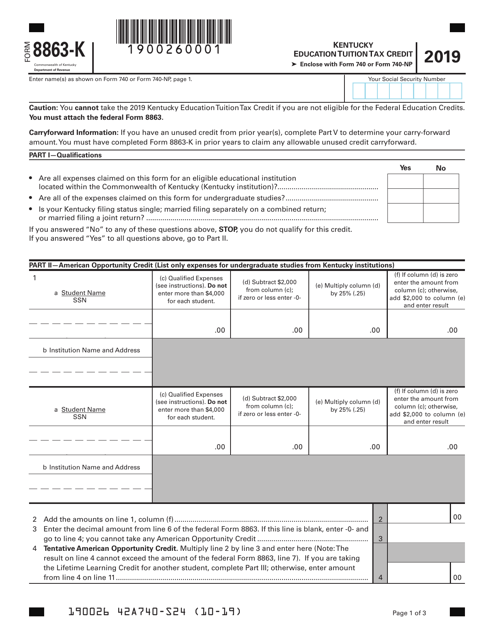

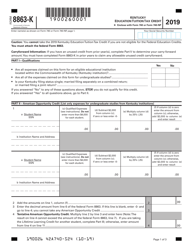

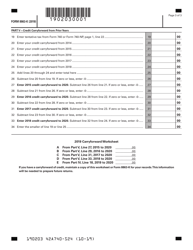

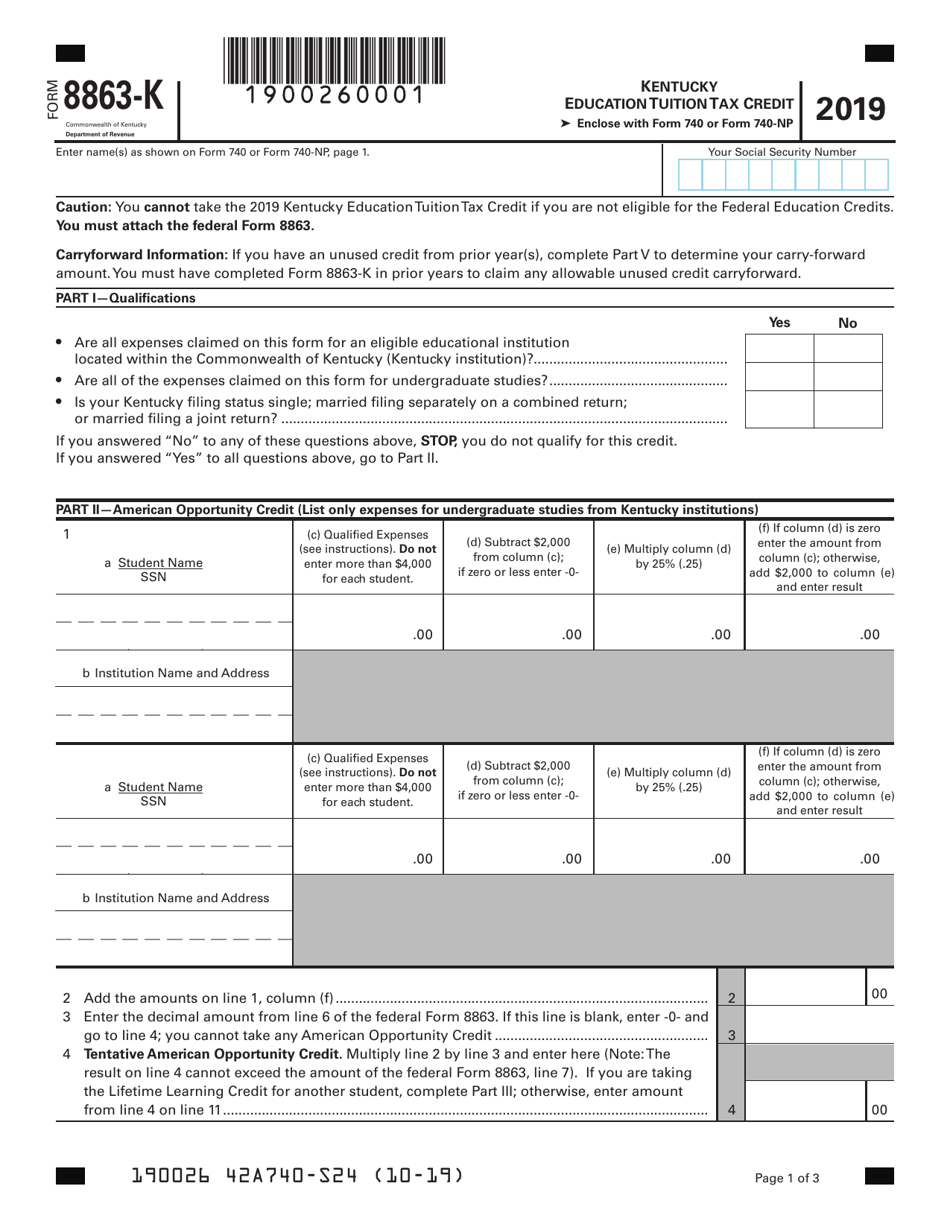

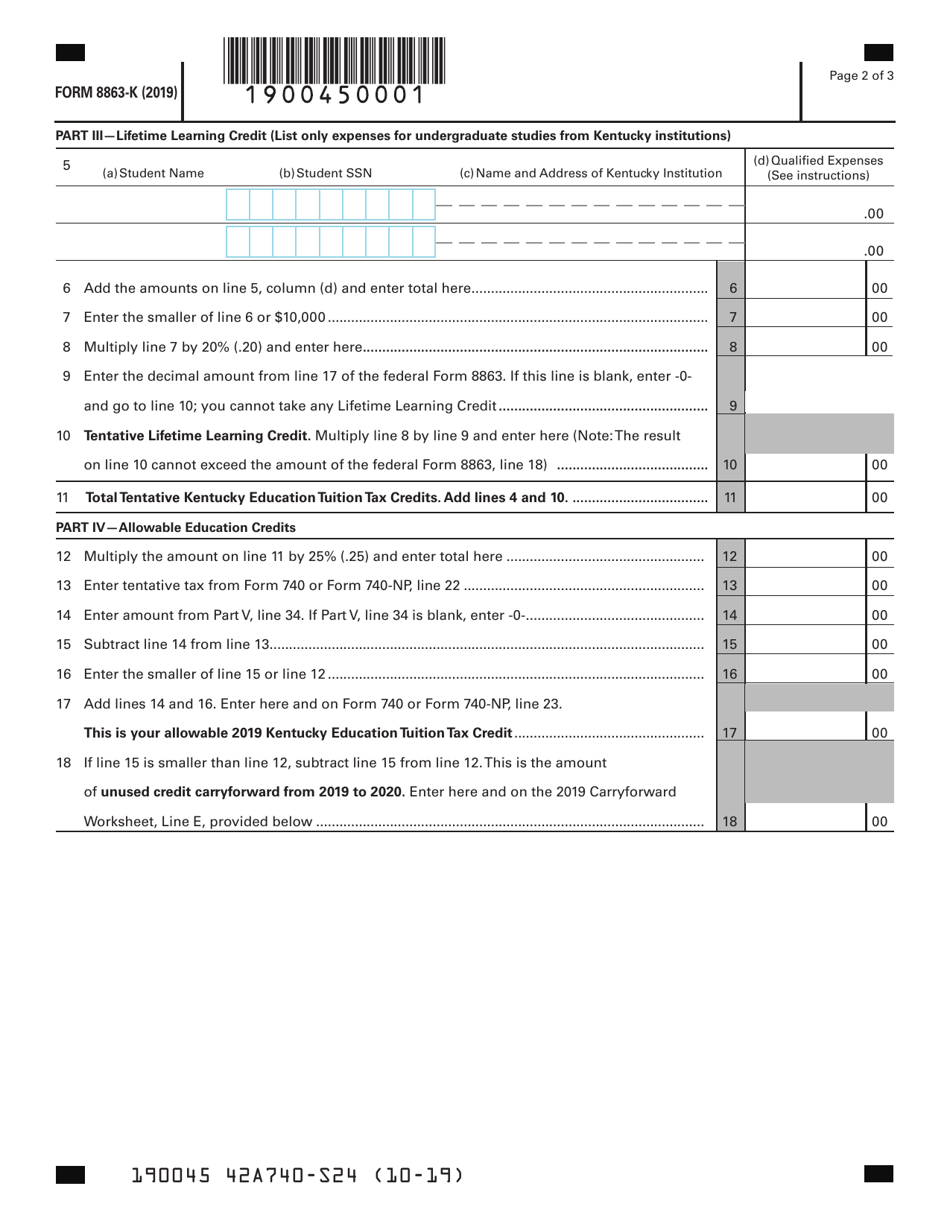

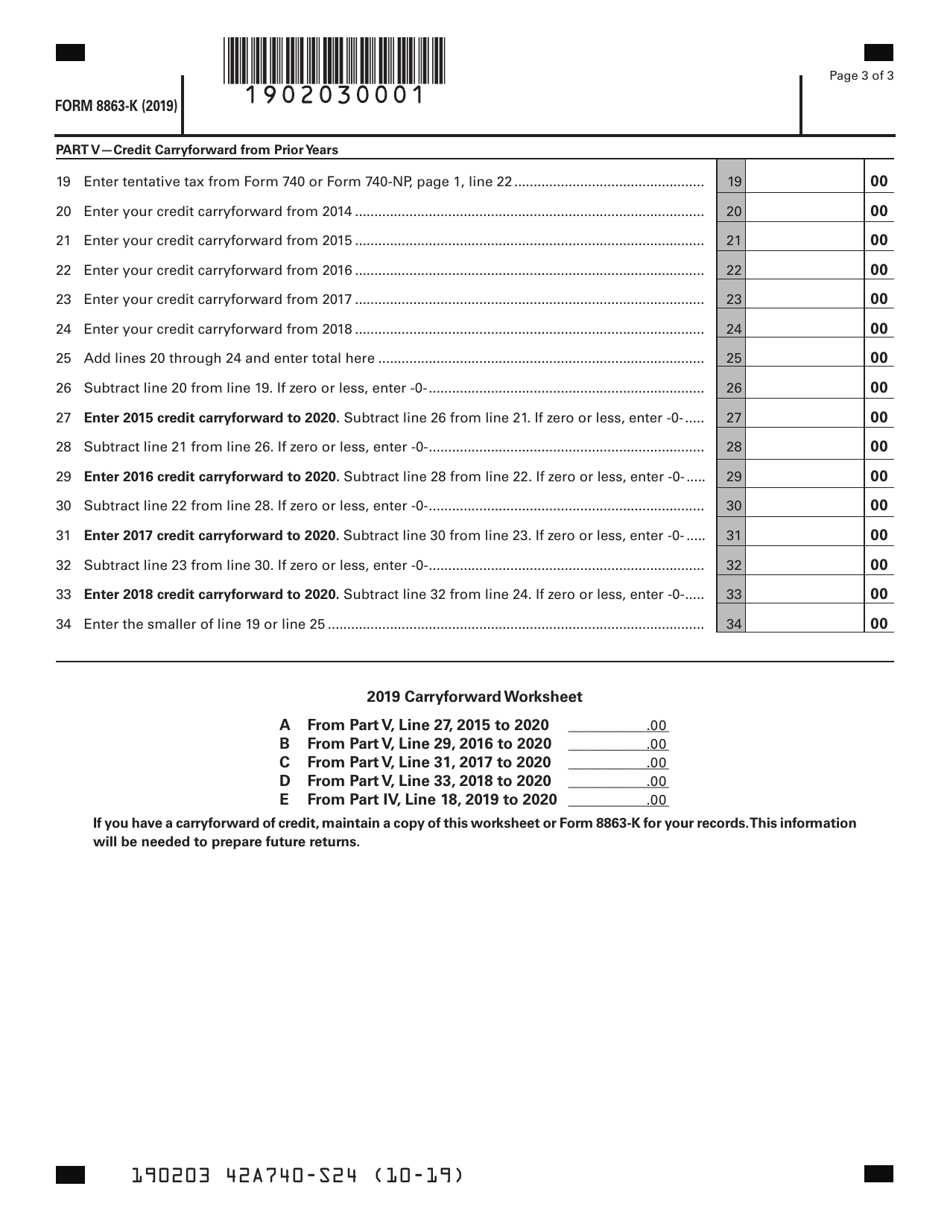

Form 8863-K

for the current year.

Form 8863-K Kentucky Education Tuition Tax Credit - Kentucky

What Is Form 8863-K?

This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8863-K?

A: Form 8863-K is the Kentucky Education Tuition Tax Credit form.

Q: What is the Kentucky Education Tuition Tax Credit?

A: The Kentucky Education Tuition Tax Credit is a tax credit available to residents of Kentucky who have paid qualifying educational expenses.

Q: Who is eligible for the Kentucky Education Tuition Tax Credit?

A: Residents of Kentucky who have paid qualifying educational expenses are eligible for the tax credit.

Q: What are qualifying educational expenses?

A: Qualifying educational expenses include tuition paid to a Kentucky educational institution.

Q: How much is the tax credit?

A: The tax credit is equal to 25% of the qualifying educational expenses paid.

Q: How do I claim the tax credit?

A: To claim the tax credit, you must complete and file Form 8863-K with your Kentucky state tax return.

Q: Is there a deadline to file Form 8863-K?

A: Yes, the deadline to file Form 8863-K is the same as the deadline to file your Kentucky state tax return.

Q: Can the tax credit be carried forward or refunded?

A: No, the tax credit cannot be carried forward or refunded. It can only be used to offset your Kentucky state tax liability.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Kentucky Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8863-K by clicking the link below or browse more documents and templates provided by the Kentucky Department of Revenue.