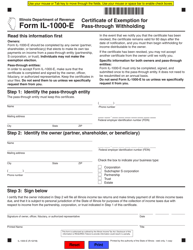

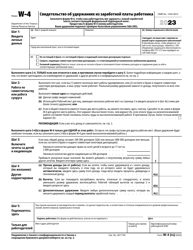

This version of the form is not currently in use and is provided for reference only. Download this version of

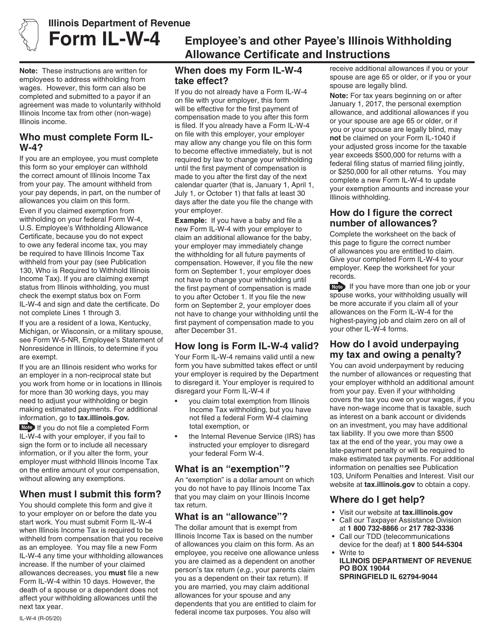

Form IL-W-4

for the current year.

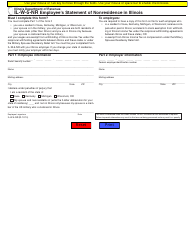

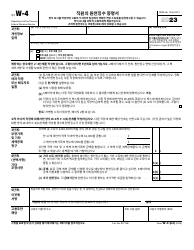

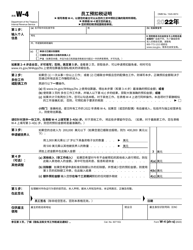

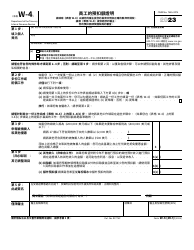

Form IL-W-4 Employee's Illinois Withholding Allowance Certificate - Illinois

What Is Form IL-W-4?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-W-4?

A: Form IL-W-4 is the Employee's Illinois Withholding Allowance Certificate.

Q: Who needs to fill out Form IL-W-4?

A: Employees who work in Illinois and want to adjust their state income tax withholding need to fill out Form IL-W-4.

Q: What is the purpose of Form IL-W-4?

A: Form IL-W-4 is used to determine the amount of state income tax to be withheld from an employee's paycheck.

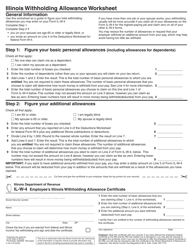

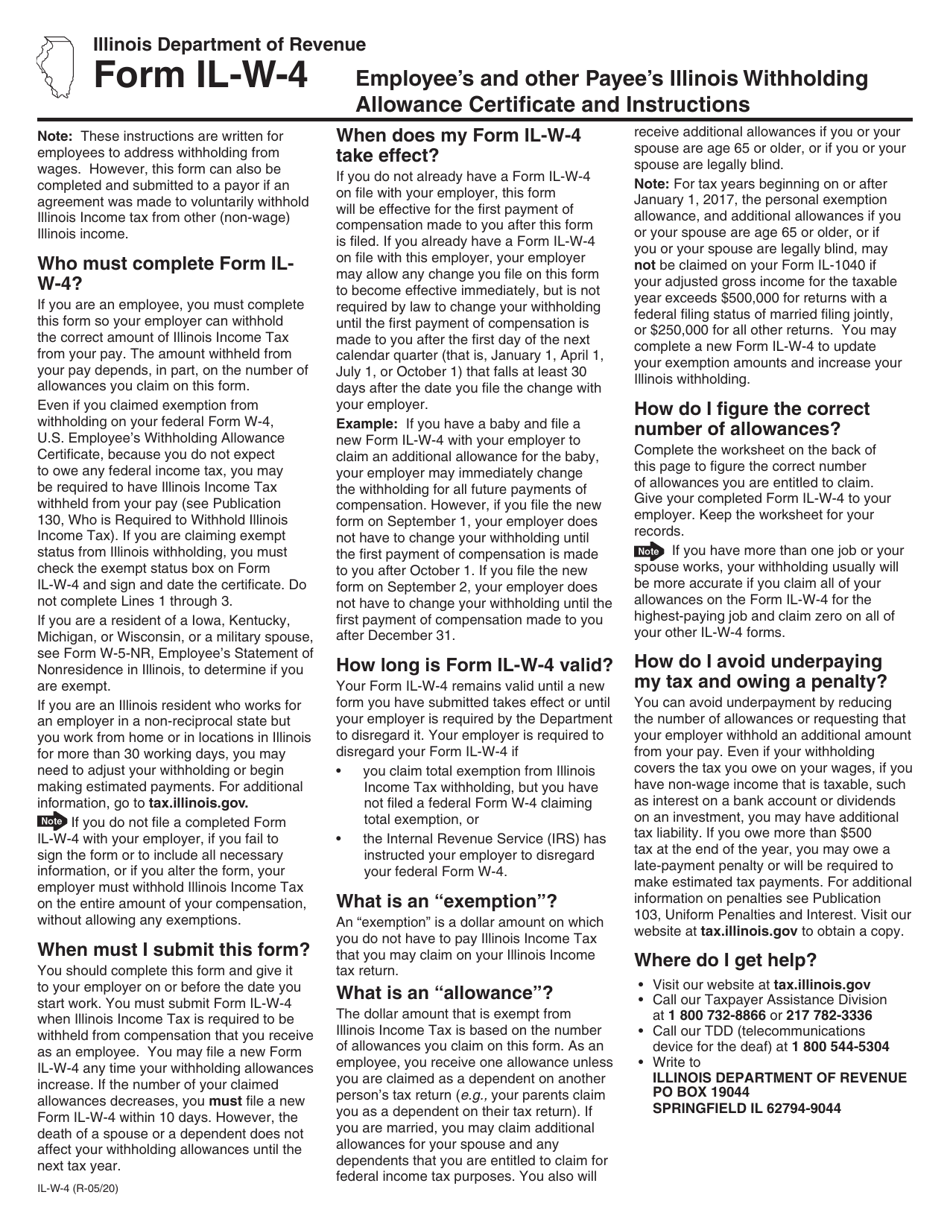

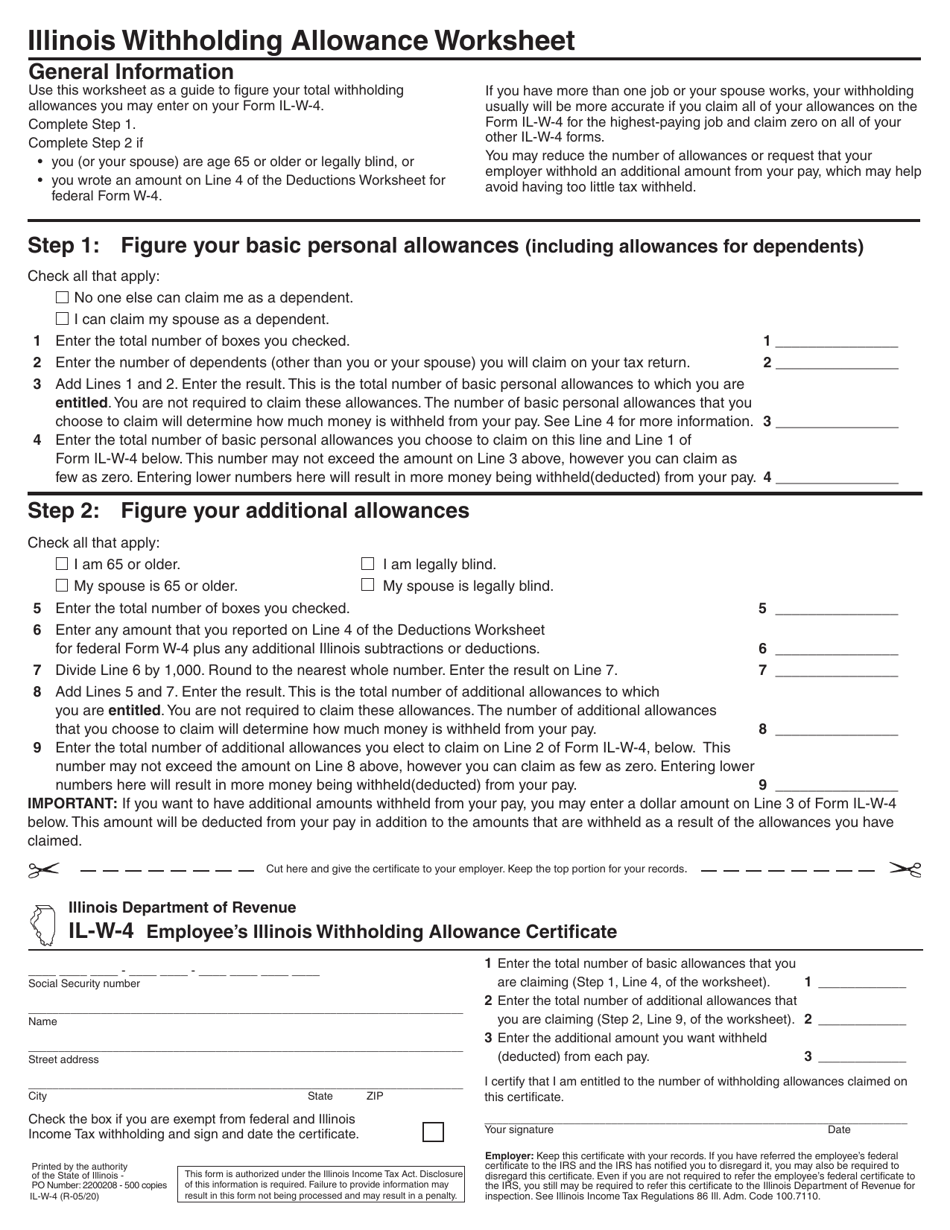

Q: How do I fill out Form IL-W-4?

A: You'll need to provide your personal information, such as your name, Social Security number, and filing status, and then indicate the number of allowances you want to claim.

Q: Can I claim exempt on Form IL-W-4?

A: Yes, if you meet certain criteria, you can claim exempt from Illinois state income tax withholding.

Q: When should I submit Form IL-W-4?

A: You should submit Form IL-W-4 to your employer as soon as possible after starting a new job or if you need to make changes to your withholding.

Q: Do I need to submit a new Form IL-W-4 every year?

A: No, you only need to submit a new Form IL-W-4 if you want to make changes to your withholding or if your personal or financial situation changes.

Q: What happens if I don't submit Form IL-W-4?

A: If you don't submit Form IL-W-4, your employer will withhold state income tax based on the default withholding rate.

Q: Can I use Form IL-W-4 for federal income tax withholding?

A: No, Form IL-W-4 is specifically for Illinois state income tax withholding. You'll need to use the federal Form W-4 for federal income tax withholding.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IL-W-4 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.