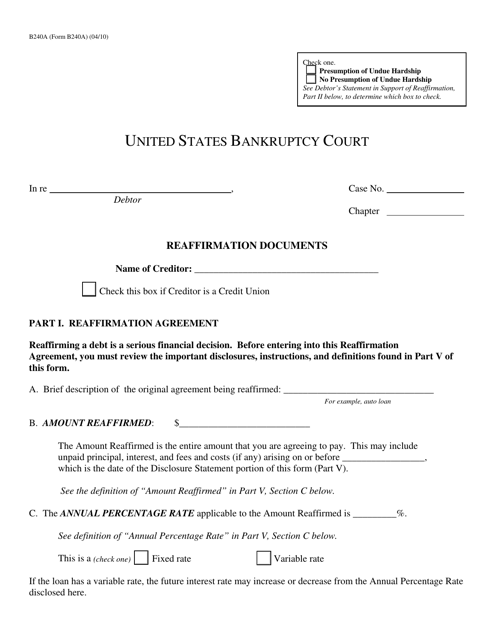

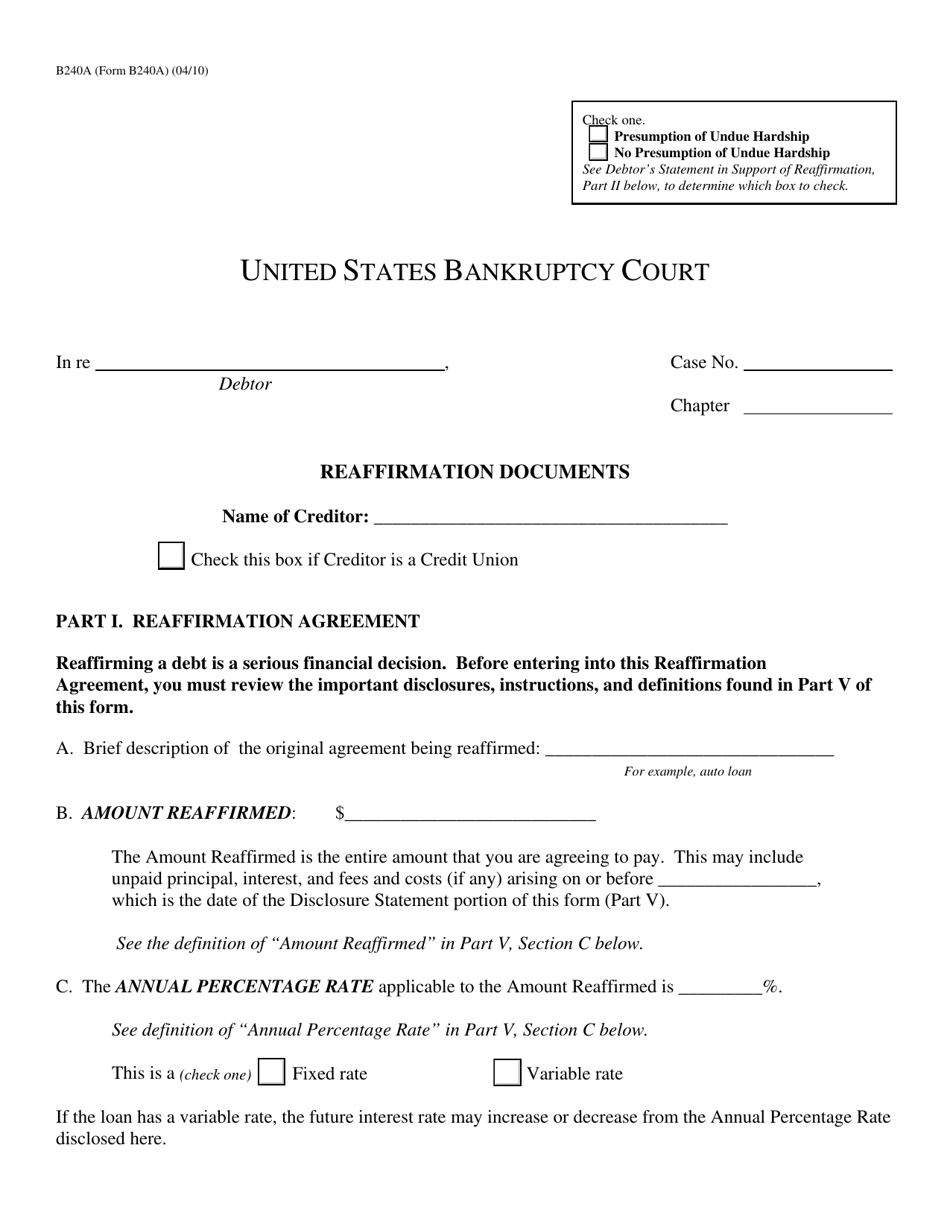

Form B240A Reaffirmation Documents

What Is Form B240A?

This is a legal form that was released by the United States Bankruptcy Court on April 1, 2010 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

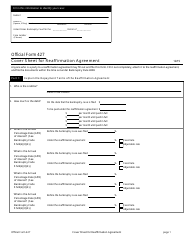

Q: What is Form B240A?

A: Form B240A is a document used in bankruptcy cases to reaffirm a debt.

Q: What are reaffirmation documents?

A: Reaffirmation documents are legal agreements between a debtor and a creditor in which the debtor agrees to repay a debt even after a bankruptcy discharge.

Q: What is the purpose of Form B240A?

A: The purpose of Form B240A is to provide information about the debtor's intention to reaffirm a specific debt and to obtain court approval for the reaffirmation.

Q: Do I need to file Form B240A in a bankruptcy case?

A: If you want to reaffirm a debt, you typically need to file Form B240A with the bankruptcy court.

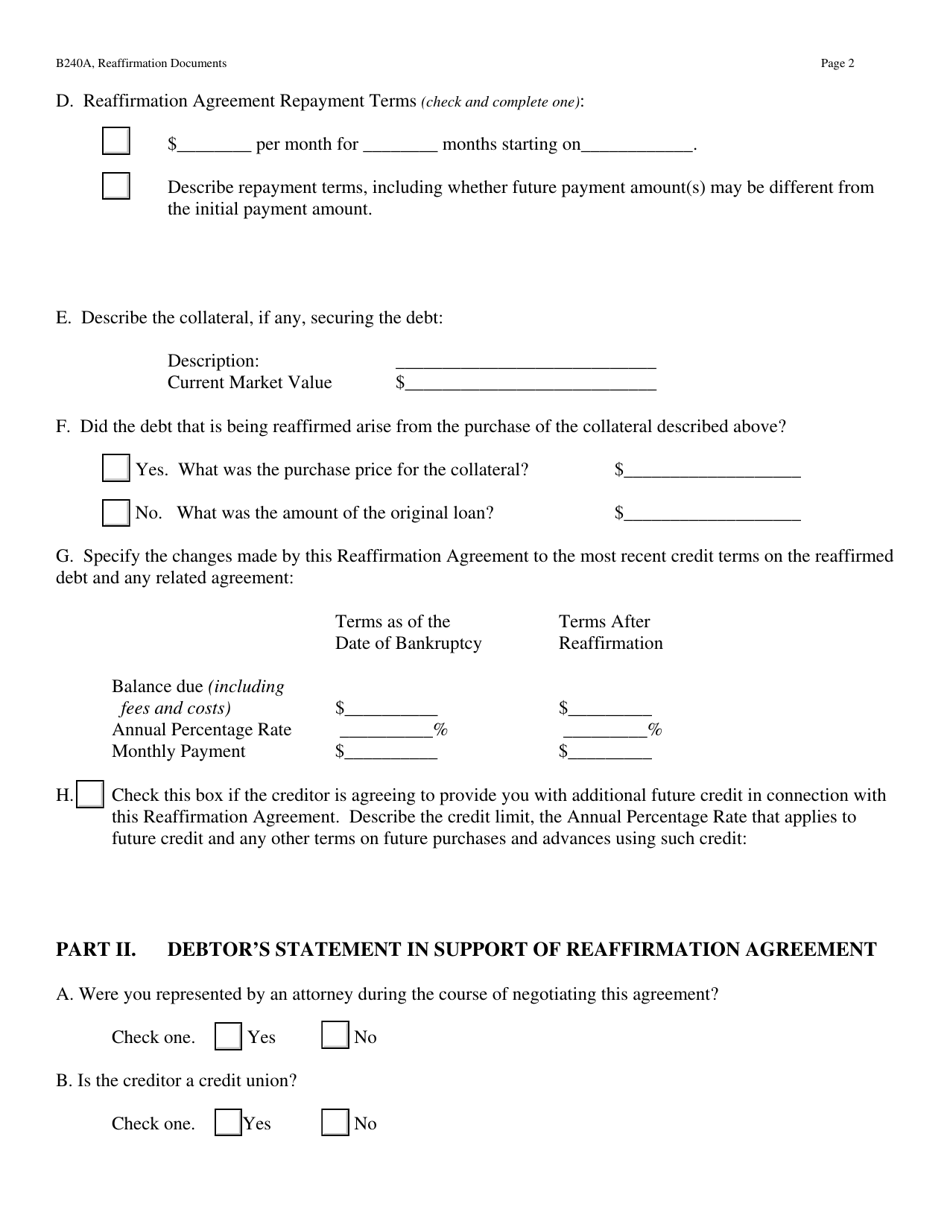

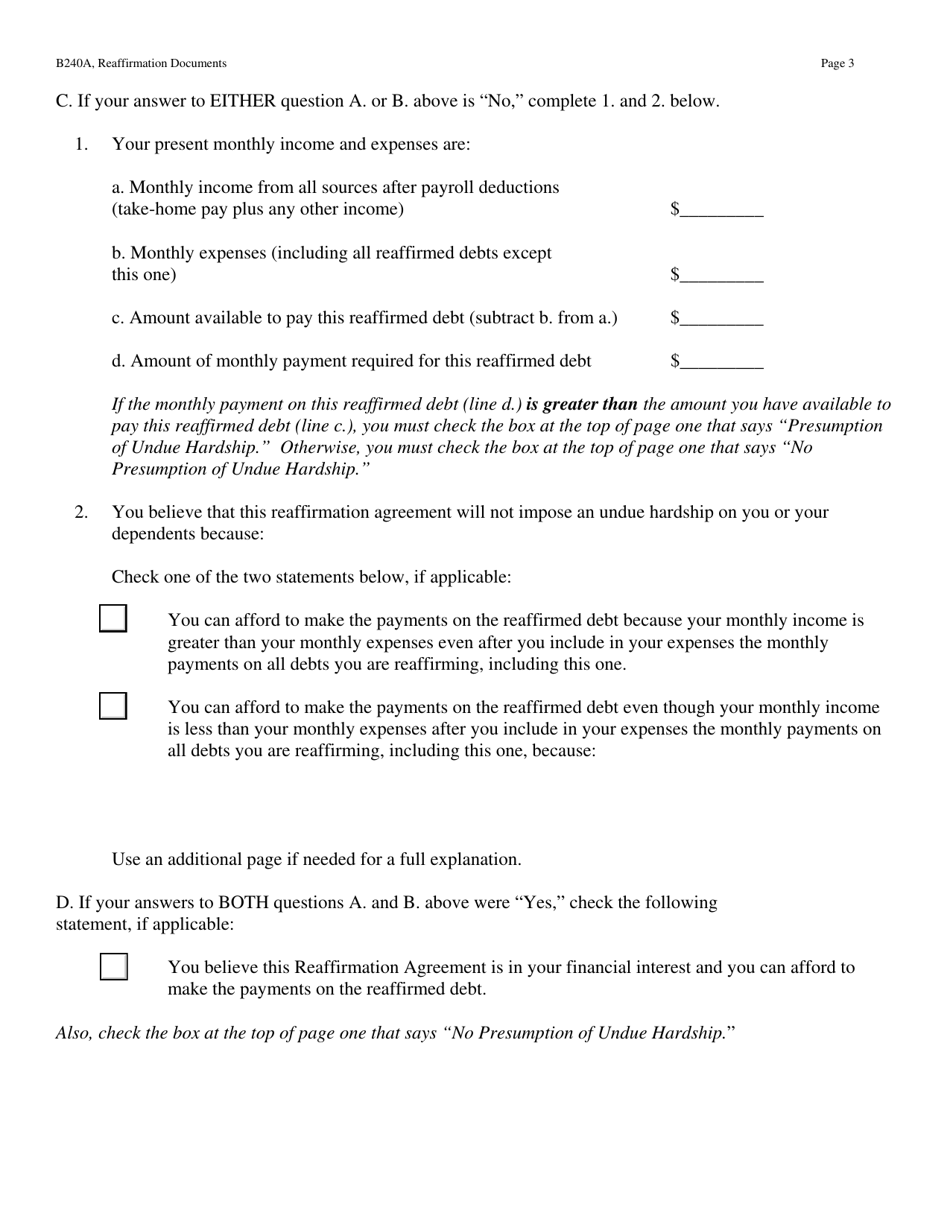

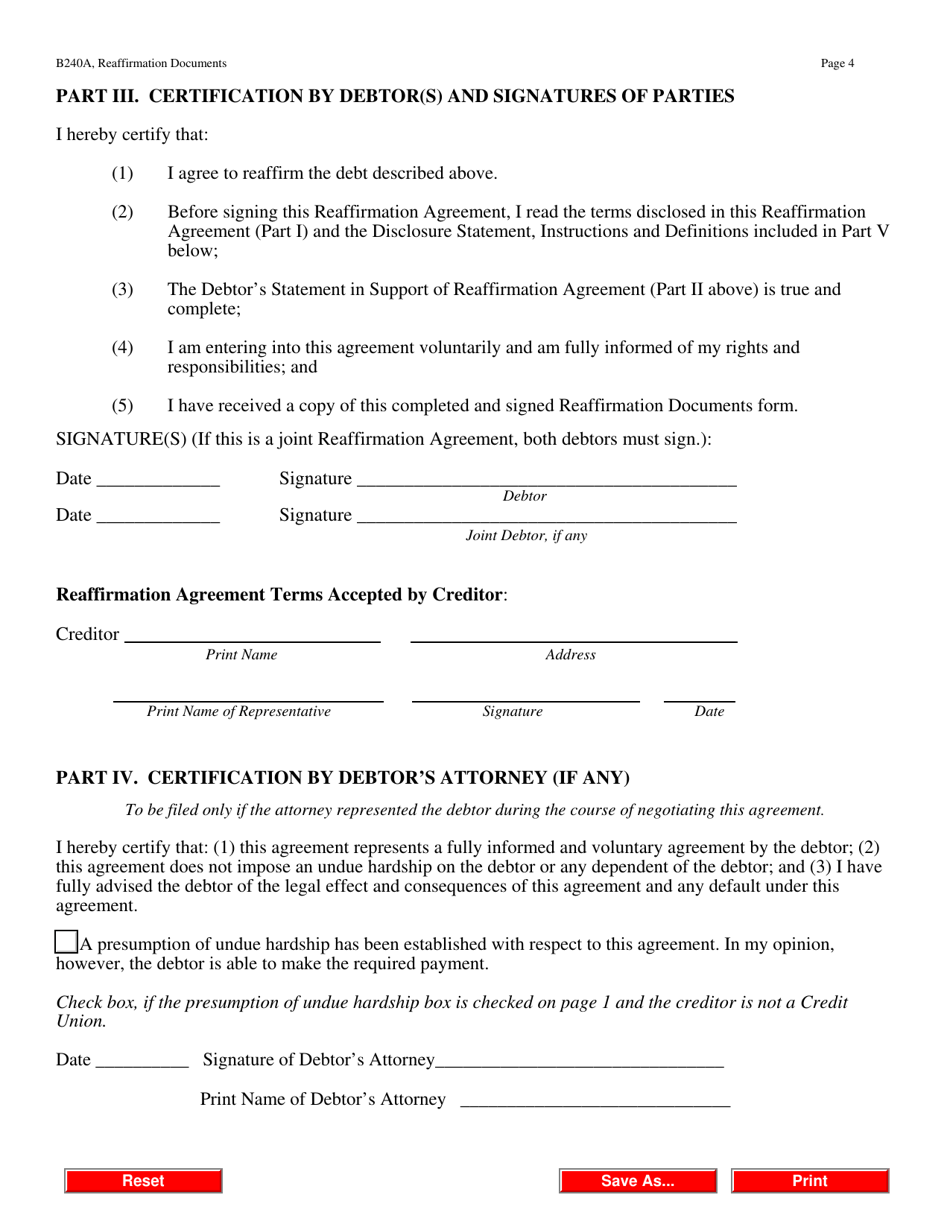

Q: What information is required in Form B240A?

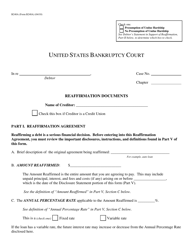

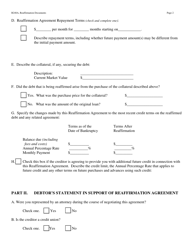

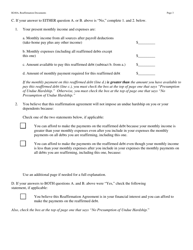

A: Form B240A requires information about the debt being reaffirmed, the debtor's income and expenses, and a statement of financial affairs.

Q: Can I reaffirm any debt using Form B240A?

A: No, Form B240A can only be used to reaffirm certain types of debts, such as secured debts for personal property.

Q: What happens if the court approves the reaffirmation agreement?

A: If the court approves the reaffirmation agreement, the debtor will be responsible for repaying the debt according to the terms of the agreement.

Q: What happens if the court does not approve the reaffirmation agreement?

A: If the court does not approve the reaffirmation agreement, the debt will be discharged in the bankruptcy and the debtor will no longer be personally liable for it.

Form Details:

- Released on April 1, 2010;

- The latest available edition released by the United States Bankruptcy Court;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form B240A by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court.