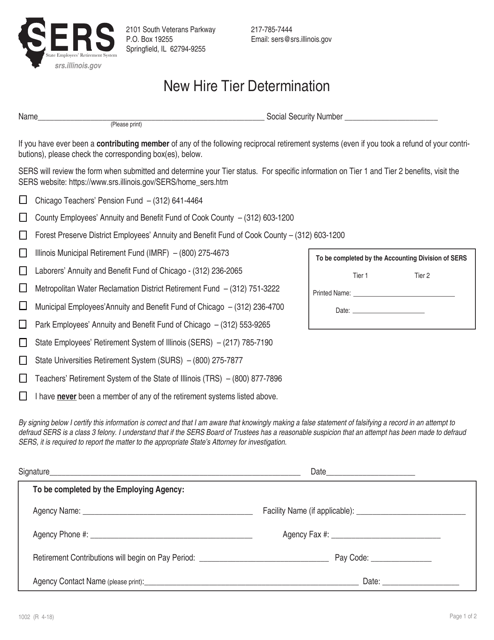

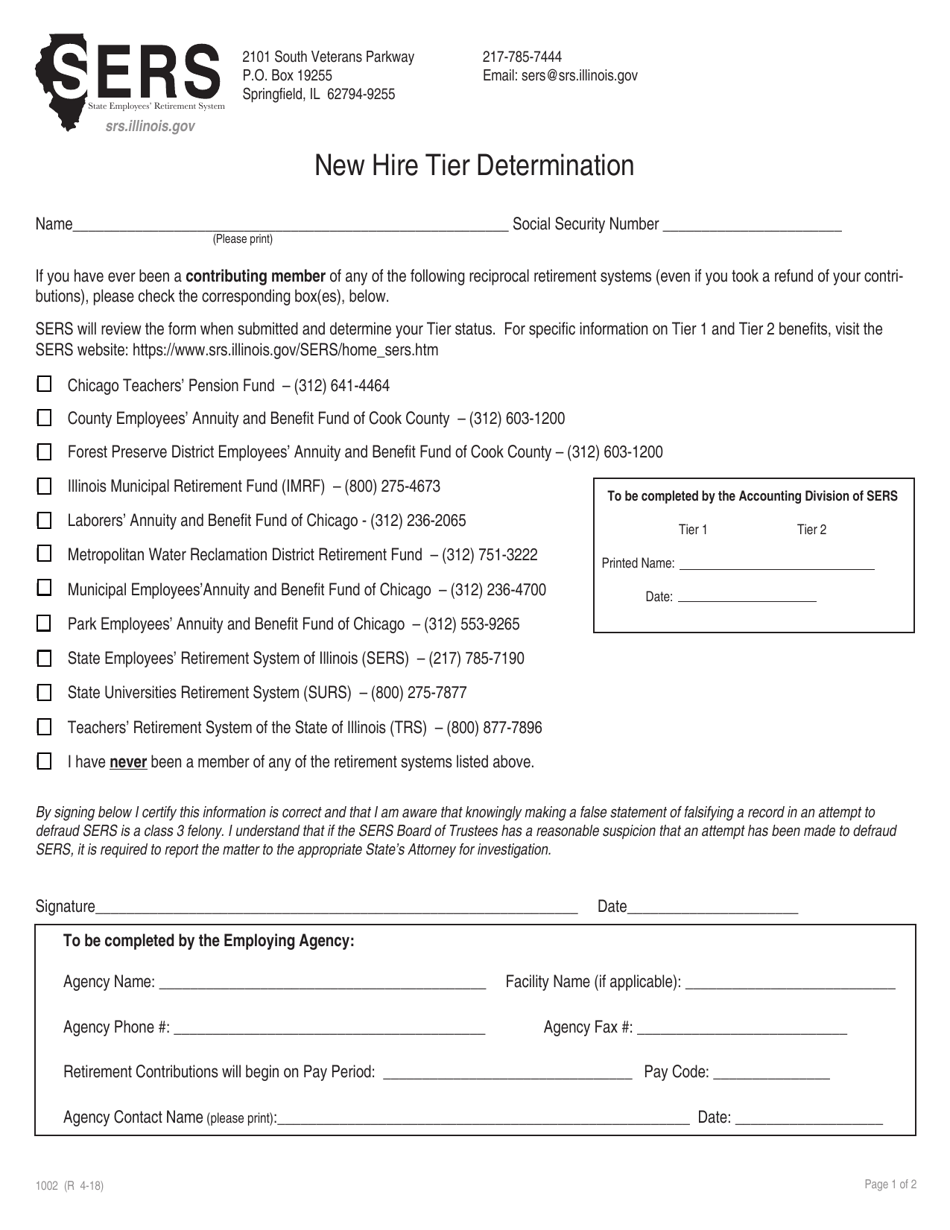

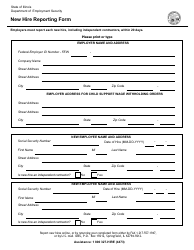

Form 1002 New Hire Tier Determination - Illinois

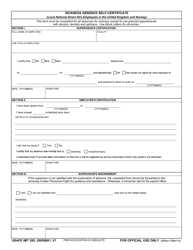

What Is Form 1002?

This is a legal form that was released by the Illinois State Employees Retirement System - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1002?

A: Form 1002 is the New Hire Tier Determination form in Illinois.

Q: What is the purpose of Form 1002?

A: The purpose of Form 1002 is to determine the tier classification of a new hire in Illinois.

Q: What is the New Hire Tier Determination in Illinois?

A: The New Hire Tier Determination in Illinois is the process of determining whether a new hire is classified as Tier 1 or Tier 2.

Q: What are Tier 1 and Tier 2 classifications?

A: Tier 1 and Tier 2 are classifications used in Illinois to determine the level of benefits and contributions for new hires.

Q: How is the tier classification determined?

A: The tier classification of a new hire is determined based on factors such as date of hire and employment history.

Q: Is Form 1002 mandatory for employers in Illinois?

A: Yes, Form 1002 is mandatory for employers in Illinois to determine the tier classification of new hires.

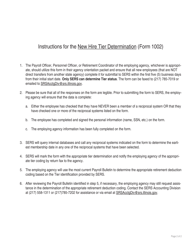

Q: What should employers do with Form 1002?

A: Employers should complete and submit Form 1002 to the appropriate authority in Illinois for the tier determination process.

Q: Are there any penalties for non-compliance with Form 1002?

A: Yes, employers may face penalties for non-compliance with Form 1002 requirements in Illinois.

Q: Is Form 1002 specific to Illinois?

A: Yes, Form 1002 is specific to the state of Illinois and its new hire tier determination process.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Illinois State Employees Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1002 by clicking the link below or browse more documents and templates provided by the Illinois State Employees Retirement System.