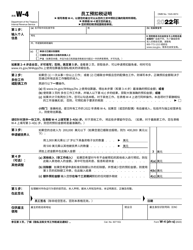

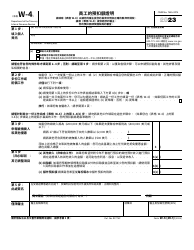

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

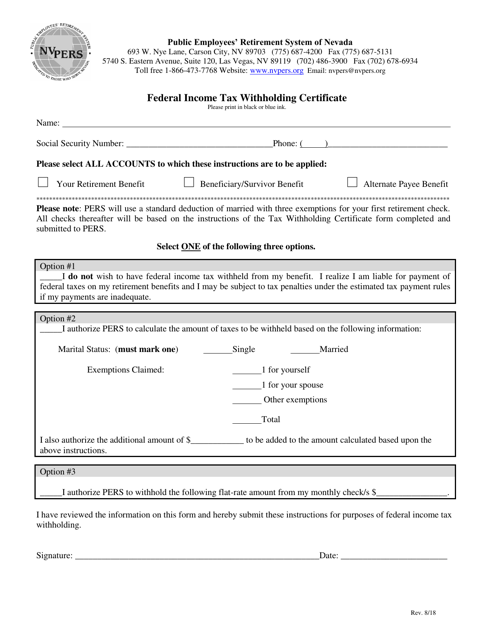

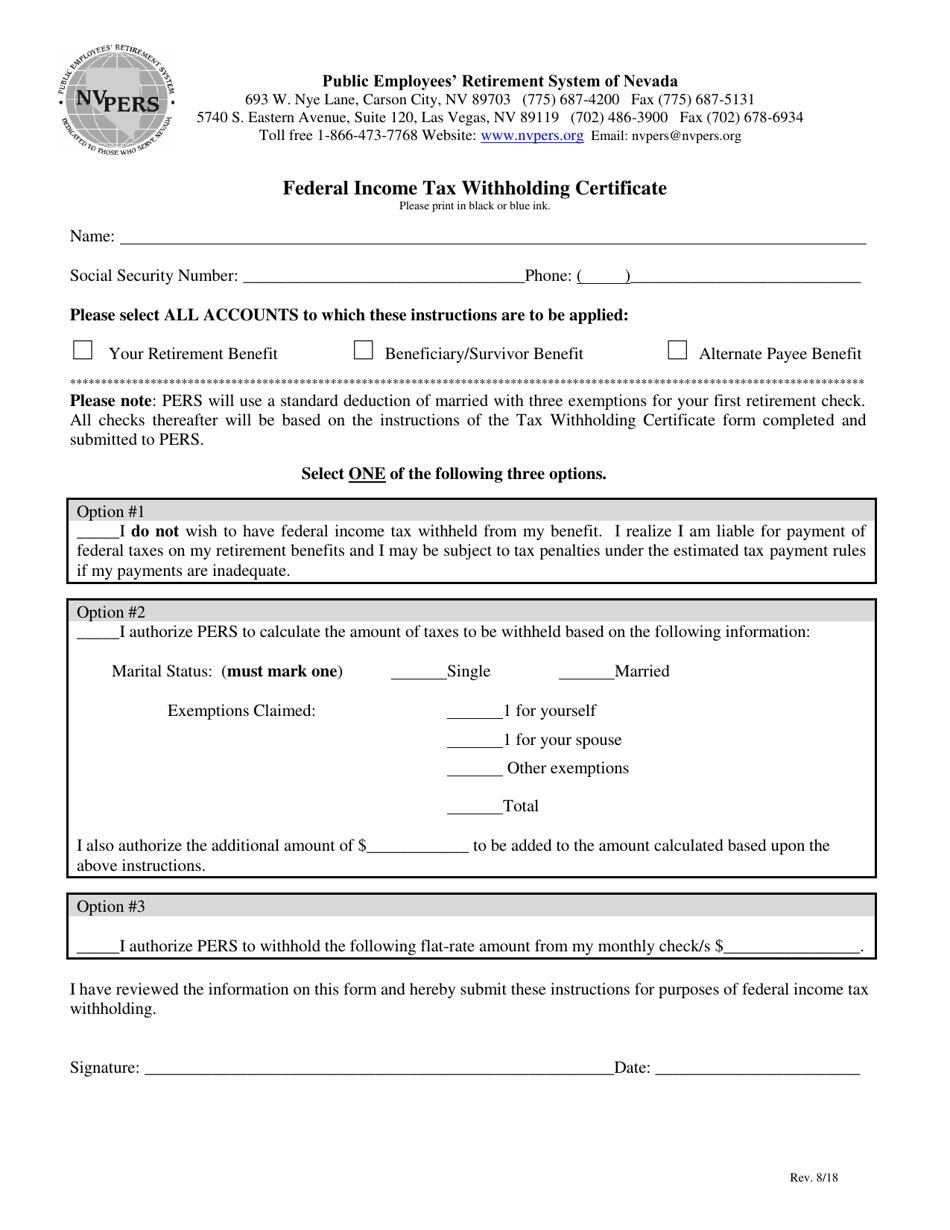

Federal Income Tax Withholding Certificate - Nevada

Federal Income Tax Withholding Certificate is a legal document that was released by the Public Employees’ Retirement System of Nevada - a government authority operating within Nevada.

FAQ

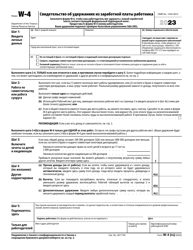

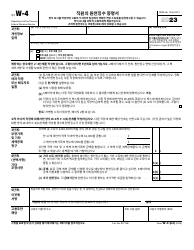

Q: What is a Federal Income Tax Withholding Certificate?

A: A Federal Income Tax Withholding Certificate, also known as Form W-4, is a form that employees use to indicate their federal tax withholding preferences.

Q: Why do I need to fill out a Federal Income Tax Withholding Certificate?

A: You need to fill out a Federal Income Tax Withholding Certificate to let your employer know how much federal income tax to withhold from your paycheck.

Q: Do I have to fill out a Federal Income Tax Withholding Certificate?

A: Yes, if you are starting a new job or want to adjust your federal tax withholding, you need to fill out a Federal Income Tax Withholding Certificate.

Q: How often should I update my Federal Income Tax Withholding Certificate?

A: You should update your Federal Income Tax Withholding Certificate whenever there are changes in your personal or financial situation that could affect your federal tax withholding.

Form Details:

- Released on August 1, 2018;

- The latest edition currently provided by the Public Employees’ Retirement System of Nevada;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Public Employees’ Retirement System of Nevada.