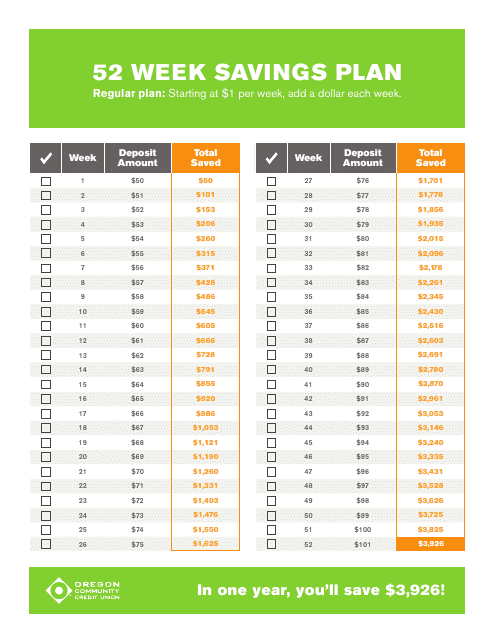

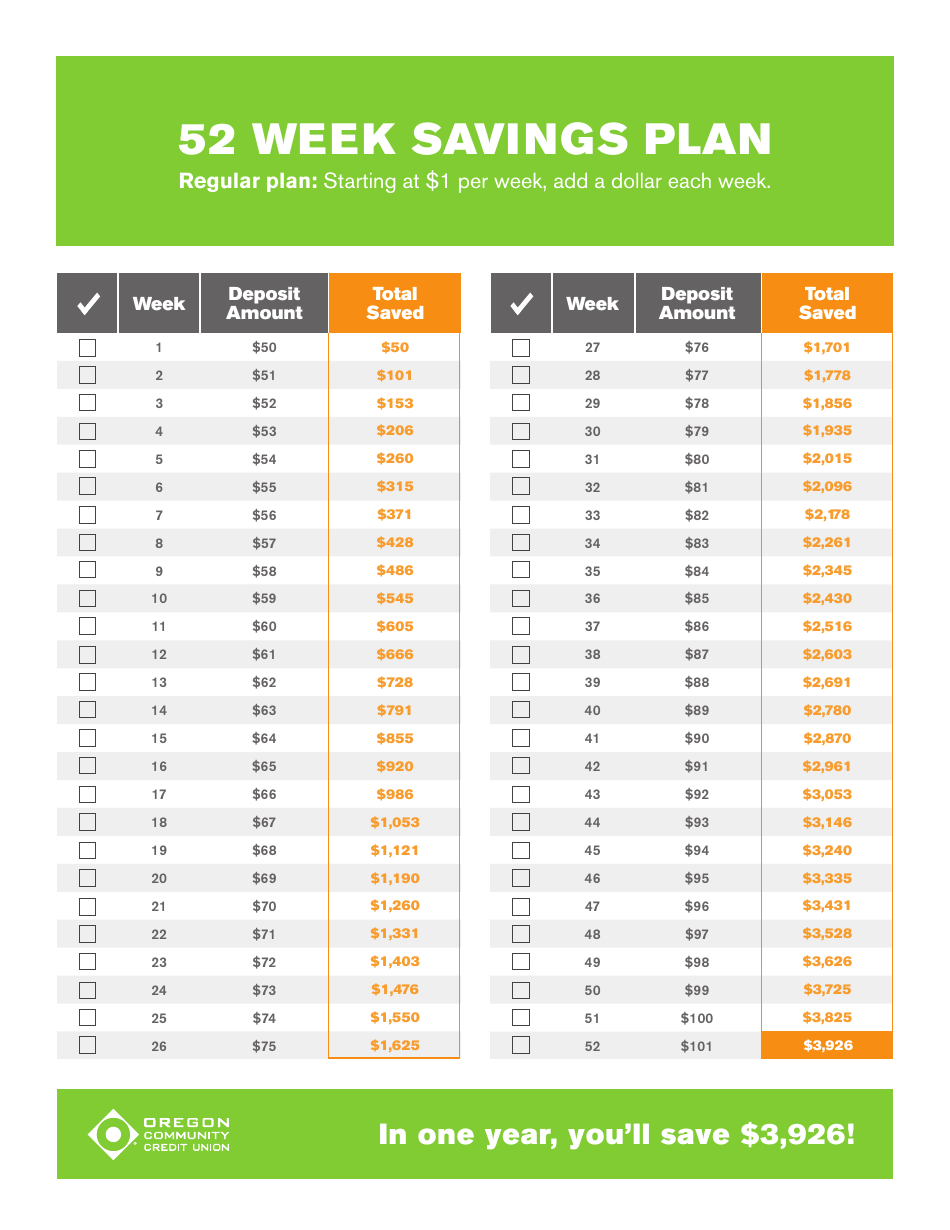

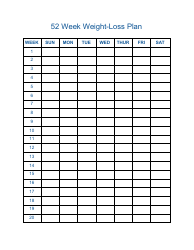

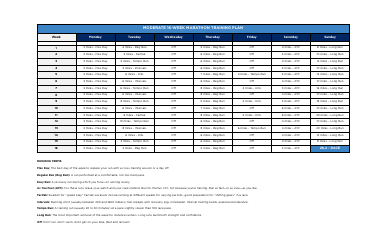

52-week Savings Plan Template - Oregon Community Credit Union

The 52-week Savings Plan Template from Oregon Community Credit Union is a tool to help individuals save money over the course of a year. It provides a structured plan for setting aside a specific amount of money each week, with the goal of building up savings over time.

FAQ

Q: What is a 52-week savings plan?

A: A 52-week savings plan is a strategy to save money over the course of one year.

Q: How does a 52-week savings plan work?

A: In a 52-week savings plan, you save a certain amount of money each week for 52 weeks.

Q: Why should I consider a 52-week savings plan?

A: A 52-week savings plan can help you develop a habit of saving and reach your financial goals.

Q: How much money should I save each week in a 52-week savings plan?

A: The amount you save each week in a 52-week savings plan can vary based on your financial situation and goals.

Q: Are there any benefits to a 52-week savings plan?

A: Yes, a 52-week savings plan can help you track your progress, stay motivated, and accumulate savings over time.

Q: Can I customize a 52-week savings plan template?

A: Yes, you can customize a 52-week savings plan template to fit your specific needs and preferences.

Q: Is a 52-week savings plan suitable for everyone?

A: A 52-week savings plan can be suitable for anyone who wants to save money and improve their financial situation.

Q: What are some tips for successfully completing a 52-week savings plan?

A: Some tips for successfully completing a 52-week savings plan include setting realistic goals, automating your savings, and staying consistent.

Q: Can a 52-week savings plan help me save for specific goals?

A: Yes, a 52-week savings plan can be used to save for specific goals such as a vacation, emergency fund, or down payment on a house.