Debt Collection Letter Template

What Is a Debt Collection Letter?

A Debt Collection Letter is a legal instrument used by financial institutions and private lenders to request the payment of the debt from the borrower.

Alternate Name:

- Debt Collection Dispute Letter.

Often used as the last warning to the borrower who may have avoided communication with their creditor, this document can be prepared before the non-breaching party decides to take further action and file a lawsuit against the person who could not prevent the default. You may add your bank account information to the letter to let the debtor pay you right away and prevent further issues.

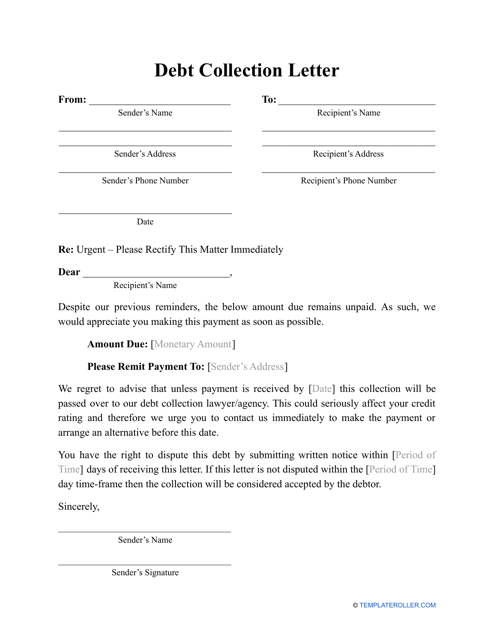

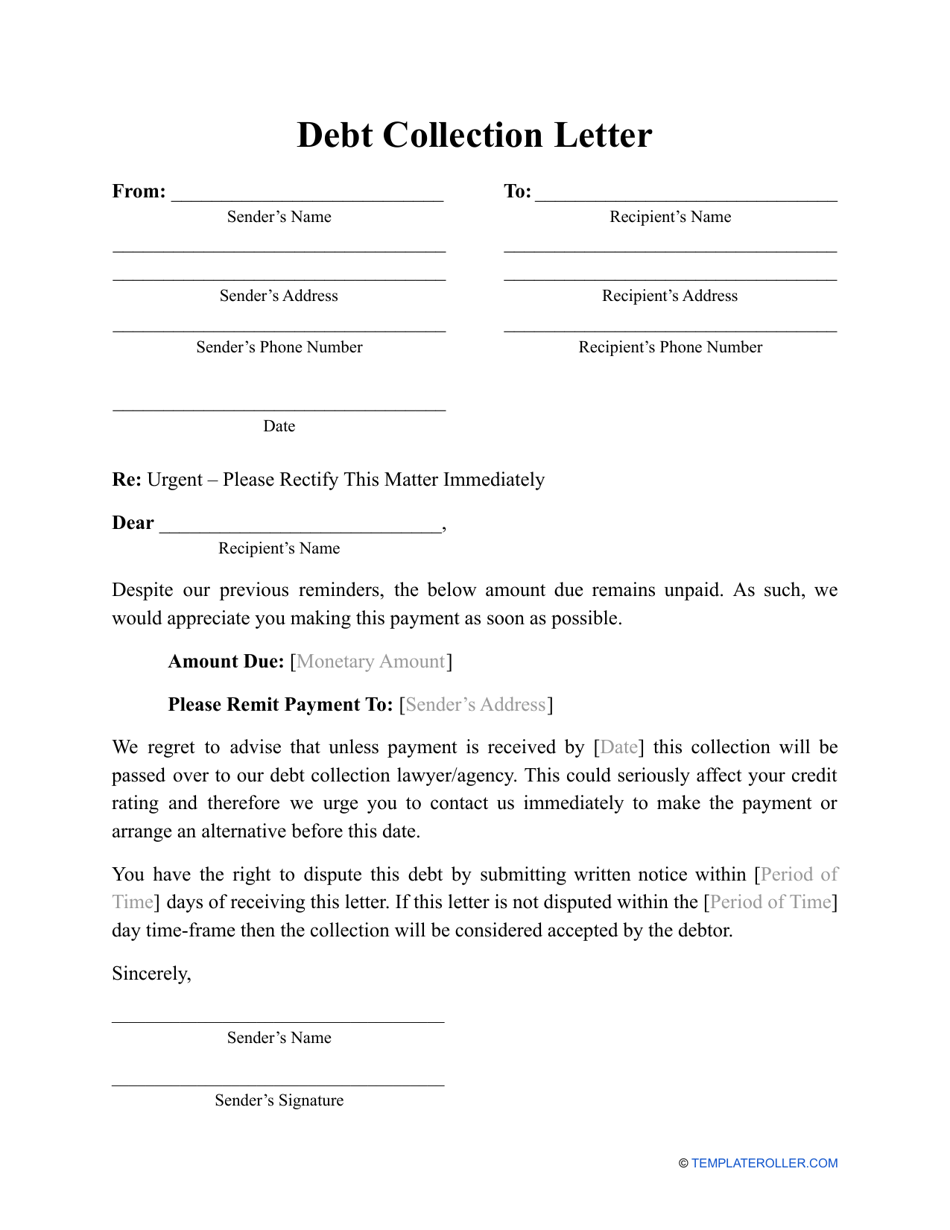

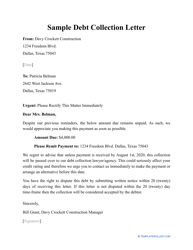

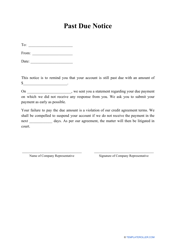

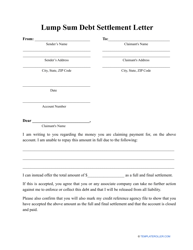

How to Write a Debt Collection Letter?

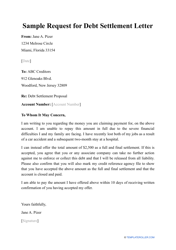

Writing a Debt Collection Letter is a straightforward process. The document should not be overloaded with details, yet it should provide all of the essential information about the debt. Make sure that your Debt Collection Letter includes the following parts:

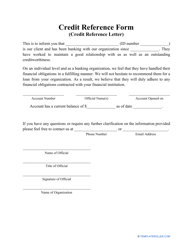

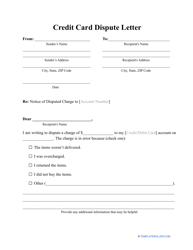

- Introduction. In the first part of the document, the creditor should state the person who they are addressing. They should provide the name of the debtor, their telephone number, email, and address. The address should include a zip code, state, city, street name, and building number.

- Information about the debt. Creditors use this part to designate information about the debt, such as its amount, when it is due, and how it is supposed to be paid back. This part of the letter should also provide information about the creditor, such as their name, address, and telephone number.

- Possible consequences. Here the creditor can provide information about the possible consequences that can take place if the debtor will not pay the debt back. They should mention that unless the debt is paid in time they will pass the collection to their lawyer. They can also warn the debtor that this can seriously affect the debtor's credit history, so it is in their best interest to pay it back as soon as possible or to contact the creditor in order to discuss alternative arrangements.

- Dispute information. In this part of the document, the creditor should inform the debtor that they have the right to dispute the debt within 30 days since the letter was received, otherwise the debt is considered to be accepted.

- Signature. To designate that everything written in the notice is true and valid and to express their intention to receive their money back the creditor should sign it. If the creditor's interests are presented by a hired specialist, then they can sign it themselves. For example, a letter from a lawyer for debt collection can be signed by a lawyer, who should state their name and information about their authorizing documents.

How to Respond to a Debt Collection Letter?

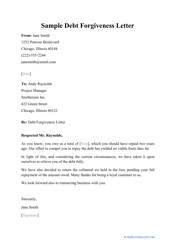

Depending on the circumstances of the situation, the debtor can respond to the debt collection letter in several ways. Documents that the debtor can send in response to the letter include the following:

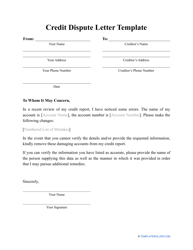

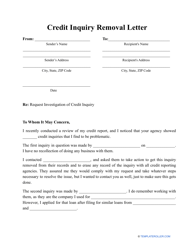

- Debt Dispute Letter. If the debtor does not agree with the information presented in the letter they have 30 days to send a Debt Dispute Letter, where they will inform the creditor that the information about the debt is invalid (or that they do not own the debt). If they do not send a letter to a collection agency disputing a debt (or to any other authorized representative), then the debt is considered to be valid.

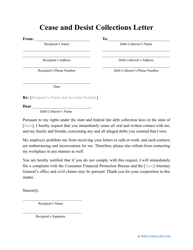

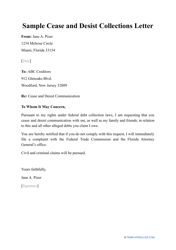

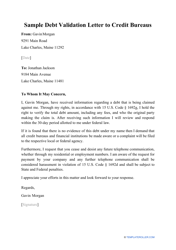

- Cease and Desist Letter. If the creditor or their representatives keep on repeatedly contacting the debtor in an illegal manner, they can send them a Cease and Desist Letter. In this letter, the debtor demands the creditor to stop contacting them or they will pursue legal action.

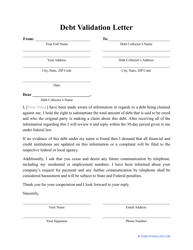

- Request for a Debt Validation Letter. After receiving the notice from debt collectors, the debtor can send them a request for more information about the debt they are asked to pay. The collector's agency will have to respond to this request with a Debt Validation Letter, where they will provide detailed information.

In addition to the documents mentioned above, the debtor can also send the creditor a letter where they can ask them to contact the debtor only in a specific way (for example, only by mail or email), or through their lawyer. In this case, they should provide their lawyer's contact information.

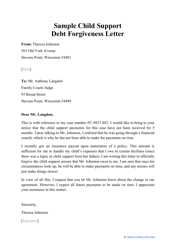

Didn't find what you were looking for? Have a look at these similar templates and samples below: