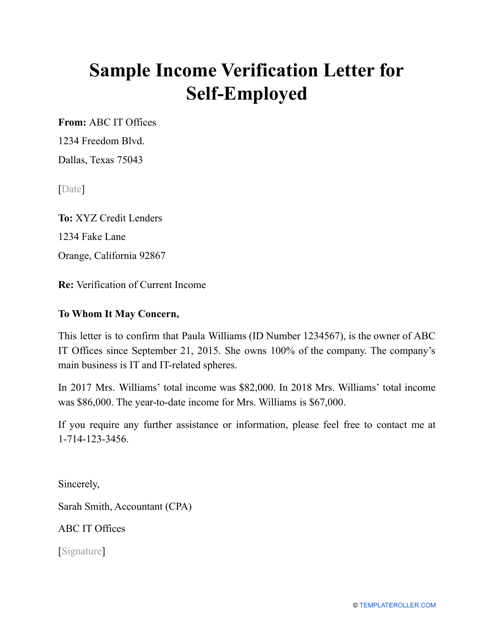

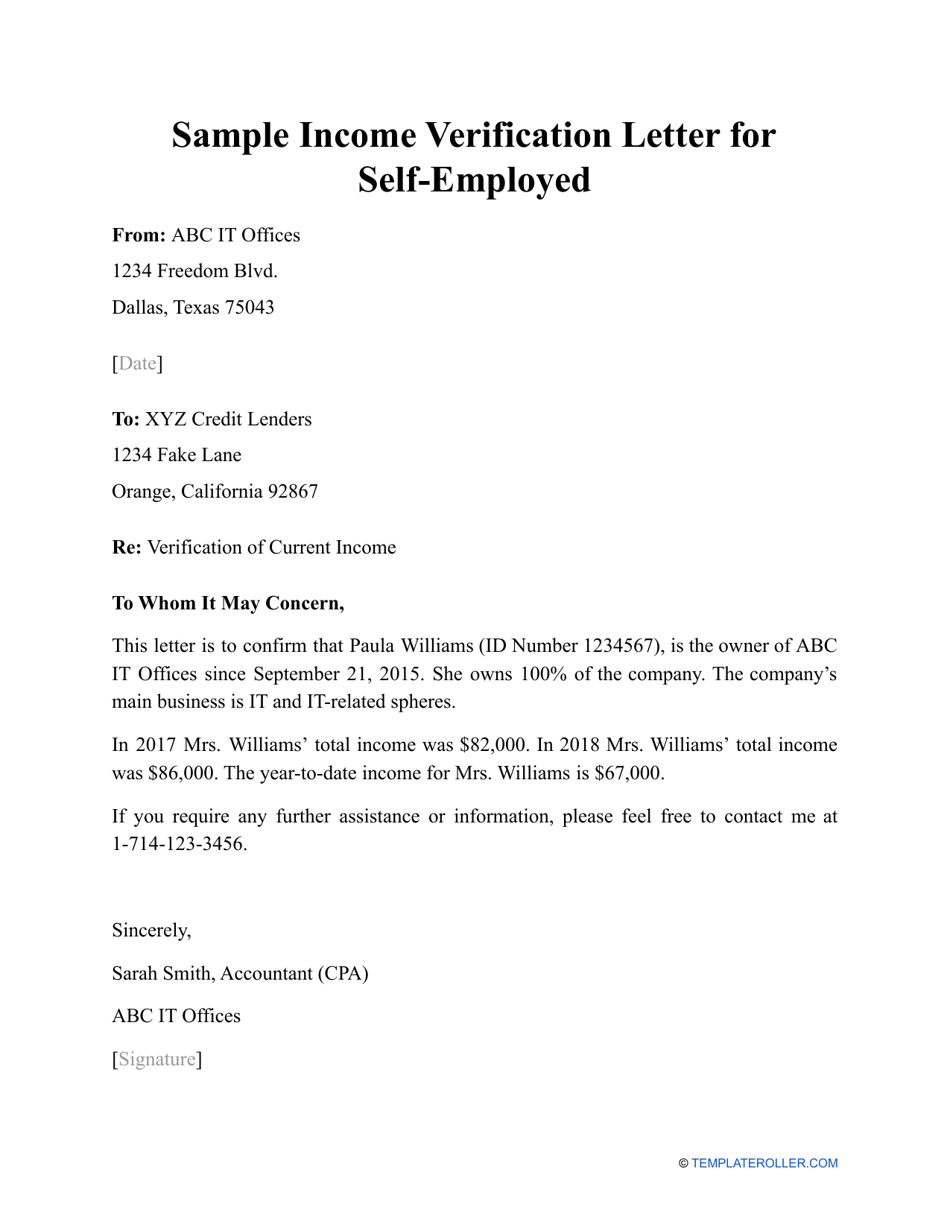

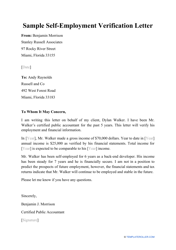

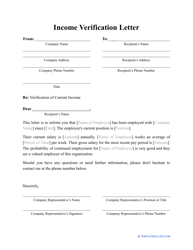

Sample Income Verification Letter for Self-employed

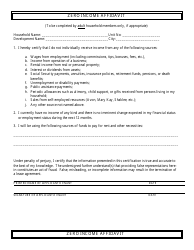

An Income Verification Letter for the Self-Employed - also known as a Self-Employment Letter - is a formal document prepared by an individual to verify the amount of money they receive as a self-employed person. This statement will come in handy if you are asked by a moneylender, financial institution, visa agency, or landlord to confirm you are earning enough money to enter into transactions and agreements that involve large or regular payments. Also, a letter like this can prove your work experience in a particular area and the duration of time you have spent working for yourself. Ask the person or company that requested a letter what information they want to learn from this document to make sure you are adding enough relevant details.

Alternate Names:

- Self-Employed Income Verification Letter;

- Income Verification Letter for Self Employment.

If you are looking for a Sample Self-Employed Income Verification Letter, you can download it through the link below.

How to Write an Income Verification Letter for Self-Employed?

Follow these steps to draft an Income Verification Letter for Self Employment:

- Introduce yourself and indicate the purpose of this statement. It is recommended to make each letter unique depending on who you are sending it to. For example, you may negotiate loans with several financial institutions - try to look up names of bank officers responsible for closing the loan and address your letters appropriately.

- Confirm you are self-employed. State the period of time you have been self-employed and write down the line of work you are in.

- Provide a breakdown of your income. Since you might not know the exact amount of money you receive each month, try to calculate your average income for the last six months. You may make references to agreements and deals you have signed with third parties to show how much money you were able to earn lately.

- Add your contact details - the recipient may want to verify certain information you have shared. Sign and date the letter. Usually, this document is considered valid for a month or two. Note that you must update the letter in case your financial situation drastically changes - for instance, you stopped earning as much money as you did.

- Make sure you provide evidence of your constant income to assure the recipient of your ability to deal with the bills, finance your travel, or pay back the loan. You can attach copies of your latest tax return, bank statements, recently signed contracts that contain a specific payment schedule.

Related Letter Templates and Topics: