Nobel Prize in Economic Sciences 2013: Trendspotting in Asset Markets

The Nobel Prize in Economic Sciences 2013 was awarded for their research on asset market trends and how they can be predicted.

The Nobel Prize in Economic Sciences 2013 for the research on trendspotting in asset markets was awarded to Eugene F. Fama, Lars Peter Hansen, and Robert J. Shiller.

FAQ

Q: What is the Nobel Prize in Economic Sciences?

A: The Nobel Prize in Economic Sciences is an award given to individuals who have made significant contributions to the field of economics.

Q: Who won the Nobel Prize in Economic Sciences in 2013?

A: The Nobel Prize in Economic Sciences in 2013 was awarded to Eugene F. Fama, Lars Peter Hansen, and Robert J. Shiller.

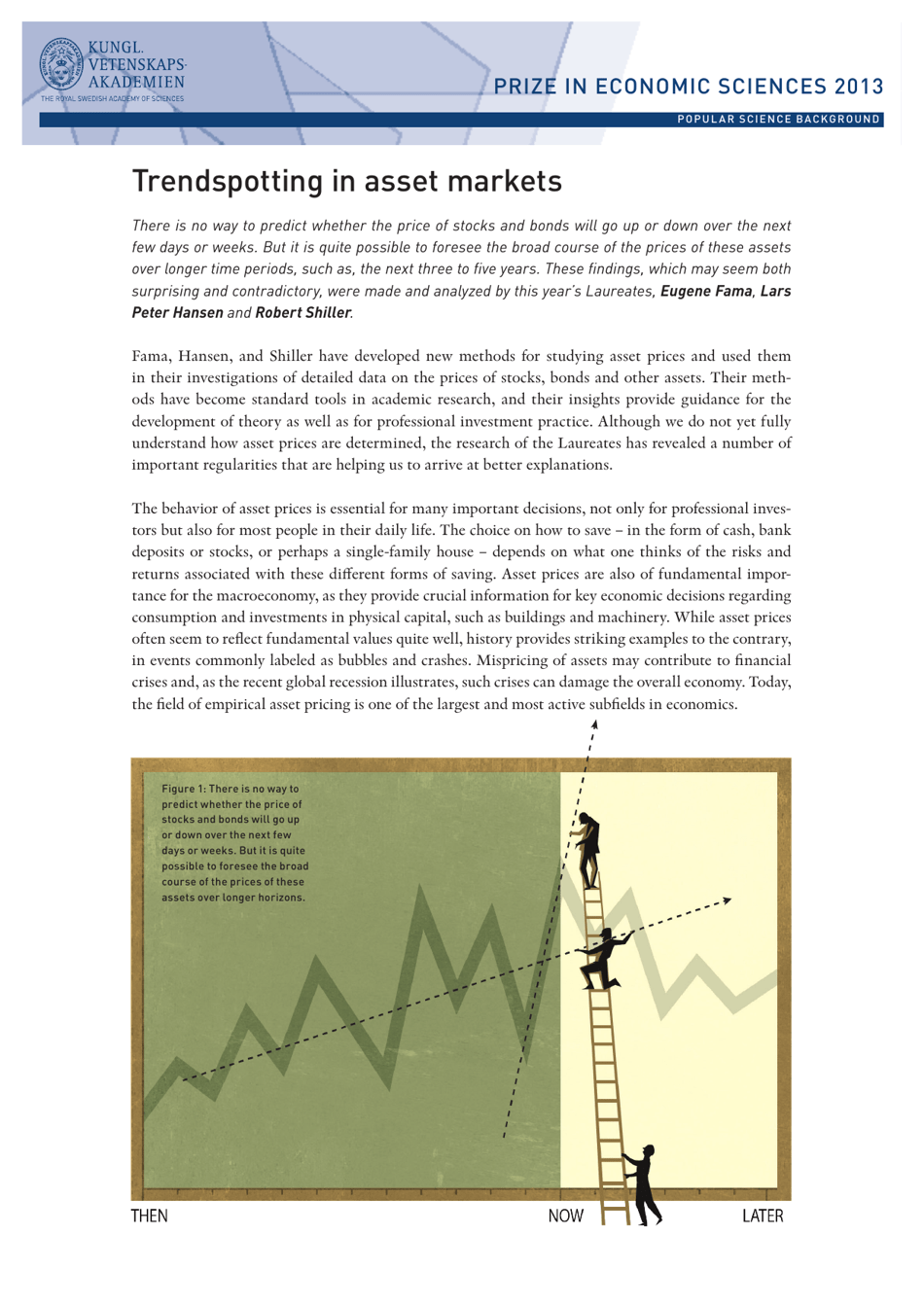

Q: What is trendspotting in asset markets?

A: Trendspotting in asset markets refers to the ability to identify trends or patterns in the movement of financial assets such as stocks, bonds, or commodities.

Q: Why was the Nobel Prize awarded for trendspotting in asset markets?

A: The Nobel Prize was awarded to Eugene F. Fama, Lars Peter Hansen, and Robert J. Shiller for their empirical analysis of asset prices, specifically highlighting the important role of trendspotting in asset markets.

Q: What were the contributions of the prize recipients?

A: Eugene F. Fama developed the efficient-market hypothesis, Lars Peter Hansen developed statistical methods for analyzing economic models, and Robert J. Shiller conducted research on the predictability of asset prices.