Credit Card Authorization Form

What Is a Credit Card Authorization Form?

A Credit Card Authorization Form is a document that contains approval from an individual (a cardholder) to a retailer to charge their credit card for an agreed purchase. The purpose of the document is to give permission to the seller to request payment once or on a regular basis when the credit card is not present. A printable Credit Card Authorization template can be downloaded through the link below.

Keeping a Credit Card Authorization Form helps vendors avoid any potential disputes since each form contains a signed consent from a customer to charge their credit card. It is especially important to keep them when the payments are recurring so that the retailer won't have to request a new form for every transaction.

How Does a Credit Card Authorization Form Work?

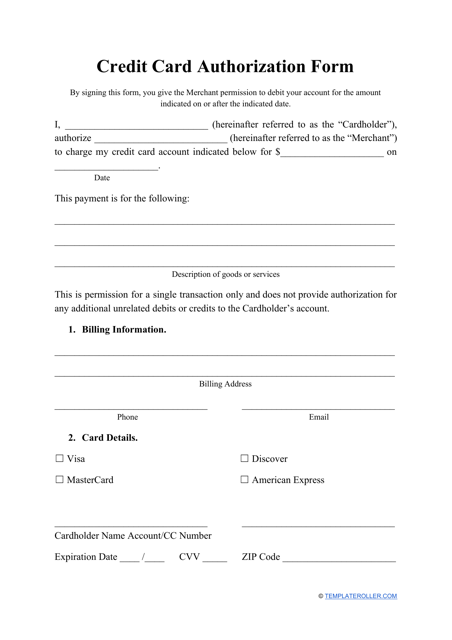

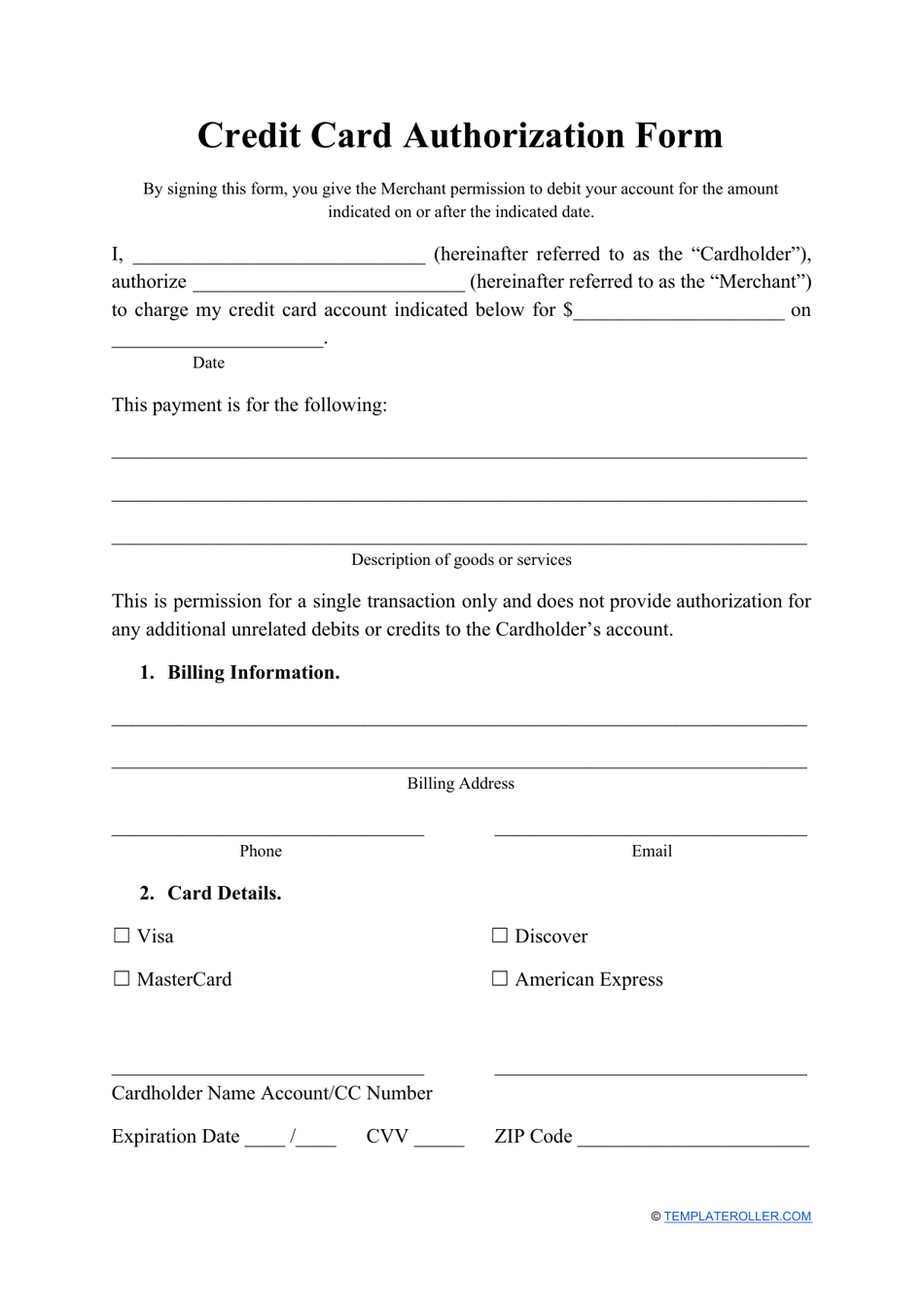

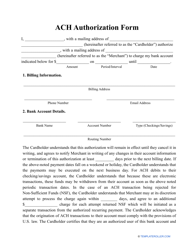

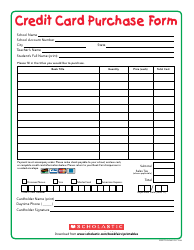

The credit card authorization process starts when a cardholder receives an application from a vendor, after that they are supposed to fill in the gaps in the document. A generic Credit Card Authorization Form consists of several parts, which include the following:

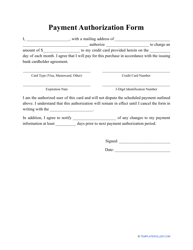

- Information about the credit card . In the first part of the application, a filer must enter their name (as stated on their credit card), credit card type, credit card number, expiration date (month and year), etc.

- Billing address . Here an applicant must designate their full billing address, including zip code, country, state, city, and street address.

- Contact information of the cardholder . In this part of the form, an individual must state their phone number and email address.

- Information about the vendor . This section is usually filled in by vendors in advance. Here they enter the information about their business: the company's name, fax, email, and person to contact.

- Information about the transaction. Filers use this part of the application to designate information about a purchase, whether it is a one-time or a regular transaction, the amount that must be transferred, how long the authorization is good for, etc.

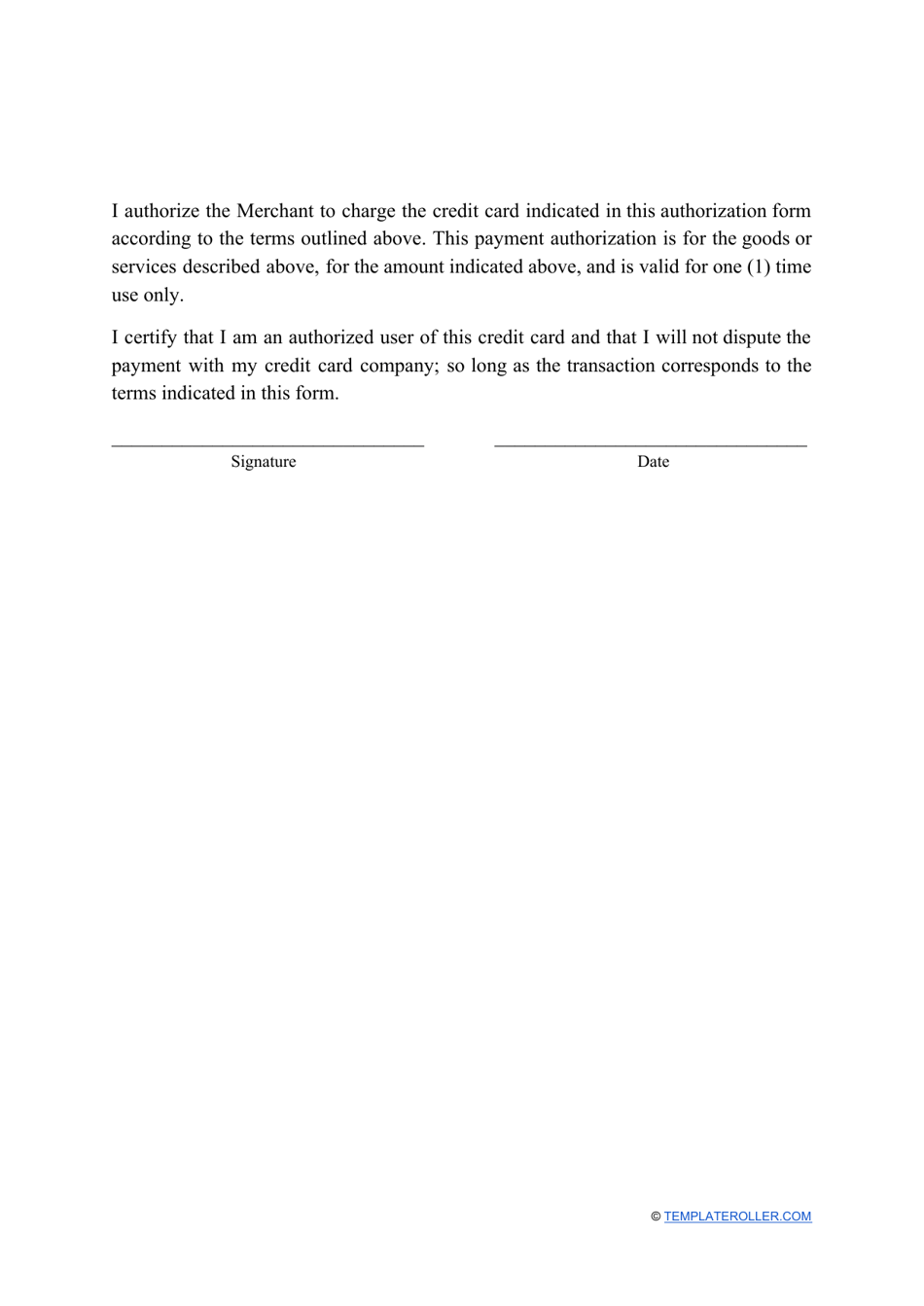

- Authorization . A form must always contain a paragraph that expresses the cardholder's authorization of the merchant to charge their credit card. This paragraph can also be presented as a list of terms and conditions that a cardholder has agreed to.

- Consent . A cardholder must express their consent for the vendor to keep their completed application in the vendor's files. Here they can designate for how long the document is supposed to be kept.

- Individual's signature and dat e. In the last section of the form, an applicant must sign and date the document.

After a vendor has gathered all of the required information, they provide it to their bank, which uses it to run the transaction. After the transfer is completed and no issues have occurred, the vendor will keep the completed authorization form in their files.

How Long Is a Credit Card Authorization Form Good For?

How long the Credit Card Authorization Form is good for usually depends on several circumstances. Retailers keep them in their records for a certain amount of time in order to protect themselves from chargebacks and other questionable situations. If it is a one-time Credit Card Authorization Form, then the seller is recommended to keep it for three to four months on average after the transaction has taken place. If it is a Recurring Credit Card Authorization Form, then it should be kept in their records for three to four months on average since the last transaction.

Some applications include a part where a filer gives consent to the vendor to keep their information in the retailer's record for a specific time period, which can be expressed by a date, a number of months, or a year.

Keeping the form is necessary since the time window for chargebacks can be different. If the bank will question the legitimacy of a transfer, a merchant must provide a document that will ensure that the transaction was authorized. Nevertheless, the vendor should check any applicable state laws in case there are exact requirements for this procedure.

Related Templates and Topics: