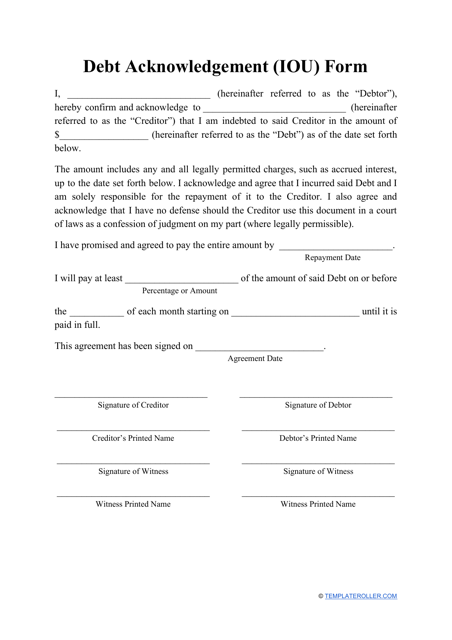

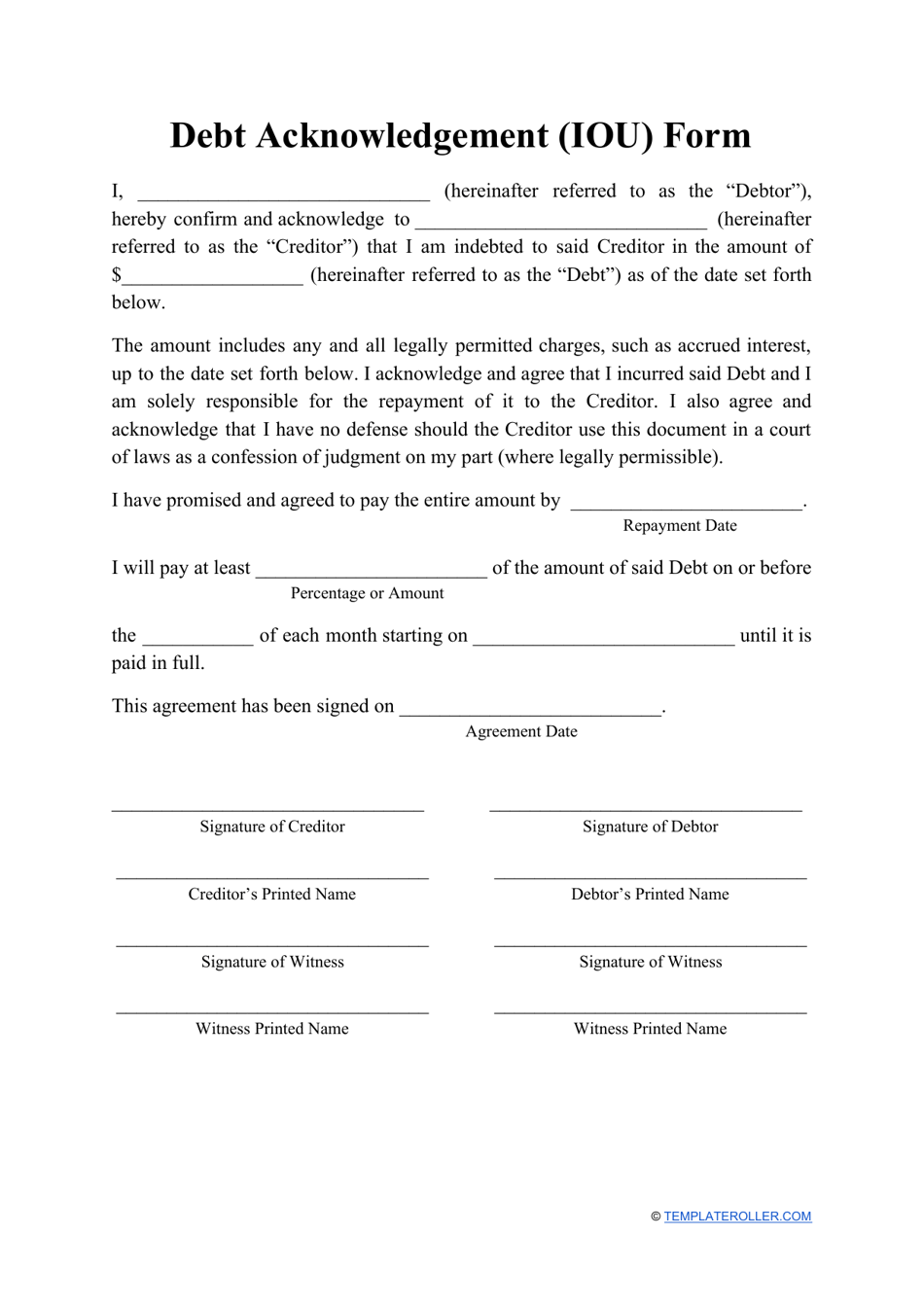

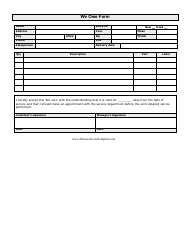

Iou Template

What Is an IOU?

An IOU is a typed or handwritten document that outlines the details about the debt owed by one party (borrower, or debtor) to another (creditor, or lender). If you need to create your own IOU template you may download a ready-made one below.

Alternate Names:

- I Owe You;

- Debt Acknowledgment Form;

- Debt Acknowledgment Note.

This informal loan contract can be used by individuals and entities alike as a simple and quick solution to make valid a transaction without a more complex legal agreement. Usually, however, an IOU is signed by parties who have established trust - family members, close friends, and long-term business partners. Creating an IOU is in everyone's best interest - even if you choose to loan money to someone you have known for years, it is important to have a record of it in case the borrower decides not to pay the money back.

It not only protects the lender but also makes the borrower think twice about whether or not to take the loan and risk ruining the personal and professional relationship with the individual or company that loaned the money.

How to Write an IOU?

Follow these steps to draft a Debt Acknowledgment Note:

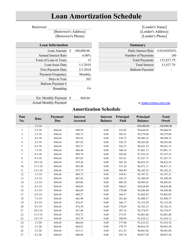

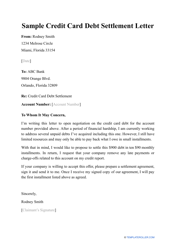

- Identify the parties to the agreement . Name the borrower and the lender. State their contact information - physical addresses, telephone numbers, and e-mail addresses. You may use driver's license numbers or another form of identification to clarify who the parties to the IOU are, especially if the names are common.

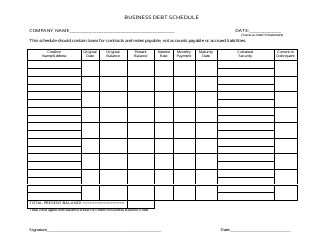

- Enter the amount of the loan in the written and numeric form . Indicate whether this sum of money includes any charges, for instance, accrued interest. The interest may be compounded monthly or yearly.

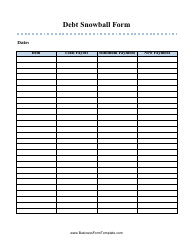

- Establish the terms of repayment . You may agree on weekly, monthly, or yearly installments until the loan is paid off in its entirety or on one lump sum payment. Negotiate acceptable payment methods - cash, bank deposits, online payments, etc.

- Record the final date on which the money must be paid and the date when the document was signed in the first place.

- Sign the document and add your names . In most instances, only the borrower signs the IOU, but you should obtain the signature of the lender as well. To protect your interests, you may find witnesses who also sign off on the IOU or present the document to the notary public who will verify the written statements and put an official seal to the IOU. It is especially important if the sum of money borrowed is large or you loan an item of value.

Is an IOU Legally Binding?

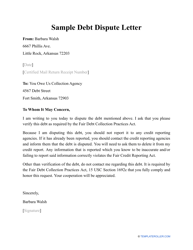

Many people have misconceptions about the legal validity of a simple IOU - they think an IOU always means a piece of paper with few words written on it and there is no reason to take such a "document" seriously. However, if this document identifies the parties, indicates the sum of money owed, and contains the borrower's signature, it is very likely to be legally binding.

A court can determine the rights and duties of the parties even if an IOU does not have payment terms and the date of payment. Nevertheless, it is highly recommended not to miss essential terms to increase the chances of the lender to get money back, so draft a proper Debt Acknowledgment Form to protect your interests. When there are missing elements in the IOU, additional information can be supplied by parties' statements, while the IOU serves as evidence of an oral agreement.

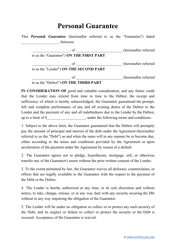

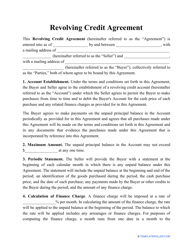

Related Templates and Topics: