Wire Transfer Form

What Is a Wire Transfer Form?

A Wire Transfer Form is a document that is used to initiate an electronic fund transfer from a sender (which can be an individual or an entity) to a recipient (also known as a beneficiary or a payee). The purpose of the document is to provide the bank with all of the information required to do the wire transfer.

Alternate Name:

- Wire Transfer Request Form.

Wire transfer is an easy and convenient method of the electronic transfer of funds. The process usually starts with a sender submitting the form to their bank. After that, the sending bank delivers the message to the receiving bank with the request to effect the payment in accordance with their instructions. After the funds are moved from the sender's account to the recipient's account, the banks may collect payment for their services.

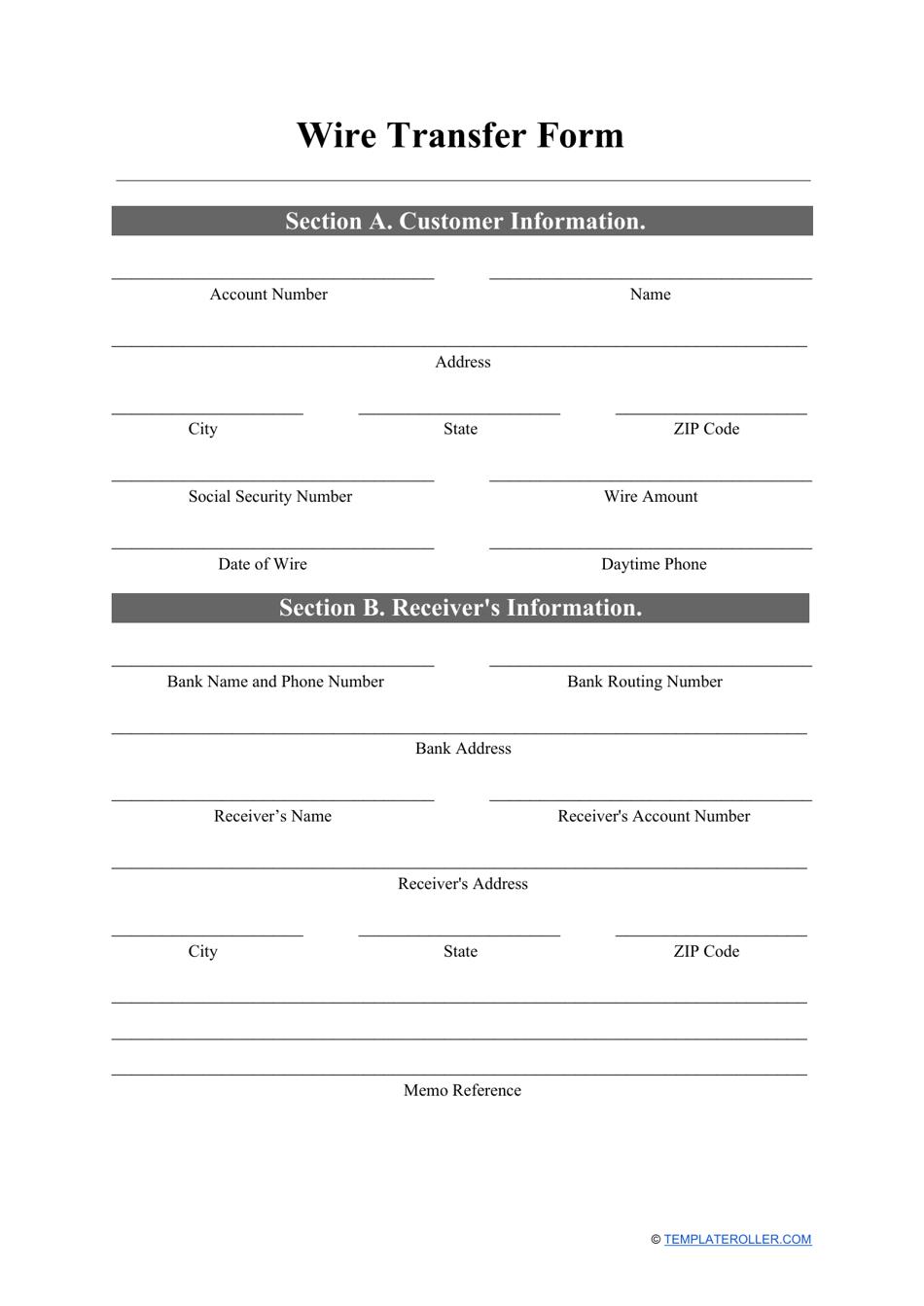

A printable Wire Transfer Form template can be downloaded below.

How to Fill Out a Wire Transfer Form?

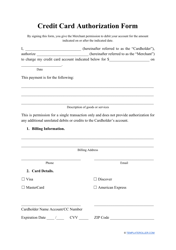

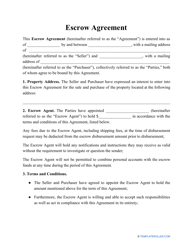

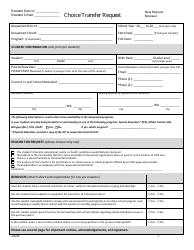

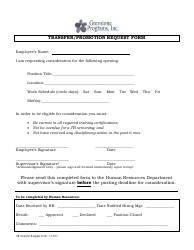

Generally, banks create separate forms for domestic wire transfers and for international wire transfers. A common domestic bank wire transfer usually requires senders to fill in the gaps in the form, which can include the following:

- Title and Date . The Wire Transfer Form should start with a title in order to express its nature. It can be followed by the date it was completed and submitted.

- Information About the Sender . In this part of the document, the sender should fill in their contact information, such as full name, full address, email, and telephone number. In some cases, the bank can require the sender to provide their banking information, but, in most cases, the sender is the client of the bank so they have already obtained all of the needed information for the transfer.

- Wire Transfer . Here the sender should designate all information about the transfer. It should state how much money is supposed to be transferred and its currency. Banks also use this section in the form to provide the sender with information about the fees that shall be charged after the transfer.

- Recipient's Information . Banks require the senders to state information about their recipients for the transfer, such as their full name, full address, information about the receiving bank and their account, routing number, etc.

- Signature . To express their consent and verify that all of the information stated above is true, the sender should sign the document.

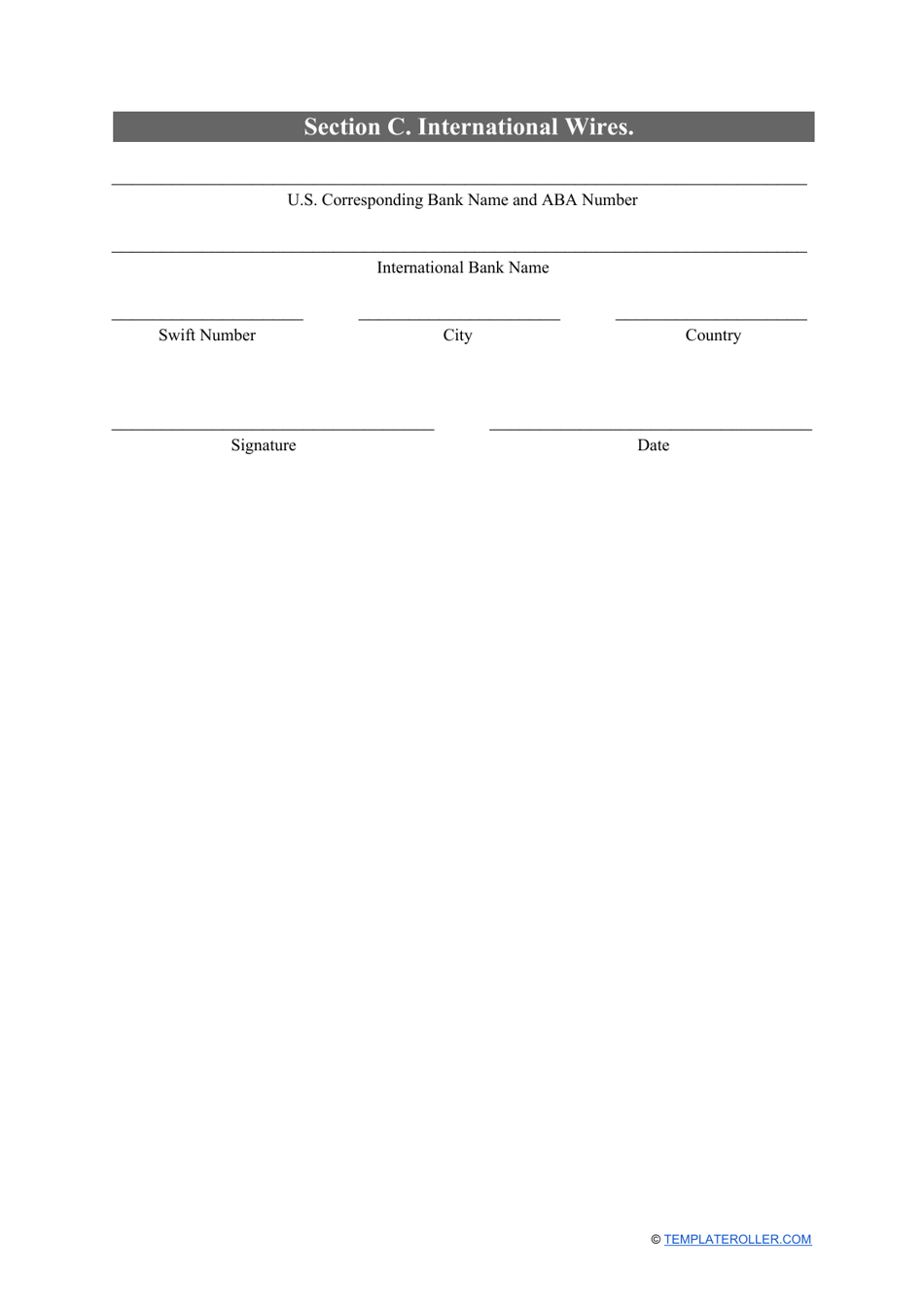

If the Wire Transfer Form is created for international wire transfers, then the sender should also designate the bank's SWIFT or BIC code. Depending on the country where the recipient's bank is operating, the sender can also designate the Sort Code - for fund transfers to the United Kingdom, or BSB Number - for transfers to Australia. To find out if there is any additional data that should be entered on the form the sender should contact their bank.

Some foreign banks cannot receive a direct transfer from U.S. banks. To solve the situation, the transfer is made with the assistance of a correspondent bank. In this case, the sender should contact the foreign bank and obtain information about the correspondent bank required for the transfer, such as its name, full address, SWIFT or BIC code, IBAN, and account number.

How Long Does a Wire Transfer Take?

A wire transfer is considered to be one of the fastest ways to send and receive money electronically. By a general rule, it doesn't take more than 24 hours to perform a non-bank wire transfer. Nevertheless, in some situations, it can take from two to five days. It can happen in the case of an international wire transfer, for example. Sometimes even a bank wire transfer can take several days, so if a sender or a recipient is in a time-sensitive situation they should consider doing a fund transfer in advance.

Not the form you were looking for? Check out these related documents: