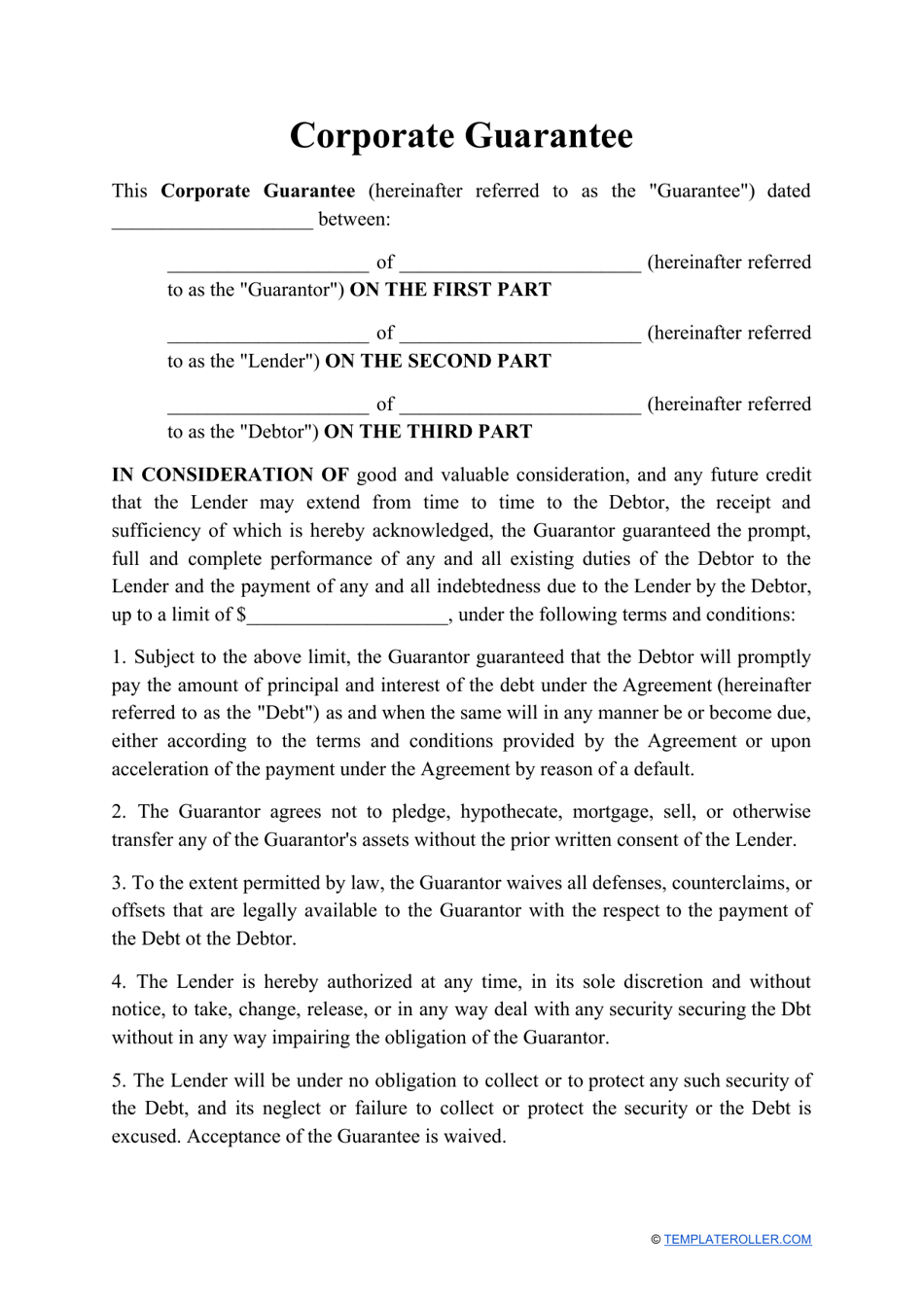

Corporate Guarantee Template

What Is a Corporate Guarantee?

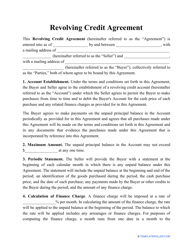

A Corporate Guarantee is a legal agreement used when an entity is facing bankruptcy between a borrower, lender, and guarantor, where a corporation (usually an insurance company) takes on the responsibility of ensuring a borrower repays their debt. This guarantee will list how much will be given for a loan and who will be responsible for paying back the amount should the debtor stop making repayments.

Alternate Name:

- Third-Party Guarantee.

There are two types of corporate guarantees: limited and unlimited. In a limited Corporate Guarantee, the guarantor is liable only up to a certain amount of the debt owed by the borrower. For an unlimited Corporate Guarantee, the guarantor is responsible for the full debt amount owed by the borrower.

There can also be a Cross Guarantee, where two or more companies provide a guarantee to one another's obligations. This often occurs between companies operating under the same group or a parent company and its subsidiaries (for example Disney acting on behalf of Marvel). You can download a Corporate Guarantee template through the link below.

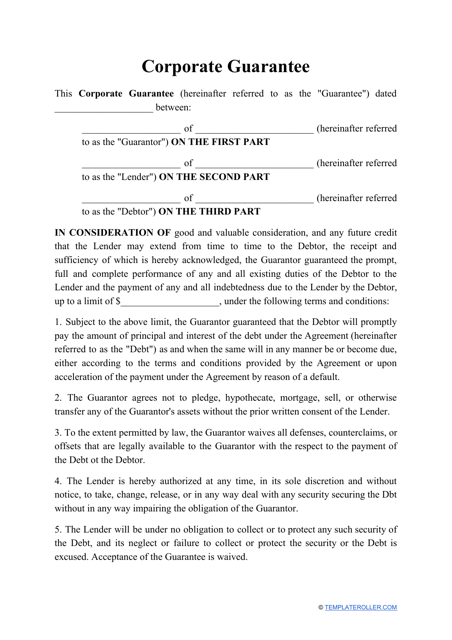

How to Write a Corporate Guarantee?

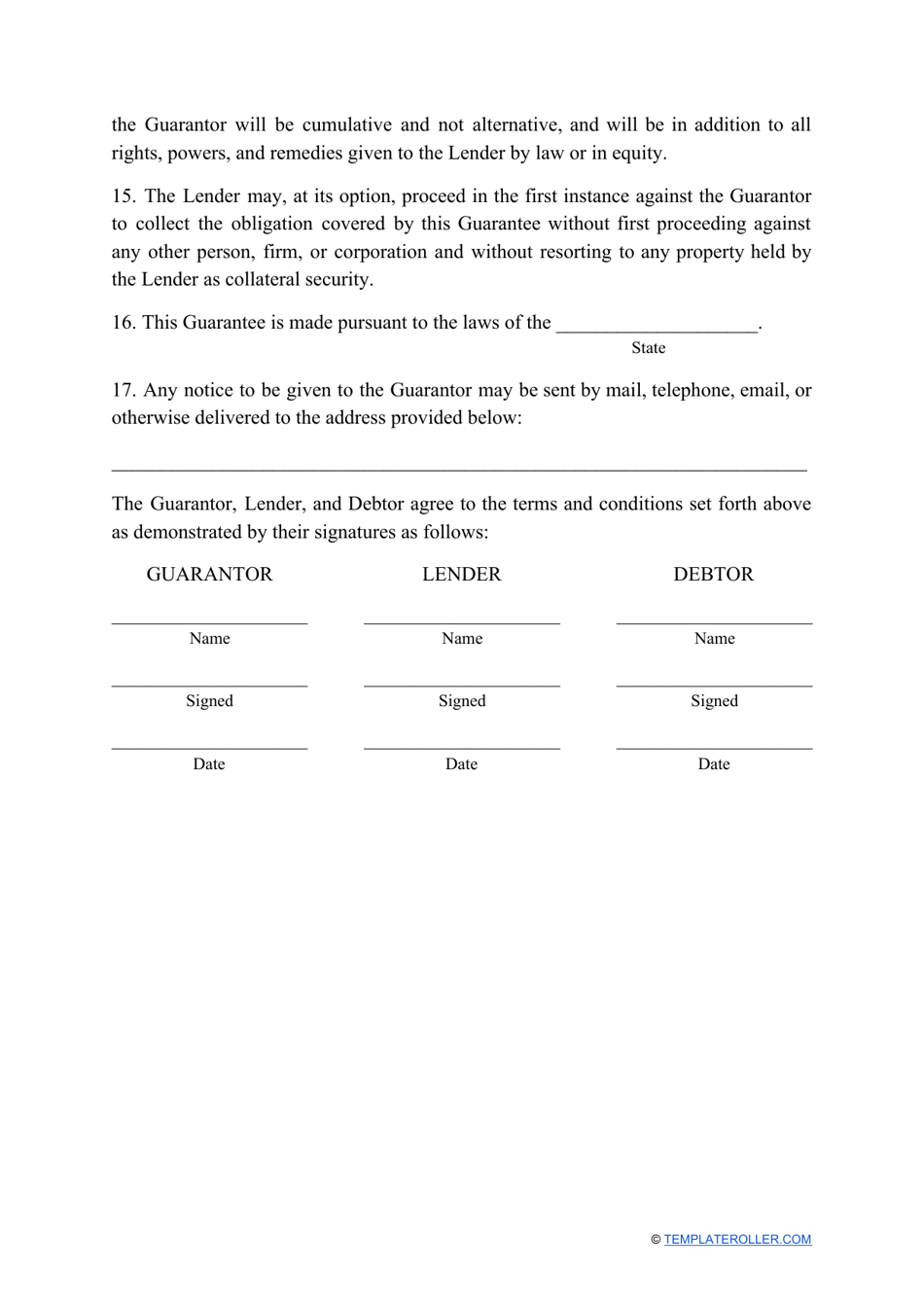

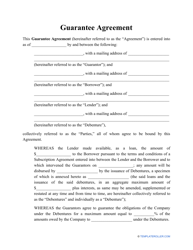

To write a Corporate Guarantee Form you will want to include the following in your introductory section:

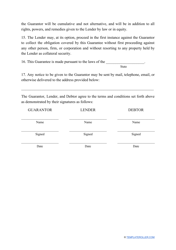

- Borrower's name (labeled "the Borrower") and address.

- Lender's name (labeled "the Lender") and address.

- Guarantor's name (labeled "the Guarantor") and address.

- Date of the loan agreement.

- Amount of the loan.

- The entity responsible for paying back the loan should the borrower fail to pay back the amount. This includes all remaining principal, interest, and any additional costs (i.e. fines or penalties).

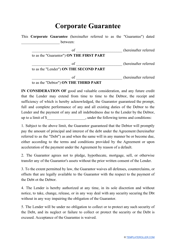

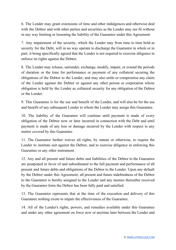

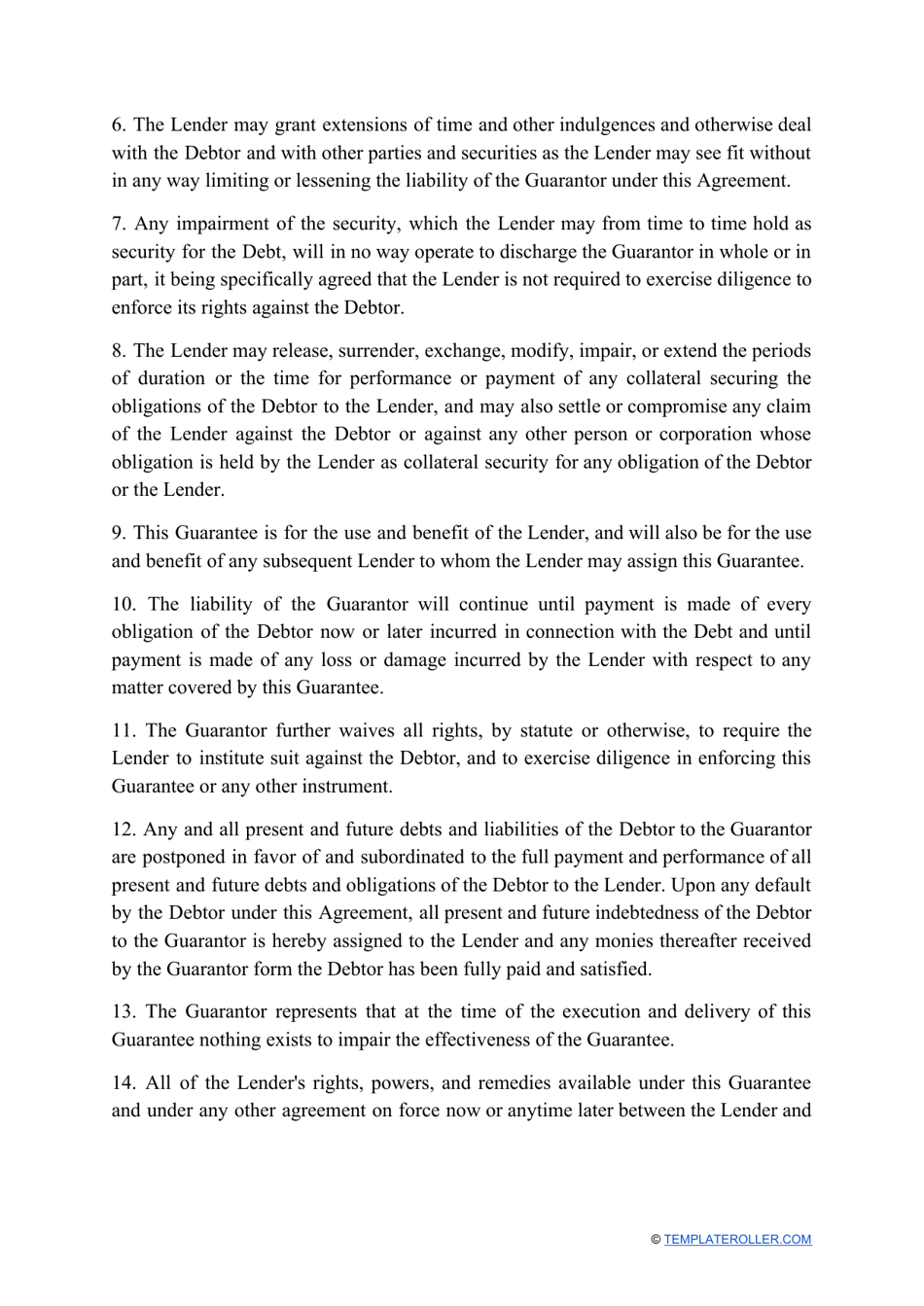

Within your Corporate Guarantee template, you will also want to include a clear description of what the responsibilities entail for the borrower, lender, and guarantor, and that this document shall not be altered or changed in any way once signed. If this is a Cross Corporate Guarantee, you will want to include a statement that the Parent Company agrees to repay the debt of the subsidiary in full.

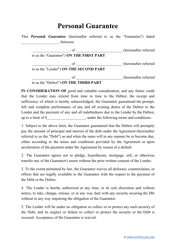

What Is the Difference Between a Corporate Guarantee and a Personal Guarantee?

The difference between a Corporate Guarantee and a Personal Guarantee is a more firm guarantee of repayment by the borrower and a promise of additional assets being repossessed. In a Personal Guarantee, the borrower is usually an executive or partner of a business that is seeking to repay debts and provides an extra layer of security to the lender that they will receive repayment of the loan.

This form of loan guarantee also ensures that the debt will still be repaid to the lender by the borrower or guarantor should the company file for bankruptcy. Borrowers who have agreed to a Personal Guarantee can also use their own financial assets as collateral or agree to use personal funds to repay the debt should the business run into default.

Related Tags and Topics: