Publication 68 - Tax Tips for Photographer, Photo Finishers, and Film Processing Laboratories - California

Publication 68 - Tax Tips for Photographer, Photo Finishers, and Film Processing Laboratories is a legal document that was released by the California State Board of Equalization - a government authority operating within California.

FAQ

Q: Who is Publication 68 for?

A: Publication 68 is for photographers, photo finishers, and film processing laboratories in California.

Q: What is the purpose of Publication 68?

A: Publication 68 provides tax tips and guidance specific to the photography industry in California.

Q: What information does Publication 68 cover?

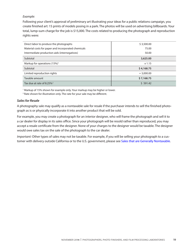

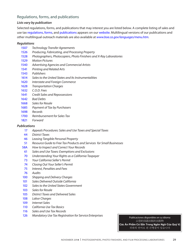

A: Publication 68 covers topics such as business expenses, sales and use tax, income tax, and recordkeeping requirements.

Q: Are there any specific tax deductions for photographers?

A: Yes, Publication 68 provides information on various tax deductions that photographers may be eligible for.

Q: What is the sales and use tax?

A: Sales and use tax is a tax imposed on the sale or use of tangible personal property in California.

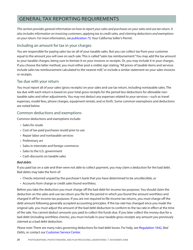

Q: What recordkeeping requirements are there for photographers?

A: Publication 68 provides information on the records that photographers should keep for tax purposes.

Q: Is Publication 68 applicable only to California?

A: Yes, Publication 68 is specifically tailored to the tax laws and regulations in California.

Form Details:

- Released on November 1, 2014;

- The latest edition currently provided by the California State Board of Equalization;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.