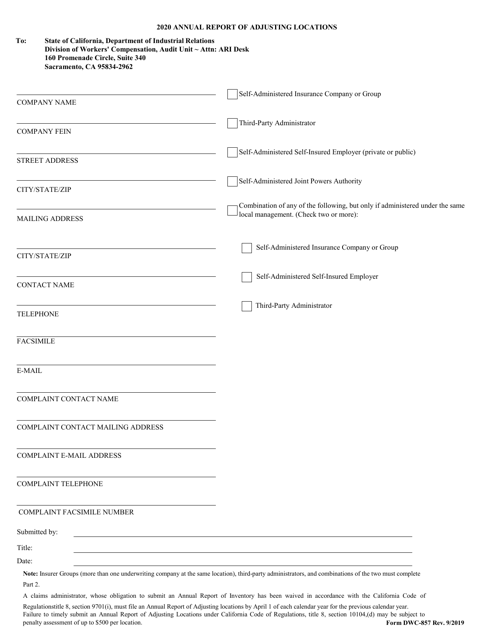

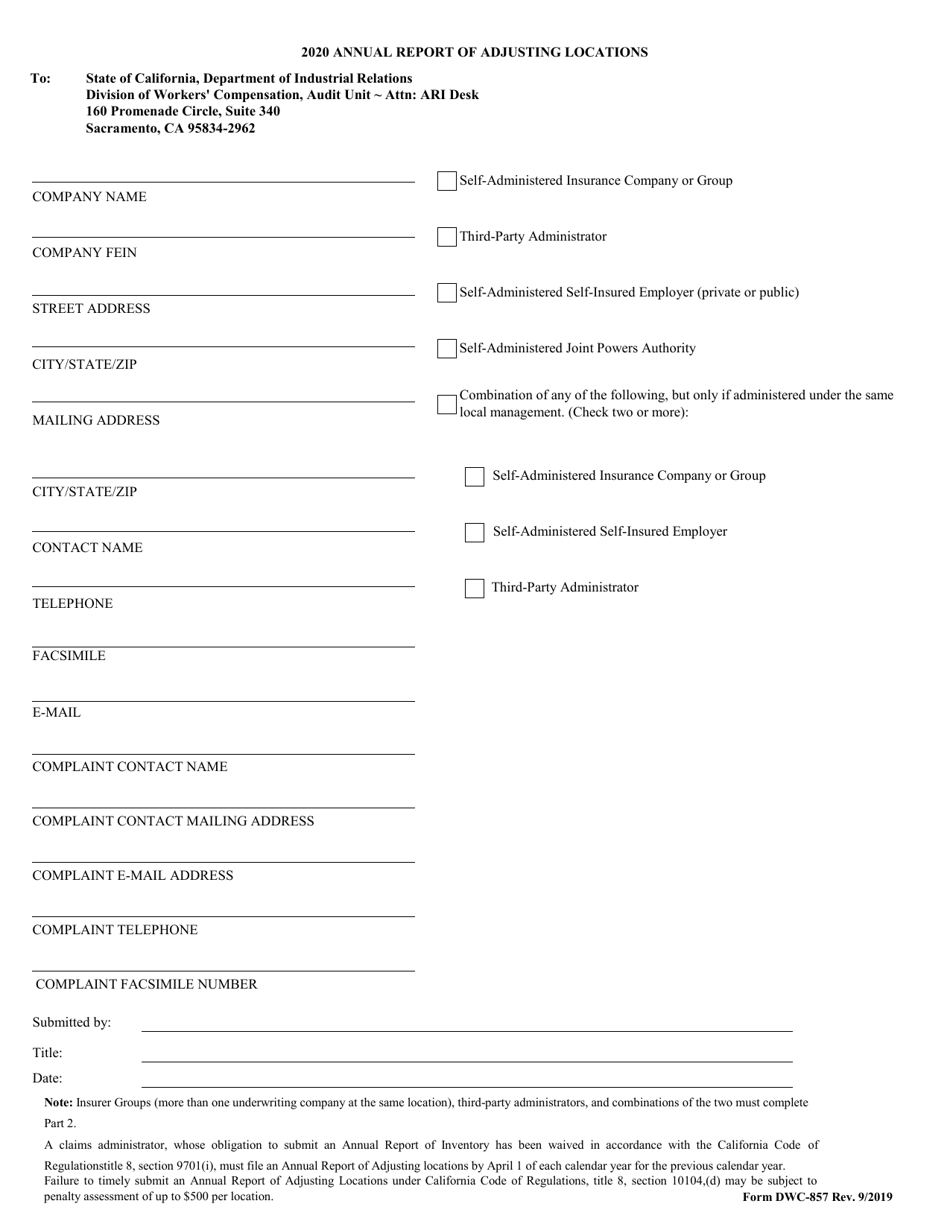

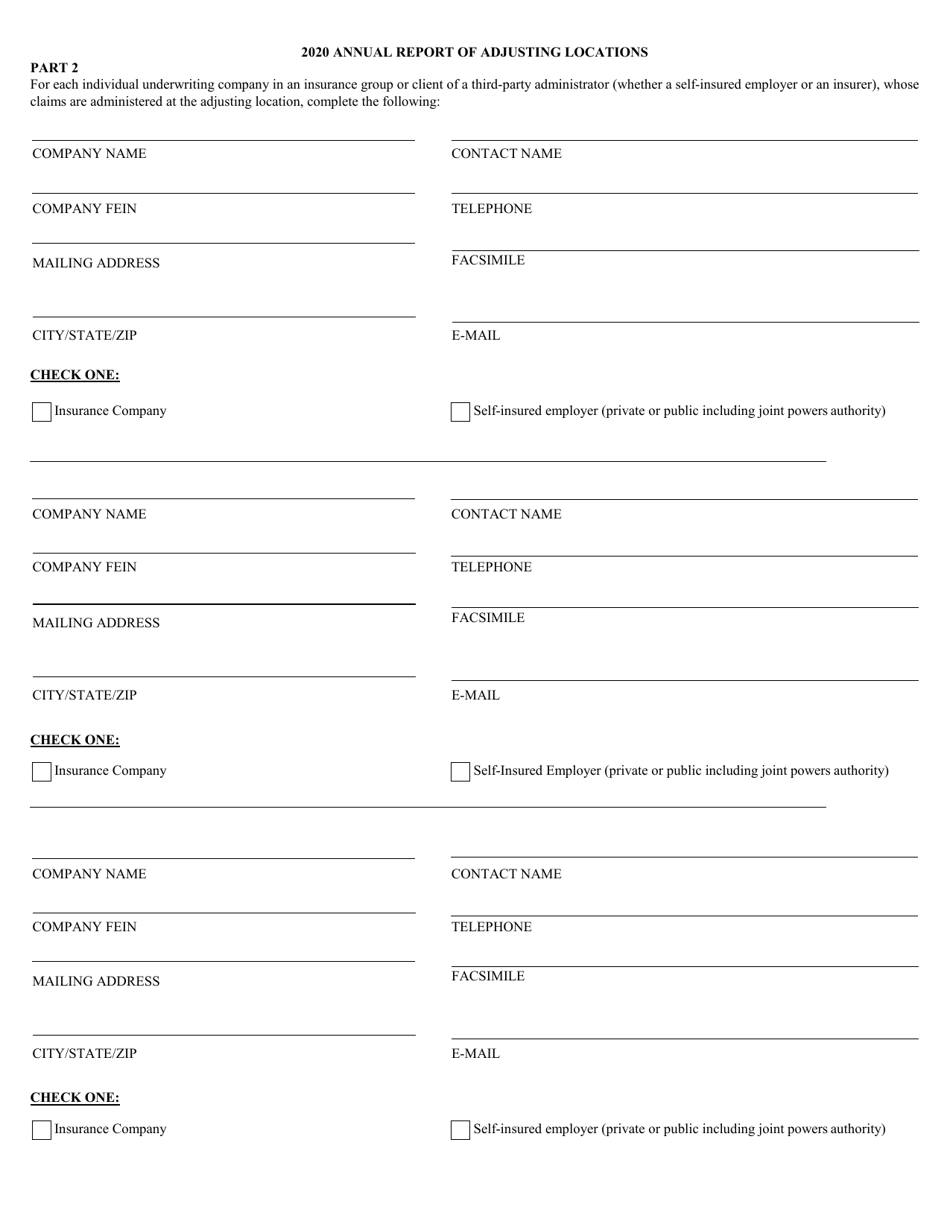

Form DWC-857 Annual Report of Adjusting Locations - California

What Is Form DWC-857?

This is a legal form that was released by the California Department of Industrial Relations - Division of Workers' Compensation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DWC-857?

A: Form DWC-857 is the Annual Report of Adjusting Locations for California.

Q: Who needs to file Form DWC-857?

A: Insurance companies and self-insured employers who have adjusting locations in California need to file Form DWC-857.

Q: What is the purpose of filing Form DWC-857?

A: The purpose of filing Form DWC-857 is to report the adjusting locations that an insurance company or self-insured employer has in California.

Q: When is Form DWC-857 due?

A: Form DWC-857 is due annually by March 1st.

Q: Is there a fee for filing Form DWC-857?

A: No, there is no fee for filing Form DWC-857.

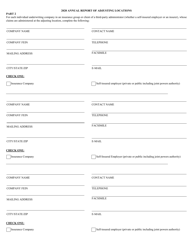

Q: What information is required on Form DWC-857?

A: Form DWC-857 requires information about the name and address of the insurance company or self-insured employer, as well as the adjusting locations in California.

Q: What happens if I fail to file Form DWC-857?

A: Failure to file Form DWC-857 may result in penalties and noncompliance with California workers' compensation regulations.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the California Department of Industrial Relations - Division of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DWC-857 by clicking the link below or browse more documents and templates provided by the California Department of Industrial Relations - Division of Workers' Compensation.