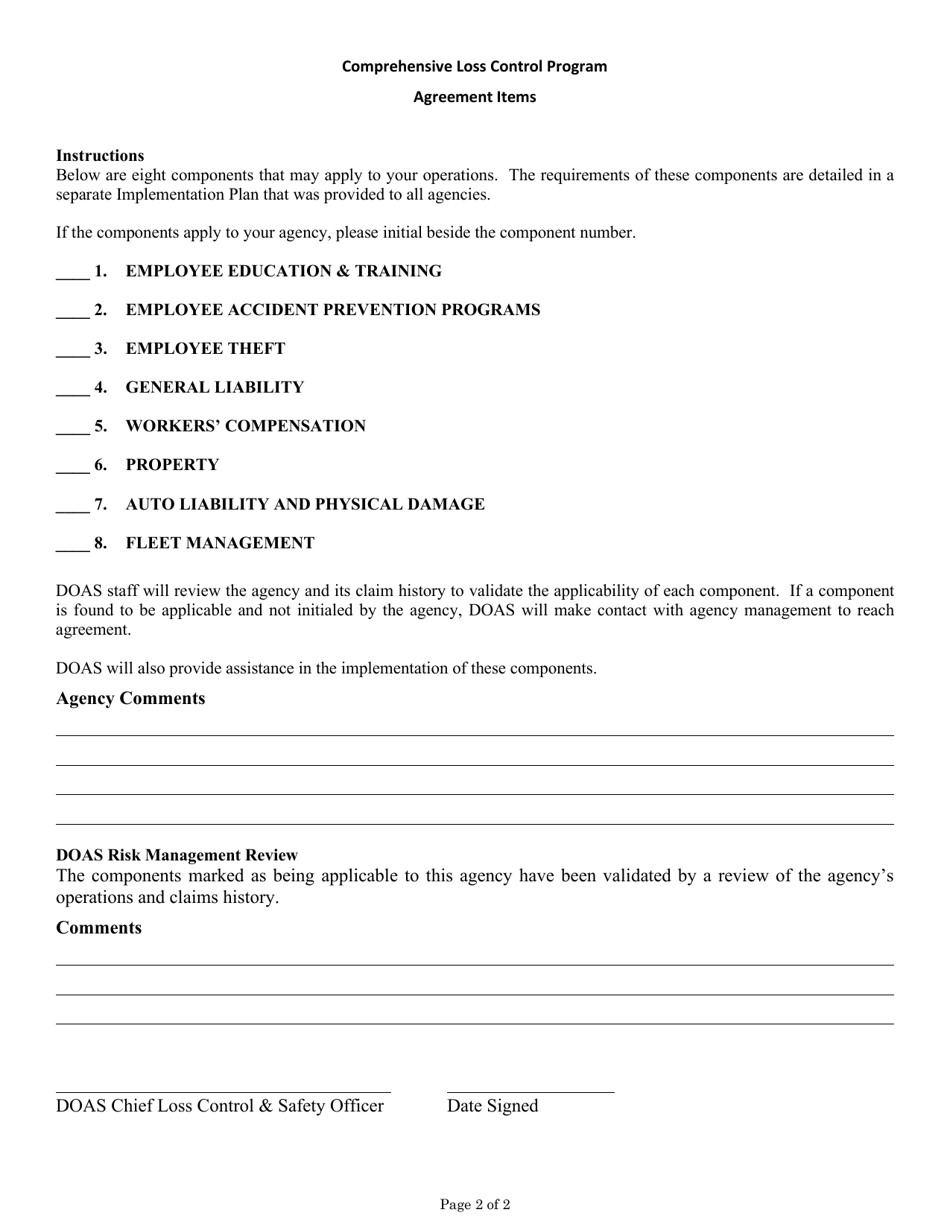

Risk Management Services Comprehensive Loss Control Plan Date of Agreement - Georgia (United States)

Risk Management Services Comprehensive Loss Control Plan Date of Agreement is a legal document that was released by the Georgia Department of Administrative Services - a government authority operating within Georgia (United States).

FAQ

Q: What is a Comprehensive Loss Control Plan?

A: A comprehensive loss control plan is a risk management strategy aimed at minimizing losses and preventing accidents or incidents.

Q: Why is a Comprehensive Loss Control Plan important?

A: A comprehensive loss control plan is important because it helps businesses identify potential risks, implement preventive measures, and reduce financial losses.

Q: What does a Comprehensive Loss Control Plan include?

A: A comprehensive loss control plan typically includes identifying potential hazards, creating safety policies and procedures, conducting regular inspections, and providing employee training.

Q: Who benefits from a Comprehensive Loss Control Plan?

A: Both businesses and employees benefit from a comprehensive loss control plan. It helps businesses protect their assets and maintain productivity, while also ensuring the safety and well-being of employees.

Q: What is the purpose of risk management services?

A: The purpose of risk management services is to help businesses identify, assess, and manage potential risks and implement measures to minimize their impact.

Q: What is risk management?

A: Risk management is the process of identifying, assessing, and prioritizing potential risks to minimize their impact on a business or organization.

Q: What are some common risks in the workplace?

A: Some common workplace risks include accidents, injuries, property damage, natural disasters, cyber threats, and legal liabilities.

Q: How can businesses mitigate risks?

A: Businesses can mitigate risks by implementing safety protocols, providing employee training, maintaining proper insurance coverage, conducting regular inspections, and having emergency response plans in place.

Q: What are the benefits of risk management services?

A: Some benefits of risk management services include reduced financial losses, improved safety and security, increased business continuity, and enhanced reputation and trustworthiness.

Q: What is the role of risk management services in insurance?

A: Risk management services play a crucial role in insurance by helping businesses assess and mitigate potential risks, which can result in more favorable insurance terms and premiums.

Form Details:

- The latest edition currently provided by the Georgia Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Georgia Department of Administrative Services.