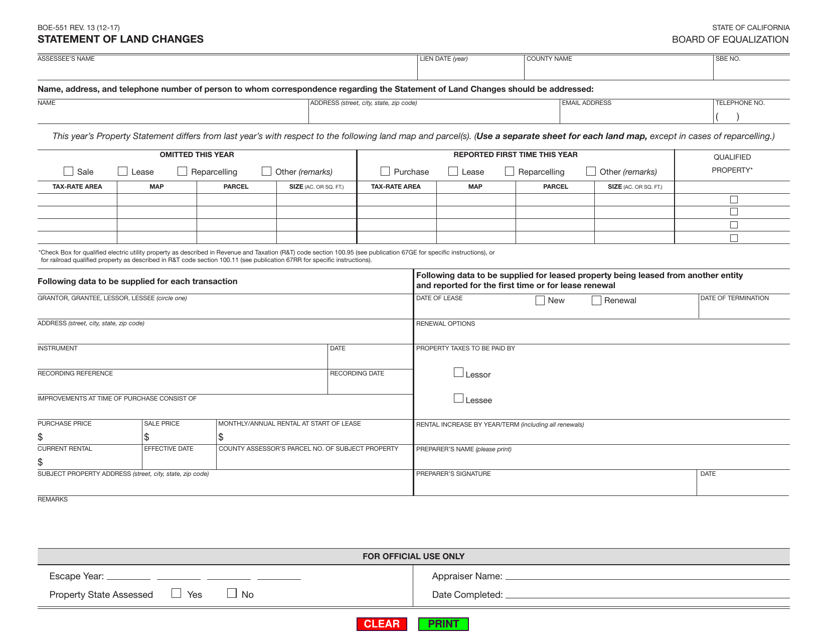

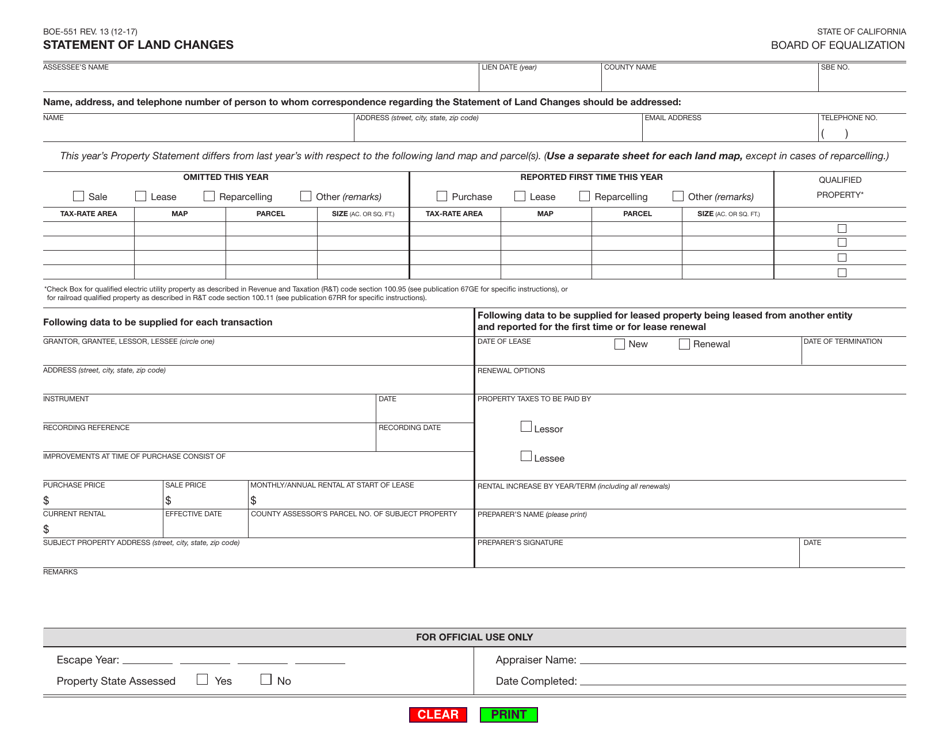

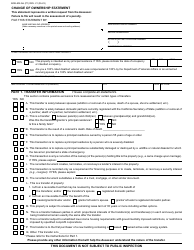

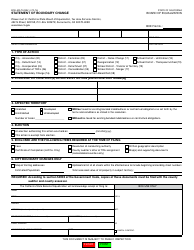

Form BOE-551 Statement of Land Changes - California

What Is Form BOE-551?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form BOE-551?

A: Form BOE-551, Statement of Land Changes, is used in California to report changes in land ownership or use that may affect property tax assessments.

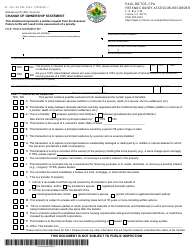

Q: Who needs to file Form BOE-551?

A: Owners of real property in California who have experienced changes in land ownership or use need to file Form BOE-551.

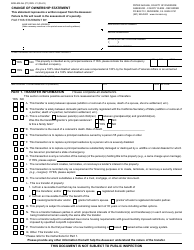

Q: What changes in land ownership or use should be reported on Form BOE-551?

A: Changes such as transfers of ownership, changes in land use or classification, subdivisions, and mergers or boundary adjustments should be reported on Form BOE-551.

Q: When should Form BOE-551 be filed?

A: Form BOE-551 should be filed within 45 days of the change in ownership or use of the land.

Q: Are there any fees associated with filing Form BOE-551?

A: No, there are no fees associated with filing Form BOE-551.

Q: What happens if I don't file Form BOE-551?

A: Failure to file Form BOE-551 may result in penalties or incorrect property tax assessments.

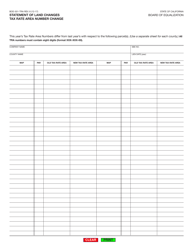

Q: Can I file Form BOE-551 for multiple properties?

A: Yes, you can file one Form BOE-551 for multiple properties if they have experienced the same changes in ownership or use.

Q: What supporting documents should be included with Form BOE-551?

A: Supporting documents such as deeds, maps, or other legal documents related to the changes in ownership or use should be included with Form BOE-551.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-551 by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.