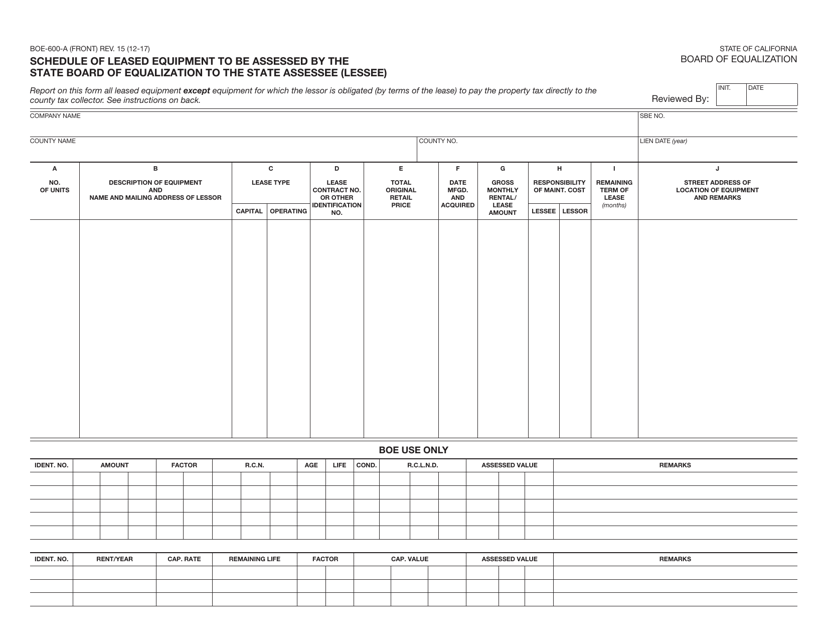

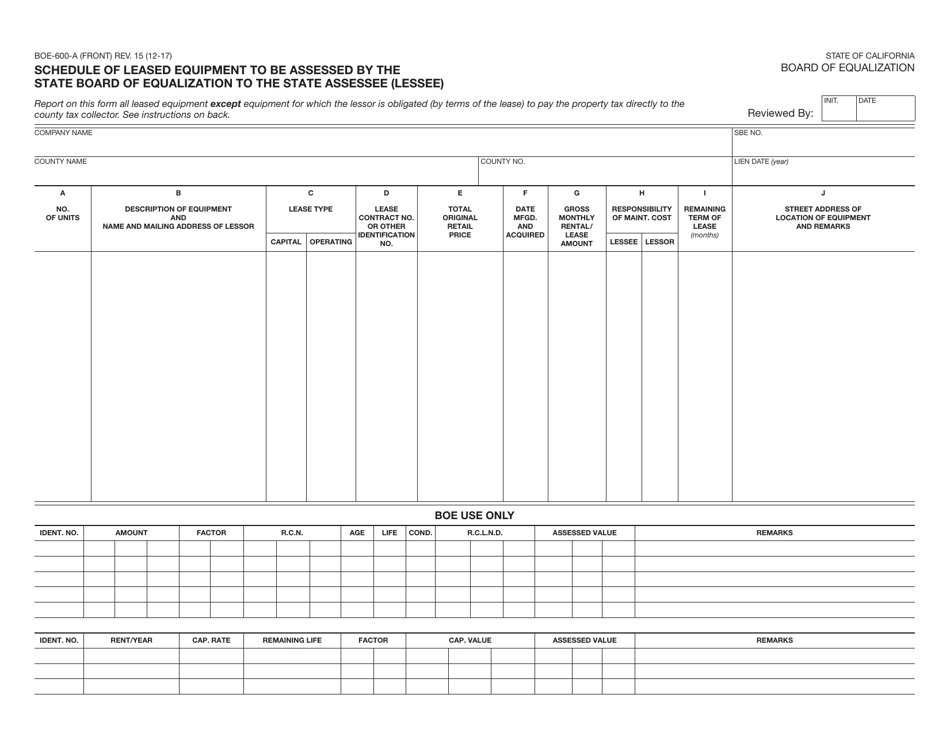

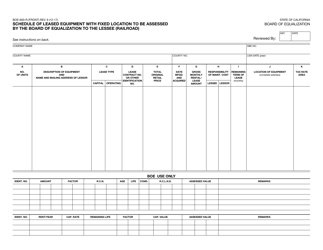

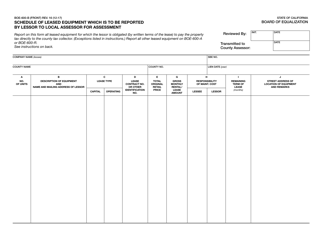

Schedule BOE-600-A Schedule of Leased Equipment to Be Assessed by the State Board of Equalization to the State Assessee (Lessee) - California

What Is Schedule BOE-600-A?

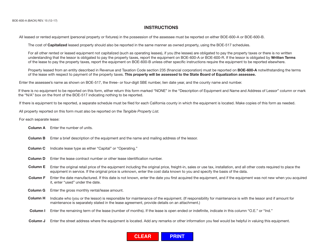

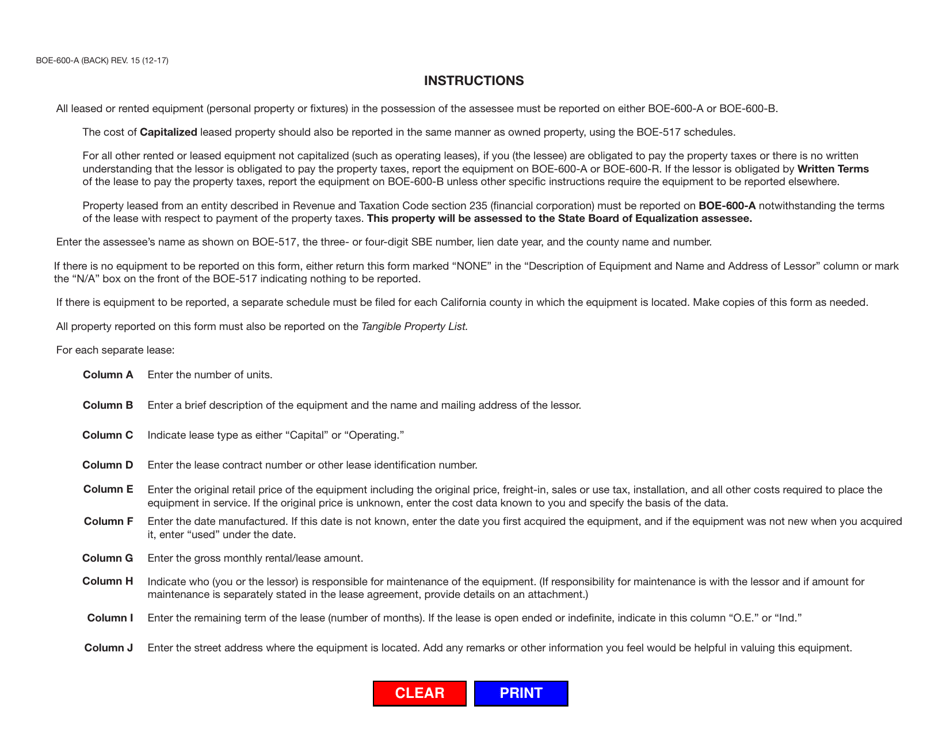

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-600-A?

A: BOE-600-A is a schedule of leased equipment to be assessed by the State Board of Equalization to the State Assessee (Lessee) in California.

Q: Who is the State Assessee (Lessee)?

A: The State Assessee (Lessee) is the entity or individual who has leased the equipment.

Q: What is the purpose of BOE-600-A?

A: The purpose of BOE-600-A is to document and assess the leased equipment for tax purposes.

Q: What does the State Board of Equalization do?

A: The State Board of Equalization is responsible for assessing and collecting various taxes in California.

Q: What type of equipment is included in BOE-600-A?

A: BOE-600-A includes leased equipment that is subject to assessment for taxation.

Q: Who needs to fill out BOE-600-A?

A: The State Assessee (Lessee) needs to fill out BOE-600-A.

Q: Are there any deadlines for submitting BOE-600-A?

A: Yes, the deadlines for submitting BOE-600-A vary and are determined by the State Board of Equalization.

Q: Do I need to pay any fees for filing BOE-600-A?

A: There may be fees associated with filing BOE-600-A, depending on the regulations of the State Board of Equalization.

Q: What happens if I do not file BOE-600-A?

A: Failure to file BOE-600-A may result in penalties or fines imposed by the State Board of Equalization.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule BOE-600-A by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.