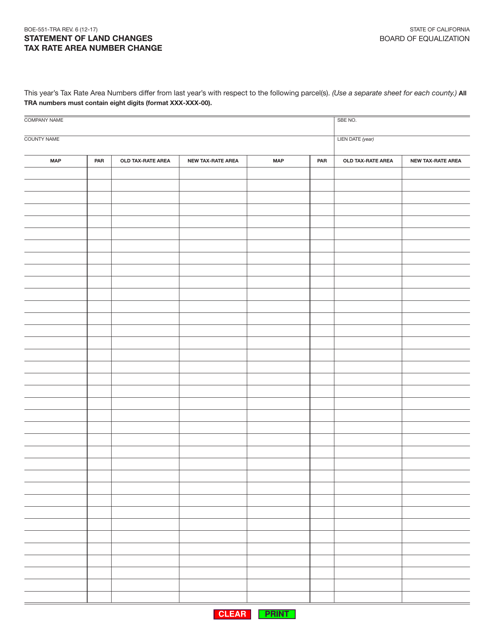

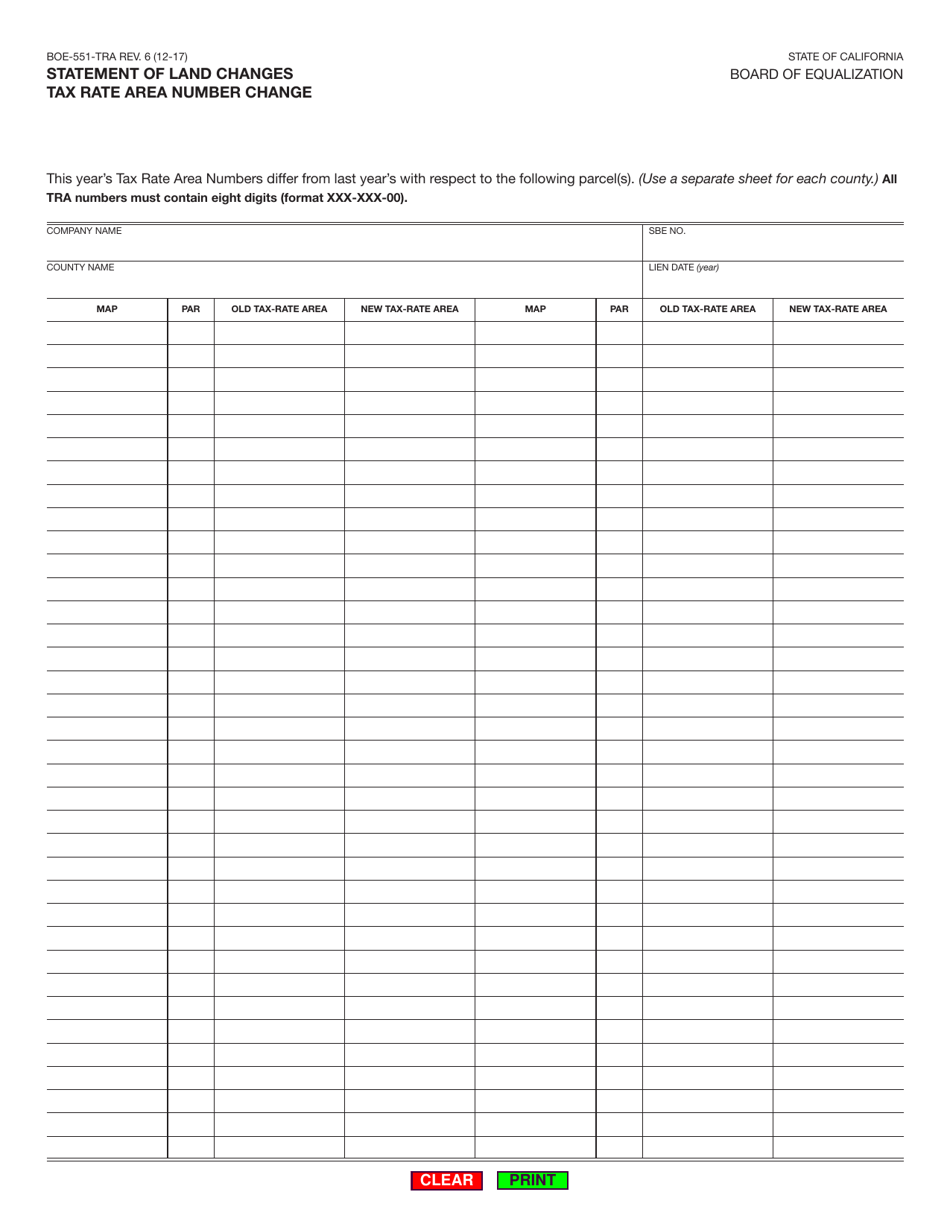

Form BOE-551-TRA Statement of Land Changes Tax Rate Area Number Changes - California

What Is Form BOE-551-TRA?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-551-TRA?

A: BOE-551-TRA is a form used in California to report changes to the tax rate area number.

Q: What is a tax rate area number?

A: A tax rate area number is a unique identifier assigned by the California State Board of Equalization to designate a specific geographic area for property tax purposes.

Q: Why would a tax rate area number change?

A: A tax rate area number may change due to updates or reorganization of tax districts or boundaries.

Q: How do I report changes to the tax rate area number?

A: You can use the BOE-551-TRA form to report changes to the tax rate area number.

Q: Who is responsible for submitting the BOE-551-TRA form?

A: The property owner or their authorized agent is responsible for submitting the BOE-551-TRA form.

Q: Are there any fees associated with submitting the BOE-551-TRA form?

A: There are no fees associated with submitting the BOE-551-TRA form.

Q: What happens after submitting the BOE-551-TRA form?

A: After submitting the BOE-551-TRA form, the California State Board of Equalization will review the changes and update the tax rate area number accordingly.

Q: Is it mandatory to report changes to the tax rate area number?

A: Yes, it is mandatory to report changes to the tax rate area number to ensure accurate property tax assessments.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-551-TRA by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.