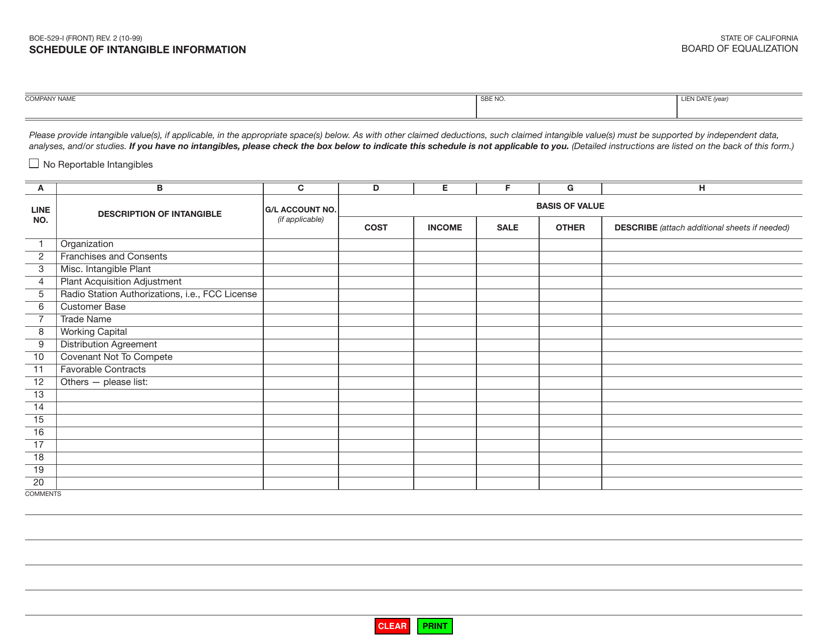

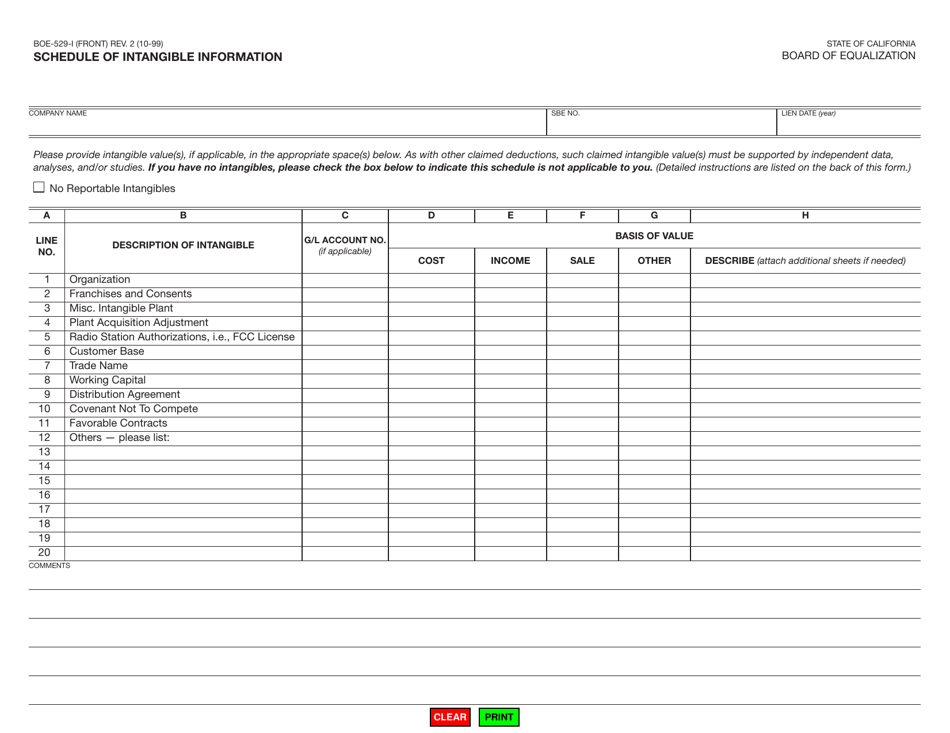

Form BOE-529-I Schedule of Intangible Information - California

What Is Form BOE-529-I?

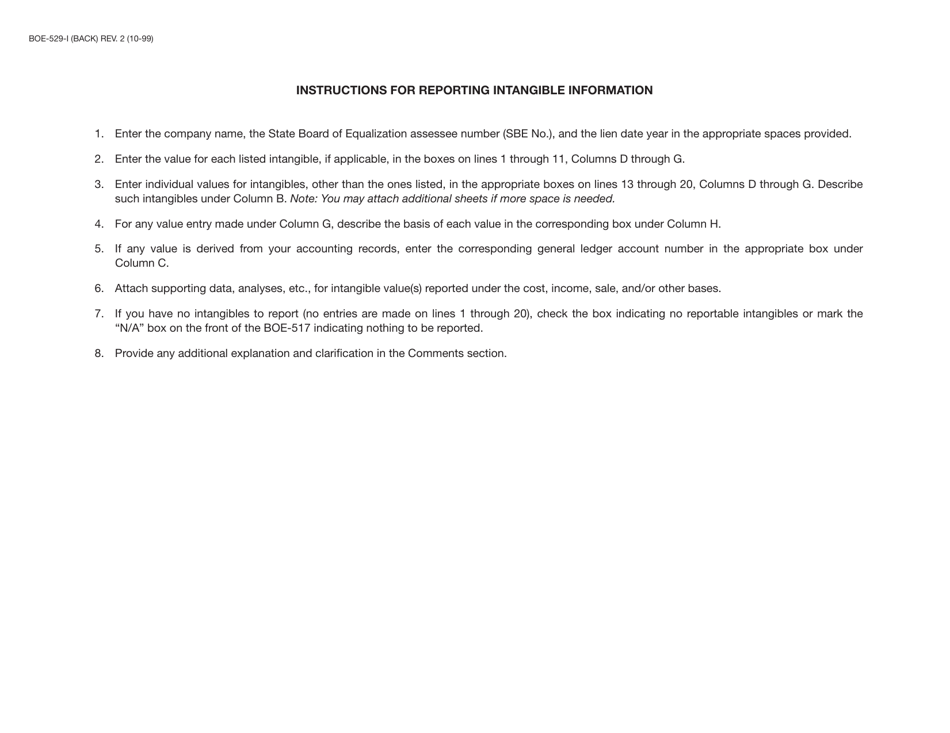

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is BOE-529-I Schedule of Intangible Information?

A: BOE-529-I Schedule of Intangible Information is a form used in California to report intangible property for taxation purposes.

Q: Who needs to file BOE-529-I Schedule of Intangible Information?

A: Taxpayers in California who own or control intangible property, such as copyrights, patents, and trademarks, need to file BOE-529-I Schedule of Intangible Information.

Q: When is BOE-529-I Schedule of Intangible Information due?

A: BOE-529-I Schedule of Intangible Information is due annually on May 7th.

Q: Is BOE-529-I Schedule of Intangible Information mandatory?

A: Yes, if you own or control intangible property in California, it is mandatory to file BOE-529-I Schedule of Intangible Information.

Q: Are there any penalties for not filing BOE-529-I Schedule of Intangible Information?

A: Yes, failure to file BOE-529-I Schedule of Intangible Information may result in penalties or fines imposed by the California State Board of Equalization.

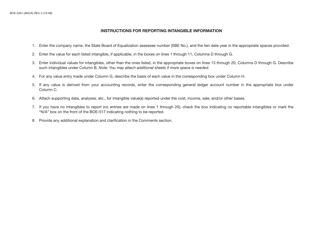

Q: What information do I need to provide on BOE-529-I Schedule of Intangible Information?

A: You will need to provide details of your intangible property, such as description, acquisition date, and cost, on BOE-529-I Schedule of Intangible Information.

Q: Can I amend BOE-529-I Schedule of Intangible Information if I made a mistake?

A: Yes, you can amend BOE-529-I Schedule of Intangible Information by submitting a revised form to the California State Board of Equalization.

Form Details:

- Released on October 1, 1999;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-529-I by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.