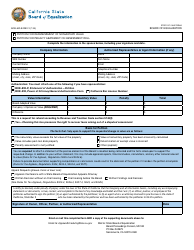

This version of the form is not currently in use and is provided for reference only. Download this version of

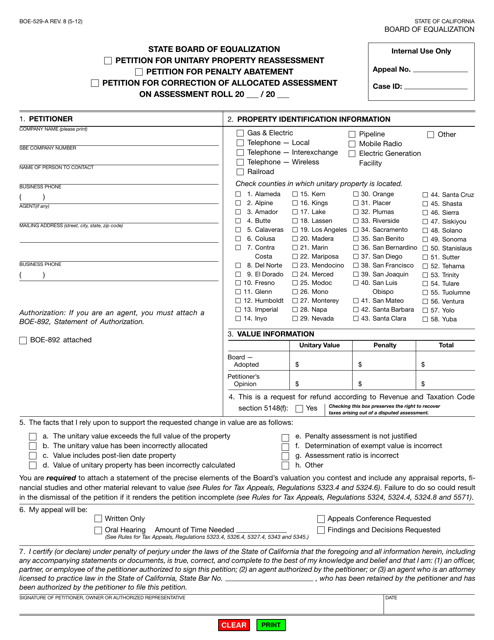

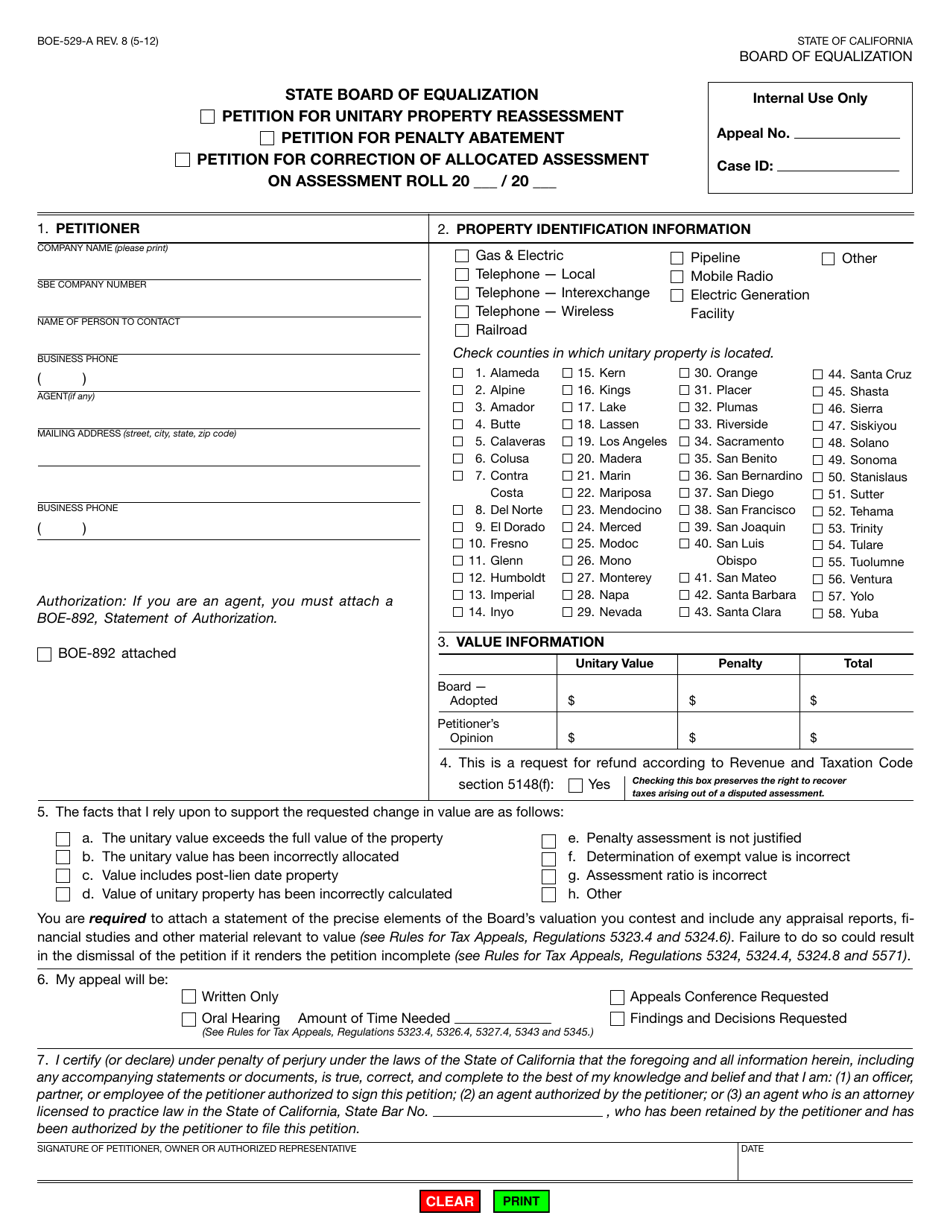

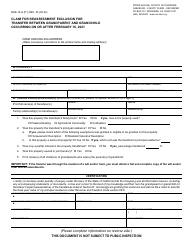

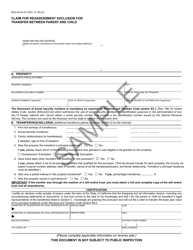

Form BOE-529-A

for the current year.

Form BOE-529-A Petition for Unitary Property Reassessment - California

What Is Form BOE-529-A?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

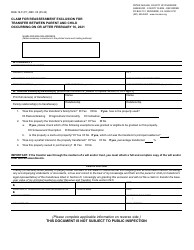

Q: What is Form BOE-529-A?

A: Form BOE-529-A is a petition to request a unitary property reassessment in California.

Q: What is a unitary property reassessment?

A: A unitary property reassessment is a review of the property value for multiple properties owned by the same entity.

Q: Who can file Form BOE-529-A?

A: Any property owner in California who believes they are entitled to a unitary property reassessment can file this form.

Q: What is the purpose of filing this form?

A: Filing Form BOE-529-A allows property owners to request a reassessment of their properties to potentially lower their property taxes.

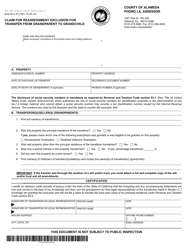

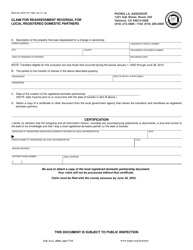

Q: What information is required on Form BOE-529-A?

A: The form requires information about the properties being reassessed, the petitioner's contact information, and supporting documentation to justify the request.

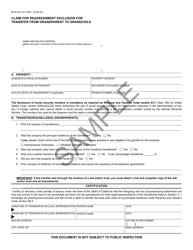

Q: Is there a deadline to file Form BOE-529-A?

A: Yes, the form must be filed within 60 days of the date of mailing of the Notice of Supplemental Assessment or the Notice of Assessed Value, whichever is later.

Q: Is there a fee for filing Form BOE-529-A?

A: No, there is no fee associated with filing this form.

Q: What happens after filing Form BOE-529-A?

A: Once the form is filed, the BOE will review the petition and supporting documentation to determine if a reassessment is warranted.

Q: Can I appeal the BOE's decision on the petition?

A: Yes, if the BOE denies the petition, the property owner has the right to appeal the decision.

Form Details:

- Released on May 1, 2012;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-529-A by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.