This version of the form is not currently in use and is provided for reference only. Download this version of

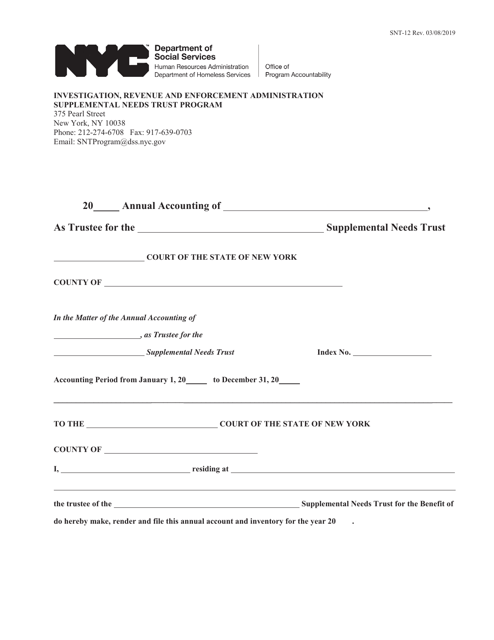

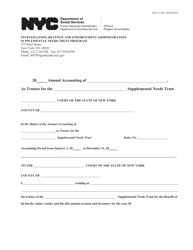

Form SNT-12

for the current year.

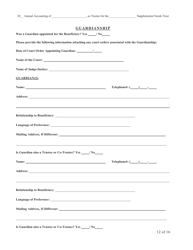

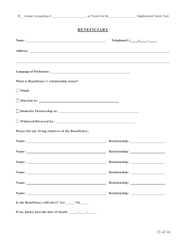

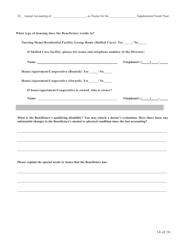

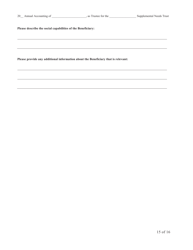

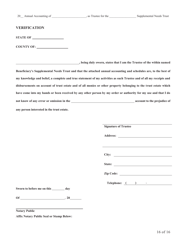

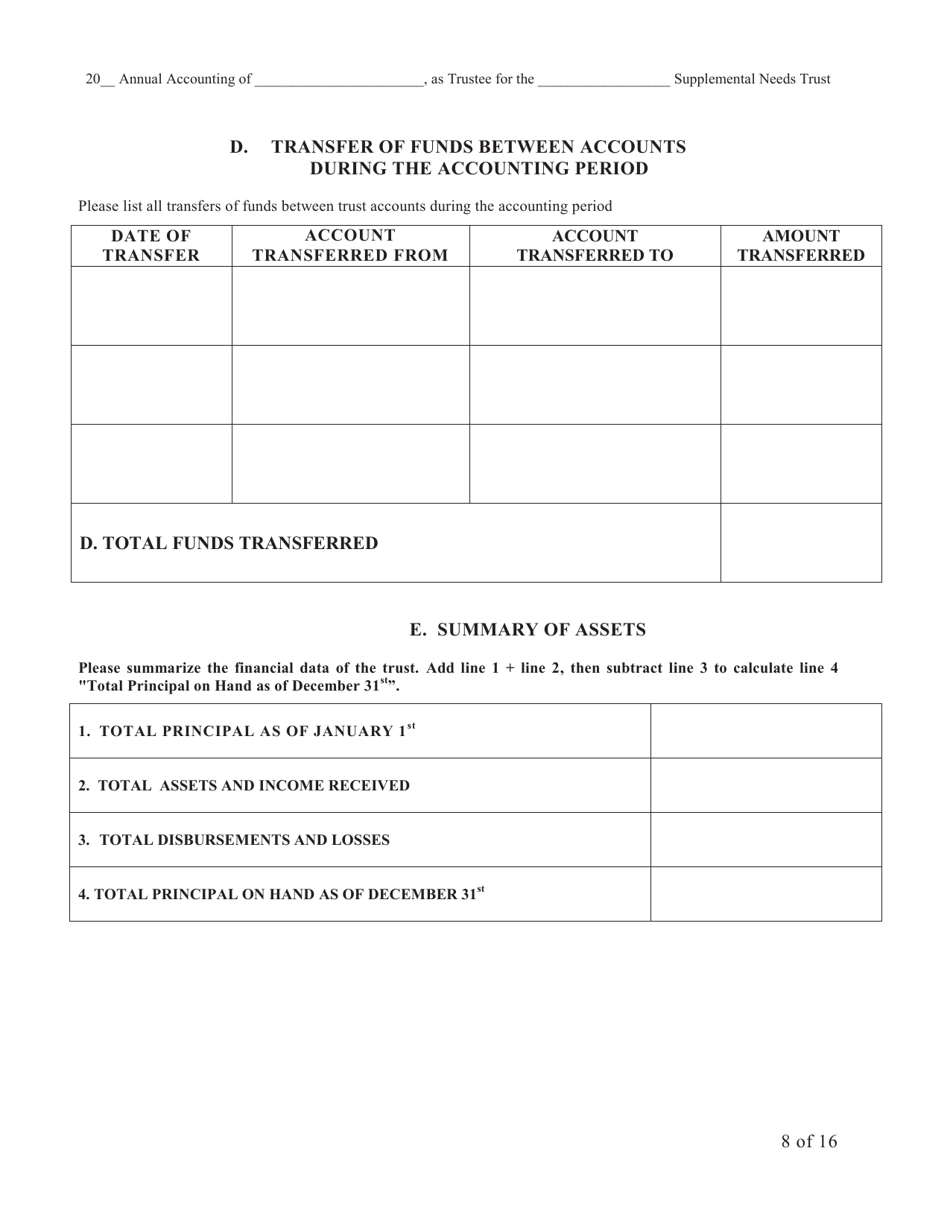

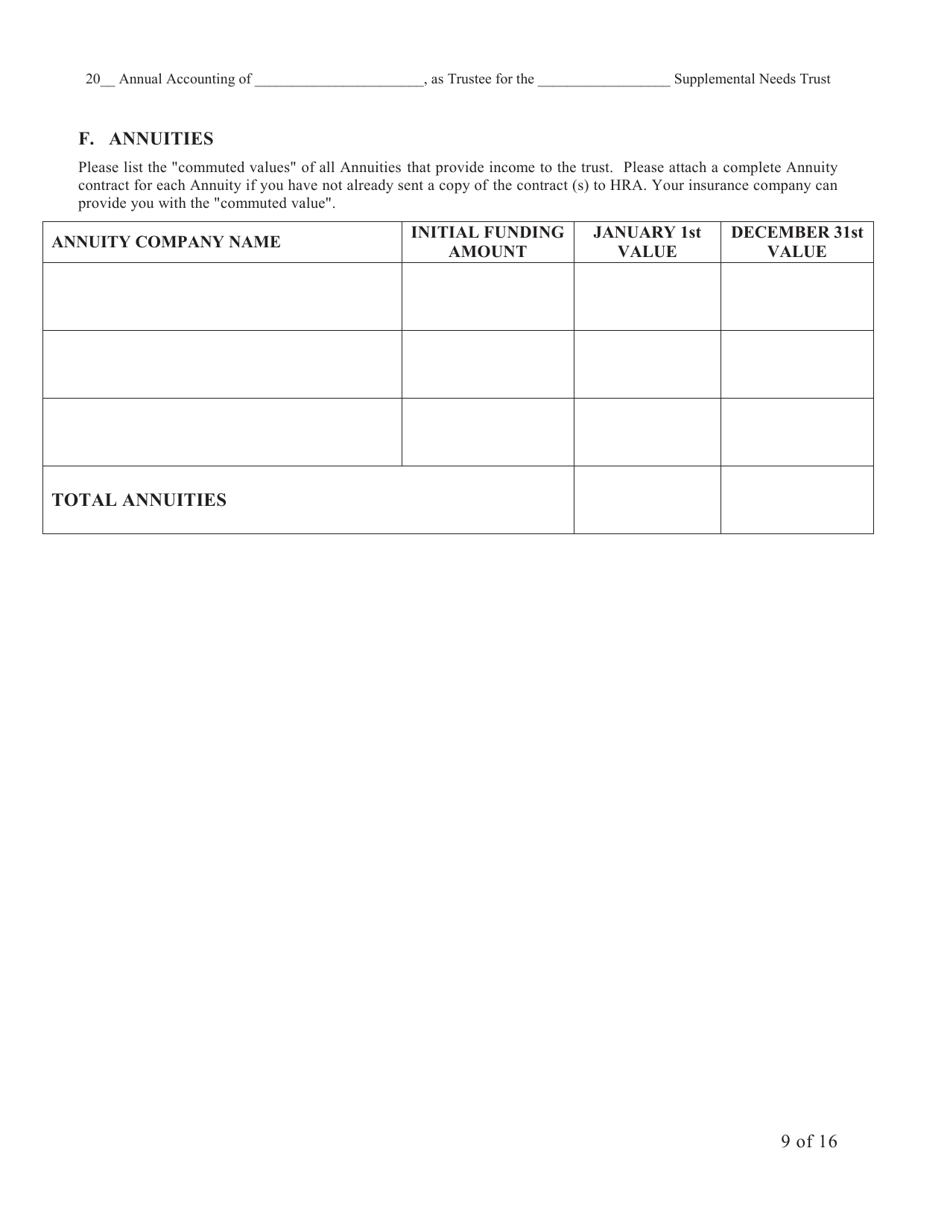

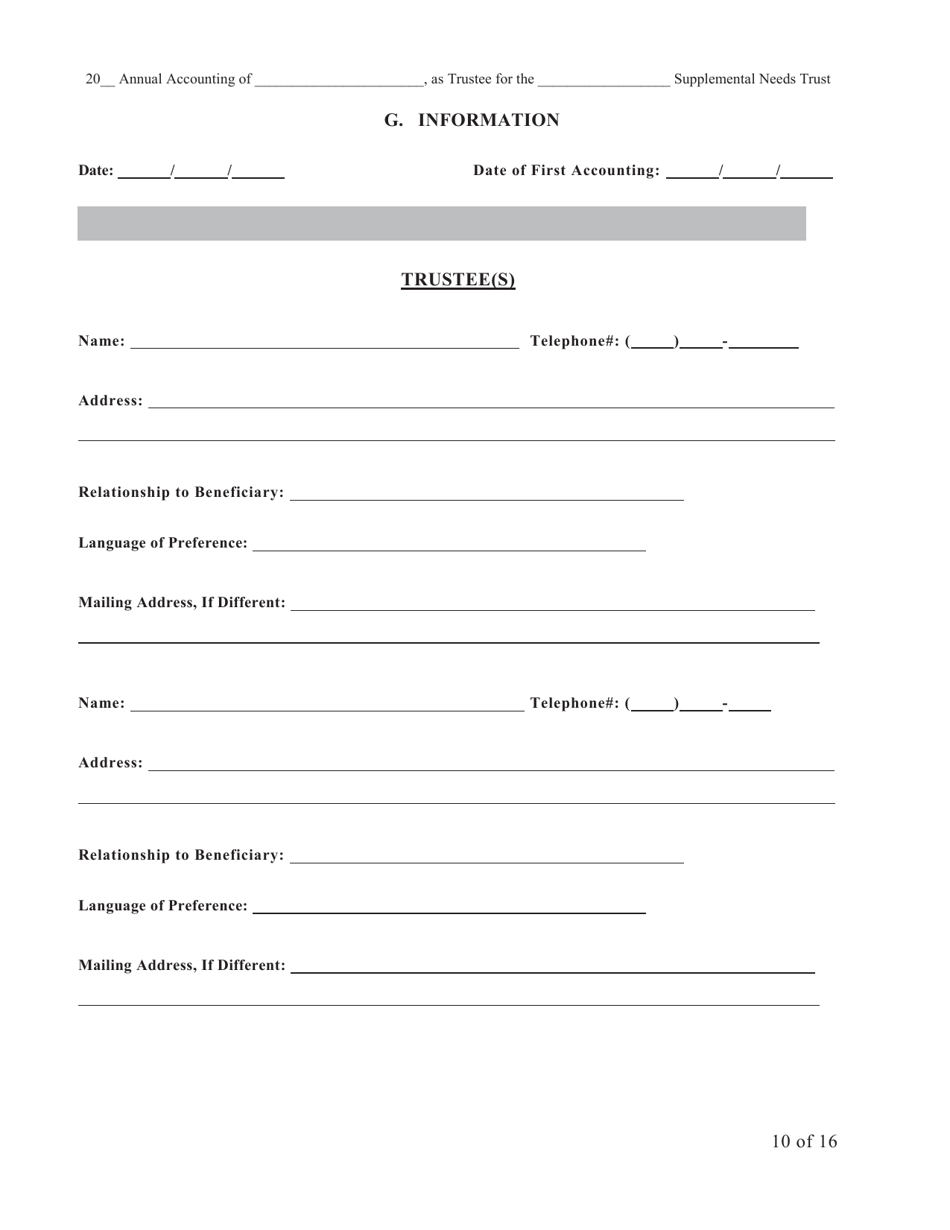

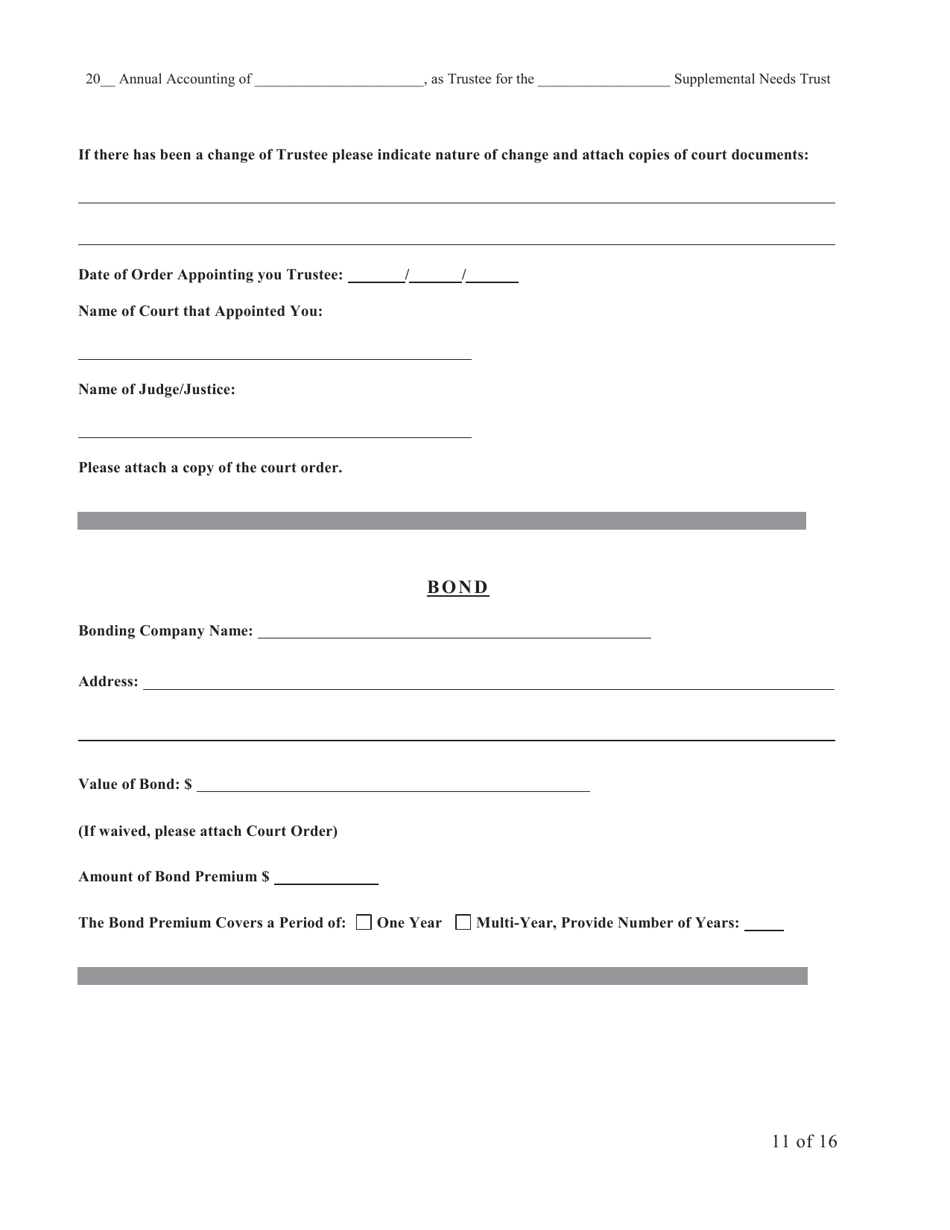

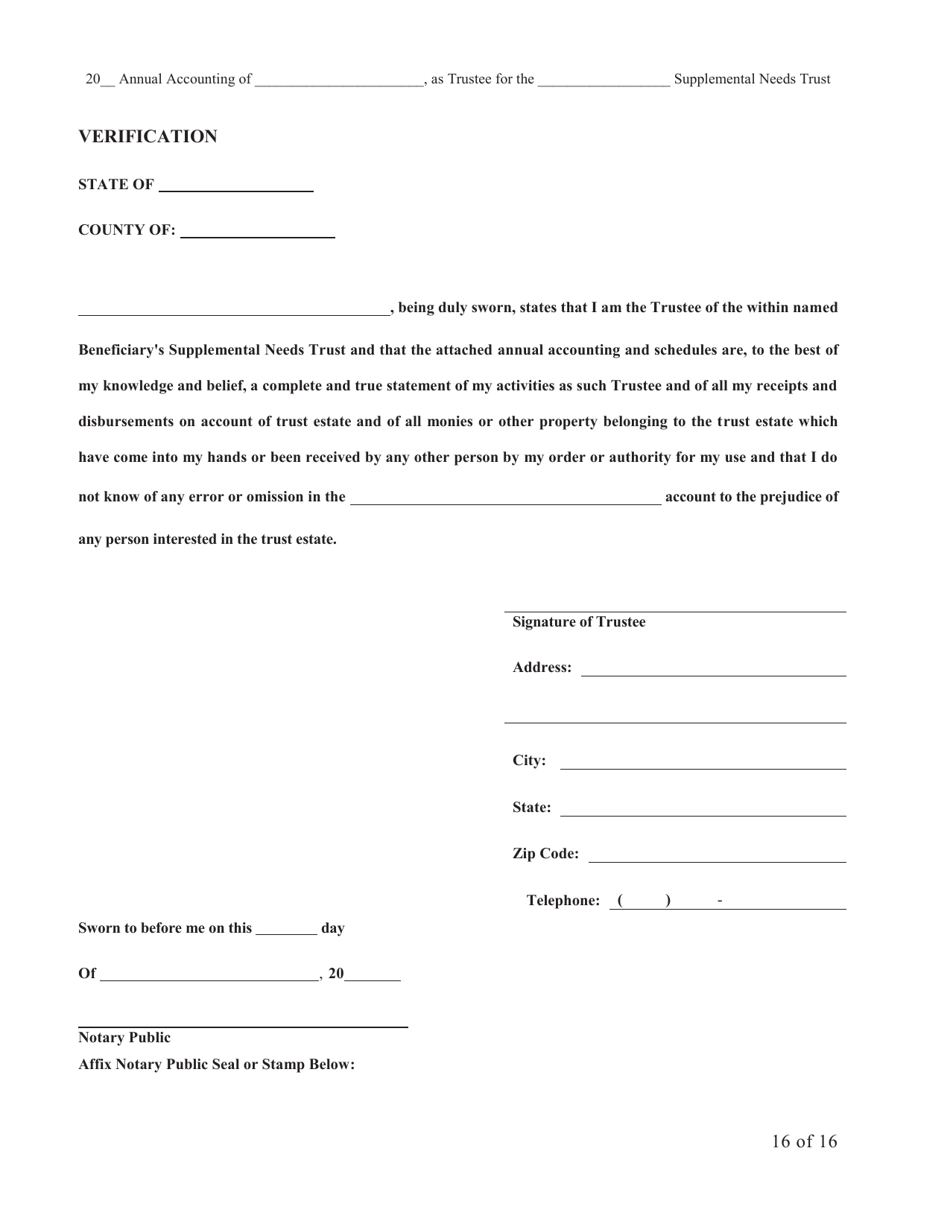

Form SNT-12 Supplemental Needs Trust Accounting - New York City

What Is Form SNT-12?

This is a legal form that was released by the New York City Department of Social Services - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Supplemental Needs Trust?

A: A Supplemental Needs Trust is a legal arrangement designed to provide for the needs of a person with disabilities without jeopardizing their eligibility for government benefits.

Q: Who can create a Supplemental Needs Trust?

A: A Supplemental Needs Trust can be created by the person with disabilities, their parents, grandparents, or a court.

Q: What is Form SNT-12?

A: Form SNT-12 is the accounting form that needs to be filed with the court to report the financial transactions of a Supplemental Needs Trust in New York City.

Q: Who needs to file Form SNT-12?

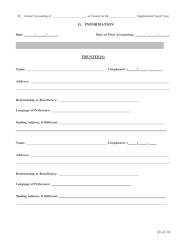

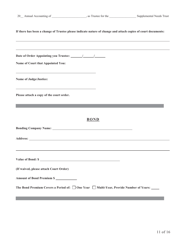

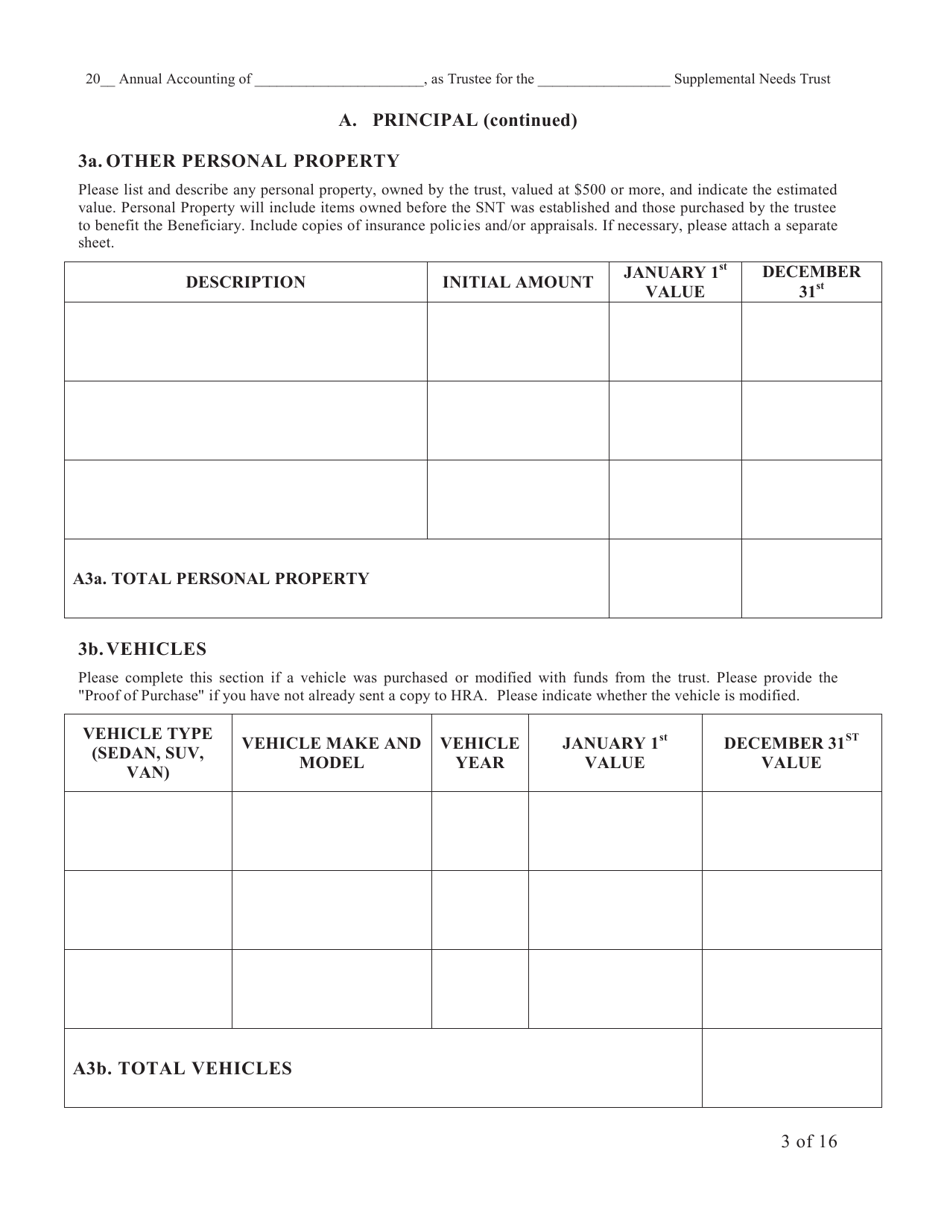

A: The trustee of the Supplemental Needs Trust is responsible for filing Form SNT-12 with the court.

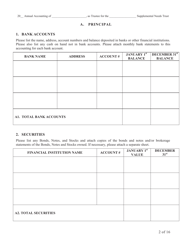

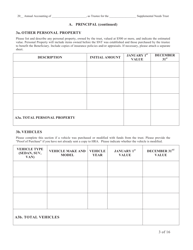

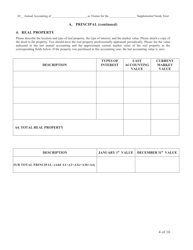

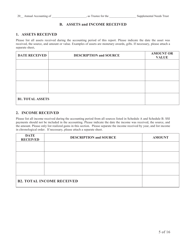

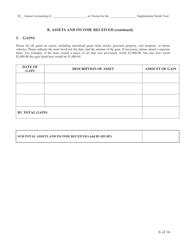

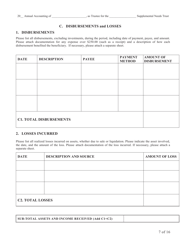

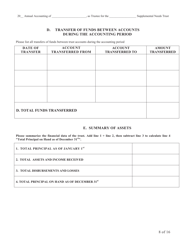

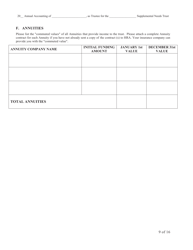

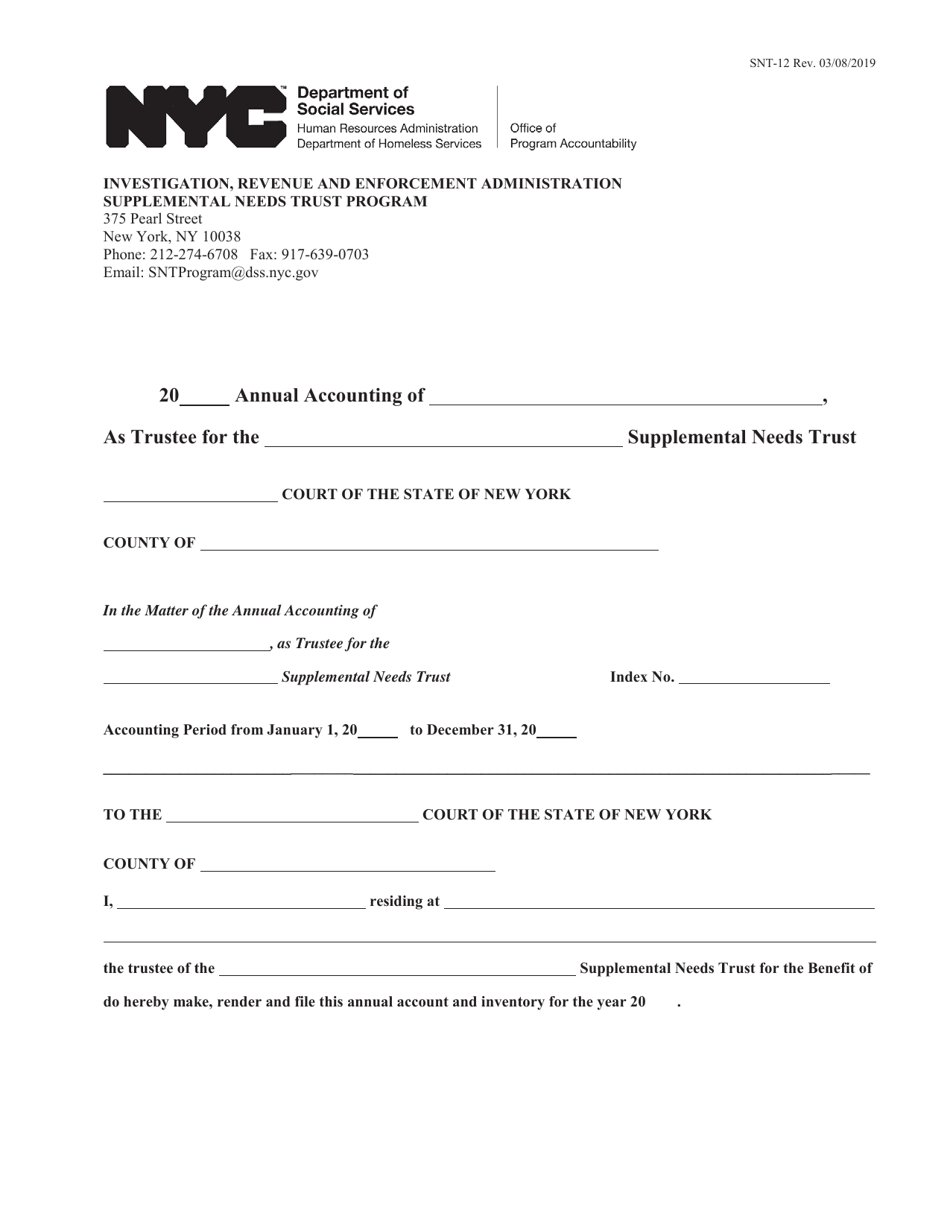

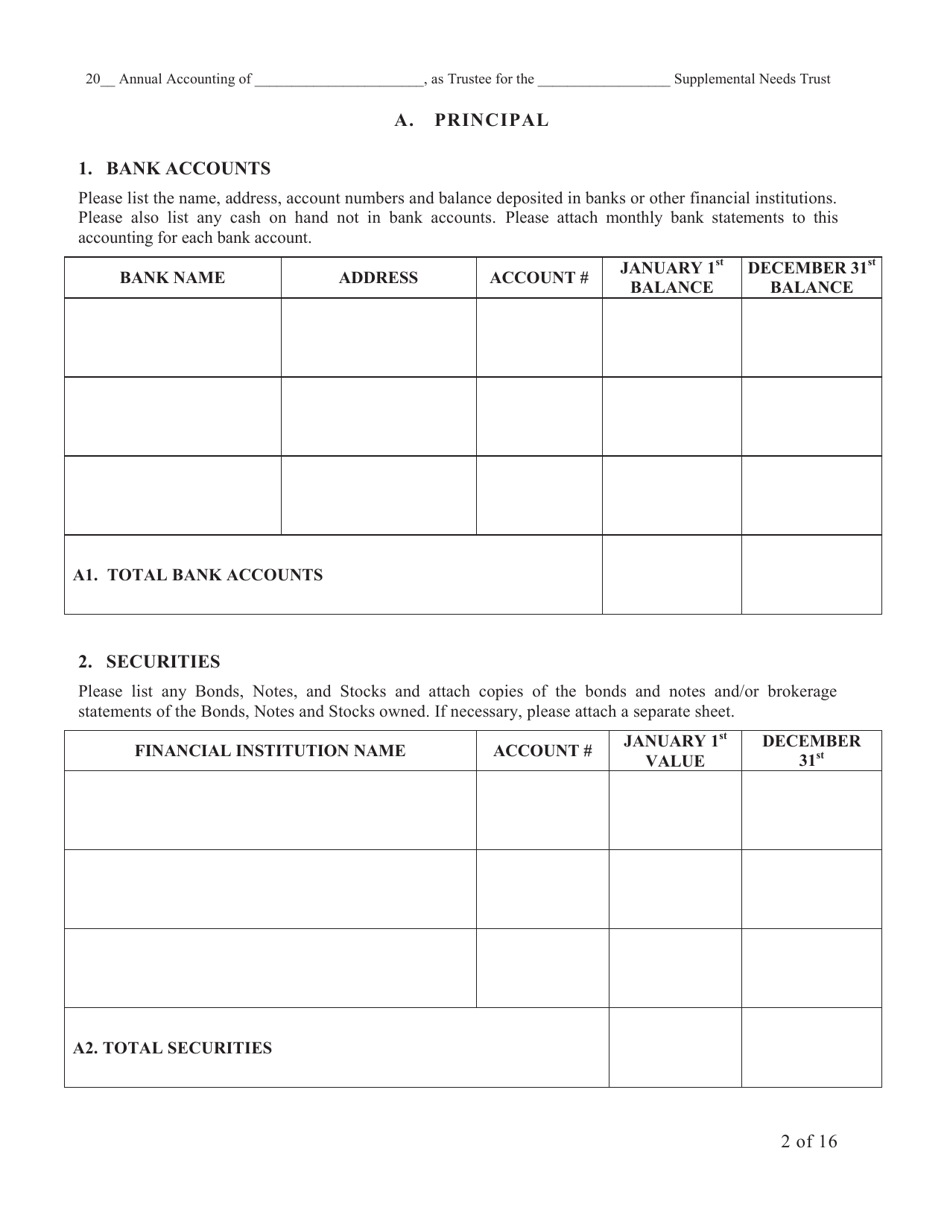

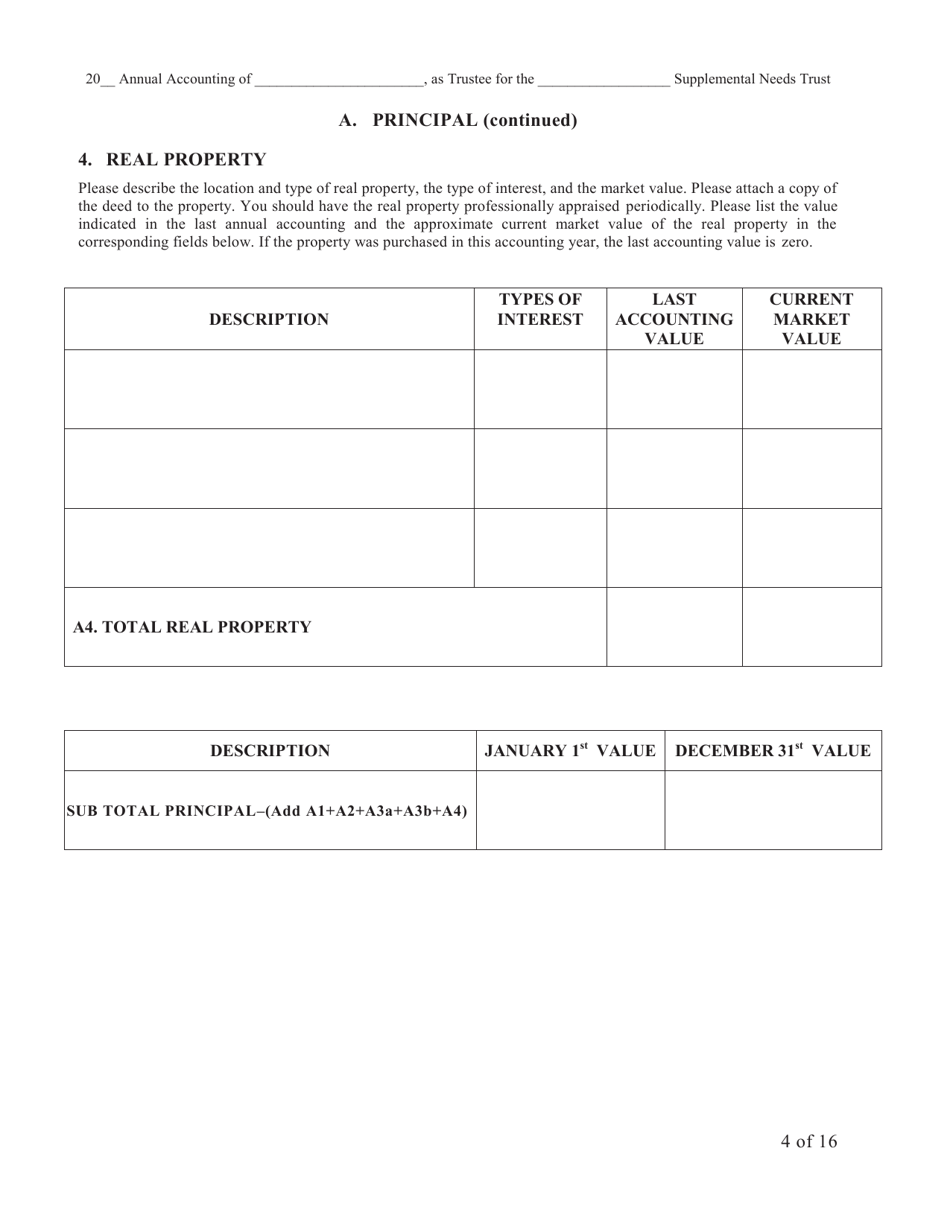

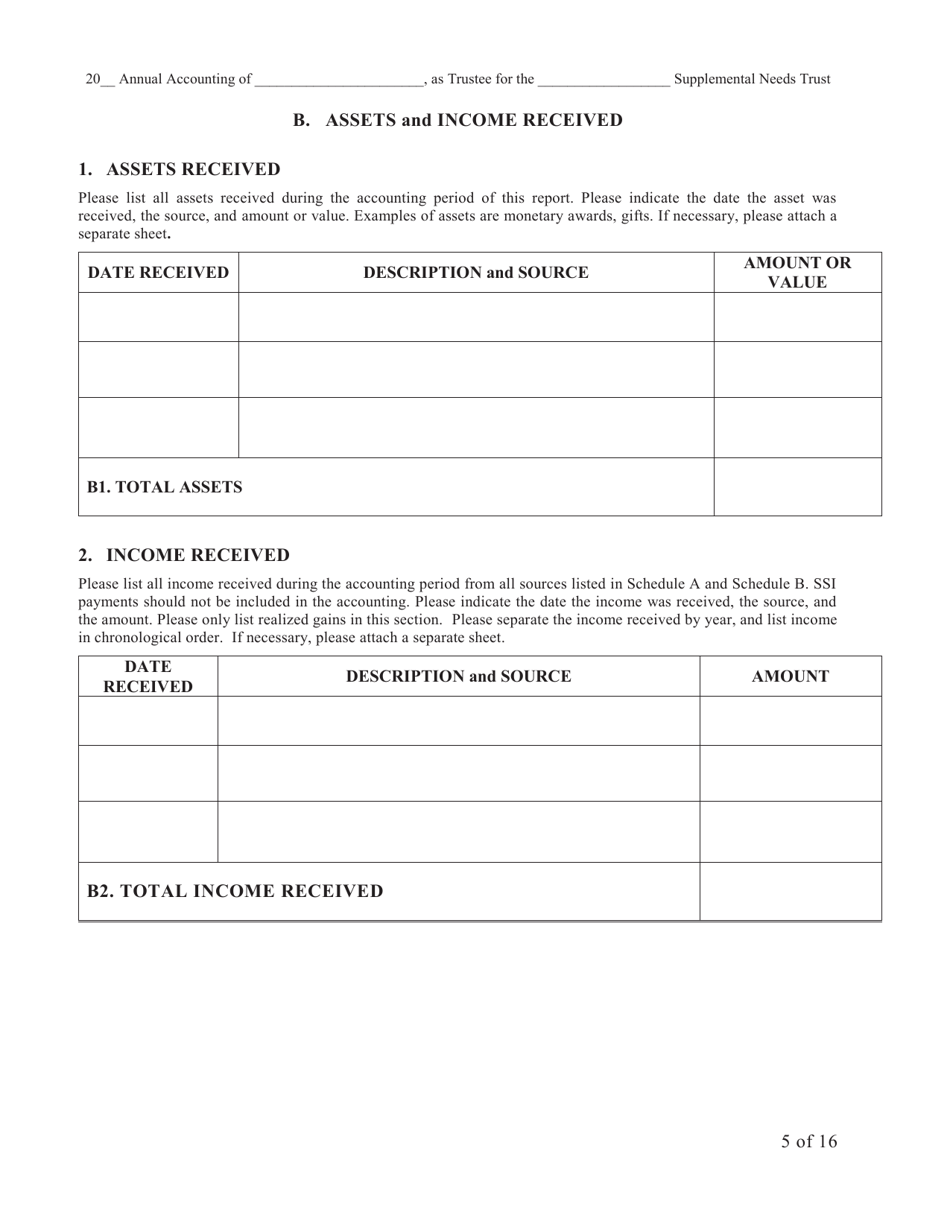

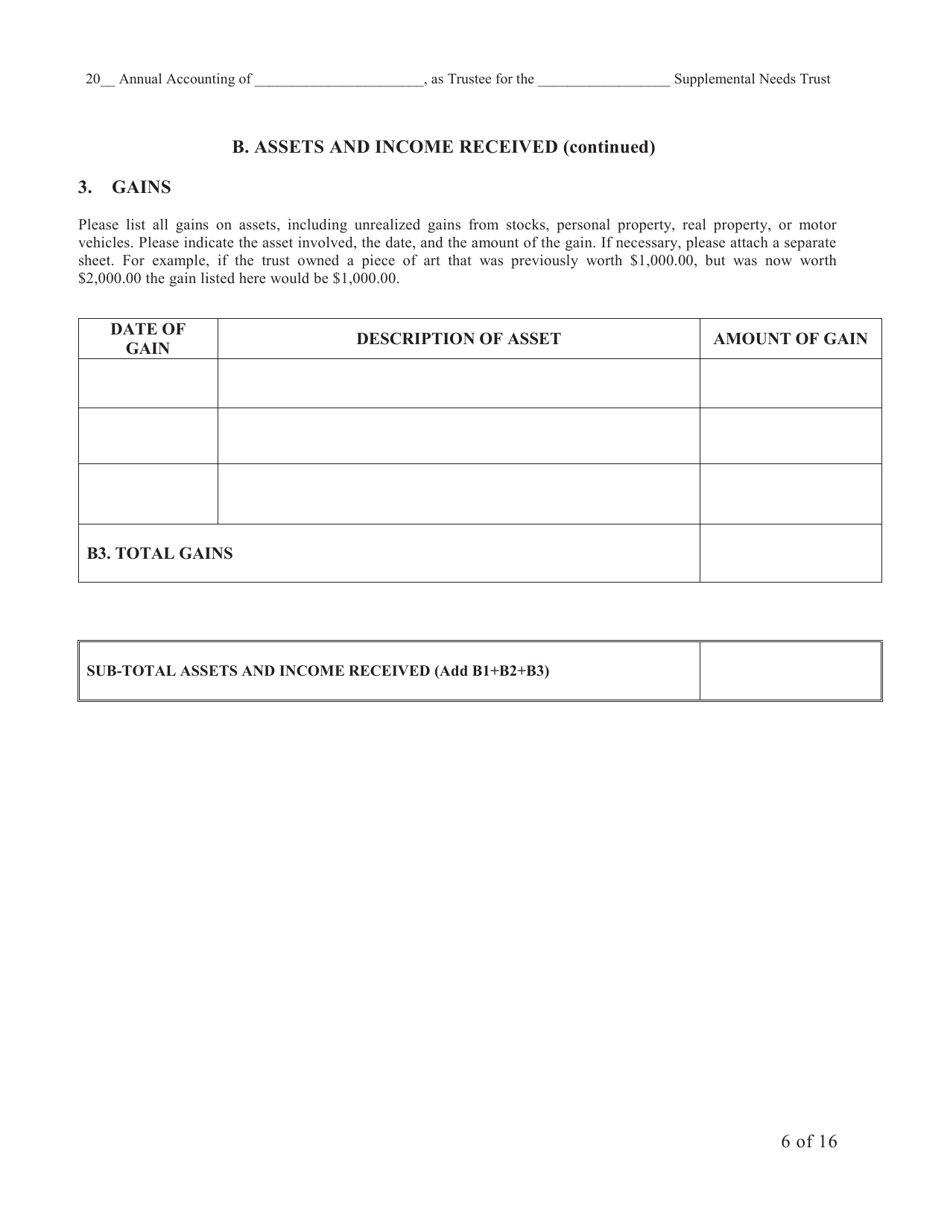

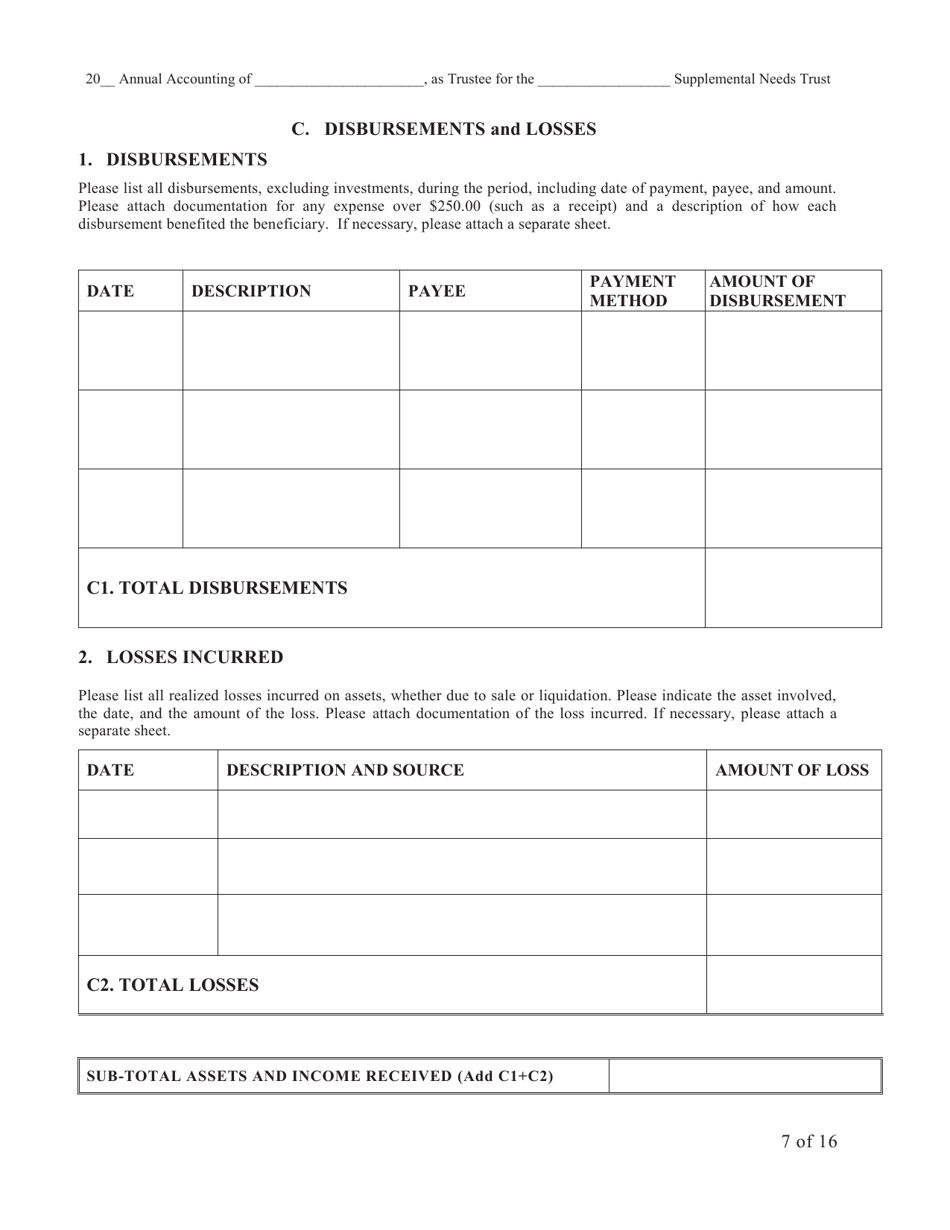

Q: What information is required on Form SNT-12?

A: Form SNT-12 requires detailed information about the financial transactions of the Supplemental Needs Trust, including income, expenses, and assets.

Q: When is Form SNT-12 due?

A: Form SNT-12 is typically due annually, within 90 days of the end of the reporting period.

Q: Is there a fee for filing Form SNT-12?

A: Yes, there is a fee for filing Form SNT-12 with the court. The amount of the fee varies depending on the value of the trust assets.

Form Details:

- Released on March 8, 2019;

- The latest edition provided by the New York City Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SNT-12 by clicking the link below or browse more documents and templates provided by the New York City Department of Social Services.