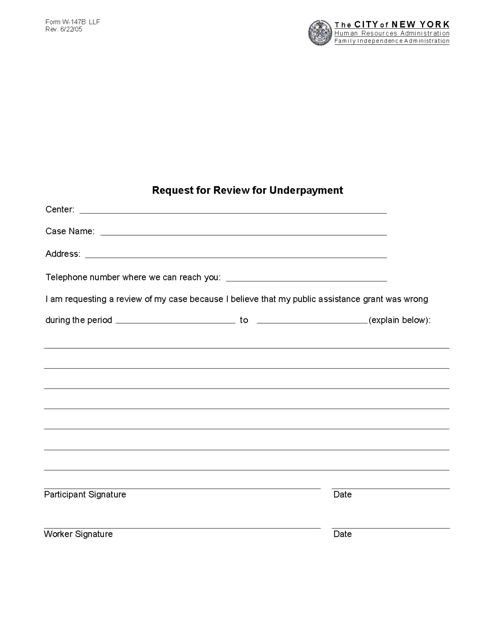

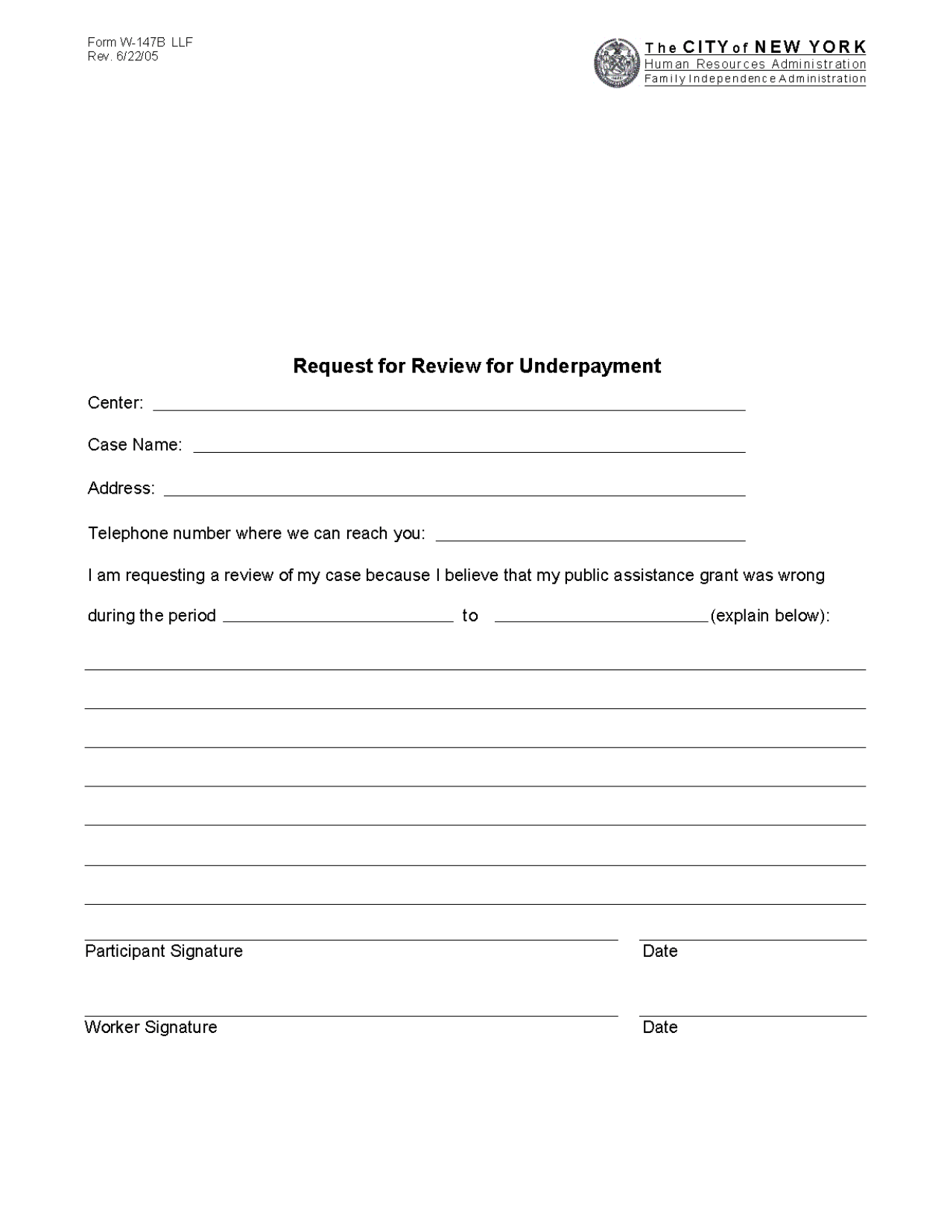

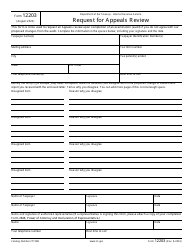

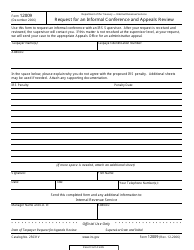

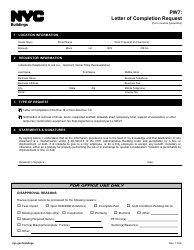

Form W-147B Request for Review for Underpayment - New York City

What Is Form W-147B?

This is a legal form that was released by the New York City Department of Social Services - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-147B?

A: Form W-147B is a request for review for underpayment in New York City.

Q: Who can use Form W-147B?

A: Individuals or businesses who believe they have underpaid taxes in New York City can use Form W-147B.

Q: What is the purpose of Form W-147B?

A: The purpose of Form W-147B is to request a review of underpaid taxes in New York City.

Q: How do I fill out Form W-147B?

A: You will need to provide your contact information, tax periods being disputed, details of the underpayment, and any supporting documentation.

Q: Is there a deadline for submitting Form W-147B?

A: Yes, Form W-147B must be submitted within 60 days of the date on the Notice of Determination or Notice of Assessment.

Q: What happens after I submit Form W-147B?

A: The New York City Department of Finance will review your request and notify you of their decision.

Q: Can I appeal the decision made on Form W-147B?

A: Yes, if you disagree with the department's decision, you have the right to appeal to the New York City Tax Appeals Tribunal.

Q: Are there any fees associated with submitting Form W-147B?

A: There are no fees associated with submitting Form W-147B.

Form Details:

- Released on June 22, 2005;

- The latest edition provided by the New York City Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form W-147B by clicking the link below or browse more documents and templates provided by the New York City Department of Social Services.