This version of the form is not currently in use and is provided for reference only. Download this version of

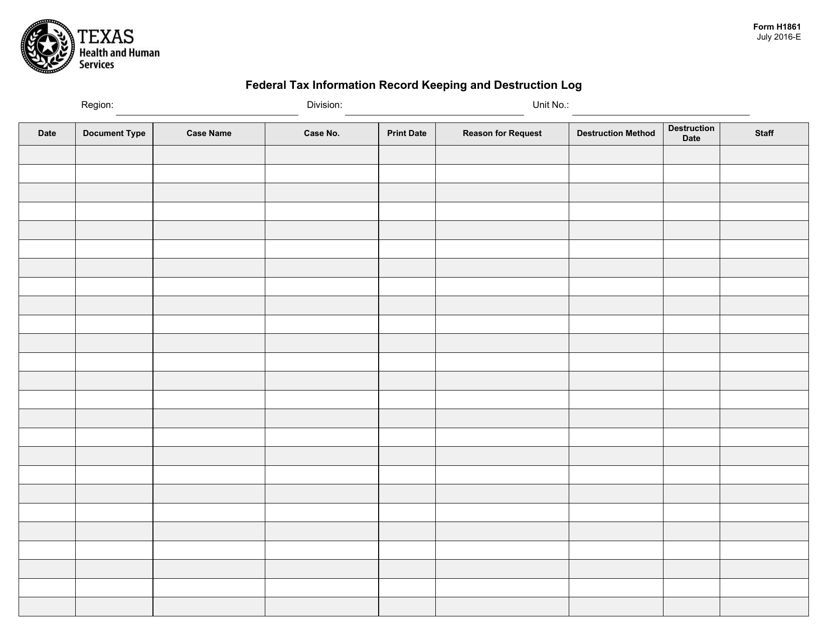

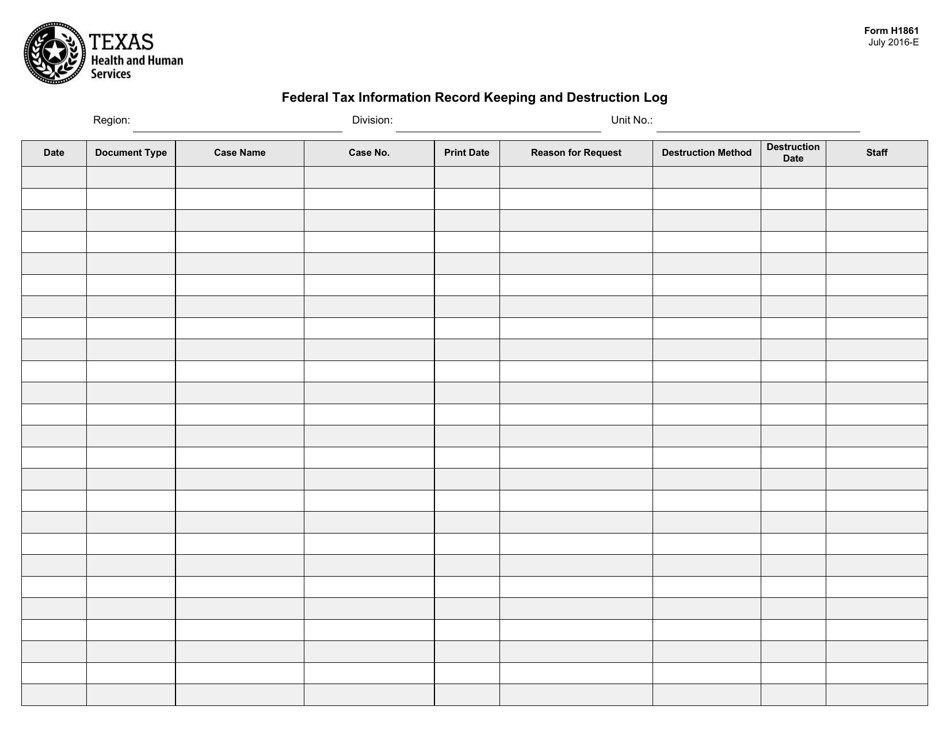

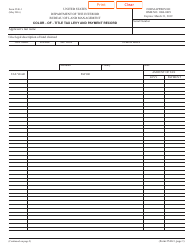

Form H1861

for the current year.

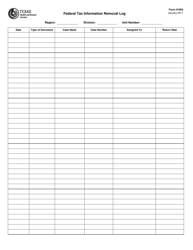

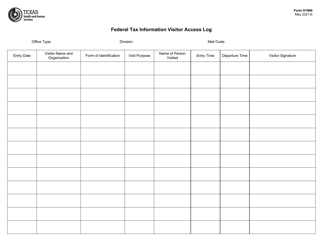

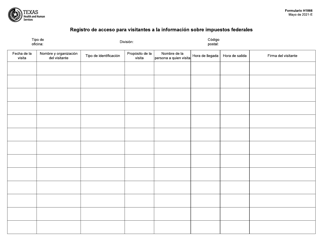

Form H1861 Federal Tax Information Record Keeping and Destruction Log - Texas

What Is Form H1861?

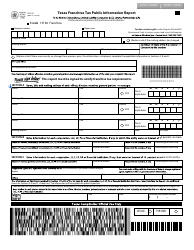

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H1861?

A: Form H1861 is the Federal Tax Information Record Keeping and Destruction Log.

Q: Who should use Form H1861?

A: Form H1861 should be used by individuals and businesses in Texas who need to keep track of their federal tax information.

Q: What is the purpose of Form H1861?

A: The purpose of Form H1861 is to provide a record of federal tax information that must be kept for a certain period of time and then properly destroyed.

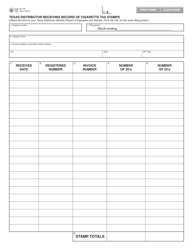

Q: What information should be recorded on Form H1861?

A: Form H1861 should include details such as the type of federal tax information, the date it was received or created, the retention period, and the destruction method.

Q: Why is it important to keep track of federal tax information?

A: Keeping track of federal tax information is important for compliance with tax laws and regulations, as well as for potential audits or inquiries.

Q: How long should federal tax information be kept?

A: The retention period for federal tax information varies depending on the type of information, but it is generally recommended to keep records for at least three years.

Q: How should federal tax information be destroyed?

A: Federal tax information should be destroyed in a secure and confidential manner, such as through shredding or digital erasure, to prevent unauthorized access or misuse.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form H1861 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.