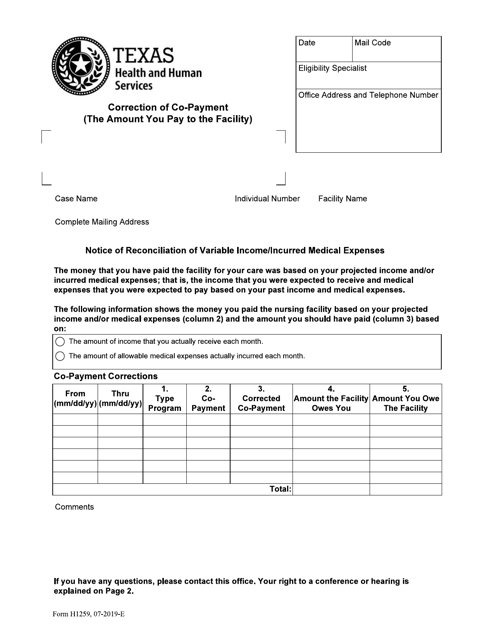

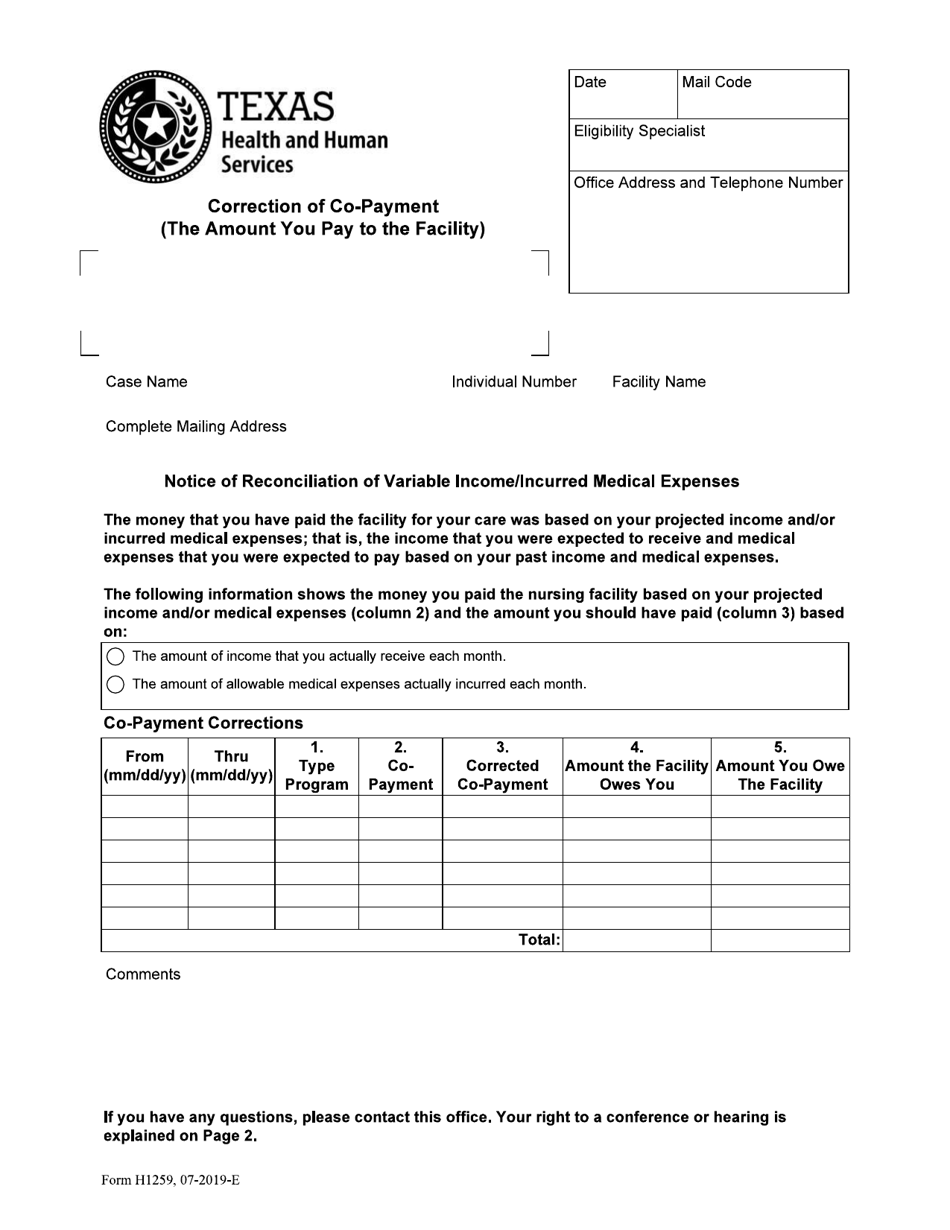

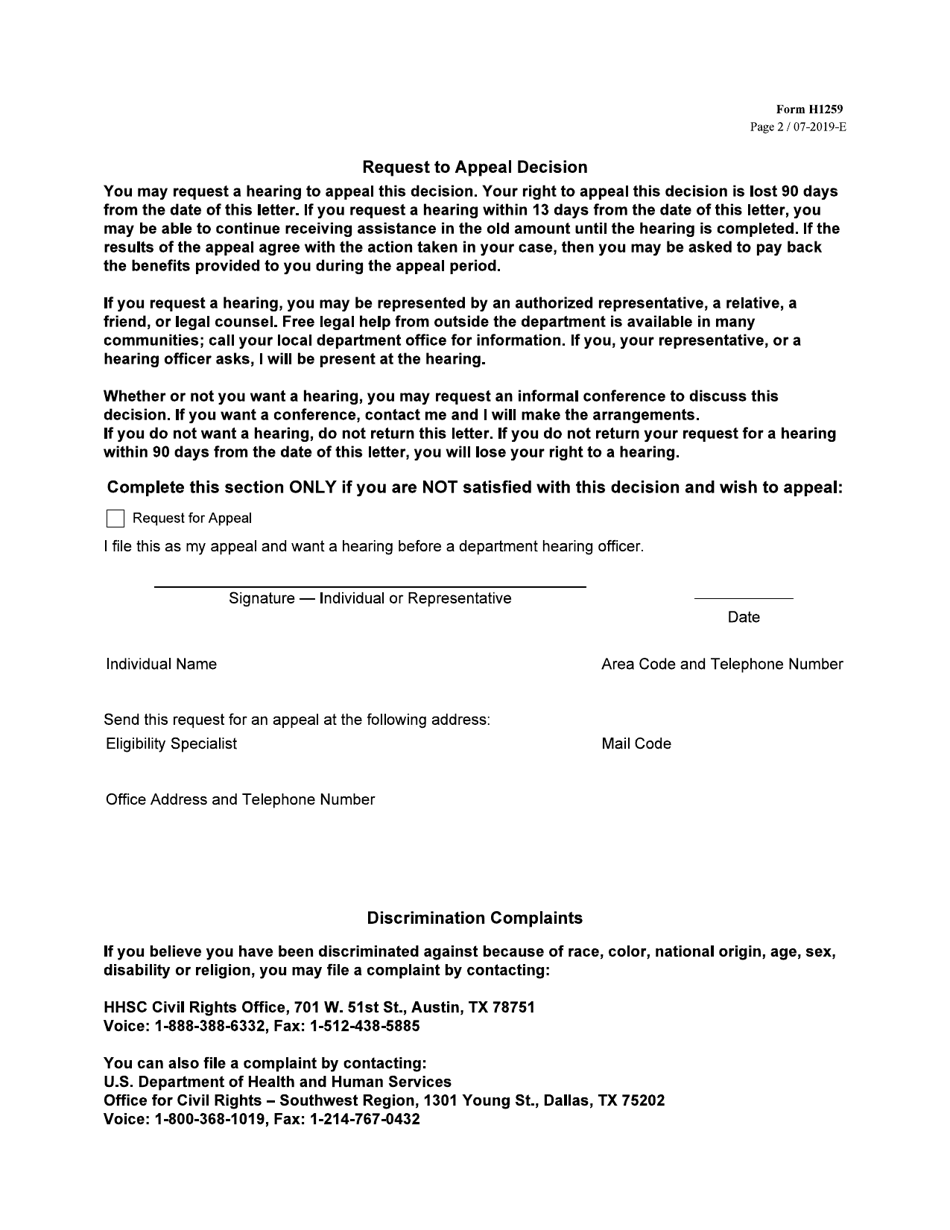

Form H1259 Correction of Applied Income - Texas

What Is Form H1259?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H1259?

A: Form H1259 is used for the correction of applied income in the state of Texas.

Q: What is applied income?

A: Applied income is the amount of income that a person receives and the amount they are required to contribute.

Q: What are the reasons for correction of applied income?

A: Some reasons for correction of applied income may include changes in income or changes in household composition.

Q: Who can use Form H1259?

A: Form H1259 can be used by individuals who receive public assistance benefits in Texas and need to correct their applied income.

Q: How do I complete Form H1259?

A: You will need to provide information about your household, current income, and any changes that need to be made to your applied income.

Q: What happens after I submit Form H1259?

A: After you submit Form H1259, your applied income will be reviewed and, if necessary, corrected accordingly.

Q: What if I need help completing Form H1259?

A: If you need assistance completing Form H1259, you can contact your local Texas Health and Human Services office for guidance.

Q: Are there any deadlines for submitting Form H1259?

A: There are no specific deadlines for submitting Form H1259, but it is recommended to submit it as soon as possible to ensure timely correction of applied income.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form H1259 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.