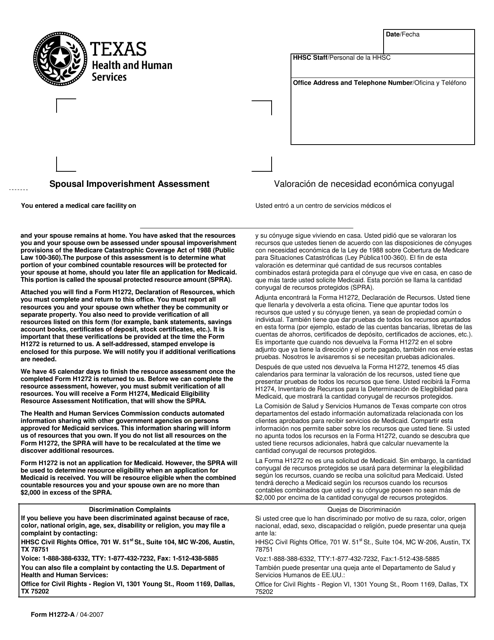

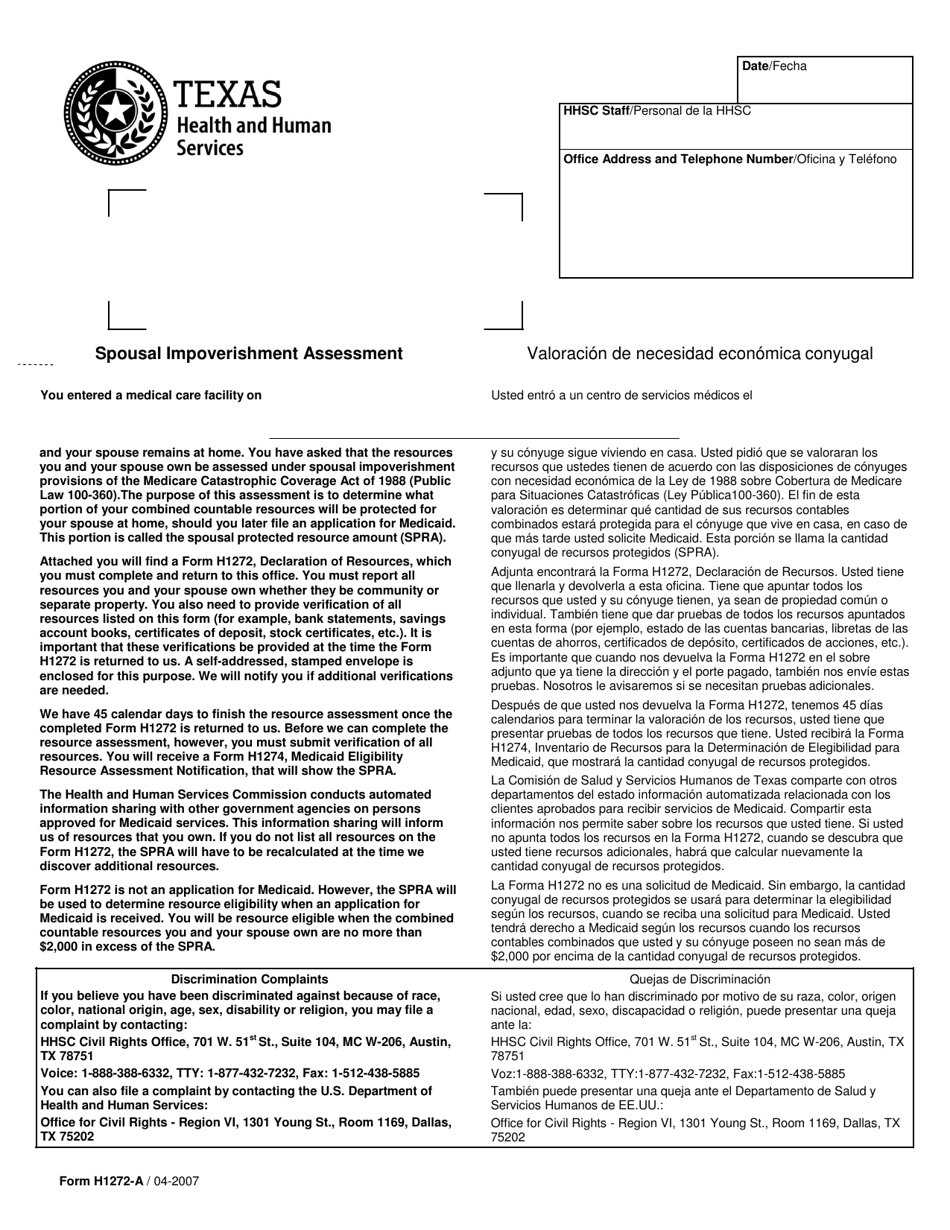

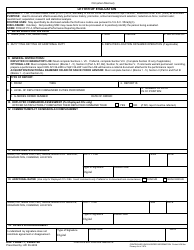

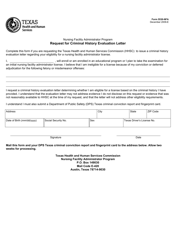

Form H1272-A Spousal Impoverishment Assessment Letter - Texas (English / Spanish)

What Is Form H1272-A?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H1272-A?

A: Form H1272-A is a Spousal Impoverishment Assessment Letter used in Texas.

Q: What is the purpose of Form H1272-A?

A: The purpose of Form H1272-A is to assess the financial situation of a spouse in relation to their eligibility for certain Medicaid programs.

Q: Who uses Form H1272-A?

A: Form H1272-A is used by individuals in Texas who are applying for Medicaid programs and have a spouse.

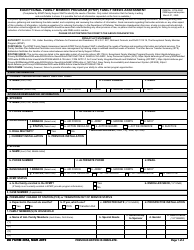

Q: Is Form H1272-A available in both English and Spanish?

A: Yes, Form H1272-A is available in both English and Spanish.

Q: Do I need to fill out Form H1272-A?

A: If you are applying for certain Medicaid programs in Texas and have a spouse, you will likely need to fill out Form H1272-A.

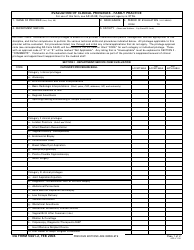

Q: What information is required on Form H1272-A?

A: Form H1272-A requires information about the spouse's income, assets, and expenses.

Q: How should I submit Form H1272-A?

A: You should submit Form H1272-A to the Texas Health and Human Services Commission by mail or in person.

Q: Are there any fees associated with filing Form H1272-A?

A: No, there are no fees associated with filing Form H1272-A.

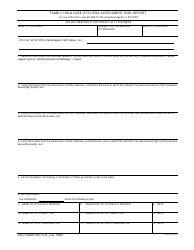

Q: What happens after I submit Form H1272-A?

A: After submitting Form H1272-A, the Texas Health and Human Services Commission will review the information and determine the spouse's eligibility for Medicaid programs.

Form Details:

- Released on April 1, 2007;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form H1272-A by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.