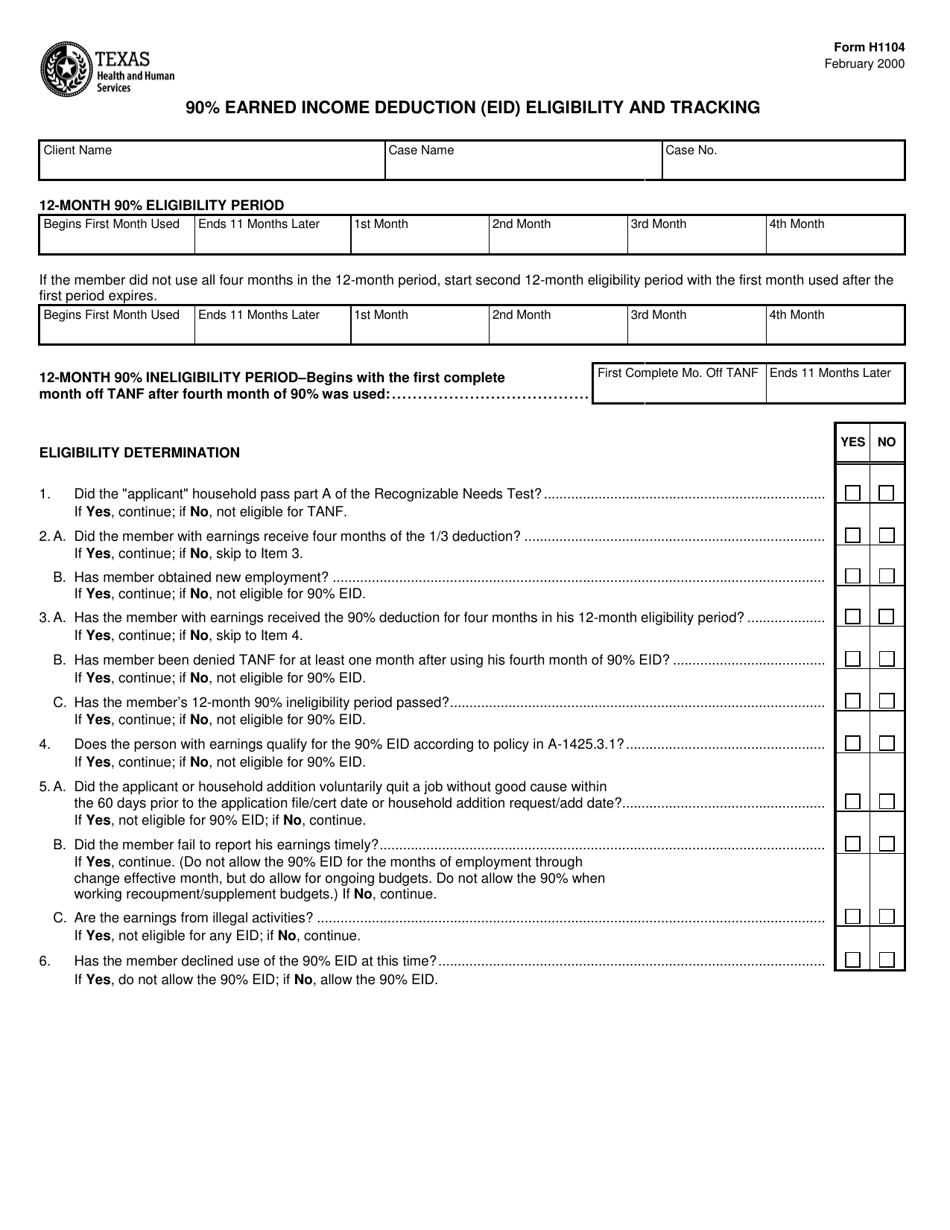

Form H1104 90% Earned Income Deduction (Eid) Eligibility and Tracking - Texas

What Is Form H1104?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H1104?

A: Form H1104 is a form used to determine eligibility and track the 90% Earned Income Deduction (EID) in Texas.

Q: What is the 90% Earned Income Deduction (EID)?

A: The 90% Earned Income Deduction (EID) is a deduction that allows certain individuals in Texas to exclude 90% of their earned income when determining eligibility for benefits.

Q: Who is eligible for the 90% Earned Income Deduction (EID)?

A: Individuals who receive certain benefits in Texas may be eligible for the 90% Earned Income Deduction (EID).

Q: What is the purpose of tracking the 90% Earned Income Deduction (EID)?

A: Tracking the 90% Earned Income Deduction (EID) allows the state of Texas to monitor and verify eligibility for benefits.

Q: How do I track my 90% Earned Income Deduction (EID) in Texas?

A: You can track your 90% Earned Income Deduction (EID) in Texas by completing and submitting Form H1104.

Q: Do I need to submit Form H1104 every year?

A: Yes, you may need to submit Form H1104 every year to continue tracking your 90% Earned Income Deduction (EID) eligibility in Texas.

Form Details:

- Released on February 1, 2000;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form H1104 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.