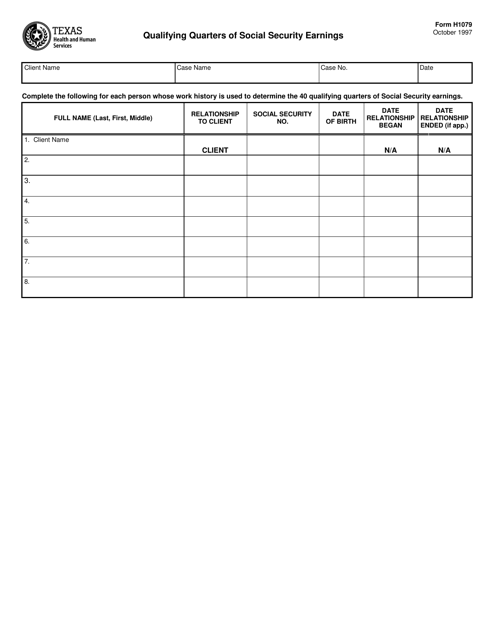

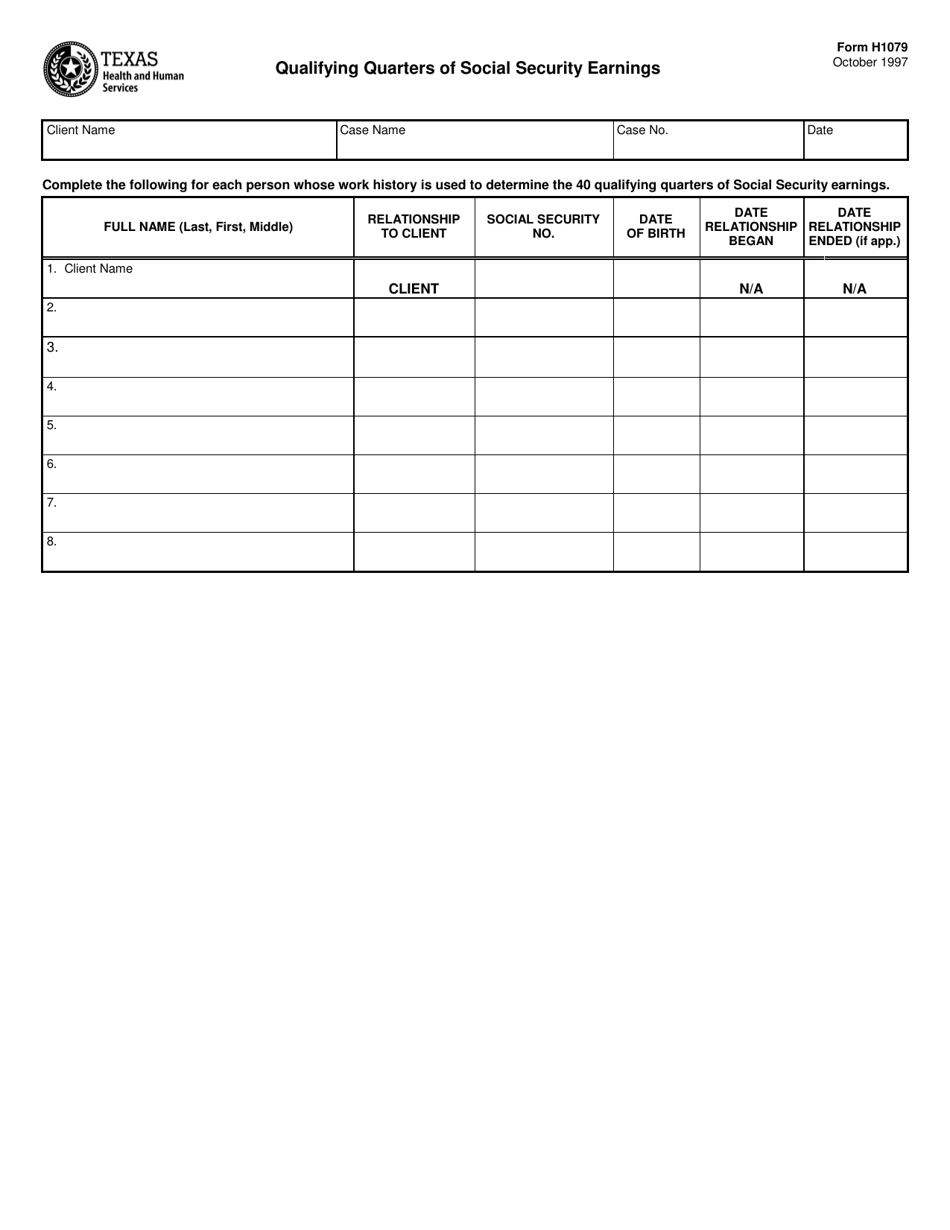

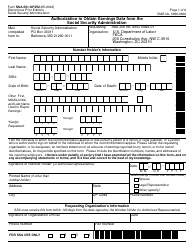

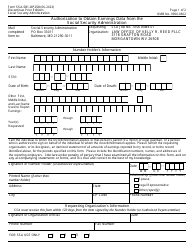

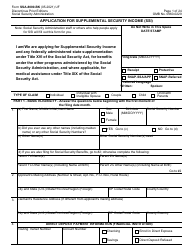

Form H1079 Qualifying Quarters of Social Security Earnings - Texas

What Is Form H1079?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form H1079?

A: Form H1079 is a document used to verify the qualifying quarters of Social Security earnings in Texas.

Q: Why is Form H1079 needed?

A: Form H1079 is needed to determine if an individual meets the qualifying criteria for certain benefits based on their Social Security earnings.

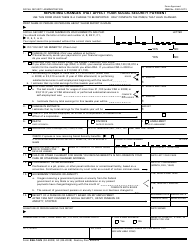

Q: What does 'qualifying quarters' mean?

A: 'Qualifying quarters' refers to the number of quarters in which an individual has earned enough income to be eligible for Social Security benefits.

Q: Who needs to fill out Form H1079?

A: Texan residents who are applying for benefits or services that require verification of their qualifying quarters of Social Security earnings need to fill out Form H1079.

Q: What information is required on Form H1079?

A: Form H1079 requires information such as the individual's name, Social Security number, and details of their qualifying Social Security earnings.

Q: How long does it take to process Form H1079?

A: The processing time for Form H1079 varies, but it typically takes a few weeks to receive a response.

Q: What happens after submitting Form H1079?

A: After submitting Form H1079, the information provided will be reviewed to determine the individual's eligibility for the requested benefits or services.

Q: Are there any fees associated with Form H1079?

A: No, there are no fees associated with submitting Form H1079.

Form Details:

- Released on October 1, 1997;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form H1079 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.