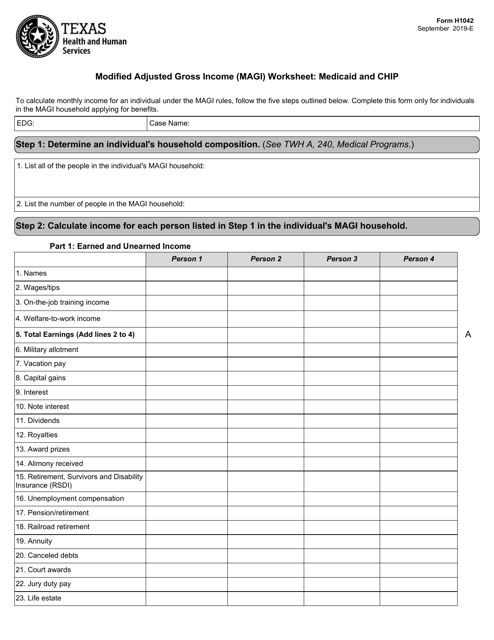

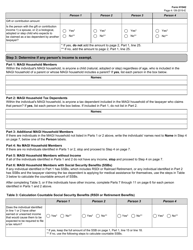

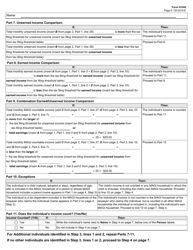

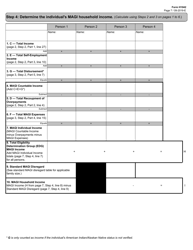

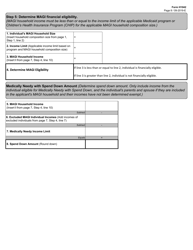

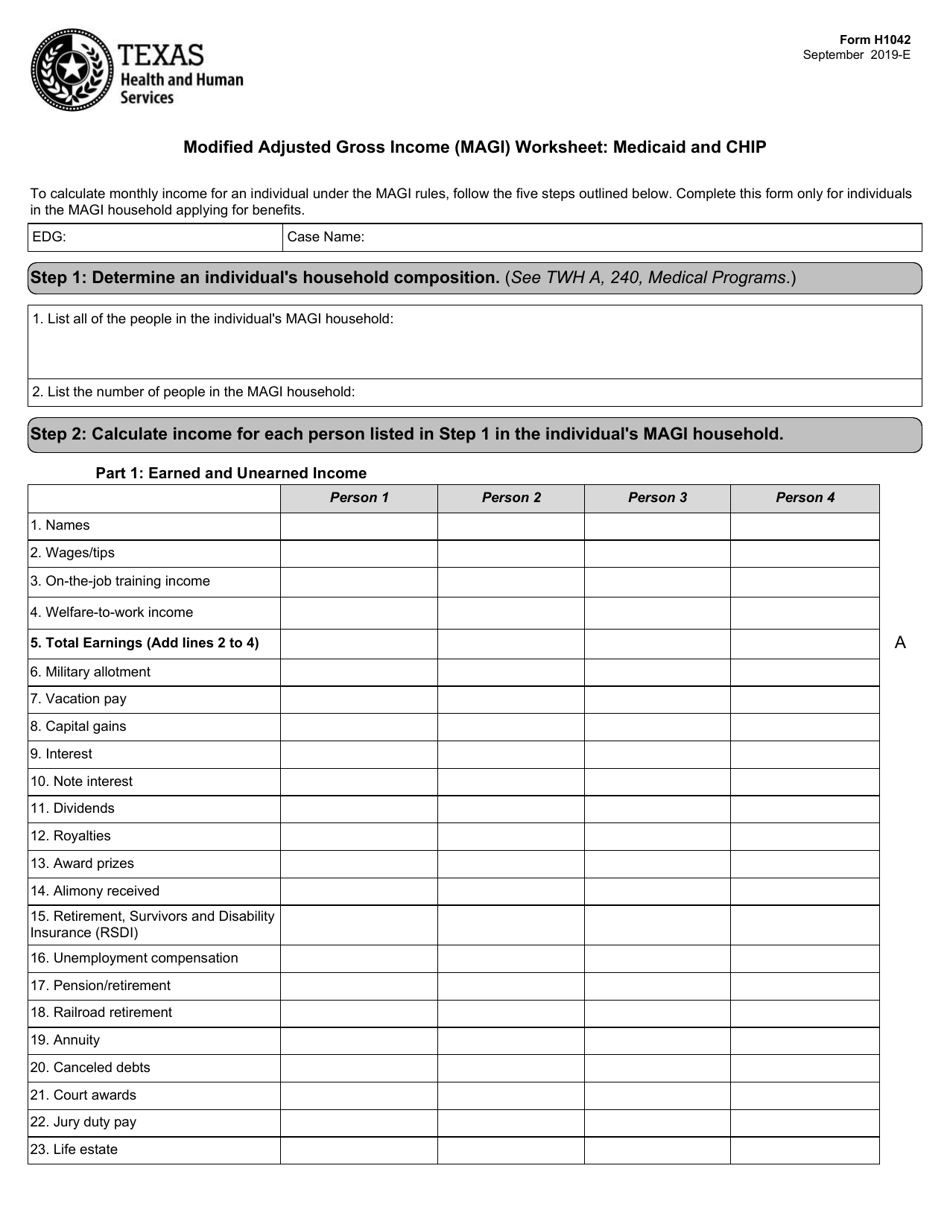

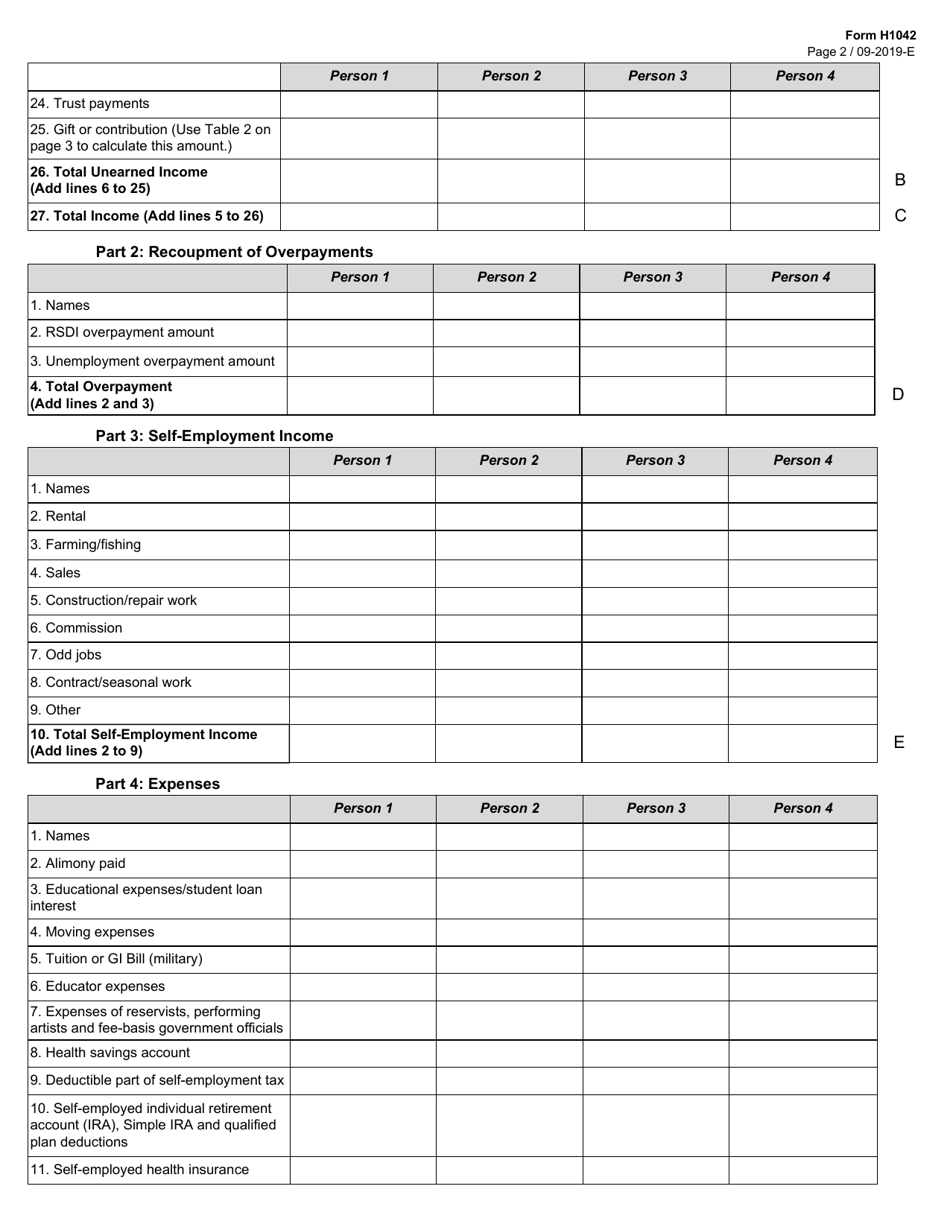

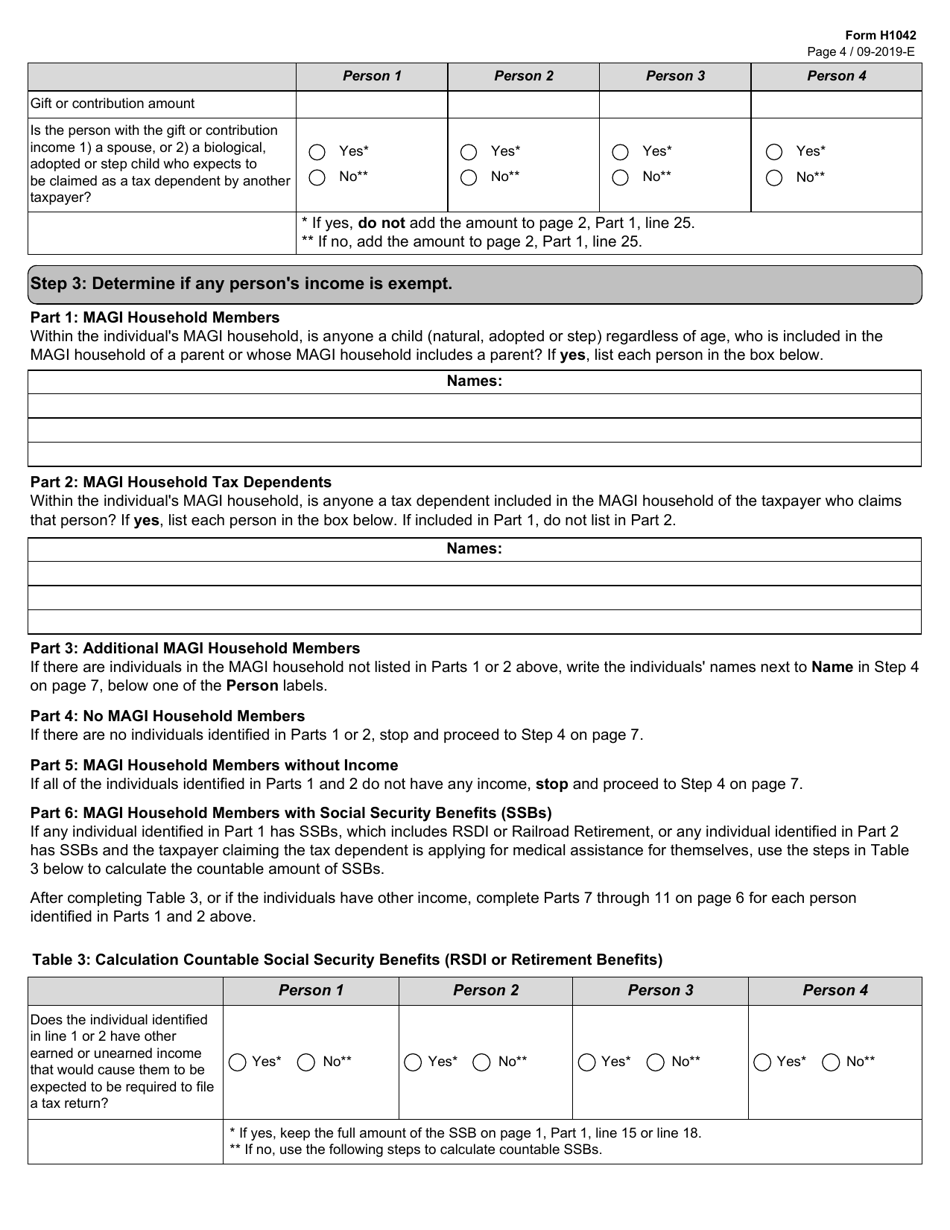

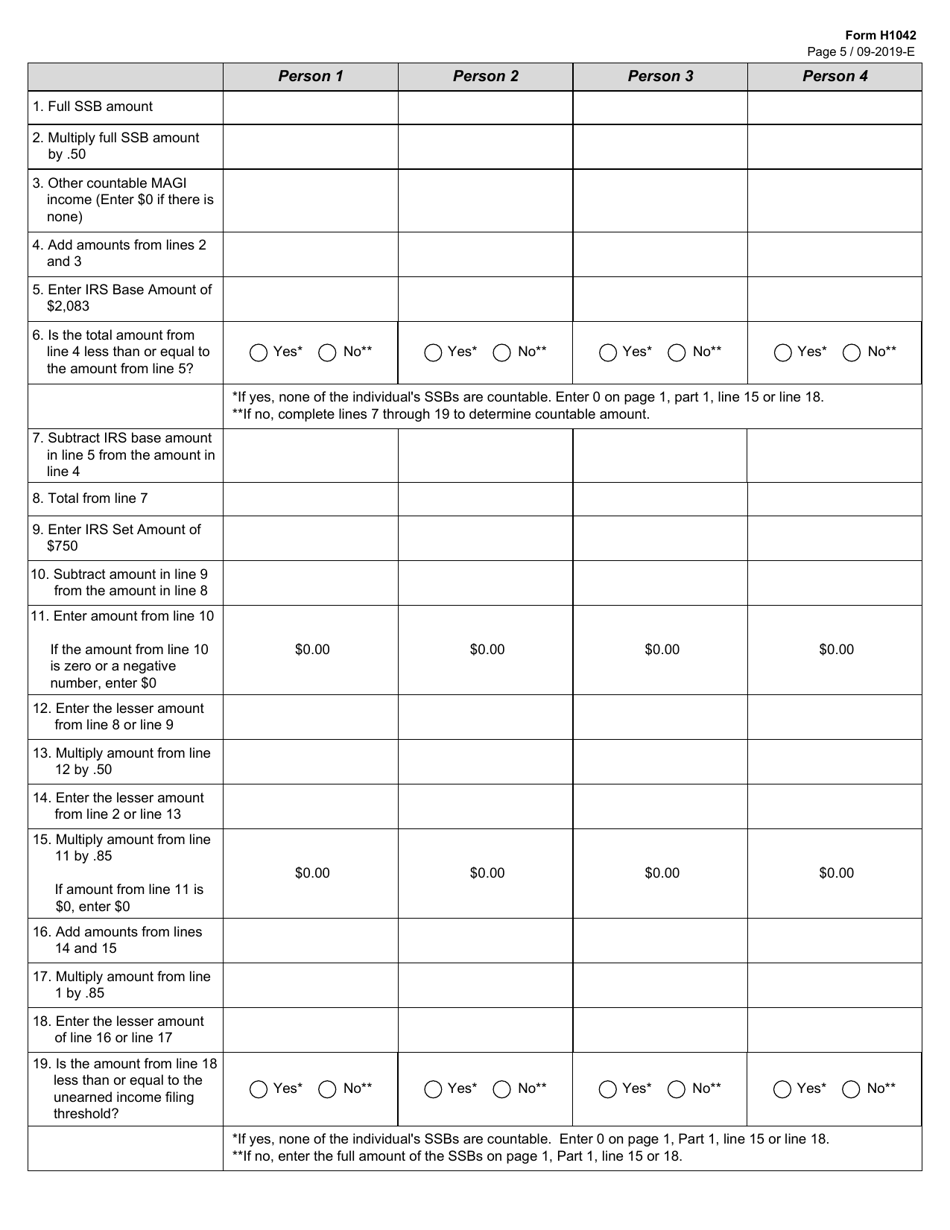

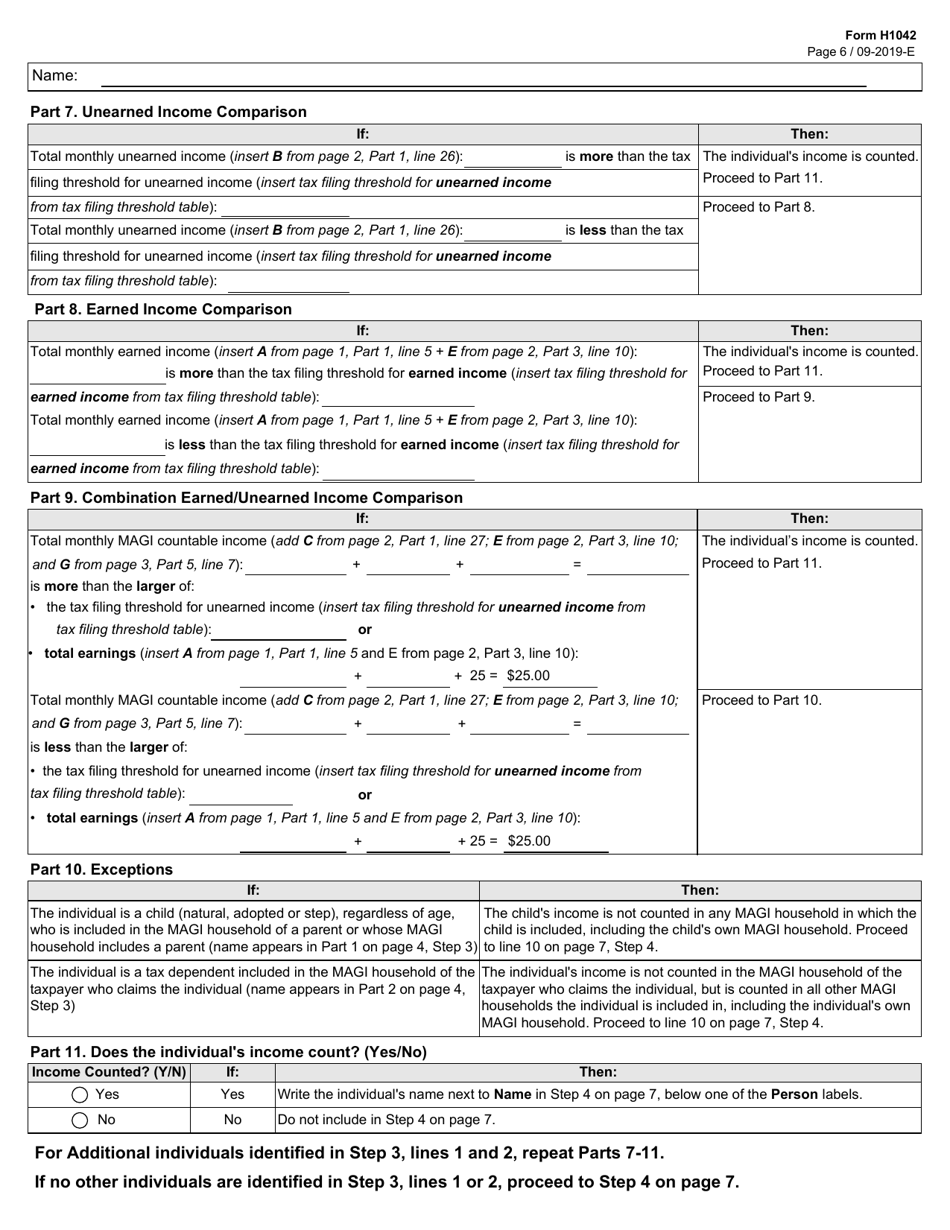

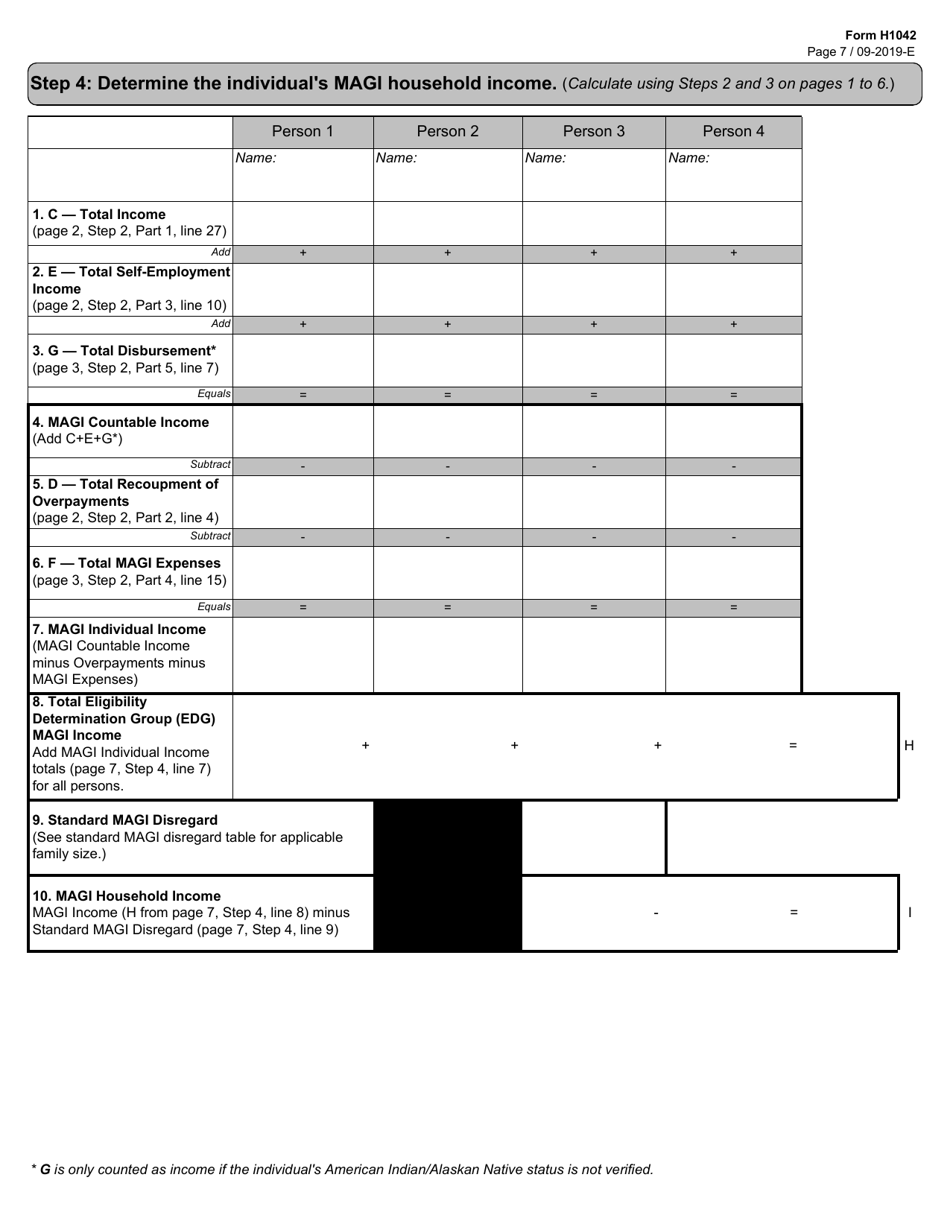

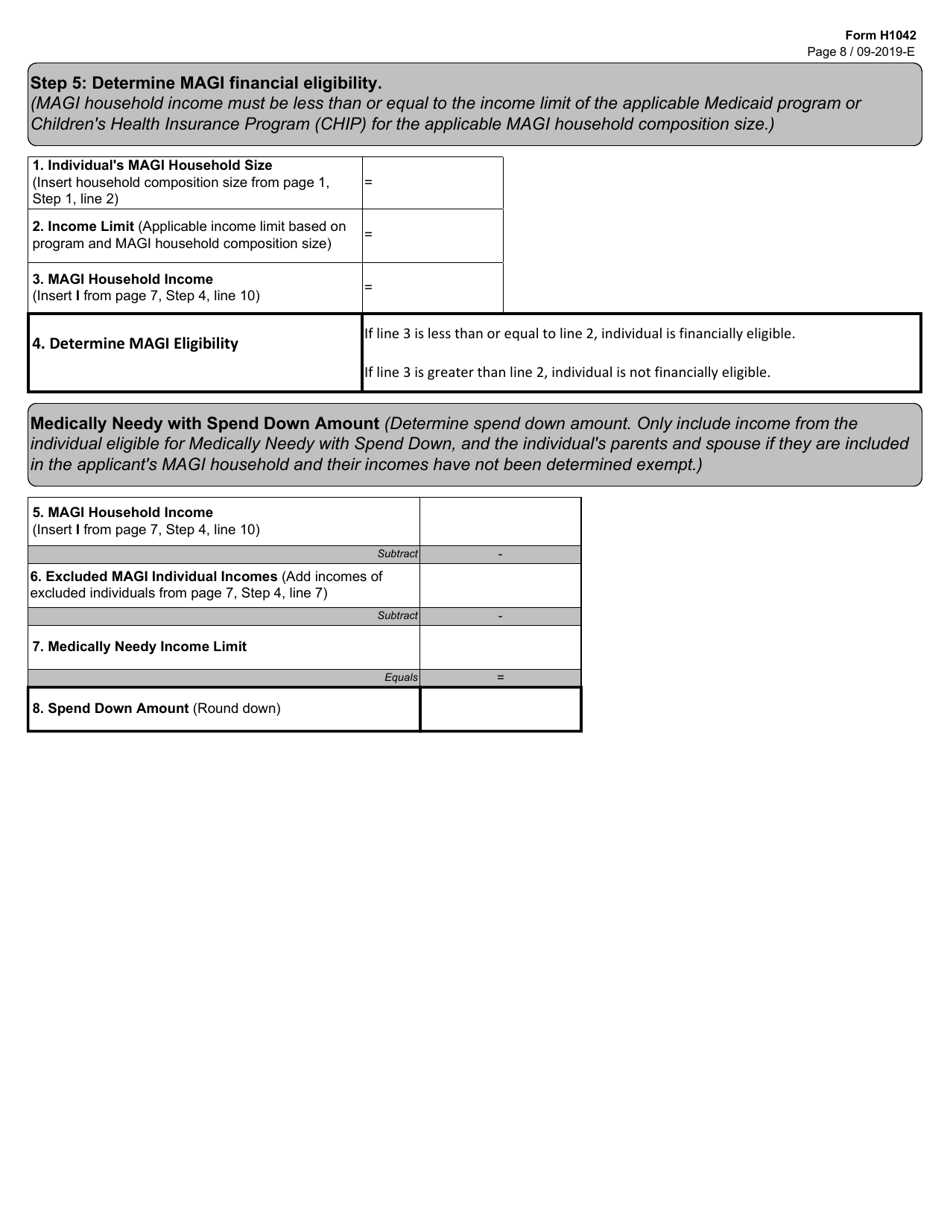

Form H1042 Modified Adjusted Gross Income (Magi) Worksheet: Medicaid and Chip - Texas

What Is Form H1042?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form H1042?

A: Form H1042 is the Modified Adjusted Gross Income (MAGI) Worksheet for Medicaid and CHIP in Texas.

Q: What is Modified Adjusted Gross Income (MAGI)?

A: Modified Adjusted Gross Income (MAGI) is a calculation used to determine eligibility for Medicaid and CHIP programs.

Q: What is Medicaid?

A: Medicaid is a government program that provides healthcare coverage for low-income individuals and families.

Q: What is CHIP?

A: CHIP stands for Children's Health Insurance Program. It provides low-cost health coverage for children in low-income families.

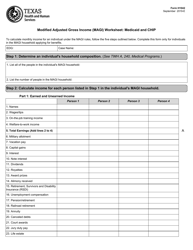

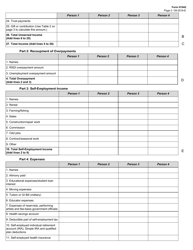

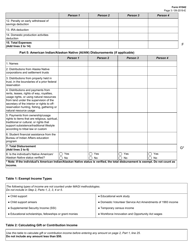

Q: How does the Form H1042 help determine eligibility?

A: The Form H1042 helps to calculate the applicant's Modified Adjusted Gross Income (MAGI), which is used to determine eligibility for Medicaid and CHIP programs in Texas.

Q: Is the Form H1042 specific to Texas only?

A: Yes, the Form H1042 is specifically used for Medicaid and CHIP eligibility determination in Texas.

Q: Do I need to fill out the Form H1042 every year?

A: You may need to fill out the Form H1042 annually or whenever there are changes to your income or household.

Q: Who is eligible for Medicaid and CHIP in Texas?

A: Eligibility for Medicaid and CHIP in Texas is based on factors such as income, household size, and citizenship status. The Form H1042 helps to determine eligibility.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form H1042 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.