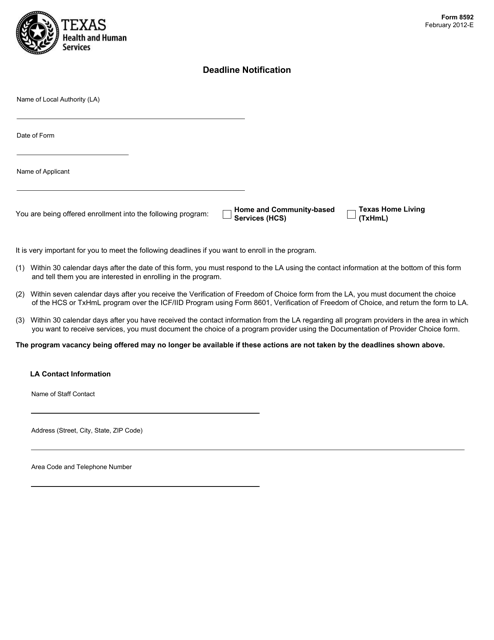

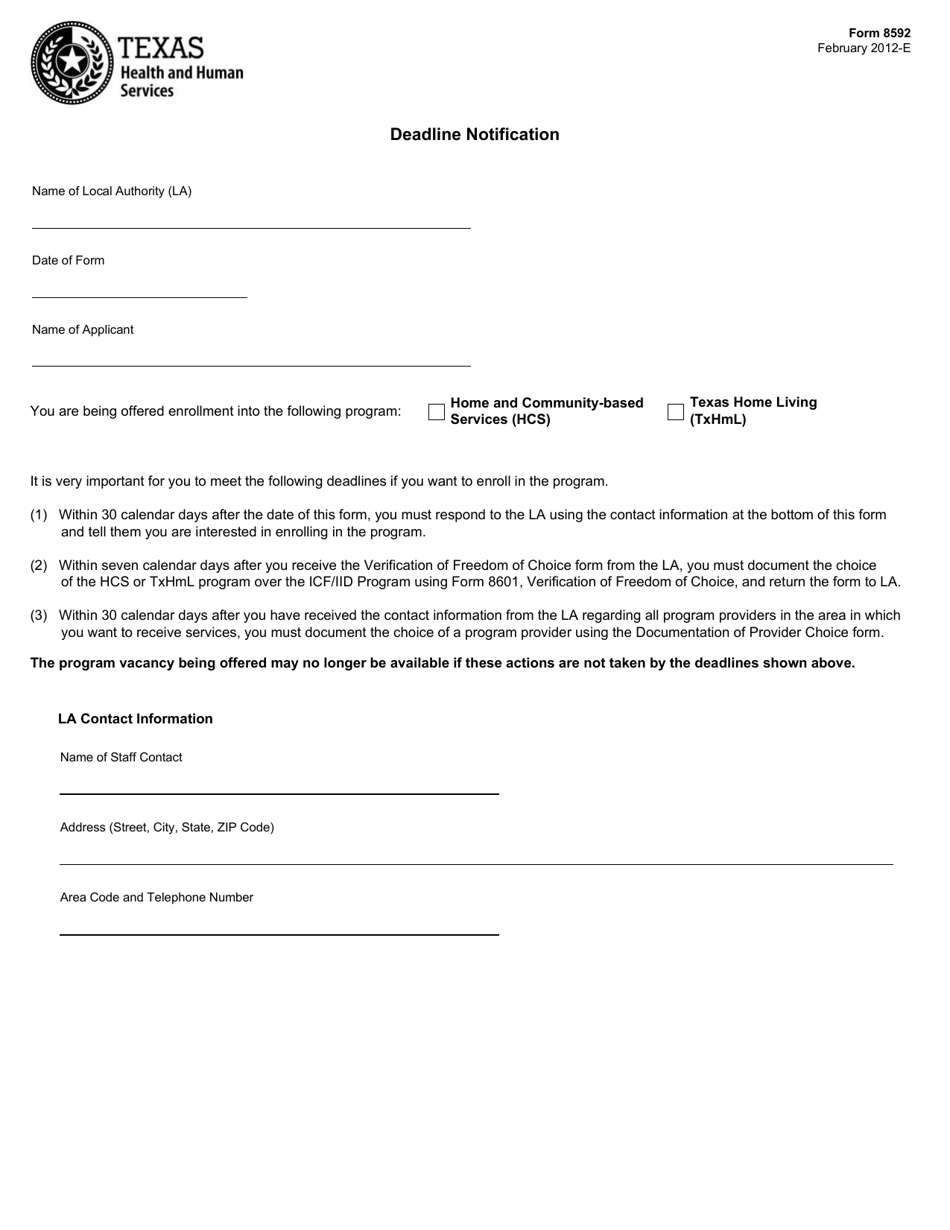

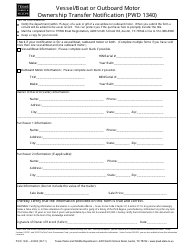

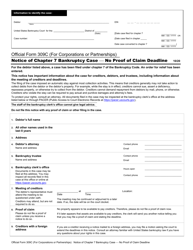

Form 8592 Deadline Notification - Texas

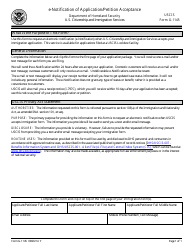

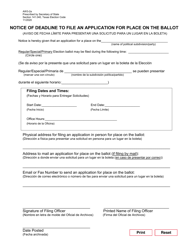

What Is Form 8592?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8592?

A: Form 8592 is a tax form used to report the passive activity loss and credit limitations for individuals and partnerships.

Q: What is the deadline for filing Form 8592?

A: The deadline for filing Form 8592 depends on the type of taxpayer. For individuals, it is usually April 15th. For partnerships, it is typically the 15th day of the third month after the end of the tax year.

Q: What happens if I miss the deadline for filing Form 8592?

A: If you miss the deadline for filing Form 8592, you may be subject to penalties and interest on any taxes owed.

Q: Do I need to file Form 8592 if I have no passive activity losses or credits?

A: No, if you have no passive activity losses or credits, you do not need to file Form 8592.

Q: I live in Texas. Are there any specific requirements or deadlines for filing Form 8592 in Texas?

A: No, there are no specific requirements or deadlines for filing Form 8592 specific to Texas. The general federal deadlines and requirements apply to all taxpayers in the United States.

Form Details:

- Released on February 1, 2012;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8592 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.