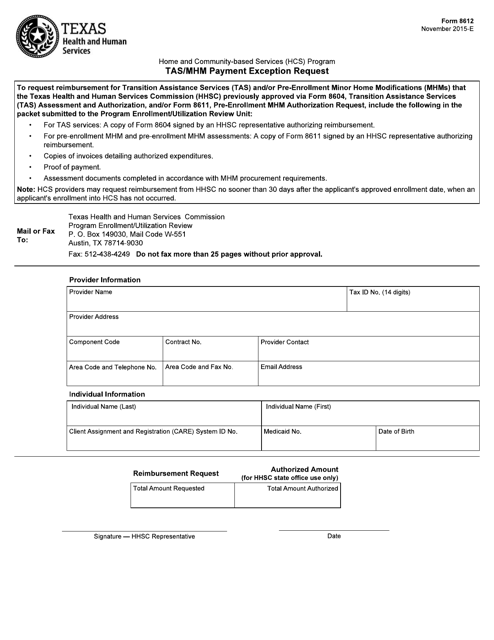

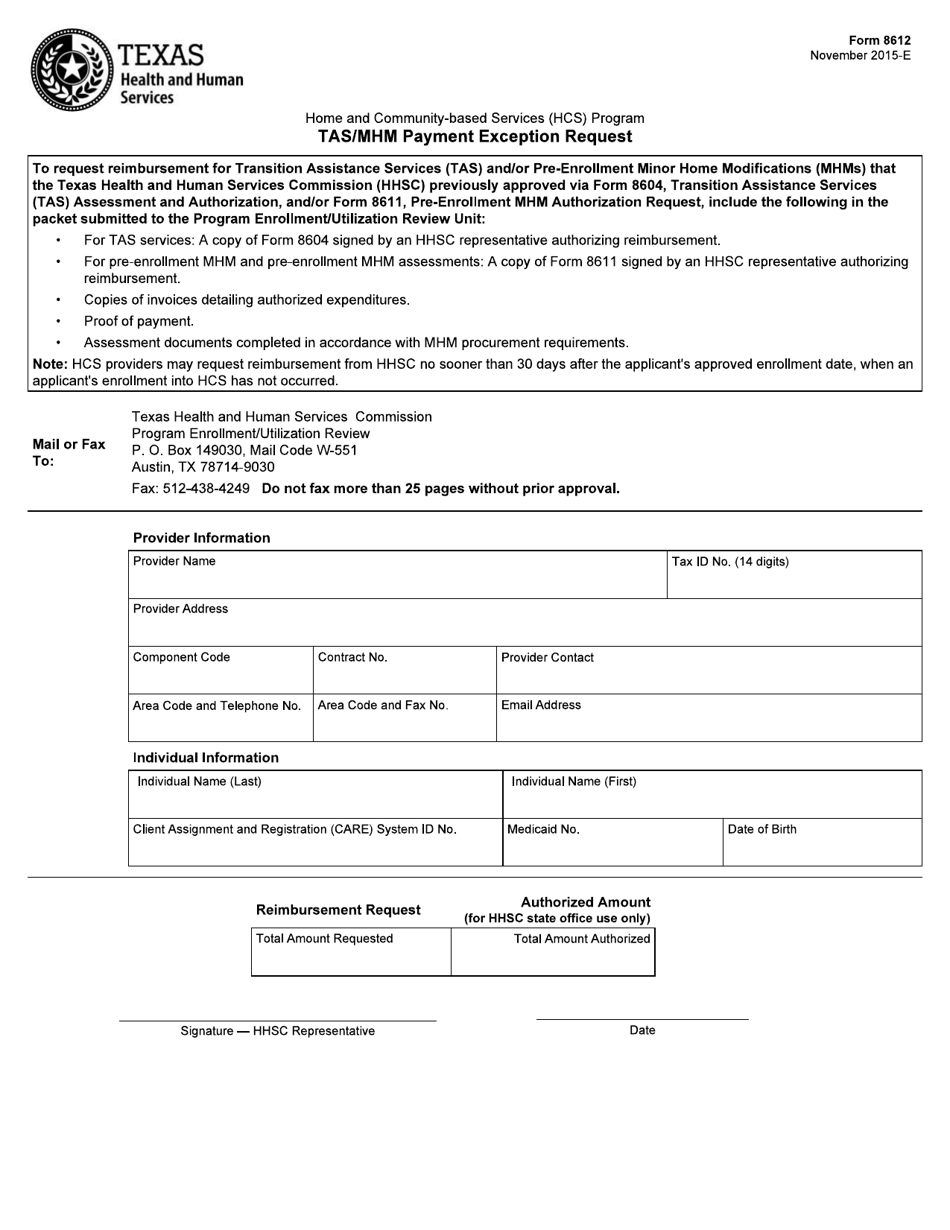

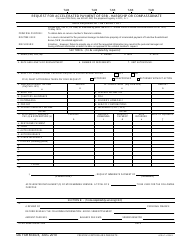

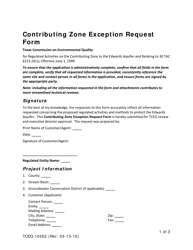

Form 8612 Tas / Mhm Payment Exception Request - Texas

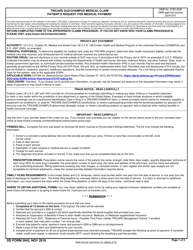

What Is Form 8612?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

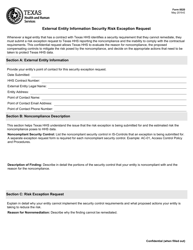

Q: What is Form 8612?

A: Form 8612 is a tax form used to request an exception from the payment of the Alternative Minimum Tax (AMT).

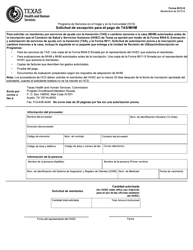

Q: What is the TAS/MHM Payment Exception Request?

A: The TAS/MHM Payment Exception Request is a specific type of Form 8612 used in Texas.

Q: Who should use Form 8612 TAS/MHM Payment Exception Request?

A: Taxpayers in Texas who want to request an exception from paying the Alternative Minimum Tax (AMT) should use this form.

Q: Why would someone request an exception from paying the AMT?

A: Taxpayers may request an exception from paying the AMT if they meet certain criteria, such as having a lower income or qualifying for specific deductions.

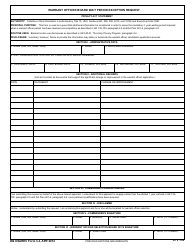

Q: Are there any fees associated with filing Form 8612 TAS/MHM Payment Exception Request?

A: No, there are no fees associated with filing Form 8612 TAS/MHM Payment Exception Request.

Q: Is Form 8612 TAS/MHM Payment Exception Request specific to Texas residents only?

A: Yes, Form 8612 TAS/MHM Payment Exception Request is specifically for Texas residents.

Q: How should I fill out Form 8612 TAS/MHM Payment Exception Request?

A: You should carefully follow the instructions provided with the form and provide accurate and complete information about your income and deductions.

Q: What happens after I submit Form 8612 TAS/MHM Payment Exception Request?

A: The IRS will review your request and determine if you qualify for an exception from paying the Alternative Minimum Tax (AMT).

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8612 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.