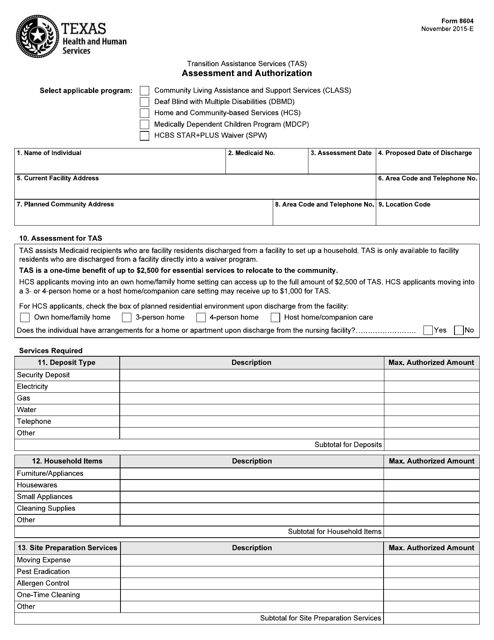

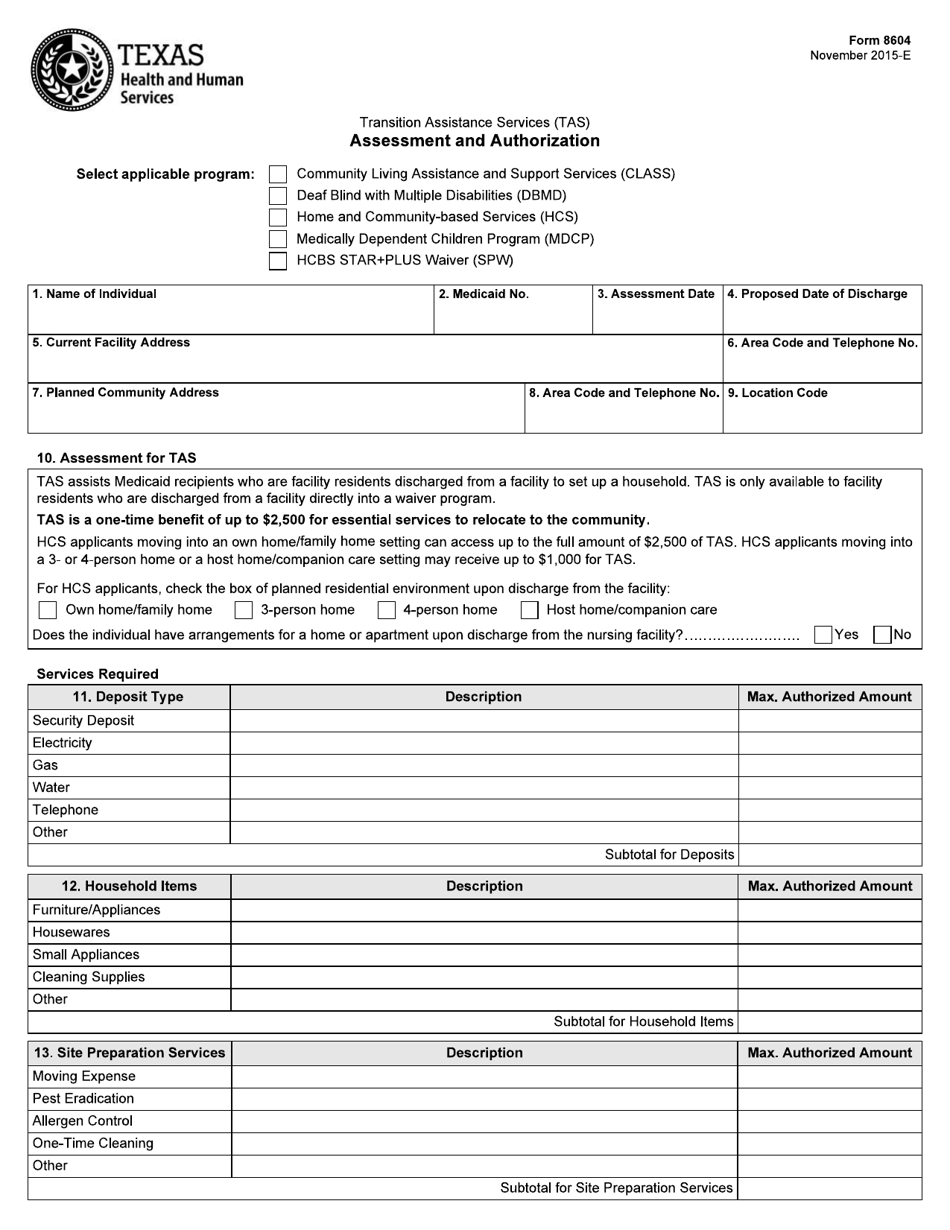

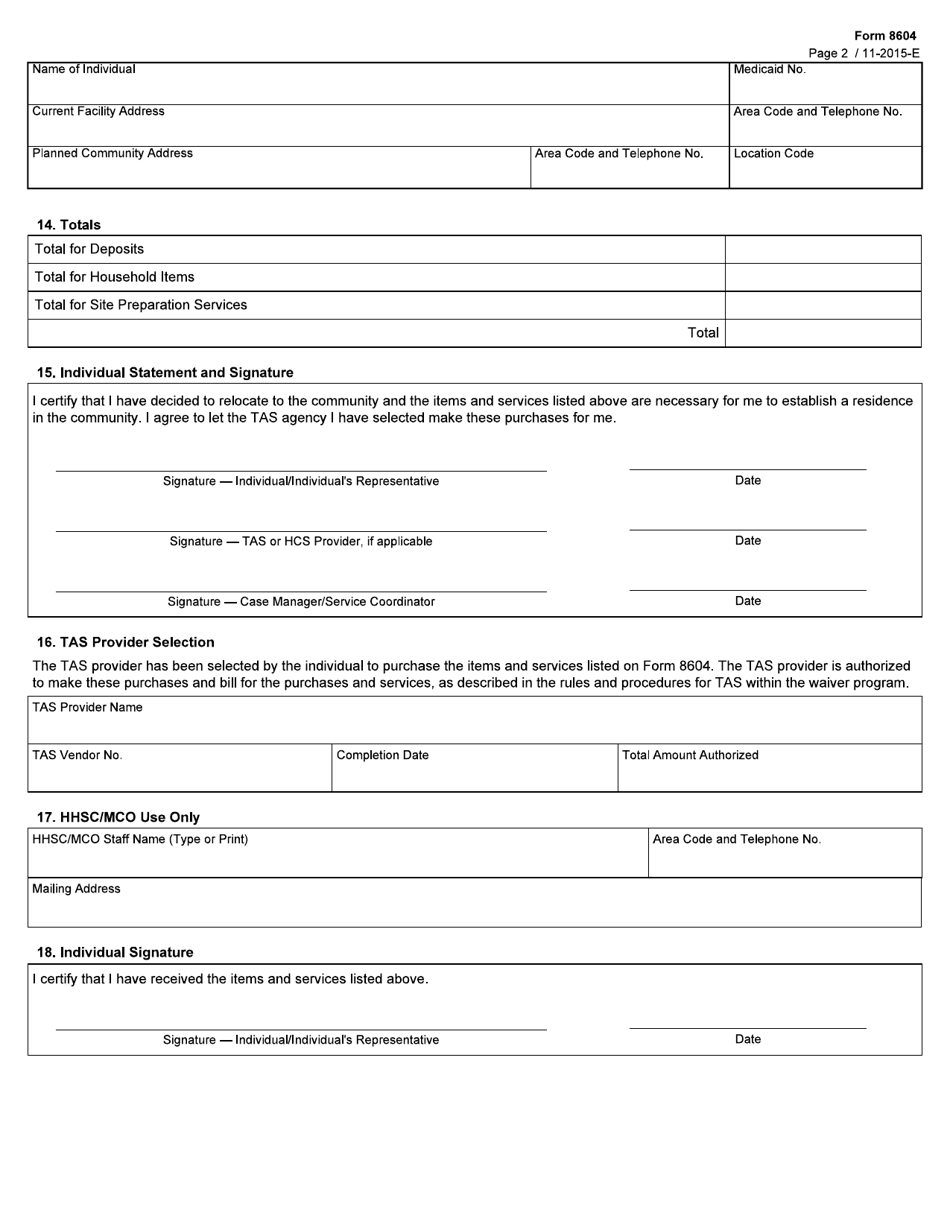

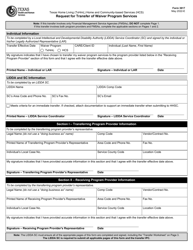

Form 8604 Transition Assistance Services (Tas) Assessment and Authorization - Texas

What Is Form 8604?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8604?

A: Form 8604 is a tax form used to report Transition Assistance Services (TAS) Assessment and Authorization.

Q: What are Transition Assistance Services (TAS)?

A: Transition Assistance Services (TAS) are services provided to members of the military to help them transition to civilian life.

Q: Who needs to file Form 8604?

A: Members of the military who receive Transition Assistance Services (TAS) in Texas need to file Form 8604.

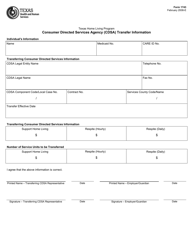

Q: What information is required on Form 8604?

A: Form 8604 requires information about the TAS provider, the amount of TAS received, and any tax withheld.

Q: When is Form 8604 due?

A: Form 8604 is generally due on the same day as your tax return, which is April 15th.

Q: Is there a penalty for not filing Form 8604?

A: Yes, there is a penalty for not filing Form 8604 or for filing it late. The penalty is based on the amount of TAS received.

Q: Can I file Form 8604 electronically?

A: Yes, you can file Form 8604 electronically using tax preparation software or through a tax professional.

Q: Are there any special considerations for filing Form 8604 in Texas?

A: Yes, there may be additional state tax considerations for filing Form 8604 in Texas. It is recommended to consult with a tax professional for guidance.

Q: Can I claim a tax credit for TAS on Form 8604?

A: No, TAS received is not eligible for a tax credit on Form 8604. It is considered taxable income.

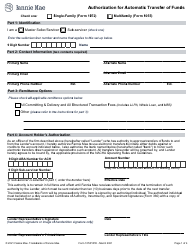

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8604 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.