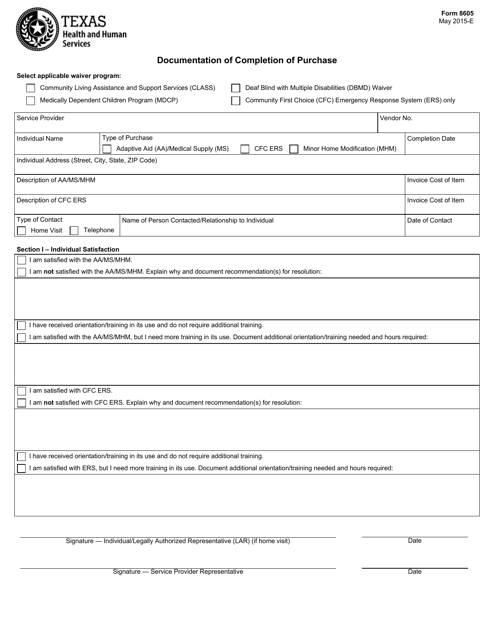

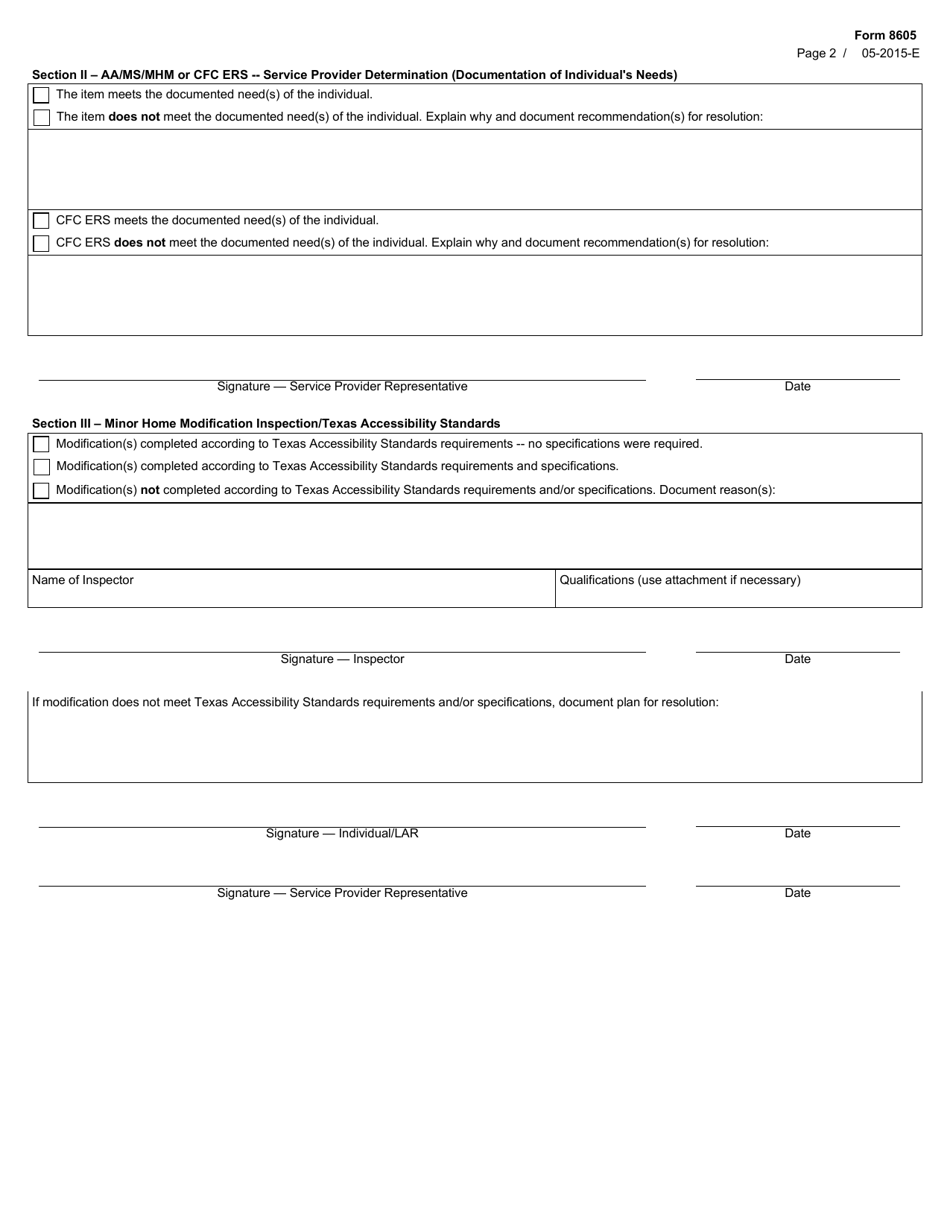

Form 8605 Documentation of Completion of Purchase - Texas

What Is Form 8605?

This is a legal form that was released by the Texas Health and Human Services - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 8605?

A: Form 8605 is a tax form used to document the completion of a purchase in Texas.

Q: Why do I need to fill out Form 8605?

A: You need to fill out Form 8605 to provide documentation of the completion of the purchase in Texas for tax purposes.

Q: What information is required on Form 8605?

A: Form 8605 requires information such as the date of purchase, purchase price, and details about the property in Texas.

Q: Are there any deadlines for filing Form 8605?

A: Yes, Form 8605 must be filed by the deadline specified by the IRS for the relevant tax year.

Q: What happens if I fail to file Form 8605?

A: Failure to file Form 8605 can result in penalties and potential issues with your tax return.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the Texas Health and Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 8605 by clicking the link below or browse more documents and templates provided by the Texas Health and Human Services.